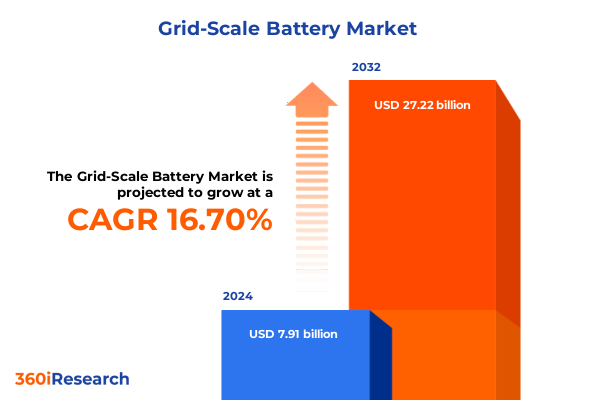

The Grid-Scale Battery Market size was estimated at USD 9.24 billion in 2025 and expected to reach USD 10.81 billion in 2026, at a CAGR of 16.67% to reach USD 27.22 billion by 2032.

Emerging Dynamics and Strategic Importance of Grid-Scale Battery Solutions in Accelerating Clean Energy Transition Across Global Power Systems

Grid-scale battery systems have rapidly emerged as cornerstones of modern power infrastructures, offering unprecedented capabilities for balancing intermittent renewables and enhancing grid resilience. As electricity demand accelerates and decarbonization remains at the forefront of energy policy, these large-scale storage solutions bridge gaps in supply and demand, ensuring stability during peak events and enabling smoother integration of wind and solar generation. Recent data demonstrates that the United States added 8.7 gigawatts of battery storage capacity in 2024 alone, representing a year-over-year expansion that underscores the transformative potential of these technologies. Moreover, grid-scale batteries are no longer peripheral; they have become essential infrastructure that supports frequency regulation, contingency reserves, and sustained power delivery amid extreme weather and resource adequacy challenges.

Policy Incentives Technological Breakthroughs and Market Forces Redefining Grid-Scale Battery Adoption in Modern Energy Infrastructures

Contemporary shifts in policy frameworks, technology advancements, and market structures are redefining the adoption trajectory of grid-scale battery installations. Federal incentives introduced through the Inflation Reduction Act and new tax credits for standalone energy storage now allow independent battery projects to qualify for up to a 30 percent Investment Tax Credit when they meet prevailing wage and apprenticeship criteria, incentivizing greater investment and deployment across the United States. In parallel, state-level mandates and industry procurement programs are fostering demand for capacity and ancillary services, driving partnerships between utilities and private developers to expedite project execution within aggressive planning cycles.

Multifaceted Layers of U.S. Trade Measures and Their Compounding Pressures on Battery Energy Storage System Costs and Project Viability in 2025

The cumulative effect of United States trade measures in 2025 has introduced multilayered tariffs that significantly influence the economics of battery storage systems. Section 301 duties on imports originating from China have persisted since 2019, while anti-dumping and countervailing duties target specific components such as anode active materials. In addition, Section 232 tariffs on steel and aluminum inputs, originally introduced to protect domestic industries in 2018, further elevate costs for balance-of-system elements. Moreover, proposals to revoke China’s Permanent Normal Trade Relations status add another layer of uncertainty, as legislation under consideration could impose even higher tariff rates or new duties on critical materials.

Insightful Examination of Market Dimensions Based on Chemistry Deployment Mode and Application for Tailored Grid-Scale Battery Strategies

When viewed through the lens of chemical composition, differentiated performance characteristics emerge: flow batteries offer long-duration storage but at a higher upfront cost, lead-acid systems deliver proven reliability for short-term applications, lithium-ion excels in high-energy density and fast response, while sodium-sulfur systems target utility-scale discharge over extended periods. Analyzing deployment modes reveals distinct value propositions: behind-the-meter installations serve commercial facilities and residential customers seeking peak shaving and backup power, whereas front-of-the-meter systems integrate directly into utility networks to provide grid services and bulk energy management. Application-specific requirements further drive technology decisions, with commercial and industrial operators focusing on demand charge reduction and resilience, residential adopters prioritizing self-consumption and energy autonomy, and utility operators emphasizing system stability and capacity firming.

This comprehensive research report categorizes the Grid-Scale Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemistry

- Deployment Mode

- Application

- Charge Type

- Power Capacity Range

- Cell Format

- Energy Capacity Range

Regional Contrasts in Policy, Infrastructure and Investment that Shape Diverse Grid-Scale Battery Deployment Patterns Globally

North America leads with aggressive incentives, established supply chains, and high-profile utility and corporate investments; grid-scale projects in the United States and Canada benefit from state and provincial mandates, tax credits, and robust financing for resilience and decarbonization. Europe, Middle East & Africa demonstrate heterogeneous growth, with the European Union accelerating battery build-out to complement ambitious renewable targets, Middle Eastern nations leveraging storage for energy export stability, and African utilities exploring off-grid or microgrid configurations to address reliability challenges. Asia-Pacific stands out for its integrated manufacturing ecosystems, with China commanding global cell production, Japan advancing virtual power plants and behind-the-meter adoption, and Australia pioneering large-scale renewables pairing to meet grid reliability needs.

This comprehensive research report examines key regions that drive the evolution of the Grid-Scale Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Realignments and Competitive Positioning of Prominent Technology Innovators in the Global Grid-Scale Battery Sector

Leading energy technology players are recalibrating their strategies to seize opportunities within the grid-scale battery market. Tesla has leveraged its Powerpack and Megapack product lines to establish a strong presence in utility-scale deployments and virtual power plant initiatives, diversifying revenue streams beyond electric vehicles. LG Energy Solution is pivoting capacity at its U.S. facilities from automotive cells to energy storage systems, capitalizing on domestic LFP production and system-level sales expansion as EV battery demand softens. Meanwhile, Fluence, the joint venture between Siemens and AES, continues to secure flagship projects, such as a 400 MWh supply agreement for Ukraine’s DTEK, while pausing certain contracts amid tariff uncertainty yet advancing its domestic manufacturing footprint in Utah to bolster supply chain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Grid-Scale Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AES Corporation

- Ambri

- BYD Company Limited

- Contemporary Amperex Technology Co., Limited

- East Penn Manufacturing

- EnerSys

- EnerVenue

- ESS Tech

- EVE Energy Co., Ltd.

- Exergonix, Inc.

- Fluence Energy, LLC

- GS Yuasa Corporation

- Hitachi Ltd.

- Hithium

- LG Energy Solution, Ltd.

- NEC Energy Solutions, Inc.

- Panasonic Corporation

- Powin Energy

- Redflow Limited

- Samsung SDI Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- Tesla, Inc.

- TotalEnergies SE

- Wärtsilä Corporation

Targeted Strategies to Navigate Supply Chain Complexities and Seize Emerging Opportunities in the Evolving Battery Storage Landscape

Industry leaders should prioritize diversification of supply chains by investing in domestic cell and balance-of-system manufacturing to mitigate tariff exposures and enhance project feasibility. In addition, embedding digital asset management platforms that incorporate predictive analytics and real-time performance monitoring will optimize operations and extend asset lifecycles. Case studies reveal that forging strategic alliances with utilities and independent power producers can unlock ancillary service contracts and capacity payments, while engaging proactively with regulators ensures alignment on interconnection standards and market rules. Finally, exploring emerging applications such as long-duration storage and hydrogen-hybrid systems positions companies to meet evolving grid requirements and capture new revenue streams as energy markets evolve.

Comprehensive and Methodical Integration of Primary Interviews and Secondary Data to Ensure Rigorous Market Analysis

This analysis integrates both primary and secondary research methodologies to ensure robust market insights. Primary intelligence was gathered through structured interviews with project developers, technology vendors, utility stakeholders, and policy experts, allowing for nuanced understanding of drivers and constraints. Secondary data sources include regulatory filings, governmental reports, and industry publications, which were corroborated with proprietary transactional databases and validated through cross-referencing with subject matter specialists. The segmentation framework was crafted to align with technical, operational, and financial decision-making criteria, while regional assessments account for policy incentives, grid characteristics, and market maturity. Quality assurance protocols, including peer review and scenario analysis, underpin the credibility and relevance of findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Grid-Scale Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Grid-Scale Battery Market, by Chemistry

- Grid-Scale Battery Market, by Deployment Mode

- Grid-Scale Battery Market, by Application

- Grid-Scale Battery Market, by Charge Type

- Grid-Scale Battery Market, by Power Capacity Range

- Grid-Scale Battery Market, by Cell Format

- Grid-Scale Battery Market, by Energy Capacity Range

- Grid-Scale Battery Market, by Region

- Grid-Scale Battery Market, by Group

- Grid-Scale Battery Market, by Country

- United States Grid-Scale Battery Market

- China Grid-Scale Battery Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Conclusive Perspectives on Strategic Imperatives for Stakeholders Navigating a Rapidly Evolving Grid-Scale Battery Ecosystem

As global energy systems transition toward higher shares of variable renewables, grid-scale battery installations are poised to play a critical role in delivering flexibility, reliability, and resilience. The multifaceted interplay of policy incentives, technological innovation, and evolving market structures underscores the strategic imperative for stakeholders to align capabilities with emerging opportunities. By fostering supply chain diversification, embracing digital optimization tools, and cultivating strategic partnerships, decision-makers can navigate complexities and position themselves at the forefront of a rapidly expanding market. In this dynamic environment, informed, proactive strategies will be the key to unlocking long-term value and accelerating the clean energy transition.

Unlock Bespoke Insights and Drive Growth by Partnering with Ketan Rohom to Secure Your Comprehensive Grid-Scale Battery Market Research Report

For strategic decision-makers seeking a competitive edge, partnering with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, is your direct route to acquiring the definitive grid-scale battery market research report. With his dedicated expertise, you will gain tailored support in understanding market dynamics, unlocking actionable insights, and accessing comprehensive data that will inform critical investments and growth strategies.

- How big is the Grid-Scale Battery Market?

- What is the Grid-Scale Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?