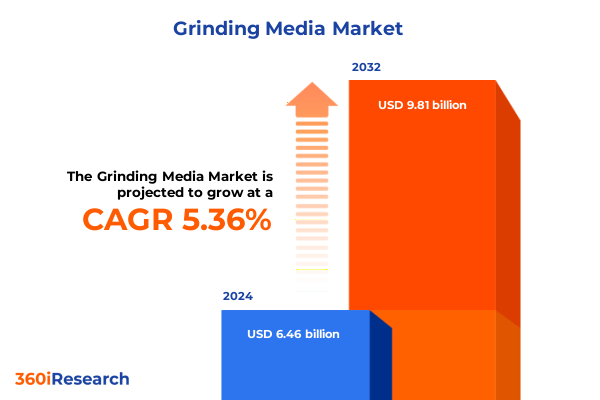

The Grinding Media Market size was estimated at USD 6.46 billion in 2024 and expected to reach USD 6.78 billion in 2025, at a CAGR of 5.36% to reach USD 9.81 billion by 2032.

Introducing the pivotal importance and evolving dynamics of grinding media within global industrial milling and material processing operations

Grinding media serve as the fundamental agents of particle size reduction and material processing across a spectrum of industrial applications, from mineral processing and cement manufacturing to pharmaceuticals and paint production. In recent years, heightened demand for energy efficiency and operational reliability has elevated the role of grinding media, compelling manufacturers, end-users, and technology providers to collaborate in addressing evolving requirements. Grinding media selection now hinges on multiple factors, including material hardness, wear resistance, and process compatibility, all of which have become critical as industries strive for lower operating costs and tighter product quality tolerances.

The introduction section provides a concise orientation to the multifaceted world of grinding media, illuminating their integral function in comminution circuits and mixing systems. We explore the distinctions between metallic and non-metallic media, highlight emerging material compositions, and underscore the balance between performance and longevity that drives purchasing decisions. As markets worldwide face pressure to reduce carbon footprints and optimize resource utilization, the grinding media landscape is adapting through advanced metallurgy and material science innovations.

This initial exploration sets the stage for a deeper analysis of the market’s transformative shifts, the specific impact of recent policy measures, segmentation nuances, and the competitive terrain. By framing the fundamental dynamics of grinding media, this introduction lays the groundwork for stakeholders to understand both the challenges and opportunities inherent in navigating this crucial segment of the industrial equipment market.

Uncovering how sustainability digital transformation and material innovations are reshaping the grinding media landscape for modern industries

Over the past decade, the grinding media industry has witnessed profound shifts propelled by sustainability mandates, digital transformation initiatives, and breakthroughs in material engineering. As environmental regulations tighten, equipment operators are prioritizing high-chrome and ceramic media that offer extended service life and reduced waste generation, marking a decisive move away from conventional low-alloy steels. This shift not only reduces maintenance downtime but also aligns with corporate sustainability goals that emphasize circular economy principles and lower total cost of ownership.

Parallel to material advancements is the growing adoption of digital monitoring and predictive analytics. Real-time sensors and data platforms now track wear rates and energy consumption, enabling plant managers to optimize mill performance and schedule proactive maintenance. The integration of advanced analytics into grinding circuits has unlocked new performance benchmarks, driving process improvements and enabling a data-driven approach to media selection.

Finally, mounting supply chain complexities-including raw material volatility and geopolitical tensions-have impelled stakeholders to diversify sourcing strategies and forge long-term partnerships. These developments collectively signal a transformative era in which innovation, sustainability, and resilience converge to redefine the grinding media landscape.

Analyzing the comprehensive effects of the 2025 United States tariffs on grinding media supply chains costs competitiveness and strategic responses

The implementation of new United States tariffs in early 2025 has exerted a cumulative impact on the grinding media sector, influencing costs, supply arrangements, and market strategies. Tariffs imposed on imported alloys and ceramic components drove raw material expenses upward, prompting domestic producers to re-evaluate their supply chains and seek alternative feedstock sources. As a result, many grinding media manufacturers increased localized production capacity for high-chrome steel and advanced ceramics to mitigate exposure to fluctuating duties.

Simultaneously, end-users in downstream industries felt the ripple effects of higher imported media costs, accelerating investments in wear monitoring and predictive maintenance to extend media lifespan. Companies also began exploring hybrid media solutions and secondary steel sources to balance performance requirements with budget constraints. While some smaller suppliers struggled to absorb increased duties without passing costs to buyers, leading global players leveraged their scale and vertical integration to maintain stable pricing and customer retention.

Overall, the 2025 tariff regime has underscored the importance of supply chain agility and cost management. Industry participants are increasingly focused on strategic stockpiling, multi-sourcing and nearshore manufacturing partnerships to navigate the evolving trade landscape and preserve margins.

Exploring in-depth insights from material composition shape size applications and distribution channels that define the grinding media market

Insights into grinding media segmentation reveal a multifaceted market shaped by an array of material compositions, geometries, size classifications, application requirements, end-user industries, and distribution strategies. Metallic media, including carbon steel, high-chrome steel, and stainless steel grades, remain prevalent in high-impact crushing and grinding circuits where durability and economic performance are paramount. Meanwhile, non-metallic alternatives such as alumina, ceramic, and glass beads have gained traction in precision dispersion and mixing tasks, valued for their chemical inertness and minimal contamination risk.

Shape diversity-from conventional spherical balls and cylindrical rods to engineered beads and cylpebs-allows operators to fine-tune milling efficiency and energy consumption. Large media exceeding 60 millimeters cater to coarse crushing applications, medium sizes spanning 20 to 60 millimeters serve general grinding operations, and smaller media below 20 millimeters excel in fine milling and dispersion processes. The demand for tailored media sizes reflects the broad spectrum of applications, whether in high-throughput cement plants or laboratory-scale pharmaceutical mills.

Application-focused segmentation underscores the distinct requirements of crushing and grinding, dispersion, and mixing and blending operations. End-user industries further differentiate market needs-cement producers prioritize wear resistance and cost optimization, chemical and paints manufacturers seek uniform particle distribution, food and beverage processors demand premium-grade non-toxic media, while mining, mineral processing, pharmaceuticals, biotechnology, and power generation each impose unique performance and regulatory standards. Distribution channels also play a pivotal role, with traditional offline partnerships coexisting alongside emerging online platforms that streamline ordering, customization, and just-in-time delivery.

This comprehensive research report categorizes the Grinding Media market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Form

- Product Size

- Operation

- Application

- End-Use Industries

- Distribution Channel

- Packaging

Evaluating regional trends in the Americas EMEA and Asia-Pacific that drive demand supply chain strategies and investment priorities for grinding media

Regional dynamics within the grinding media industry vary significantly across the Americas, Europe Middle East Africa, and Asia-Pacific. In the Americas, the emphasis on shale gas and mining expansions has sustained demand for robust metallic grinding media, with key manufacturing hubs in North America investing in automated production lines to enhance throughput and quality control. Latin American markets continue to present growth opportunities, albeit tempered by infrastructure constraints and currency fluctuations.

Across Europe, the Middle East and Africa, stringent environmental regulations and energy efficiency targets have catalyzed the adoption of premium high-chrome and ceramic media, particularly in Western Europe’s advanced cement and mining sectors. Manufacturers are responding with innovation centers in strategic European locations to co-develop application-specific solutions. In the Middle East, large-scale infrastructure projects and diversification strategies have driven investments in robust grinding circuits, while African mining expansions in copper, gold, and critical minerals have elevated demand for highly durable media.

Asia-Pacific commands the largest share of global consumption, driven by rapid industrialization in China India and Southeast Asia. Local producers in the region are scaling up production of low-cost carbon steel media while simultaneously investing in research and development for advanced non-metallic solutions. Government initiatives to upgrade mining and cement capacities, coupled with rising demand from the pharmaceutical food and beverage industries, reinforce the region’s central role in the global grinding media ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Grinding Media market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading global manufacturers technological innovators and strategic collaborations that shape the competitive dynamics of the grinding media sector

Key companies within the grinding media sector are distinguished by their technological prowess, geographic reach, and strategic alliances. Leading metal media manufacturers have invested heavily in metallurgical research, forging proprietary high-chrome and stainless steel compositions that deliver enhanced abrasion resistance and extended operational lifespans. Simultaneously, non-metallic media specialists have pioneered novel ceramic blends and glass bead formulations optimized for chemical compatibility and minimal contamination in sensitive applications.

Strategic partnerships between media producers and mill OEMs have further accelerated innovation, as co-development projects yield custom-shaped media designed to maximize mill efficiency and reduce energy consumption. Several global players are leveraging additive manufacturing techniques for rapid prototyping of complex media geometries, enabling swift iteration based on customer feedback. In parallel, companies with integrated supply chains are offering bundled services that include on-site performance assessments, digital wear monitoring platforms, and media replenishment programs.

Competitive dynamics are also shaped by mergers and acquisitions, as regional leaders seek scale and cross-border synergies. Alliances that combine material science expertise with advanced manufacturing capabilities are emerging as a pathway for market entrants to establish credibility and challenge established incumbents.

This comprehensive research report delivers an in-depth overview of the principal market players in the Grinding Media market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIA Engineering Ltd.

- AlphaGrindingMedia Company

- Anhui Ningguo Chengxi Wear-Resistant Material Co., Ltd

- Anhui Sanfang New Material Technology Co., Ltd.

- Anyang Hongshun Industrial Co., Ltd

- Changshu Longteng Special Steel Co., Ltd.

- Compagnie de Saint-Gobain S.A.

- ENERGOSTEEL LTD

- Gerdau S/A

- Glen Mills, Inc.

- Growth Steel Group

- Iraeta Energy Equipment Co., LTD.

- Jinan Huafu Forging Joint-Stock Co., Ltd.

- Jinan Sinai Casting and Forging Co., Ltd.

- Jinan Zhongwei Casting and Forging Grinding Ball Co., Ltd.

- JSW STEEL LIMITED

- Litzkuhn & Niederwipper GmbH

- Luoyang zhili new materials co.,ltd

- Magotteaux Group

- Me Elecmetal International Inc.

- Metinvest B.V

- Molycop Group

- Ningguo Hexin Wear-resistant Castings & Equipment Co., Ltd.

- Oriental Casting and Forging Co., Ltd.

- QINGZHOU TAIHONG SPECIAL CASTING STEEL CO., LTD.

- SCAW Limited

- Shandong Huamin Steel Ball Joint-Stock Co.,Ltd.

- Shandong Jinchi Heavy Industry Joint-stock Co., LTD

- Shilpa Alloys Pvt. Ltd.

- TDI Enterprises Inc.

- TOYO Grinding Ball Co.Ltd

Presenting actionable strategies for industry leaders to optimize operations diversify portfolios and capitalize on emerging opportunities in grinding media

Industry leaders must prioritize a multifaceted strategy to thrive in the complex grinding media market. First, optimizing supply chain resilience through diversified sourcing and nearshoring initiatives will mitigate exposure to trade disruptions and tariff fluctuations. By establishing regional production hubs and strategic stockpiles, companies can maintain consistent media availability and pricing stability for end-users.

Second, continued investment in research and development is essential to advance high-performance media formulations and adaptive geometries. Collaborative partnerships with equipment OEMs and research institutions can accelerate material innovations and validate performance gains in real-world settings. Integrating digital wear monitoring and service analytics into product offerings will further differentiate providers and add customer value through reduced downtime and predictive maintenance capabilities.

Finally, expanding value-added services-such as on-site grinding consultations, customized media selection tools, and performance-based contracts-will enhance customer loyalty and support long-term growth. A proactive approach to sustainability, including media recycling programs and life-cycle assessments, will also resonate with stakeholders focusing on environmental responsibility.

Detailing the rigorous research methodology employed combining primary interviews secondary data and analytical frameworks to ensure robust insights

The insights presented in this report are grounded in a rigorous research methodology designed to ensure accuracy, reliability, and relevance. Primary data collection involved in-depth interviews with C-suite executives, plant engineers, and procurement specialists across major grinding media consuming industries. These conversations provided firsthand perspectives on performance expectations, supply chain challenges, and innovation priorities.

Secondary research encompassed the systematic review of industry journals, trade publications, academic papers, and publicly available financial reports from leading manufacturers. Data triangulation validated key findings by cross-referencing primary insights with quantitative benchmarks and trend analyses. Advanced analytical frameworks, including Porter’s Five Forces and SWOT evaluations, were employed to dissect competitive dynamics and growth drivers.

Quality assurance measures included iterative review cycles with industry experts to refine insights and ensure that the final deliverables reflect the most current market developments. This comprehensive methodology underpins the credibility of the conclusions and recommendations, providing stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Grinding Media market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Grinding Media Market, by Material

- Grinding Media Market, by Form

- Grinding Media Market, by Product Size

- Grinding Media Market, by Operation

- Grinding Media Market, by Application

- Grinding Media Market, by End-Use Industries

- Grinding Media Market, by Distribution Channel

- Grinding Media Market, by Packaging

- Grinding Media Market, by Region

- Grinding Media Market, by Group

- Grinding Media Market, by Country

- United States Grinding Media Market

- China Grinding Media Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Concluding perspectives on current challenges opportunities and strategic imperatives guiding stakeholders in the evolving grinding media environment

In conclusion, the grinding media industry stands at a crossroads of material innovation, digital integration, and shifting regulatory landscapes. The convergence of sustainability imperatives, advanced analytics, and resilient supply chain strategies has set the stage for a new era of performance-driven solutions. Stakeholders across the value chain must adapt to evolving segmentation demands-from specialty ceramics to high-chrome alloys-while navigating geopolitical uncertainties and tariff regimes that influence cost structures.

Regional disparities underscore the importance of localized strategies and strategic partnerships, whether in the growing Asia-Pacific manufacturing belt or the mature EMEA markets emphasizing energy efficiency. Leading companies will distinguish themselves through continuous investment in R&D, digital service offerings, and collaborative ecosystem engagements. As the sector advances, the ability to align product innovation with customer-centric services and sustainability initiatives will be the hallmark of market leadership.

The insights captured here offer a comprehensive lens on current challenges and opportunities, empowering decision-makers to chart a proactive course across the global grinding media landscape.

Inviting executives to connect with Ketan Rohom Associate Director Sales & Marketing to secure comprehensive market intelligence on grinding media solutions

To procure the exhaustive market intelligence and strategic insights on grinding media solutions tailored to your organization’s specific needs, reach out directly to Ketan Rohom Associate Director, Sales & Marketing at 360iResearch. Ketan’s deep expertise and guidance will help you navigate this comprehensive report, ensuring you gain immediate access to the actionable recommendations, in-depth segmentation analysis, regional outlook, and competitive profiling essential for driving growth and innovation. Engage today to secure your copy and empower your strategic decision-making within the grinding media industry.

- How big is the Grinding Media Market?

- What is the Grinding Media Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?