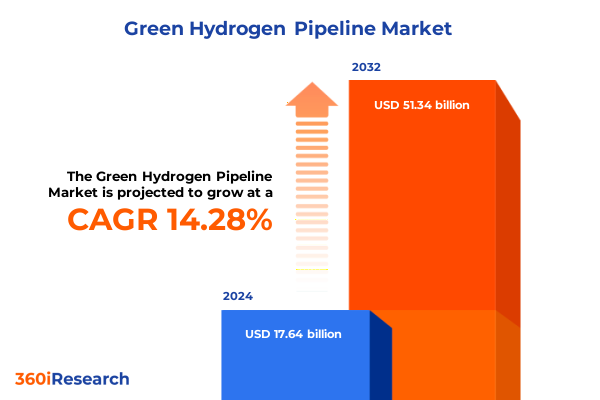

The Green Hydrogen Pipeline Market size was estimated at USD 19.98 billion in 2025 and expected to reach USD 22.96 billion in 2026, at a CAGR of 14.43% to reach USD 51.34 billion by 2032.

Unveiling the Role of Green Hydrogen Pipelines in Accelerating the Energy Transition Toward Low-Carbon Industrial and Transport Sectors

Green hydrogen pipelines are poised to become a linchpin in the global energy transition as economies seek to minimize carbon footprints across industries and transportation networks. According to the International Energy Agency, pipelines remain the most efficient and least costly means to transport hydrogen over distances of up to 3,000 kilometers for annual capacities exceeding 200 kilotons of hydrogen, particularly when repurposed from existing natural gas infrastructure. In the United States alone, approximately 2,600 kilometers of dedicated hydrogen pipelines are operational, serving industrial clusters and demonstrating early proof points for scaled low-carbon energy transport.

Despite this promising potential, green hydrogen pipeline development must overcome significant hurdles before widespread adoption. Globally, some 5,000 kilometers of hydrogen pipelines are already in operation, yet only one green pipeline project is currently under construction in Rotterdam, illustrating the nascent stage of network expansion. This limited progress is often attributed to technical and economic barriers, including hydrogen embrittlement concerns, high capital expenditure for new pipelines, and the need for robust safety standards tailored to hydrogen’s unique properties.

At the same time, momentum is building through targeted policy support and strategic industrial partnerships. Recent investment decisions in Europe and Asia underscore stakeholders’ commitment to overcoming these obstacles, and the alignment of green energy targets with hydrogen production capacity is emerging as a critical enabler. As the transport and storage infrastructure scales, the role of green hydrogen in hard-to-decarbonize sectors such as steelmaking, chemical production, and heavy transportation is set to expand rapidly, positioning pipelines as the connective arteries of a zero-carbon energy network.

Navigating Transformative Shifts in the Green Hydrogen Pipeline Landscape Fueled by Technological Innovation and Evolving Policy Imperatives

The green hydrogen pipeline ecosystem is undergoing transformative shifts driven by policy incentives, technological innovation, and strategic repurposing of existing infrastructure. In the United States, the Inflation Reduction Act introduced the 45V hydrogen production tax credit, offering up to three dollars per kilogram for hydrogen with lifecycle emissions below 0.45 kilograms of CO₂ equivalent per kilogram of hydrogen, alongside a 30% investment tax credit for fuel cells, electrolyzers, and related infrastructure. These measures, coupled with a direct pay option, are catalyzing new investments and reducing the financial risk of pioneering pipeline projects across the country.

On the technology front, advances in pipeline materials and engineering design are enhancing the feasibility of long-distance hydrogen transport. Recent analyses by the International Renewable Energy Agency indicate that repurposing existing natural gas pipelines can extend hydrogen transport cost-effectively to distances approaching 8,000 kilometers, while newly built trunk lines fuel local connectivity and regional hubs. Concurrently, composite pipe materials such as fiber-reinforced plastics are being tested for lower embrittlement risk and easier maintenance, offering a cost-competitive alternative where steel tariffs or supply constraints present barriers.

Internationally, collaboration on large-scale network planning is driving market confidence. In Europe, the SoutH2 Corridor and European Hydrogen Backbone initiative envision a 3,300-kilometer network linking Austria, Germany, Italy, and North Africa, with ambitions to expand to nearly 12,000 kilometers by 2030. This concerted effort is setting benchmarks for cross-border regulatory frameworks, tariff harmonization, and joint financing mechanisms, illustrating how strategic alignment can unlock the transformative potential of green hydrogen pipelines.

Assessing the Cumulative Impact of 2025 United States Steel and Aluminum Tariffs on Green Hydrogen Pipeline Development and Material Costs

Over the course of 2025, the United States significantly tightened its trade policy on steel and aluminum, with profound implications for green hydrogen pipeline projects. Following the termination of all country-specific exemptions under Section 232, imports of steel articles and derivative products from major trading partners faced reinstated ad valorem duties effective March 12, 2025, marking the end of lengthy alternative agreements and blanket quotas. This policy shift reestablished a uniform 25% tariff baseline on steel, directly affecting the primary pipeline material for many green hydrogen initiatives.

In June 2025, the tariff on steel and aluminum content in imported products was raised to 50%, heightening material cost pressures for pipeline constructors and operators. This doubling of tariffs stemmed from a renewed invocation of Section 232 authority and reflected a strategic emphasis on bolstering domestic manufacturing. As a result, project budgets must now accommodate higher procurement expenses for steel pipe segments, flanges, and fittings, prompting a re-evaluation of material sourcing strategies.

The elevated tariff environment has prompted leading developers to explore alternative materials and domestic supply chains. For instance, several engineering firms are now specifying composite pipelines over carbon steel options to mitigate tariff-driven cost escalations and avoid supply chain bottlenecks. This pivot not only aligns with broader decarbonization goals but also underscores the resilience of multi-material strategies when geopolitical factors threaten traditional procurement channels.

Moreover, industry stakeholders warn that retaliatory trade measures and ongoing legal challenges under the International Economic Emergency Powers Act may introduce further uncertainty. A series of sector-specific investigations, including those targeting copper, lumber, and semiconductors under Section 232, could expand this restrictive trade environment if additional import restrictions are enacted. As a result, pipeline project timelines and capital allocation are increasingly influenced by the evolving tapestry of U.S. trade policy.

Gaining Insights into Market Segmentation for Green Hydrogen Pipelines Across End Users Pipeline Types Materials Pressure Ratings Lengths and Delivery Modes

Understanding the green hydrogen pipeline market requires a nuanced view of how different demand segments drive project prioritization. From an end-user perspective, the market spans industrial applications-where chemical production, refining, and steel manufacturing seek low-carbon feedstocks-to power generation through fuel cells and gas turbines, and in transportation for both heavy-duty and light-duty vehicle fueling corridors. Each of these end users defines unique pressure and purity requirements, capital intensity profiles, and regulatory interfaces, shaping network design and operational strategies.

Pipeline typology further enriches the landscape, bifurcating into offshore routes along coastal corridors or subsea connections-critical for linking renewable hydrogen hubs to island or marine-adjacent demand centers-and onshore systems that may be dedicated green hydrogen pipelines or repurposed natural gas lines. Renowned global infrastructure operators are evaluating the benefits of retrofitting existing rights-of-way against the performance gains of purpose-built green hydrogen networks.

Material selection represents another pivotal segmentation axis. Composite pipelines, particularly those built with fiber-reinforced plastic, offer corrosion resistance and reduced hydrogen embrittlement risk, while steel grades-ranging from carbon steel to stainless variants-provide proven mechanical strength and established fabrication pathways. Pressure rating classifications, from high-pressure long-distance transmission to medium-pressure regional lines and low-pressure distribution networks, further influence pipe diameter, wall thickness, and compressor station requirements.

Finally, pipeline length categories-long-distance trunk lines, medium-distance regional feeders, and short-distance in-district loops-and delivery modes, whether blending hydrogen with natural gas in existing networks or deploying dedicated pure hydrogen pipelines, determine the commercial model, safety protocols, and tariff structures. These segmentation dimensions collectively guide investment prioritization, risk assessment, and stakeholder engagement in the green hydrogen pipeline sector.

This comprehensive research report categorizes the Green Hydrogen Pipeline market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pipeline Type

- Pipeline Material

- Pressure Rating

- Pipeline Length

- Delivery Mode

- End User

Revealing Regional Dynamics Shaping Green Hydrogen Pipeline Adoption Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a determinative role in shaping green hydrogen pipeline strategies and investment flows. In the Americas, the United States leads with operational networks spanning industrial clusters in the Gulf Coast and Midwest, supported by 2,600 kilometers of existing infrastructure and bolstered by federal incentives that align with state-level clean energy mandates. Canada’s provincial strategies in Alberta and Quebec are also attracting cross-border pipeline proposals, reflecting a North American value chain that integrates renewable electricity exports with hydrogen transport.

Across the Europe, Middle East, and Africa region, the European Hydrogen Backbone initiative is the flagship project, envisioning an interconnected network of over 11,600 kilometers by 2030 and nearly 40,000 kilometers by 2040, linking renewable-rich areas with industrial hubs through coastal and transnational corridors. The Middle East’s nascent green hydrogen exports, driven by solar-heavy Gulf states, anticipate subsea pipelines to import terminals in Europe, while South Africa’s integrated energy policy is exploring repurposed gas lines to support local platinum-hydrogen technology clusters.

In the Asia-Pacific, China’s pioneering 737-kilometer Zhangjiakou-Kangbao–Caofeidian pipeline represents a landmark for large-scale green hydrogen transport, set for completion by mid-2027 and underscoring the region’s ambition to decarbonize steelmaking and chemical industries. Australia’s massive renewable resource base is delivering pilot trunk lines for ammonia carriers, complemented by feasibility studies for onshore hydrogen networks in Queensland and Western Australia. Together, these regional insights highlight the importance of tailored policy frameworks, infrastructure financing approaches, and cross-border coordination to realize green hydrogen pipeline objectives at scale.

This comprehensive research report examines key regions that drive the evolution of the Green Hydrogen Pipeline market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Driving Innovation Collaboration and Infrastructure Expansion in the Green Hydrogen Pipeline Sector

Leading industry players are carving the path forward for green hydrogen pipeline infrastructure through strategic partnerships and first-mover investments. In Europe, Gasunie’s HyTransPort pipeline in the Port of Rotterdam has moved from concept to reality, with Shell as the inaugural customer for the 32-kilometer Maasvlakte-to-Pernis route, demonstrating a replicable model for port-adjacent industrial clusters. This modular expansion approach is fostering a pan-European network that integrates electrolyzer deployments with transport logistics.

In the United States, Plug Power has publicly highlighted its advantage from extended fuel cell equipment credits and up to three dollars per kilogram green hydrogen production credits under newly enacted legislation, enabling the company to allocate capital toward fueling stations and localized distribution pipelines with improved financial certainty. These policy extensions are integral to supporting nascent domestic pipeline corridors and fueling infrastructure across key freight and transit nodes.

Global gas majors also play a central role in shaping cross-border corridors, with companies such as Linde and Air Liquide uniting under the European Hydrogen Backbone consortium to advance regional transmission projects and shared compressor stations. Their combined expertise in gas infrastructure is streamlining permit processes and driving economies of scale, setting benchmarks for risk-sharing and regulatory harmonization.

In the Asia-Pacific arena, Sinopec and State Power Investment Corporation are spearheading China’s first long-haul green hydrogen pipeline, leveraging state support and local renewable energy resources to supply low-carbon hydrogen to steel and fertilizer plants. This large-scale investment exemplifies how integrated energy policy and domestic technological capacity can accelerate pipeline deployment in emerging markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Green Hydrogen Pipeline market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- ArcelorMittal

- Ballard Power Systems Inc.

- Cummins Inc.

- Enapter s.r.l.

- ENGIE SA

- Fortescue Future Industries Pty. Ltd.

- Green Hydrogen Systems A/S

- Hexagon Purus AS

- Hydrogenics Corporation

- ITM Power PLC

- Larsen & Toubro Limited

- Linde PLC

- McPhy Energy S.A.

- Nel ASA

- Plug Power Inc.

- Salzgitter AG

- Siemens Energy AG

- Snam S.p.A.

- Tata Steel Limited

- Tenaris

- Welspun Corp Ltd.

Implementing Actionable Recommendations to Overcome Challenges Scale Infrastructure and Foster Sustainable Growth in Green Hydrogen Pipeline Deployments

Industry leaders must proactively integrate policy intelligence into capital planning to navigate evolving tariff regimes and incentive structures. By aligning project timelines with tax credit qualification windows and engaging early with regulatory bodies, organizations can secure cost advantages and mitigate compliance risks. Incorporating flexible contract terms that allow for material substitution-whether steel or composite-will further buffer projects against sudden shifts in trade policy.

Collaboration among pipeline developers, electrolyzer manufacturers, and end users is essential to optimize integrated value chains. Establishing joint ventures or public-private partnerships can spread risk across stakeholders, lower capital barriers, and accelerate permitting processes. Transparent sharing of best practices on compressor station design, leak detection, and maintenance protocols will drive down operational expenditures and elevate safety standards.

Adoption of digital twins and predictive analytics for pipeline integrity management can significantly enhance operational efficiency and reduce unplanned downtime. Investing in real-time monitoring systems that leverage machine learning for embrittlement detection and flow optimization will preserve asset longevity and support regulatory reporting requirements.

Finally, embedding sustainability principles into procurement and construction practices-such as prioritizing recycled materials, embracing circularity for pipeline components, and integrating community engagement processes-will not only meet ESG mandates but also fortify social license to operate, which is increasingly critical for green hydrogen projects.

Outlining a Robust Research Methodology Integrating Primary Expert Engagement and Comprehensive Secondary Data Analysis for Market Clarity

Our research framework combined extensive primary engagement with subject matter experts and rigorous secondary data analysis to ensure comprehensive market clarity. We conducted in-depth interviews with senior executives at leading pipeline operators, electrolyzer manufacturers, and policy makers, capturing insights on project timelines, technology adoption curves, and regulatory evolution. These firsthand perspectives were invaluable in validating emerging trends in pipeline segmentation and supply chain dynamics.

On the secondary research front, we leveraged authoritative data sources, including International Energy Agency reports, government fact sheets on Section 232 tariffs, and industry association publications on tax credit mechanisms. Detailed analyses of congressional and executive branch proclamations informed our assessment of trade policy impacts, while technology white papers provided context on material innovation and pressure rating considerations.

To triangulate findings, we cross-referenced project-level data from corporate disclosures, infrastructure consortium announcements, and regional development plans. This iterative validation process allowed us to reconcile discrepancies in reported pipeline capacities, project completion timelines, and funding commitments, ensuring the insights presented are both robust and actionable.

Finally, an expert advisory panel comprising former trade negotiators, pipeline engineers, and renewable energy financiers reviewed preliminary conclusions, offering peer-level scrutiny and confirming that the recommendations align with real-world operational considerations and investment criteria.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Green Hydrogen Pipeline market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Green Hydrogen Pipeline Market, by Pipeline Type

- Green Hydrogen Pipeline Market, by Pipeline Material

- Green Hydrogen Pipeline Market, by Pressure Rating

- Green Hydrogen Pipeline Market, by Pipeline Length

- Green Hydrogen Pipeline Market, by Delivery Mode

- Green Hydrogen Pipeline Market, by End User

- Green Hydrogen Pipeline Market, by Region

- Green Hydrogen Pipeline Market, by Group

- Green Hydrogen Pipeline Market, by Country

- United States Green Hydrogen Pipeline Market

- China Green Hydrogen Pipeline Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Chart a Strategic Path Forward for Green Hydrogen Pipeline Investments and Policy Formulations

The confluence of policy initiatives, technological innovation, and strategic material segmentation is positioning green hydrogen pipelines as a cornerstone of the low-carbon energy future. Nations around the globe are coalescing around interoperable network standards and shared financing frameworks, as evidenced by the European Hydrogen Backbone and significant U.S. tax incentives that underscore market confidence.

At the same time, trade policy developments, particularly the reinstated and elevated steel and aluminum tariffs in the United States, are reshaping material cost structures and driving diversification into composite alternatives. This evolving environment mandates agile supply chain strategies and underscores the critical importance of cross-sector collaboration to manage geopolitical and regulatory risks.

Market segmentation insights reveal that tailored pipeline solutions-whether dedicated long-distance trunk lines, medium-pressure regional feeders, or low-pressure distribution loops-must align with end-user specifications in industrial, power, and transport applications. Incorporating this multi-dimensional view will enable decision-makers to prioritize investments that deliver the greatest strategic impact and optimize returns.

As countries and companies race to establish hydrogen economies, those that leverage integrated policy intelligence, proven engineering practices, and structured segmentation frameworks will be best positioned to capture the transformative opportunities presented by green hydrogen pipelines.

Take the Next Step Toward Clean Energy Leadership With Expert Market Research Insights Structured to Inform Your Green Hydrogen Pipeline Strategy

Ready to translate these insights into actionable strategies customized for your organization’s unique challenges and seize the growth opportunities in the green hydrogen pipeline sector Reach out to Ketan Rohom to discuss how tailored market intelligence can empower your strategic decisions and position you at the forefront of the clean energy revolution

- How big is the Green Hydrogen Pipeline Market?

- What is the Green Hydrogen Pipeline Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?