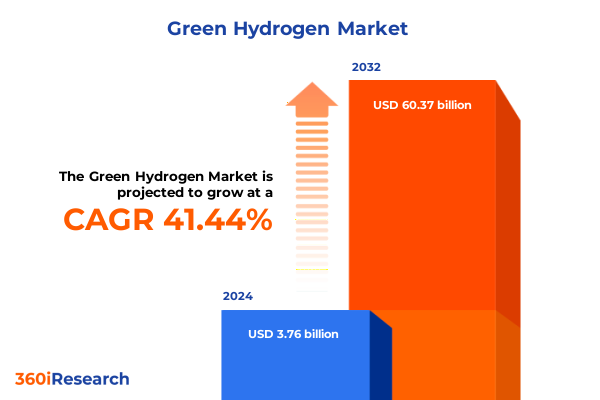

The Green Hydrogen Market size was estimated at USD 5.20 billion in 2025 and expected to reach USD 7.24 billion in 2026, at a CAGR of 41.91% to reach USD 60.37 billion by 2032.

Understanding the Rising Momentum and Strategic Importance of Green Hydrogen as a Cornerstone of Decarbonization and Energy Security

Global decarbonization efforts have positioned green hydrogen as a pivotal solution for reducing carbon emissions across multiple industries and strengthening energy security. As economies strive to meet net-zero targets, hydrogen produced from renewable-powered electrolysis is gaining recognition for its capacity to support heavy-duty transport, industrial feedstocks, and long-duration energy storage. Governments and corporations worldwide are aligning on hydrogen as a key enabler of clean energy transitions, demonstrating its strategic importance beyond niche applications.

In late 2024, the U.S. Department of Energy awarded $2.2 billion to two regional clean hydrogen hubs under the Bipartisan Infrastructure Law’s Hydrogen Hubs program. The Gulf Coast and Midwest Hydrogen Hubs are expected to create high-quality jobs and catalyze domestic production, storage, and distribution of low-carbon hydrogen. These initial investments underscore policy momentum in the United States to establish a robust hydrogen economy.

Technological advances have further accelerated green hydrogen’s trajectory. Electrolyzer capital expenditures have declined significantly due to manufacturing scale-up and innovation, while system efficiencies for proton exchange membrane and solid oxide electrolyzers now exceed 80 percent. With more than thirty-five countries having launched national hydrogen strategies, global coordination in research, standardization, and infrastructure planning is driving cost reductions and deployment at scale.

Underpinning these developments, analyses by the International Energy Agency highlight that low-emissions hydrogen production costs could be halved by 2030 under net-zero emissions scenarios. This rapid cost evolution, coupled with policy incentives, is propelling green hydrogen toward commercial viability and reinforcing its role as a cornerstone for deep decarbonization strategies.

Exploring the Technological Advancements Policy Incentives and Cost Declines Revolutionizing the Green Hydrogen Market Landscape

Over the past two years, transformative shifts in technology, cost structures, and policy frameworks have reshaped the green hydrogen landscape. The levelized cost of hydrogen from renewable-powered electrolysis has fallen to between $2.50 and $3.50 per kilogram in optimal locations, reflecting breakthroughs in electrolyzer design, improved power-to-hydrogen integration, and competitive renewable electricity prices below $20 per megawatt-hour. These cost dynamics are unlocking new project economics and broadening the set of viable applications.

Policy incentives have been equally significant in driving scale-up. The U.S. Inflation Reduction Act offers a hydrogen production tax credit worth up to $3 per kilogram, while the European Union’s Hydrogen Strategy sets out a pathway to install 40 gigawatts of electrolyzer capacity by 2030. Combined with supportive frameworks in Asia-Pacific markets such as Japan’s Green Growth Strategy and Australia’s Export Hubs Initiative, these measures have galvanized private investment and spurred large-scale partnerships among energy majors and technology providers.

Meanwhile, industry coalitions and sector coupling initiatives are broadening hydrogen’s role across supply chains. Strategic collaborations between renewable developers, ammonia producers, and pipeline operators are delivering integrated solutions that address production, transport, and end-use demands. Innovations in energy storage systems and hydrogen carriers such as ammonia and liquid organic hydrogen carriers are also emerging to tackle seasonal and long-distance transport challenges, further diversifying the applications and strengthening market resilience.

Assessing the Cumulative Impact of Newly Enacted United States Trade Tariffs on Green Hydrogen Supply Chains and Project Viability in 2025

In 2025, U.S. trade policy has introduced a complex tariff regime that significantly affects green hydrogen supply chains and project viability. A baseline tariff of 10 percent on all imports, coupled with elevated duties of up to 125 percent on certain Chinese-origin components and a 20 percent reciprocal tariff on key European goods, has reshaped procurement strategies. Solar modules and wind components critical for powering electrolyzers are subject to tariffs of up to 145 percent, while steel inputs face a 25 percent duty, compounding cost pressures for developers.

These measures have disrupted traditional supply chains, as leading European electrolyzer manufacturers like Siemens Energy see their cost advantage erode in the absence of domestic production facilities. Although some producers have started localized manufacturing in the United States, the timing and scale of these investments remain uncertain. The resulting supply constraints contributed to a 43 percent week-over-week decline in container imports to U.S. ports by April 2025, reflecting the broader scramble to secure alternative sources and manage timeline risks.

On the other hand, the protective tariff environment has temporarily benefited domestic equipment suppliers. U.S.-based electrolyzer firms may gain market share at home amidst reduced competition, yet they continue to contend with upstream cost inflation from non-electrolyzer components that remain tariffed. The evolving geopolitical climate, marked by potential retaliatory measures from trading partners, further complicates market access and long-term strategic planning for both international and domestic players.

Unveiling Key Market Segmentation Insights Based on Production Process Technology End-Use Industry and End Application Dynamics for Green Hydrogen

A nuanced analysis of the green hydrogen market emerges when viewed through the lens of production process, technology, end-use industry, and application. The production process dimension differentiates traditional biomass gasification routes from modern electrolysis pathways and nascent photocatalysis methods. Within the electrolysis segment, alkaline electrolyzers have secured early commercial deployments, while proton exchange membrane devices are favored for their operational flexibility and rapid response, and solid oxide electrolyzers offer high efficiencies at elevated temperatures for industrial integration.

From a technology standpoint, membrane and electrolyte innovations are at the forefront of cost and performance optimization. Anion exchange membranes are advancing to lower reliance on precious metals and improve durability. Polymer electrolyte membranes remain the most widely adopted, benefiting from mature manufacturing and scale. Solid oxide electrolytes, operating at high temperatures, are unlocking attractive thermodynamic efficiencies when paired with industrial waste heat sources.

Examining end-use industries reveals that chemical feedstock producers continue to command the largest share of demand, leveraging hydrogen for ammonia and methanol synthesis. Industrial applications such as steelmaking and refining follow closely, with power generation using hydrogen blends and pure hydrogen turbines gaining traction for grid balancing. The transportation sector is also positioning itself as a key growth engine, particularly for heavy-duty trucks, maritime fuel cells, and rail electrification scenarios.

Finally, application insights highlight the evolving landscape of hydrogen utilization. Commercial settings, including data centers and district energy systems, are tapping into hydrogen fuel cells for reliable backup and peak load support. Domestic pilots, focused on residential heating and microgrid systems, are driving community-scale demonstrations. Portable power solutions, spanning off-grid industrial operations and remote telecom installations, underscore hydrogen’s versatility in niche contexts where batteries alone cannot meet energy density and endurance requirements.

This comprehensive research report categorizes the Green Hydrogen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Process

- Source

- Project Size

- Delivery Mode

- End-Use Industry

Revealing Critical Regional Dynamics Across the Americas EMEA and Asia-Pacific That Are Driving Divergent Green Hydrogen Deployment and Investment Trends

Regional market dynamics for green hydrogen reveal distinct trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific, reflecting varied policy frameworks, resource endowments, and industrial priorities. In the Americas, the United States leads with federal support through tax credits and hydrogen hub funding, while Canada and select Latin American nations are exploring export opportunities tied to abundant renewable energy resources. Private sector commitments and public-private partnerships are essential in unlocking these continental synergies.

In Europe, Middle East & Africa, the European Union has charted an ambitious course with its Hydrogen Strategy, emphasizing cross-border infrastructure corridors and regulatory standardization. North African and Middle Eastern solar and wind resources are attracting investment as potential export hubs, with electrolysis projects aiming to supply European and intra-regional markets. Meanwhile, Africa’s growing renewable capacity and industrial decarbonization requirements are catalyzing emerging hydrogen initiatives in South Africa and other markets.

The Asia-Pacific region exhibits a broad spectrum of engagement. Australia’s export-oriented green hydrogen roadmap is underpinned by vast solar and wind potential, targeting Asian importers such as Japan and South Korea. China’s scale-up in electrolyzer manufacturing and domestic pilot projects has driven down component costs, while policy support in Japan and South Korea focuses on industrial adoption, mobility demonstrations, and strategic import partnerships. These varied regional approaches underscore the importance of tailored strategies for project development and market entry.

This comprehensive research report examines key regions that drive the evolution of the Green Hydrogen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Profiles and Competitive Dynamics Among Leading Players Shaping the Global Green Hydrogen Industry

Leading companies across the green hydrogen value chain are demonstrating distinct strategies to capture market opportunities and navigate emerging challenges. Siemens Energy remains a dominant electrolyzer supplier in global project pipelines, particularly for polymer electrolyte membrane systems, although its lack of established U.S. manufacturing capacity has exposed it to recent tariff headwinds. Concurrently, domestic technology firms are scaling production to address local demand and mitigate trade risks.

Electrolyzer specialists such as Nel, HydrogenPro, and Haldor Topsoe are diversifying their geographic footprints. Nel and John Cockerill have announced localized assembly or manufacturing lines in North America to circumvent tariff pressures and shorten lead times. HydrogenPro’s planned alkaline electrolyzer facility in Texas has been temporarily delayed, reflecting strategic caution amidst evolving policy guidelines and tax credit uncertainties.

On the corporate side, industrial gas giants like Linde and Air Liquide are investing in large-scale production and distribution projects, leveraging integrated pipelines and storage networks. Air Liquide’s reassessment of its hydrogen hub investments demonstrates the interplay between government funding announcements and project prioritization. Meanwhile, energy majors such as Shell, BP, and TotalEnergies are strategically partnering with technology providers to secure offtake agreements, ensuring fleet scalability and end-use integration across sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Green Hydrogen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Group

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Avaada Energy Pvt. Ltd.

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- Cummins Inc.

- CWP Global

- ENAPTER AG

- ENGIE SA

- Green Hydrogen Systems A/S

- Hiringa Energy Ltd

- HydrogenPro ASA

- Iberdrola, S.A.

- ITM Power plc

- Iwatani Corporation

- Kawasaki Heavy Industries, Ltd.

- Larsen & Toubro Limited

- Linde PLC

- McPhy Energy S.A.

- Messer SE & Co. KGaA

- Nel ASA

- NEOM Company

- Ohmium International, Inc.

- Plug Power Inc.

- PowerCell Sweden AB

- Reliance Industries Limited

- Saudi Arabian Oil Company

- Siemens AG

- Thermax Limited

- ThyssenKrupp AG

- Topsoe A/S

- Toshiba Corporation

- Uniper SE

Actionable Strategic Recommendations for Industry Leaders to Navigate Policy Complexities and Drive Sustainable Growth in the Green Hydrogen Sector

Industry leaders should proactively engage with policy makers to advocate for stable tax incentive frameworks and clear tariff exemptions on critical components, aligning regulatory regimes with long-term decarbonization goals. Unlocking the full potential of hydrogen requires coordinated lobbying for timely disbursement of production tax credits and harmonized standards that facilitate cross-border trade.

Simultaneously, supply chain resilience must be enhanced through diversification of procurement sources and strategic partnerships with electrolyzer and component manufacturers across multiple regions. Investing in localized manufacturing hubs and joint ventures can mitigate tariff exposure while fostering knowledge transfer and workforce development within key markets.

Leaders should also prioritize innovation pipelines, allocating resources to next-generation electrolyzer technologies, advanced membrane materials, and digital process optimization tools. By collaborating with research institutions and leveraging public funding for R&D, companies can accelerate cost reductions and improve operational performance.

Finally, fostering offtake agreements and consortium-based project structures can de-risk large-scale deployments. Integrating green hydrogen into industrial clusters, utilities, and transport corridors through multi-stakeholder partnerships will facilitate demand aggregation, infrastructure sharing, and economies of scale necessary for commercial viability.

Detailing the Comprehensive Research Methodology Employed to Ensure Robust Data Collection Analysis and Insight Generation in Green Hydrogen Studies

This report’s insights are derived from a rigorous multi-method research approach combining primary and secondary data sources. Desk research included an extensive review of government filings, regulatory announcements, and policy frameworks, supplemented by in-depth analysis of peer-reviewed literature and industry white papers.

Expert interviews with senior executives from leading electrolyzer manufacturers, utilities, industrial gas companies, and clean energy policy analysts provided qualitative perspectives on market dynamics, technology trajectories, and strategic priorities. These discussions informed scenario analyses and risk assessments related to tariffs, tax incentives, and geopolitical factors.

Quantitative modeling was supported by proprietary databases tracking project pipelines, equipment costs, and module pricing, with data triangulated against public disclosures and market intelligence. Regional case studies were developed to contextualize deployment drivers, infrastructure readiness, and regulatory environments.

Throughout the analysis, strict quality control measures ensured data accuracy and consistency, including cross-verification of key metrics and peer review by subject-matter advisors. This methodology underpins the reliability and actionability of the strategic insights presented in the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Green Hydrogen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Green Hydrogen Market, by Production Process

- Green Hydrogen Market, by Source

- Green Hydrogen Market, by Project Size

- Green Hydrogen Market, by Delivery Mode

- Green Hydrogen Market, by End-Use Industry

- Green Hydrogen Market, by Region

- Green Hydrogen Market, by Group

- Green Hydrogen Market, by Country

- United States Green Hydrogen Market

- China Green Hydrogen Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on Green Hydrogen’s Evolving Role in the Energy Transition and Strategic Imperatives for Stakeholder Engagement and Collaboration

Green hydrogen is rapidly advancing from pilot projects to commercial endeavors, driven by technological breakthroughs, policy incentives, and strategic corporate partnerships. Cost declines in electrolyzer systems and renewable power are enabling diverse applications across chemical production, heavy industry, power generation, and transportation.

However, the introduction of complex tariffs and evolving tax credit regimes underscores the importance of agile strategies. Balancing supply chain security with cross-border innovation requires forward-looking policy engagement and investment in localized manufacturing capabilities. Market segmentation based on production processes, technology types, end-use industries, and applications illuminates the differentiated needs and growth pathways across the value chain.

Regional dynamics reveal that while the Americas prioritize domestic hub development, EMEA is capitalizing on export-oriented corridors and regulatory harmonization, and Asia-Pacific leverages scale, resource endowments, and import partnerships. Leading companies are staking out competitive advantages through strategic alliances, manufacturing localization, and technology diversification.

As the green hydrogen sector matures, stakeholder collaboration, stable policy frameworks, and continued R&D investments will be critical to realizing its full potential as a cornerstone of the global energy transition.

Engaging Directly with Ketan Rohom to Secure Your Comprehensive Market Research Report and Capitalize on Emerging Green Hydrogen Opportunities Today

To discuss how your organization can leverage the insights from this comprehensive report and tailor strategic initiatives for the rapidly evolving green hydrogen market, please contact Ketan Rohom (Associate Director, Sales & Marketing) for a personalized consultation. Engage with an expert who can guide you through the nuanced dynamics of policy shifts, technological advancements, and competitive landscapes to help you capture emerging growth opportunities. Seize this moment to transform your hydrogen strategy and drive sustainable innovation by securing access to the full market research report today.

- How big is the Green Hydrogen Market?

- What is the Green Hydrogen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?