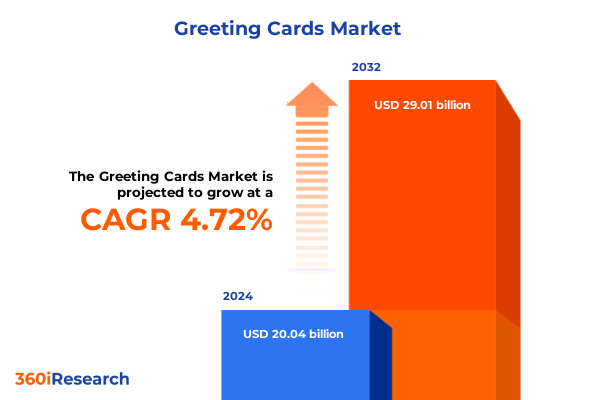

The Greeting Cards Market size was estimated at USD 20.98 billion in 2025 and expected to reach USD 21.98 billion in 2026, at a CAGR of 4.73% to reach USD 29.01 billion by 2032.

Unveiling the Pivotal Dynamics Shaping Today’s Greeting Cards Landscape Amid Digital Transformation and Consumer Demand Shifts

The greeting card sector stands at a pivotal juncture where traditional paper formats coexist alongside dynamic digital offerings and personalized experiences. Digital adoption has accelerated, compelling legacy manufacturers and startups alike to integrate interactive features and bespoke messaging into their products. Consumers now expect cards that reflect individual stories and emotions, driving firms to leverage data-driven customization platforms to meet unique preferences and lifestyle narratives. Simultaneously, ecological concerns have elevated sustainability as a non-negotiable value proposition, with a growing number of purchasers favoring recycled and biodegradable materials over conventional paper stocks.

In parallel, evolving distribution models underline the importance of omnichannel strategies. Physical storefronts-ranging from bookstores and gift shops to supermarkets and hypermarkets-remain vital for spontaneous, tactile purchases, while e-commerce channels such as company websites and third-party platforms offer unparalleled convenience and reach. Brands that seamlessly synchronize inventory management, personalized recommendations, and efficient fulfillment across these touchpoints are distinguishing themselves in a competitive landscape. This dynamic interplay between heritage and innovation frames the current market context and sets the stage for deeper analysis of transformative shifts, regional nuances, and actionable opportunities.

How Digital Innovation, Sustainability Imperatives, and Personalized Experiences are Redefining the Greeting Card Industry’s Future

The greeting card industry is undergoing a profound transformation fueled by three interrelated forces: digital innovation, sustainability imperatives, and heightened personalization expectations. Virtual greetings, once viewed as niche, have surged in adoption, with mobile-optimized platforms now capturing nearly half of all ecard interactions, signaling a fundamental shift in consumer behavior. This rapid digital uptake is complemented by AI-driven customization tools, which are projected to be adopted by nearly half of all card companies by 2025, enabling designers to craft emotionally resonant messages and graphics at scale.

Environmental consciousness is also redefining product development priorities. Digital solutions reduce paper consumption significantly-by billions of sheets annually-while eco-friendly physical card offerings, made from recycled paper or renewable fibers such as hemp, have recorded double-digit year-over-year growth. As buyers increasingly demand transparent green credentials, manufacturers are embedding sustainability metrics into their branding and supply chains to meet regulatory requirements and consumer expectations.

Furthermore, personalization has evolved from simple name insertion to immersive experiences integrating augmented reality, voice notes, and interactive video elements. Brands that embrace this experiential differentiation are witnessing deeper engagement and repeat purchases, as consumers covet the authenticity of bespoke communication. This convergence of technology, ecology, and emotional intelligence is reshaping competitive dynamics and setting a new standard for the greeting card of tomorrow.

The Complex Web of 2025 Tariffs and Their Ripple Effects on U.S. Greeting Card Producers' Costs and Supply Chain Resilience

The United States’ tariff landscape in 2025 has created a complex fabric of cost pressures and supply chain challenges for greeting card producers. In early February, a 25% tariff on imports from Canada and Mexico was temporarily paused following diplomatic negotiations, while a simultaneous 10% levy on Chinese goods took effect immediately under Section 301 provisions. Despite a brief reprieve for North American materials, the cumulative impact of Chinese import duties, national security tariffs, and existing protective measures has driven the average U.S. tariff rate to historic heights, placing unprecedented cost burdens on manufacturers reliant on cross-border pulp and paper inputs.

Corporate America has largely absorbed these tariff shocks to shield end customers, yet many suppliers are operating at razor-thin margins. Major firms including automotive and furnishing giants have reported significant profit declines, and printing industry stakeholders warn that extended tariffs could erode domestic capacity if cost pressures persist. Smaller publishers, particularly those dependent on China-based fabrication, faced imminent margin collapse until the White House indefinitely suspended planned card tariffs in April-a move hailed by the Greeting Card Association as crucial for industry stability.

Looking ahead, businesses are reassessing their sourcing strategies, either absorbing additional cost through leaner operations or contemplating price adjustments that may ripple through retail channels. This period of tariff volatility underscores the importance of agile supply chain management, strategic inventory buffering, and ongoing dialogue with trade regulators to mitigate long-term disruptions.

Decoding Diverse Product Types, Channels, Materials, End Users, and Printing Techniques Driving Segmented Growth in Greeting Cards

The greeting card market thrives on the interplay of distinct product types, each with unique thematic resonances and consumer rituals. Birthday cards, a perennial favorite, coexist with expressions of sympathy, gratitude, wedding blessings, and a spectrum of holiday-specific greetings-from Halloween spookiness to Valentine romance, Easter celebrations, and the multifaceted obsessions of Christmas, be they secular or religious. Behind these categories lies a rich tapestry of design motifs and sentiment strategies tailored to emotional contexts and cultural calendars.

Equally nuanced is how customers acquire these keepsakes. Traditional brick-and-mortar venues such as independent bookstores, gift boutiques, and large-scale supermarkets and hypermarkets anchor the offline experience, inviting serendipitous discoveries and impulse buys. Complementing this, a thriving online ecosystem spans brand-owned websites and third-party marketplaces, empowering shoppers to explore extensive catalogs, filter by occasion, and leverage digital previews and customization tools before purchase.

Material choices further define market segments. Animated electronic cards captivate with motion and sound, while static digital formats appeal through immediacy and eco-friendly credentials. In the physical realm, glossy finishes impart vibrant imagery, matte surfaces add refined subtlety, and textured stocks lend artisanal gravitas. These material distinctions intersect with printing methodologies: digital techniques like inkjet and laser offer agile, low-volume personalization, whereas conventional and UV offset processes drive high-fidelity mass production.

Finally, end-user profiles inform product strategies. Individual consumers seek cards that resonate personally, while corporate clients leverage client-gifting suites or in-house event programs to reinforce brand relationships. This segmentation matrix-spanning type, channel, material, end-user, and technique-drives differentiated growth trajectories and informs targeted innovation across the industry.

This comprehensive research report categorizes the Greeting Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Card Format

- Printing Technique

- Customization Level

- Distribution Channel

- End User

Regional Variations Shaping Greeting Card Demand Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

In the Americas, the greeting card industry benefits from robust consumer enthusiasm for both digital and physical formats. Heightened mobile adoption and social media sharing have amplified the popularity of ecards during key celebrations, while U.S. and Canadian players have deepened omnichannel integration, blending seamless e-commerce capabilities with immersive in-store experiences. Corporate gifting in North America has particularly embraced digital personalization tools for client outreach and employee engagement-a reflection of broader business trends toward thoughtful, data-driven communications.

Across Europe, the Middle East, and Africa, sustainability considerations take center stage. Regulatory frameworks incentivize the use of recycled and certified papers, and consumers show growing preference for brands that transparently communicate environmental practices. In Western Europe, eco-friendly materials have captured as much as one-fifth of total physical card sales, while emerging markets in the Middle East leverage festive occasions to introduce localized motifs rendered in green-certified inks.

The Asia-Pacific region presents a dynamic fusion of tradition and technology. Japan and South Korea lead in digital greeting adoption, driven by mobile-first cultures and integrated social platforms that support animated and interactive cards. Meanwhile, rapid urbanization in Southeast Asia has spurred demand for personalized physical keepsakes that blend regional aesthetics with global design influences. Localization strategies, including region-specific artwork and language support, remain critical for market penetration and consumer loyalty in this fast-evolving landscape.

This comprehensive research report examines key regions that drive the evolution of the Greeting Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players’ Strategic Moves Highlight Innovation in Collaboration, Digital Expansion, and Experience-Driven Offerings

Leading firms in the greeting card arena are spearheading strategic initiatives that highlight creativity, collaboration, and digital expansion. Hallmark, celebrating more than a century of emotional connection, has broadened its product portfolio with ‘Gift Card Greetings,’ a hybrid format that combines a tangible card with an integrated digital voucher experience. This innovation addresses the modern desire for convenience without sacrificing the tactile delight of a physical card. The brand’s collaboration with actress Lacey Chabert further underscores its emphasis on thematic curation and nostalgic design influences, extending these limited-edition collections into broader lifestyle offerings both in retail and media channels.

American Greetings, renowned for its expansive digital business unit, has amplified its e-gifting platforms through partnerships with Virgin Experience Gifts, Songfinch, and Birdie. These alliances allow users to embed experiences, custom songs, and cash directly within digital cards, thereby transforming simple ecards into multifaceted tokens of appreciation and strengthening the company’s direct-to-consumer reach. Meanwhile, independent designers and emerging brands are leveraging print-on-demand services and online marketplaces to introduce culturally specific themes and artisanal craftsmanship, enriching the market with novel design perspectives.

This competitive ecosystem illustrates how incumbent leaders and agile newcomers alike are capitalizing on technology, partnerships, and brand storytelling to offer differentiated products. By combining heritage credibility with forward-looking innovation, these companies are redefining what it means to celebrate life’s moments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Greeting Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Greetings Corporation

- ARC DOCUMENT SOLUTIONS

- Archies Limited

- Avanti Press, Inc.

- Biely & Shoaf Co.

- Blue Mountain Arts, Inc.

- Calypso Cards

- Card Factory PLC

- Crane & Co., Inc.

- Culture Greetings by CPAI Group, Inc

- Galison Publishing LLC by McEvoy Group

- Hallmark Cards, Incorporated

- IG Design Group UK Limited

- JibJab Catapult CA, Inc.

- Lovepop Inc.

- Minted LLC

- NobleWorks Inc.

- Paperless Inc.

- Pictura Inc.

- Postable LLC

- Rifle Paper Co.

- SHUANGXIN Paper products Co. Ltd.

- Shutterfly, Inc.

- Someecards, Inc.

- UK Greetings Ltd

- Viabella Holdings, LLC

Strategic Imperatives and Tactical Pathways for Industry Leaders to Harness Emerging Trends and Mitigate Tariff-Related Risks

Industry leaders must prioritize an integrated digital roadmap that blends AI-driven personalization with seamless e-commerce and in-store experiences. Investing in machine learning tools to analyze consumer preferences and automate custom design suggestions can yield faster turnaround times and heightened emotional engagement. Simultaneously, companies should deepen sustainability practices by sourcing recycled fibers, adopting low-impact inks, and transparently communicating green credentials to reinforce brand authenticity.

To mitigate tariff-induced cost volatility, organizations should cultivate diversified supply chains that balance domestic production capabilities with strategically sourced international materials. Scenario modeling and inventory buffering can further cushion the impact of trade policy shifts and regulatory adjustments. Engaging proactively with trade associations and advocating for industry-specific exemptions will also help preserve margin stability and maintain competitive pricing.

Additionally, forging partnerships with lifestyle influencers, content creators, and complementary digital platforms can amplify product visibility and drive cross-category synergies. Collaborations akin to celebrity-curated collections or integrated gift experiences enable brands to tap into new customer segments and extend the functional appeal of greeting cards. Finally, robust data analytics frameworks should be implemented to monitor regional trends, segmentation performance, and distribution efficacy, thereby informing iterative product development and targeted marketing initiatives.

A Comprehensive Research Framework Combining Primary Interviews, Secondary Data, and Triangulation for Insight-Rich Analysis

This report’s findings derive from a rigorous mixed-methods approach that combines primary and secondary research pillars. In-depth interviews were conducted with senior executives from leading greeting card manufacturers, retail partners, and design studios to capture firsthand perspectives on innovation drivers and operational challenges. These qualitative insights were complemented by comprehensive secondary research, which included analysis of corporate press releases, industry association publications, and regulatory documents pertaining to trade policies and environmental standards.

Data triangulation techniques were employed to validate overarching trends and ensure consistency across multiple sources. Quantitative datasets such as ecard usage metrics, AI adoption rates, and sustainability benchmarks were sourced from reputable market intelligence reports and proprietary databases. All information was cross-referenced with publicly available financial statements and third-party analyses to enhance reliability.

The research also incorporated a systematic review of consumer sentiment studies and social media discourse to contextualize emerging preferences. Regional case studies provided additional granularity, highlighting variances in cultural themes, digital penetration, and environmental regulations. This methodological framework guarantees a nuanced, evidence-based portrayal of the greeting card industry’s evolving landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Greeting Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Greeting Cards Market, by Product Type

- Greeting Cards Market, by Card Format

- Greeting Cards Market, by Printing Technique

- Greeting Cards Market, by Customization Level

- Greeting Cards Market, by Distribution Channel

- Greeting Cards Market, by End User

- Greeting Cards Market, by Region

- Greeting Cards Market, by Group

- Greeting Cards Market, by Country

- United States Greeting Cards Market

- China Greeting Cards Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Critical Insights to Illuminate the Greeting Card Industry’s Evolution and Inform Strategic Decision-Making

The greeting card industry’s evolution reflects a broader narrative of tradition intersecting with technological innovation and sustainability stewardship. Digital formats and AI-powered customization tools have recalibrated consumer expectations, demanding higher levels of personalization and seamless omnichannel interactions. Concurrently, environmental consciousness has compelled brands to rethink material sourcing, while tariff fluctuations have underscored the necessity of resilient supply network design.

Segmentation insights reveal a multifaceted market where product types, distribution channels, material choices, end-user profiles, and printing techniques converge to shape targeted opportunities. Regional analysis highlights divergent priorities: North American markets prize digital convenience and corporate adoption; EMEA emphasizes eco-friendly credentials; and Asia-Pacific blends heritage aesthetics with mobile-first digital solutions.

Leading companies-including Hallmark and American Greetings-are responding with inventive collaborations, hybrid product formats, and expansive digital gifting partnerships that transcend conventional card offerings. Moving forward, success will hinge on the ability to integrate data-driven personalization, fortify supply chains against trade policy swings, and articulate a compelling sustainability narrative.

By synthesizing these critical insights, stakeholders can chart strategic courses that align with consumer values and anticipate market dynamics, thereby securing lasting relevance and growth in a rapidly shifting industry.

Connect with Ketan Rohom to Access Exclusive Market Intelligence That Will Elevate Your Greeting Card Business Strategy Today

To explore these in-depth insights, gain strategic guidance tailored to your organization’s needs, and secure a competitive edge in the evolving greeting card marketplace, reach out to Ketan Rohom, Associate Director of Sales & Marketing, without delay. Ketan’s expertise in guiding leading firms through transformational industry shifts will ensure you have the critical intelligence and practical support required to make informed decisions. Engage with Ketan today and unlock the next level of market clarity that will elevate your business strategy and drive sustainable growth.

- How big is the Greeting Cards Market?

- What is the Greeting Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?