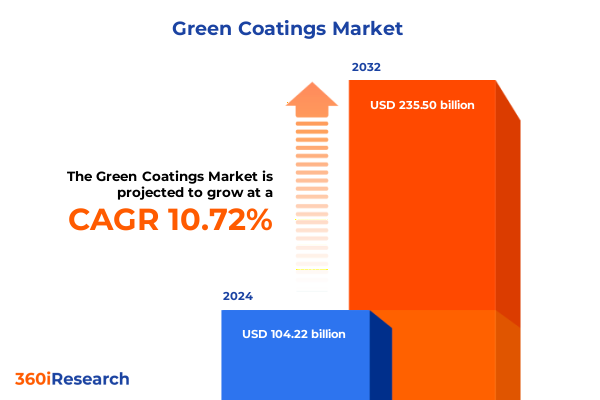

The Green Coatings Market size was estimated at USD 115.54 billion in 2025 and expected to reach USD 126.45 billion in 2026, at a CAGR of 10.70% to reach USD 235.50 billion by 2032.

How Environmental Awareness and Technological Innovations Are Forging the Next Phase of Sustainable Coating Solutions Across Industries

The global imperative for sustainable solutions is rapidly shifting the coatings industry toward environmentally friendly formulations that reduce volatile organic compound emissions and support circular economy principles. As governments strengthen regulations on air quality and chemical safety, manufacturers are investing heavily in waterborne, powder, and UV-curable technologies that deliver performance without environmental compromise. At the same time, consumer awareness of ecological impact and corporate commitments to net-zero targets are creating powerful demand signals for green coating alternatives. Consequently, what once was a niche segment is now at the forefront of innovation, driving research into bio-based resins, recycled content, and energy-efficient curing processes.

Moreover, the convergence of digitalization and sustainability is accelerating product development cycles through advanced color matching, predictive maintenance for coating application equipment, and data-driven lifecycle assessments. This intersection is fostering unprecedented collaboration between raw material suppliers, equipment manufacturers, and end users, all striving to meet stricter environmental benchmarks while optimizing cost and performance. Thus, the industry’s future hinges on the ability to harmonize regulatory requirements, technological breakthroughs, and evolving customer preferences, setting the stage for a new era of green coatings that deliver both ecological value and operational excellence.

Why Converging Regulatory Pressures and Material Science Breakthroughs Are Redefining Performance and Sustainability Standards in Coatings

In recent years, the transformation of the green coatings landscape has accelerated, driven by tightening global emissions standards, rising raw material costs, and growing investor focus on ESG performance. Waterborne coatings, once hampered by performance limitations, have achieved parity with solvent-borne systems through nano-dispersion techniques and hybrid resin chemistries that enhance durability and adhesion. Powder-based technologies have similarly evolved, incorporating functional additives for corrosion resistance and scratch durability, thereby expanding their applicability beyond metal substrates into wood and plastic markets.

Concurrently, UV-curable coatings are experiencing a renaissance, fueled by rapid curing times and energy-efficient operations that support lean manufacturing. Breakthroughs in photoinitiator chemistry are enabling deeper cure depths and improved substrate compatibility, unlocking new applications in packaging and automotive OEM finishing. With these transformative shifts, industry stakeholders are redefining performance benchmarks to include sustainability metrics, digital traceability, and cradle-to-cradle accountability. As a result, the competitive landscape is realigning, with traditional players forging partnerships and agile innovators disrupting value chains through specialized green formulations and service-based solutions.

How Recent US Tariff Revisions Are Disrupting Supply Chains and Prompting Domestic Innovation in Sustainable Coatings Production

In 2025, the United States government implemented a revised tariff structure aimed at protecting domestic chemical manufacturing while balancing trade considerations with major partners. These tariffs have selectively targeted key raw material imports, including certain specialty monomers and crosslinkers essential to high-performance green coatings. As a consequence, domestic producers have faced increased input costs, leading some to invest in backward integration or strategic alliances with polymer manufacturers to secure supply and stabilize pricing.

Despite these headwinds, the tariff landscape has also catalyzed innovation within the domestic supply base. Companies are exploring alternative bio-based raw materials that are locally sourced, thereby insulating production from global trade volatility. Additionally, licensing agreements for proprietary resin technologies have become more prevalent, as downstream formulators seek to diversify their supplier portfolios. Moving forward, the ongoing recalibration of tariffs-in conjunction with potential trade negotiations-will continue to shape the competitive dynamics of the green coatings market, reinforcing the need for agile procurement strategies and robust scenario planning.

Why Multifaceted Segmentation Across Applications, Resin Chemistries, and Technologies Reveals Hidden High-Value Opportunities in Coatings

The green coatings market exhibits a rich tapestry of application-centric and technology-driven submarkets, each characterized by unique performance requirements and regulatory considerations. In architectural segments, the contrast between high-traffic commercial surfaces and decorative residential finishes has led to tailored waterborne acrylic systems with enhanced scrub resistance and color retention. Automotive OEM lines, by comparison, prioritize cycle time reduction and corrosion protection, while refinish operations focus on VOC compliance and easy polishability.

On the resin front, solventborne acrylics are still favored for certain niche applications requiring extreme weather resistance, whereas waterborne acrylics dominate where regulatory scrutiny is most intense. Epoxy systems-both aliphatic and aromatic-serve industrial customers who demand chemical resilience and mechanical strength, while polyurethane variants cater to premium wood flooring and furniture markets that value aesthetics and durability. From a technology perspective, UV-curable formulations are rapidly displacing solventborne coatings in packaging, owing to their instant cure and low energy footprint, whereas powder coatings remain indispensable in heavy-duty industrial and automotive sectors. By layering these dimensions-application, resin type, technology, and end-use industry-manufacturers can pinpoint the precise innovation pathways and distribution channels required to serve each niche market effectively.

This comprehensive research report categorizes the Green Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Resin Type

- Technology

- End Use Industry

How Diverse Regional Policy Frameworks and Industry Dynamics Are Fuelling Varied Growth Patterns in the Global Coatings Landscape

Geographically, the green coatings sector is experiencing disparate growth trajectories driven by regional policy frameworks, infrastructure maturity, and end-use industry density. In the Americas, federal and state-level regulations are accelerating the shift toward low-VOC and powder coatings, particularly within the construction and automotive markets. Renewable energy initiatives, including offshore wind and solar installations, are also bolstering demand for corrosion-resistant marine coatings across ports and manufacturers along the Gulf and Atlantic coasts.

Across Europe, Middle East, and Africa, the European Union’s Green Deal and stringent REACH directives have set a high bar for chemical safety, spurring investment in advanced waterborne and UV-curable systems. Simultaneously, emerging markets in the Middle East are adopting these technologies in infrastructure projects, while the African region remains at an early adoption stage, with potential for growth as regulatory enforcement strengthens. In the Asia-Pacific region, government incentives in China, Japan, and South Korea for renewable energy and electric vehicles are driving demand for specialized epoxy and polyurethane coatings, while powder technologies gain traction in India’s booming automotive assembly sector. These varied regional dynamics underscore the importance of localized go-to-market strategies and partnerships to address differing regulatory landscapes, cost structures, and end-user priorities.

This comprehensive research report examines key regions that drive the evolution of the Green Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Strategic Alliances, Targeted Acquisitions, and Venture Investments Are Reshaping Competitive Dynamics in Sustainable Coatings

Major industry players are adopting distinct strategies to capture value within the green coatings sphere, ranging from organic R&D investment to targeted acquisitions and co-development partnerships. Established multinational chemical companies are leveraging their broad distribution networks and deep technical expertise to roll out next-generation waterborne and powder products at scale, while sustaining legacy solventborne lines for niche applications. At the same time, mid-sized specialty formulators are differentiating through proprietary bio-resin platforms and customized service offerings, such as on-site color matching and application support.

Strategic alliances between raw material manufacturers and equipment suppliers are enabling more integrated solutions, exemplified by turnkey spray and curing systems optimized for low-energy operation. In parallel, corporate venture arms are funding startups focused on breakthrough chemistries, including lignin-based binders and 3D printing coatings. This blend of inorganic and organic growth activities is reshaping competitive boundaries, prompting incumbent firms to enhance their supply chain resilience and digital capabilities. As a result, the industry landscape is splitting into diversified conglomerates with global reach and agile challengers that excel in targeted innovation and rapid market response.

This comprehensive research report delivers an in-depth overview of the principal market players in the Green Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Limited

- Chugoku Marine Paints, Ltd.

- DAW SE

- Evonik Industries AG

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

- The Valspar Corporation

- Tikkurila Oyj

Why Proactive Regulatory Engagement, Collaborative Innovation, and Circular Economy Strategies Are Critical for Coating Manufacturers to Thrive

Industry leaders must adopt a multi-pronged approach to capitalize on the green coatings revolution, beginning with proactive regulatory engagement and scenario planning. By monitoring upcoming policy changes and participating in standards committees, companies can anticipate compliance requirements and secure first-mover advantages for new formulations. In parallel, investment in modular production lines and continuous processing technologies will support swift scale-up of waterborne, powder, and UV-curable systems while minimizing capital expenditure risks.

Furthermore, executives should forge cross-sector collaborations with construction, automotive, and packaging OEMs to co-create application-specific coatings, leveraging digital analytics to optimize formulation performance in real-world conditions. Embracing circular economy principles through take-back programs and closed-loop recycling initiatives will not only reduce raw material dependency but also enhance brand reputation among sustainability-focused customers. Finally, embedding sustainability metrics into product roadmaps and incentive structures will align organizational objectives with broader environmental goals, ensuring that green coatings deliver both ecological impact and business value.

How Rigorous Triangulation of Primary Interviews, Patent Insights, and Regulatory Analysis Ensures the Report’s Robustness and Strategic Relevance

Our research approach integrates primary interviews with leading chemical producers, formulation experts, and end-use customers alongside secondary analysis of patent filings, regulatory databases, and industry publications. On the primary side, structured dialogues were conducted with R&D directors in automotive OEMs, facility managers at architectural coating operations, and sustainability officers at major packaging corporations to capture firsthand insights on performance criteria, cost pressures, and compliance challenges.

Secondary research encompassed review of recent peer-reviewed studies on low-VOC resin systems, analysis of global trade data to assess tariff impacts, and scrutiny of corporate sustainability reports to identify emerging strategic priorities. Market mapping included technology adoption curves and ecosystem assessments of startups funded through chemical industry venture arms. Finally, triangulation of qualitative findings with industry shipment trends provided a robust foundation for our segmentation and regional analyses, ensuring that the report’s conclusions are grounded in both empirical data and expert perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Green Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Green Coatings Market, by Application

- Green Coatings Market, by Resin Type

- Green Coatings Market, by Technology

- Green Coatings Market, by End Use Industry

- Green Coatings Market, by Region

- Green Coatings Market, by Group

- Green Coatings Market, by Country

- United States Green Coatings Market

- China Green Coatings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Why Integrating Advanced Resin Technologies and Circular Economy Principles Is Essential to Lead the Green Coatings Revolution Successfully

The green coatings arena stands at an inflection point where environmental necessity and performance innovation converge to redefine industry standards. Stakeholders who navigate the complex interplay of regulatory shifts, supply chain disruptions, and evolving application requirements will unlock new avenues for growth and differentiation. Key to this success is the ability to integrate advanced resin technologies with digital tools and circular economy practices, thereby delivering coatings that meet strict ecological benchmarks without compromising on durability or aesthetic appeal.

As the market matures, the leaders will be those who leverage collaborative ecosystems, embrace backward integration for raw materials, and maintain agile manufacturing footprints to accommodate rapid formula changes. By embedding sustainability at the core of their business models and forging strategic partnerships across the value chain, organizations can transform regulatory challenges into competitive advantages. The coming years promise to be defining for green coatings, with the potential to catalyze broader shifts toward greener industrial processes and consumer products.

Unlock the Full Strategic Potential of the Green Coatings Market by Connecting With Ketan Rohom to Acquire the Definitive Industry Intelligence

If you are looking to gain a deeper understanding of the evolving green coatings space and to position your organization for strategic success in this expanding market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to purchase the comprehensive market research report. Leverage this detailed analysis to inform product development, optimize supply chain strategies, and identify high-growth segments aligned with emerging environmental regulations and sustainability goals. Connect with Ketan Rohom today and ensure your teams have the intelligence they need to drive profitability, innovation, and sustainability across all coating applications.

- How big is the Green Coatings Market?

- What is the Green Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?