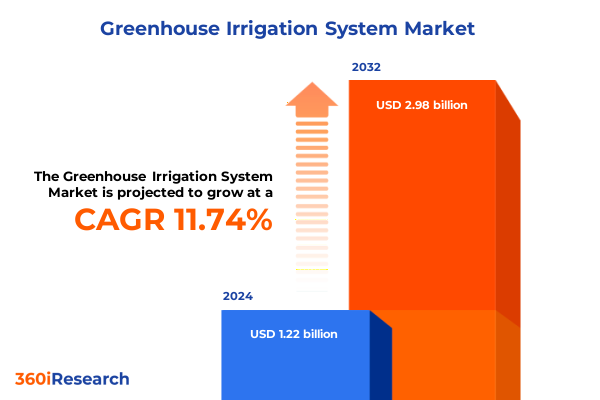

The Greenhouse Irrigation System Market size was estimated at USD 1.35 billion in 2025 and expected to reach USD 1.51 billion in 2026, at a CAGR of 11.87% to reach USD 2.98 billion by 2032.

Innovative greenhouse irrigation strategies unlocking unprecedented water efficiency and plant health optimization in controlled environment agriculture

Greenhouse irrigation technologies are at the forefront of a sustainability revolution in controlled environment agriculture, responding to growing concerns around global water scarcity, rising crop demands, and the need for precision resource management. As traditional farming methods face limitations in space efficiency and environmental control, greenhouse cultivation emerges as a pivotal solution for year-round, high-yield production. Within this evolving context, irrigation systems play a critical role not only in delivering water but also in optimizing nutrient delivery, reducing runoff, and ensuring uniform plant development.

Over the past decade, greenhouse operators have shifted from labor-intensive watering practices toward automated systems capable of fine-tuning water application at the root zone. This transition has been driven by advances in sensor technology, greater availability of modular irrigation components, and increased pressure to adhere to stricter environmental regulations. Moreover, the integration of data analytics and remote monitoring platforms has empowered growers to make informed real-time decisions, driving efficiency gains and supporting more sustainable production models.

Looking ahead, the continued innovation in greenhouse irrigation will be defined by systems that marry high-precision delivery mechanisms with intelligent controls. As growers seek to balance resource conservation with the intensification of production, the imperative for smart, adaptable irrigation frameworks will only intensify, setting the stage for a new era of agricultural productivity.

Rapid advancements in climate control integration and digital monitoring are revolutionizing greenhouse irrigation systems for the modern grower

Recent years have witnessed a profound transformation in how greenhouse irrigation systems are designed, deployed, and managed. The confluence of IoT-enabled sensor networks, cloud-based analytics, and AI-driven optimization engines has accelerated the pace at which growers can diagnose plant water needs, predict system failures, and adjust irrigation regimens dynamically. Technology providers are embedding humidity, moisture, and temperature sensors directly into controllers, enabling seamless data flow and predictive maintenance alerts that safeguard both crop health and system uptime.

Simultaneously, the emergence of advanced delivery methods such as misting, ultrasonic fog, and subsurface drip has opened new pathways for maximizing uniformity of water distribution while minimizing evaporation losses. Fog systems, once niche, are becoming mainstream for high-value ornamentals, while subsurface and surface drip networks are increasingly tailored to fruit and vegetable crop cycles. These innovations are supported by developments in materials science, including durable polyethylene tubing resistant to UV and chemical degradation, and solenoid valves optimized for rapid cycling with minimal energy consumption.

Crucially, the digital revolution in greenhouse irrigation is fostering closer collaboration between equipment manufacturers and growers. Co-innovation partnerships are driving modular, retrofit-friendly solutions that can be deployed in existing facilities, accelerating adoption across diverse geographies. As a result, the greenhouse irrigation landscape is shifting from static, hardware-centric installations toward flexible, software-defined water management ecosystems.

Evaluation of recent United States tariff measures and their cascading effects on greenhouse irrigation equipment supply chains and grower operational costs

In early 2025, the United States government implemented new tariff measures targeting key components used in greenhouse irrigation equipment, including certain steel and aluminum fittings, precision nozzles, and electronic controllers. These measures were introduced with the intent to protect domestic manufacturing and reduce dependency on imports, yet they have generated significant reverberations across global supply chains. As import costs climbed, system integrators and original equipment manufacturers began to reevaluate sourcing strategies, shifting toward regional suppliers and seeking alternative materials with comparable performance characteristics.

The immediate consequence for greenhouse operators was an uptick in capital expenditures, as retrofitting existing systems or installing new infrastructure carried higher sticker prices. Smaller growers in particular faced budgetary pressures, prompting a search for lower-cost retrofit solutions or financing models to spread out investment over time. At the same time, lead times for custom-fabricated components extended due to congestion at domestic fabrication shops, creating bottlenecks and delaying critical planting schedules in peak seasons.

However, these challenges also spurred innovation. Equipment suppliers accelerated the development of local manufacturing partnerships, and some introduced additive manufacturing for complex fittings to bypass traditional supply constraints. Meanwhile, the industry’s pivot toward smart, adaptable systems gained momentum, as operators sought to extract maximum value from each unit of water and nutrient solution. The net result has been a more resilient, diversified supply ecosystem, albeit one that demands careful navigation of tariff-related cost dynamics.

Comprehensive segmentation analysis revealing critical irrigation technology and component performance drivers across diverse crop types and distribution models

Delving into irrigation technology segmentation reveals the nuanced drivers propelling system selection and adoption. Drip solutions, ranging from surface applications ideal for broad planting beds to subsurface networks that deliver water directly to the root zone, continue to dominate due to their precision and minimal evaporation losses. Fog delivery in the form of fine misting or ultrasonic droplets is carving out a niche among floriculture operations, providing uniform coverage without waterlogging delicate cut flowers and ornamentals. In parallel, hydroponic configurations are evolving beyond traditional nutrient film techniques; the convergence of drip hydroponic emitters, ebb and flow bench systems, and nutrient film tracks is enabling growers to fine-tune nutrient concentration and pH levels in real time. Ground and overhead sprinklers remain relevant for hardy vegetable and berry production, although their use is increasingly supplemented by targeted subsurface or fog interventions to balance water conservation with crop requirements.

Component analysis further underscores the importance of controller sophistication and sensor granularity. Smart controllers with remote connectivity and programmable cycles outpace basic timer models by offering dynamic adjustments based on soil moisture, ambient humidity, and temperature readings. Tubing materials, whether polyethylene for its flexibility and UV resilience or rigid PVC for consistent flow characteristics, are selected based on installation longevity and chemical compatibility. Valve choice, between manual actuators and electronically driven solenoid variants, reflects the degree of automation desired by the grower and the need for rapid pressure regulation.

Crop-type considerations overlay these technology and component choices. Specialty cut flower and ornamental producers often favor misting systems paired with humidity sensors, while berry and citrus operations leverage drip hydroponic emitters for precise nutrient management. Fruiting vegetables, leafy greens, and root and tuber cultivations employ a mix of subsurface drip and ground sprinklers, balancing efficiency with uniformity. Distribution channels influence system procurement as well; direct sales relationships facilitate bespoke system design, whereas third-party platform purchases emphasize modular, plug-and-play components. At the same time, the decision between installing new infrastructure or retrofitting existing frameworks hinges on expansion plans, capital availability, and operational disruption tolerances.

This comprehensive research report categorizes the Greenhouse Irrigation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Irrigation Technology

- Installation Type

- Crop Type

- Distribution Channel

Strategic evaluation of regional greenhouse irrigation dynamics highlighting tailored solutions and emerging opportunities across key global geographies

Regional dynamics play a pivotal role in shaping greenhouse irrigation strategies, as climatic conditions, regulatory environments, and market maturity vary significantly across geographies. In the Americas, the United States and Canada are at the forefront of adopting precision irrigation due to heightened awareness of water scarcity in arid zones and robust incentive programs that offset capital investments. Greenhouse operators benefit from state-level grants and federal research initiatives focusing on water reuse, driving interest in closed-loop hydroponic and subsurface drip systems that minimize resource loss.

Across Europe, the Middle East, and Africa, progressive water management regulations in the European Union are catalyzing a shift toward smart controllers and sensor-driven monitoring. The Netherlands remains a global leader in high-tech greenhouse operations, pioneering aeroponic and fog technologies under controlled climate conditions. In contrast, Middle Eastern growers are prioritizing robust, low-maintenance sprinkler and drip installations capable of withstanding saline irrigation sources, while conservation policies in parts of Africa are encouraging the implementation of low-pressure drip networks in smallholder greenhouse ventures.

In the Asia-Pacific region, rapid urbanization and population growth have intensified demand for year-round greenhouse production. Advanced hydroponic benches proliferate in China’s vegetable belt, supported by government subsidies that promote food security. India is witnessing a surge in both new installations and retrofitted systems, as growers seek to enhance yield consistency for high-value fruits and leafy greens. Meanwhile, Australia’s emissions reduction targets and drought resilience programs are fostering uptake of solar-powered controllers and sensor-based feedback loops. Collectively, these regional nuances underscore the importance of tailored irrigation solutions that align with local environmental and economic priorities.

This comprehensive research report examines key regions that drive the evolution of the Greenhouse Irrigation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful profiling of leading manufacturers and innovators shaping the future of greenhouse irrigation through technological leadership and partnerships

Several industry leaders are driving innovation and shaping market directions through technology breakthroughs, strategic collaborations, and targeted product development. A handful of global irrigation equipment manufacturers have expanded their portfolios to include both hardware and software offerings, integrating advanced controllers with proprietary analytics platforms to offer end-to-end solutions. Partnerships with agritech startups and academic institutions have accelerated the introduction of AI-enabled water management systems capable of learning crop-specific irrigation profiles and optimizing schedules automatically.

At the component level, specialists in sensor manufacturing are refining humidity, moisture, and temperature detectors to deliver sub-percent accuracy, supporting tighter feedback loops. Tubing and valve producers are innovating with antimicrobial coatings and self-cleaning features to reduce maintenance demands and prevent biofilm accumulation. Companies focusing on fog and ultrasonic misting technology are achieving finer droplet control, enabling growers to maintain consistent microclimates for high-value ornamentals and propagation houses.

Meanwhile, leading irrigation integrators are differentiating themselves through service models that bundle system design, installation, and ongoing performance audits. By offering predictive maintenance contracts and remote monitoring dashboards, these providers are deepening grower relationships and enhancing system uptime. Collectively, these corporate initiatives are elevating the standard for greenhouse irrigation, as competition centers on delivering not just components, but fully integrated, intelligence-driven water management ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Greenhouse Irrigation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amiad Water Systems Ltd.

- DIG Corporation

- Galcon Bakarim Agricultural Cooperative Society Ltd.

- Hunter Industries, Inc.

- Jain Irrigation Systems Ltd.

- Janco Greenhouses, Inc.

- JIANGSU SKYPLAN GREENHOUSE TECHNOLOGY CO., LTD.

- Lindsay Corporation

- LLK Greenhouse Solutions

- Nelson Irrigation Corporation

- Netafim Ltd.

- Precision Pumping System

- Rain Bird Corporation

- RDI Technologies, Inc.

- Rivulis Irrigation Ltd.

- ROBERTS IRRIGATION CO INC.

- Sichuan Baolida Metal Pipe Fittings Manufacturing Co., Ltd.

- Solar Innovations, Inc.

- The Toro Company

- TRICKL-EEZ Irrigation Inc.

- Valmont Industries, Inc.

Practical strategies for industry stakeholders to enhance greenhouse irrigation efficiency leverage innovation mitigate risks and optimize operational outcomes

To navigate the complex greenhouse irrigation landscape successfully, stakeholders should prioritize a technology roadmap that aligns with both immediate operational needs and long-term sustainability objectives. First, leveraging modular, retrofit-capable systems enables growers to incrementally upgrade existing infrastructure, reducing capital outlay while rolling out precision water delivery where it matters most. Integrating IoT-enabled sensors and smart controllers should be staged alongside existing timer-based equipment to demonstrate tangible efficiency gains prior to full system migration.

Second, diversifying component sourcing and establishing strategic partnerships with local fabricators can mitigate tariff-induced cost volatility and lead-time disruptions. By qualifying multiple tubing, valve, and nozzle suppliers, growers can maintain operational continuity even as international trade policies fluctuate. Third, investing in grower training programs focused on sensor calibration, data interpretation, and system maintenance will maximize return on technology investments and foster a culture of continuous improvement.

Finally, adopting digital performance dashboards that consolidate irrigation data, crop health metrics, and environmental parameters into a unified view will drive smarter decision making. Stakeholders should explore subscription-based analytics services that offer prescriptive recommendations, ensuring growers can respond swiftly to changing conditions. Through these concerted efforts, organizations will unlock the full potential of their irrigation assets, enhance resource stewardship, and strengthen resilience in an increasingly dynamic market.

Rigorous research approach integrating primary and secondary data sources combined with qualitative and quantitative techniques for robust market analysis

This analysis is built upon a rigorous research framework combining both primary and secondary intelligence to ensure comprehensive, unbiased insights. Primary data was collected through structured interviews with greenhouse operators across multiple regions, equipment manufacturers, component suppliers, and distribution partners. These discussions provided first-hand perspectives on system performance, adoption drivers, and the real-world implications of tariff changes on operational budgets and supply chain reliability.

Secondary research drew on technical papers, trade publications, government policy documents, and expert commentary to contextualize the primary findings within broader industry trends. Patent filings and regulatory filings were systematically reviewed to identify emerging technologies and materials innovations. Competitive benchmarking exercises examined leading product portfolios, service models, and partnership ecosystems to highlight differentiators and best practices.

Quantitative inputs were triangulated using trade data on agricultural machinery imports and domestic manufacturing statistics, while qualitative synthesis was applied to distill actionable themes and recommendations. The combined methodology ensures that the insights presented are both empirically grounded and strategically relevant, serving as a reliable guide for stakeholders navigating the evolving greenhouse irrigation environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Greenhouse Irrigation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Greenhouse Irrigation System Market, by Component

- Greenhouse Irrigation System Market, by Irrigation Technology

- Greenhouse Irrigation System Market, by Installation Type

- Greenhouse Irrigation System Market, by Crop Type

- Greenhouse Irrigation System Market, by Distribution Channel

- Greenhouse Irrigation System Market, by Region

- Greenhouse Irrigation System Market, by Group

- Greenhouse Irrigation System Market, by Country

- United States Greenhouse Irrigation System Market

- China Greenhouse Irrigation System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding observations summarizing pivotal insights on greenhouse irrigation evolution industry challenges and opportunities for sustainable growth

The evolution of greenhouse irrigation systems reflects a broader shift toward precision agriculture, where data-driven decision making and automation converge to optimize resource use and bolster crop yields. Technology advancements, from subsurface drip networks to AI-powered controllers, are enabling growers to conserve water, reduce labor, and minimize environmental impacts while maintaining high standards of production. The cumulative effect of 2025 tariff measures has accelerated local innovation, compelling supply chain diversification and fostering domestic manufacturing capabilities.

Segmentation analysis underscores the importance of matching irrigation methods and components to specific crop requirements and distribution strategies, while regional insights highlight the necessity of solutions tailored to local climate conditions and regulatory frameworks. Leading companies are raising the bar by combining hardware excellence with software intelligence and service-oriented business models. To remain competitive, stakeholders must adopt modular upgrade paths, diversify sourcing to mitigate geopolitical risks, and cultivate the skills needed to interpret and act on complex irrigation data streams.

Ultimately, the intersection of emerging technologies and strategic partnerships offers an unprecedented opportunity to redefine greenhouse cultivation. By harnessing the lessons and recommendations outlined here, industry participants can position themselves at the vanguard of sustainable, resilient, and highly productive greenhouse operations.

Engage with Ketan Rohom to secure comprehensive greenhouse irrigation market insights and empower your strategic decisions with expert guidance

To gain access to the most comprehensive analysis of greenhouse irrigation systems and empower your strategic decision making, reach out to Associate Director, Sales & Marketing at 360iResearch, Ketan Rohom. With deep expertise in greenhouse water management and an understanding of emerging market dynamics, Ketan is ready to guide you through the key findings of this report. By partnering directly, you’ll uncover actionable intelligence on technology adoption, tariff impacts, and regional growth patterns tailored to your organization’s needs. Secure your copy today and tap into critical insights that will drive efficiency, sustainability, and competitive advantage in your greenhouse operations. Let Ketan Rohom help you navigate the complexities of the global irrigation market and align your growth strategies with the latest industry developments

- How big is the Greenhouse Irrigation System Market?

- What is the Greenhouse Irrigation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?