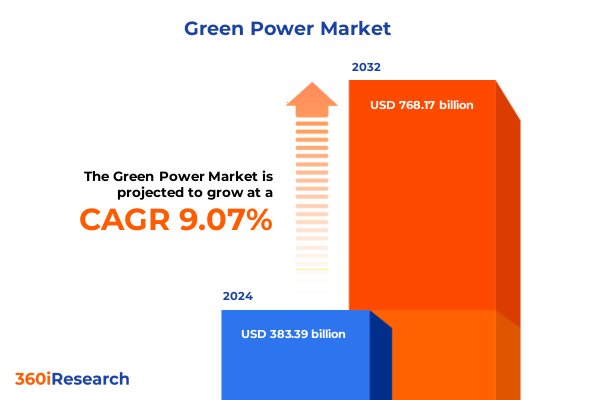

The Green Power Market size was estimated at USD 417.40 billion in 2025 and expected to reach USD 454.42 billion in 2026, at a CAGR of 9.10% to reach USD 768.17 billion by 2032.

Exploring the Emergence and Strategic Importance of Green Power in a Transforming Global Energy Ecosystem amid Policy and Market Shifts

The rapid expansion of green power has transformed energy portfolios worldwide as nations and corporations strive to decarbonize their electricity supply. In 2024, an astonishing 93% of new energy capacity in the United States originated from low-emission sources, with wind, solar and battery storage accounting for the lion’s share of deployments. Globally, renewable power contributed roughly 80% of the total increase in electricity generation, underscoring the centrality of sustainable technologies in meeting rising demand while curbing carbon emissions.

Declining technology costs, particularly for solar photovoltaic modules and wind turbines, have accelerated adoption across markets. At the same time, innovation in digital energy management tools, advanced battery chemistries and hybrid renewable solutions has unlocked new efficiency gains, enabling grid operators to integrate intermittent resources at unprecedented levels. Institutional investors have responded accordingly; in 2025, clean-energy investments are projected to outpace fossil fuel financing by a factor of two, reflecting confidence in the long-term viability of renewable assets.

Underpinning this momentum are ambitious policy frameworks that span from national decarbonization targets to international climate agreements. At the COP28 conference, governments committed to tripling global installed renewable capacity by 2030, placing durable emphasis on sustainable energy pathways. Fueling domestic manufacturing through tax incentives, import quotas and public–private partnerships is now a strategic imperative for many countries seeking energy security.

In this report, we examine the strategic drivers reshaping the green power market, assess the cumulative impact of United States tariffs introduced in early 2025, and reveal actionable insights across segmentation criteria. Through this analysis, decision-makers will gain a holistic view of evolving risks and growth levers as they navigate the global energy transition.

Unveiling the Critical Technological Innovations Policy Drivers and Financial Mechanisms Reshaping the Green Power Landscape Worldwide

Against a backdrop of accelerating climate commitments, the green power sector is experiencing seismic transformations propelled by technological breakthroughs, novel policy instruments and evolving finance models. Breakthroughs in long-duration storage, including flow batteries and green hydrogen fuel cells, are extending the operational window of renewable assets and reducing reliance on fossil-based peaking plants. Concurrently, digitalization of grid management through artificial intelligence and blockchain-enabled energy trading platforms is streamlining grid balancing and unlocking new revenue streams for distributed energy resource owners.

Meanwhile, corporate procurement of renewable energy via power purchase agreements has surged, with volumes contracted globally rising by more than a third in 2024. Leading data-center operators and manufacturing giants are locking in green power supply, leveraging long-term contracts to hedge energy price volatility and demonstrate progress toward net-zero goals. These offtake arrangements are now a critical enabler of project financing, with financial institutions increasingly regarding contracted revenue streams as creditworthy collateral.

Financial innovation is also expanding the range of capital available for renewable projects. Green bonds, yield-cos and sustainability-linked loans have attracted new sources of institutional funding, while development finance institutions are deploying concessional capital to de-risk investments in emerging markets. At the same time, government battery storage programs and capacity auctions are mobilizing billions in private investment to strengthen grid resilience.

Policy frameworks such as the U.S. Inflation Reduction Act, the European Green Deal and targets under China’s 2060 carbon-neutral pledge are channeling financial incentives and regulatory support toward green power deployment. By marrying bold policy vision with robust market mechanisms, these initiatives are driving a virtuous cycle of cost declines and infrastructure expansion that is set to redefine the global energy landscape.

Examining the Complex and Far Reaching Effects of the United States 2025 Trade Tariffs on Green Power Supply Chains and Development Costs

In early 2025, a suite of trade measures introduced by the United States government has reshaped economics across the green power supply chain. Universal import duties of 10% on a broad array of clean energy components were enacted alongside elevated country-specific levies, including a 30% surcharge on goods from China layered atop existing anti-dumping tariffs. These policy changes were intended to stimulate domestic manufacturing yet have produced complex cost dynamics for developers and suppliers alike.

Solar module prices from Southeast Asian manufacturing hubs have spiked sharply, with some importers reporting increases of 50% to over 100% following the enforcement of new duties. These higher equipment costs have squeezed contractor margins, disrupted procurement schedules and triggered pass-through pricing adjustments in residential and commercial markets. Simultaneously, utility-scale project budgets have been stretched, compelling developers to renegotiate offtake agreements or delay project execution to accommodate shifting input costs.

Energy storage systems have been equally affected by trade tensions. While domestic battery cell capacity expanded to meet only a fraction of demand, tariffs on imported cells and related components could drive storage project costs up by as much as 50%. In 2025, it is estimated that U.S. manufacturing meets merely 6% of total battery demand, leaving the industry vulnerable to further cost escalations should additional levies be imposed.

Longer term, high-tariff scenarios modeled by leading consultancies suggest that solar deployment could decline by nearly 9% by 2035 as cost pressures curb project pipelines and complicate financing conditions. While some measures, such as expanded tariff-rate quotas for crystalline silicon photovoltaic cells, offer relief to certain import volumes, the net effect of these trade actions will continue to reverberate through supply chains and capital markets for years to come.

Deriving Actionable Perspectives from Diverse Technology Power Output Installation Types and End User Segmentation in the Green Power Sector

The green power market can be disaggregated by technology, revealing the distinct characteristics that biomass, geothermal, hydro, offshore wind, onshore wind and solar photovoltaic systems bring to project developers and grid operations. Within solar photovoltaics, monocrystalline modules deliver higher efficiencies at a premium, polycrystalline panels offer balanced cost-performance trade-offs for mid-scale applications, and thin-film technologies provide flexibility in low-light or specialized installations. This technology segmentation informs resource planning, capital allocation and site suitability assessments across project portfolios.

Power output represents another critical dimension, with sub-megawatt installations catering to decentralized, behind-the-meter applications, capacities between 1 and 10 megawatts occupying a middle ground of commercial and utility contexts, and systems exceeding 10 megawatts driving large-scale generation and wholesale market participation. The distribution of capacity classes influences grid integration strategies, interconnection processes and tariff structures, shaping the economics of dispatchable versus intermittent resources.

Installation type further refines market dynamics, as floating arrays exploit unused water surfaces while ground-mounted systems capitalize on proximity to high-voltage transmission corridors and rooftop deployments address local consumption patterns and distributed energy objectives. These variations in civil works, permitting and maintenance requirements guide technology selection and engineering design across diverse geographic settings.

End user segmentation underscores the spectrum of demand drivers: commercial and industrial buyers seek to offset high energy bills and meet sustainability mandates, residential customers prioritize cost savings and energy autonomy, and utility-scale offtakers focus on large volume procurement to satisfy regulatory quotas and public service obligations. Understanding these end-use profiles is essential for tailoring financing structures, contract tenors and revenue models to distinct market segments.

This comprehensive research report categorizes the Green Power market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Power Output

- Installation Type

- End User

Illuminating How Regional Dynamics across the Americas Europe Middle East & Africa and Asia Pacific Are Driving Divergent Green Power Opportunities

Regional market dynamics reveal how local policy frameworks, resource endowments and investment climates shape green power opportunities. In the Americas, the passage of tax incentives under the Inflation Reduction Act and the expansion of federal grant programs have spurred large-scale solar and wind developments, while Canada and Mexico benefit from nearshoring trends that strengthen cross-border supply chains. Corporate buyers and public utilities alike are leveraging power purchase agreements to secure long-term energy supply, reflecting a maturing market with diverse procurement channels.

Across Europe, the Middle East & Africa, national decarbonization targets embedded in the European Green Deal and hydrogen strategies in Gulf states are converging to elevate the role of renewable energy in core infrastructure. Competitive auctions in Europe have driven down solar and onshore wind tariffs to record lows, while Middle Eastern nations are investing in gigawatt-scale photovoltaic and green hydrogen projects. African markets, though at varying stages of grid maturity, are witnessing an uptick in off-grid and mini-grid solar installations that address access challenges and offer scalable solutions for remote communities.

In the Asia-Pacific region, China and India continue to lead global capacity additions, backed by aggressive renewable portfolio standards and domestic manufacturing incentives. Southeast Asian economies are strengthening auction frameworks and exploring regional interconnections, while Australia’s corporates and utilities are driving new business models for variable renewables and battery storage integration. Across these markets, policymakers are balancing energy security concerns with decarbonization imperatives, creating a dynamic environment for technology deployment and market innovation.

This comprehensive research report examines key regions that drive the evolution of the Green Power market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning R&D Initiatives and Collaborative Efforts of Leading Green Power Companies Accelerating Market Growth

Industry leadership in green power is marked by strategic investments in research and collaborative ventures that push technological frontiers. Prominent module manufacturers are allocating significant resources to next-generation cell architectures, with thin-film specialists optimizing flexible substrates and crystalline silicon leaders enhancing wafer efficiency. Wind turbine OEMs are advancing offshore foundation designs and digital performance analytics to maximize uptime and yield on high-humidity, high-wind coastal sites. Integrated utilities and independent power producers are expanding their portfolios through joint ventures that span renewable generation, storage integration and grid modernization initiatives.

Notable alliances between equipment suppliers, financiers and technology startups are emerging to tackle critical bottlenecks. For instance, partnerships focused on green hydrogen commercialization are pooling electrolyzer R&D with existing renewable capacities to unlock new decarbonized fuel pathways. Collaborative programs aimed at circular economy principles-recovering critical minerals from decommissioned turbines and panels-are reshaping supply chain resilience strategies. Meanwhile, developers are diversifying procurement options, establishing multi-supplier contracts to mitigate tariff risk and ensure continuity of component availability.

Energy storage innovators are forming strategic alliances with battery cell manufacturers, integrating AI-driven control systems to optimize dispatch and lifecycle performance. Such cross-sector collaborations are central to addressing the intermittency of renewables and creating value-stacked applications in frequency regulation, capacity markets and behind-the-meter services.

These corporate and consortia efforts underscore the importance of coordination across capital providers, policymakers and technology developers to sustain momentum in global green power deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Green Power market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACCIONA, S.A.

- Adani Green Energy Limited

- Brookfield Renewable Partners L.P.

- Canadian Solar Inc.

- China Energy Investment Corporation

- China Three Gorges Corporation

- Drax Group plc

- EDP Renováveis, S.A.

- Enel SpA

- First Solar, Inc.

- General Electric Company

- Iberdrola, S.A.

- Innergex Renewable Energy Inc.

- JinkoSolar Holding Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Neoen S.A.

- NextEra Energy, Inc.

- ReNew Energy Global PLC

- State Power Investment Corporation (SPIC)

- Statkraft AS

- Sungrow Power Supply Co., Ltd.

- Suzlon Energy Limited

- Vestas Wind Systems A/S

- Ørsted A/S

Presenting Practical Recommendations for Industry Leaders to Navigate Challenges Capitalize on Opportunities and Drive Sustainable Growth

Industry leaders must adopt proactive strategies to navigate persistent trade barriers and cost uncertainties while sustaining growth momentum. To mitigate tariff impacts, organizations should diversify their supplier base across multiple regions, establish local assembly hubs where feasible and negotiate flexible contract terms with escalation clauses to absorb sudden duty increases. Early procurement planning and forward-looking inventory management can also shield project pipelines from disruptive price swings.

Simultaneously, investing in the maturation of emerging technologies is critical. Allocating capital toward long-duration storage solutions, green hydrogen pilots and next-generation photovoltaic innovations will position companies to capitalize on evolving market demands. Support for open-access testing facilities and collaborative R&D consortia can accelerate commercialization timelines and de-risk technology adoption.

Engaging constructively with policymakers and regulators remains a top priority. By articulating clear path-to-market roadmaps, sharing granular cost data and demonstrating local economic benefits, industry stakeholders can influence the design of incentive mechanisms and ensure predictable regulatory environments. Thoughtful participation in consultation processes for tariff schedules, renewable portfolio standards and grid interconnection reforms can unlock new growth corridors.

Finally, forging partnerships across the value chain-from raw material suppliers to digital platform providers-will foster resilience and agility. Joint ventures, consortium bids and co-development agreements create economies of scale, disseminate best practices and facilitate the rapid scaling of integrated clean energy solutions.

Detailing the Comprehensive Research Approach Employed Including Secondary Analysis Primary Consultations and Rigorous Data Triangulation

This research applies a robust, multi-stage methodology to ensure the accuracy and relevance of our findings. We commenced with an extensive review of publicly available documents, including government trade notices, tariff schedules and regulatory filings. Proprietary industry databases provided granular insights into technology deployments and corporate procurement trends. Peer-reviewed journals and sector-specific white papers supplemented our understanding of emerging storage and hydrogen applications.

To validate and enrich secondary data, we conducted structured interviews with senior executives, project developers, technology OEM representatives and policy experts across North America, Europe, the Middle East and Asia-Pacific. These consultations offered first-hand perspectives on tariff management, financing strategies and technology roadmaps.

Our analysis incorporated quantitative data obtained from trade associations, energy agencies and leading consultancies. This information was cross-referenced with third-party market intelligence to triangulate results and reduce potential biases. Rigorous data cleansing and consistency checks were performed at each stage to uphold quality standards.

Finally, our findings were subjected to an internal peer review by subject-matter specialists, ensuring that insights reflect both current market realities and plausible near-term developments. This integrated approach delivers a comprehensive framework to support strategic decision-making in the evolving green power sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Green Power market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Green Power Market, by Technology

- Green Power Market, by Power Output

- Green Power Market, by Installation Type

- Green Power Market, by End User

- Green Power Market, by Region

- Green Power Market, by Group

- Green Power Market, by Country

- United States Green Power Market

- China Green Power Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing the Key Findings Insights and Themes Underscoring the Pivotal Role of Green Power in Future Energy Transition Strategies

The landscape of green power is being redefined by converging dynamics: technological breakthroughs are unlocking new efficiency frontiers while policy frameworks and financial innovations are channeling unprecedented capital toward sustainable energy projects. At the same time, trade policy shifts in 2025 have injected complexity into supply chains, prompting companies to re-evaluate sourcing strategies and cost management practices.

Segmentation analysis reveals that understanding the nuances of technology types, power output classes, installation modalities and end user profiles is essential for tailoring market entry and expansion plans. These dimensions directly influence project design, revenue structures and risk profiles, offering multiple levers for differentiation.

Regionally, the Americas lead through fiscal incentives and strong corporate offtake markets, Europe, the Middle East & Africa advance via regulatory auctions and emerging hydrogen hubs, and the Asia-Pacific thrives on scale, policy ambition and manufacturing linkages. Corporate and developer collaborations-spanning R&D, supply chain alliances and integrated services-are central to sustaining growth trajectories.

Collectively, these insights highlight that success in the green power sector demands agility, strategic foresight and collaborative mindsets. By aligning investment decisions with evolving policy signals, leveraging segmentation intelligence and forging resilient partnerships, stakeholders can drive long-term value creation while advancing the global clean energy transition.

Inviting Engagement and Action With Ketan Rohom to Obtain In Depth Market Insights Digital Briefings and Customized Strategic Support

To deepen your understanding of the complex dynamics and emerging opportunities within the global green power market, we invite you to engage directly with Ketan Rohom (Associate Director, Sales & Marketing). By partnering with him, you can secure an exclusive digital briefing tailored to your strategic priorities, explore customized data slices aligned with your investment thesis, and receive expert guidance on how to leverage the insights contained in this comprehensive market report. Ketan’s expertise bridges the technical nuances of renewable energy technologies with pragmatic business intelligence, ensuring that your organization can make informed decisions with confidence. Reach out to unlock a competitive advantage, access premium deliverables and position your team at the forefront of the clean energy transition.

- How big is the Green Power Market?

- What is the Green Power Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?