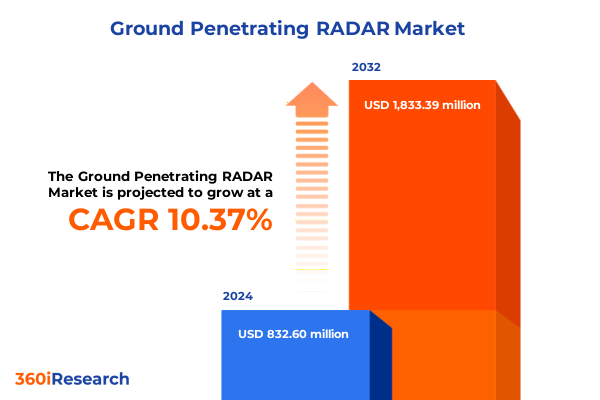

The Ground Penetrating RADAR Market size was estimated at USD 910.72 million in 2025 and expected to reach USD 996.36 million in 2026, at a CAGR of 10.51% to reach USD 1,833.39 million by 2032.

Ground Penetrating Radar Emerges as a Critical Subsurface Imaging Technology Shaping Infrastructure, Defense, and Environmental Assessments

Ground penetrating radar has rapidly evolved into an indispensable tool for subsurface exploration, delivering high-resolution imaging capabilities that support civil engineering, defense operations, environmental monitoring, and beyond. By emitting electromagnetic pulses and capturing their reflections from buried structures and interfaces, this technology enables professionals to conduct surveys with minimal disruption and maximal safety. This non-invasive approach reduces the reliance on traditional excavation methods, thereby accelerating project timelines and minimizing environmental impact.

Recent years have seen an acceleration in demand driven by aging infrastructure in developed markets and emerging development projects in urban and remote regions alike. Governments, utilities, and private enterprises are increasingly turning to ground penetrating radar to assess the integrity of pipelines, roadways, and rail lines, identify voids or sinkholes, and guide precision drilling for oil, gas, and mineral extraction. As infrastructure networks become more complex and regulatory requirements for public safety intensify, the ability to visualize subsurface conditions before committing to capital-intensive interventions has become ever more critical.

Moreover, technological advancements in sensor design, data processing algorithms, and visualization software have democratized access to ground penetrating radar insights. Integrations with geographic information systems and unmanned aerial platforms enable seamless mapping and rapid deployment across diverse terrains. Together, these factors underscore why ground penetrating radar is poised to remain at the forefront of subsurface assessment solutions for years to come.

Breakthrough Innovations and Digital Integration Are Redefining Subsurface Radar Capabilities for Real-Time Decision-Making and Predictive Insights

Accelerated innovation trajectories are reshaping the ground penetrating radar landscape, with breakthroughs spanning hardware miniaturization, real-time data analytics, and cross-platform interoperability. Advances in antenna architecture and signal processing now allow for both two-dimensional and volumetric three-dimensional imaging modalities, expanding the range of detectable features from shallow utility lines to deep geological formations. As a result, practitioners can select systems optimized for high-frequency resolution in archaeological studies or low-frequency penetration for geological surveys with unprecedented flexibility.

Complementing these hardware developments, the integration of artificial intelligence and machine learning into data interpretation workflows has proven transformative. Automated feature extraction and anomaly classification reduce operator dependency, enabling field teams to make near-instantaneous decisions. This shift toward predictive analytics not only improves survey efficiency but also enhances the accuracy of defect detection in critical infrastructure, thereby mitigating project risks and cost overruns.

Furthermore, the convergence of ground penetrating radar platforms with unmanned aerial vehicles and autonomous ground vehicles is unlocking new survey paradigms. These mobile deployments, combined with cloud-based visualization tools, allow remote stakeholders to monitor subsurface conditions in real time, irrespective of geographic constraints. Together, these transformative shifts are establishing a new performance baseline for subsurface imaging technologies in a variety of specialized applications.

Escalating US Tariffs in 2025 Are Intensifying Supply Chain Pressures and Catalyzing Strategic Shifts in Ground Penetrating Radar Sourcing

The introduction of elevated tariffs in 2025 by the United States government has exerted palpable pressure on ground penetrating radar system manufacturers and end users alike. With an uptick in duties on imported electronic components, including specialized antennas, transceiver modules, and high-frequency circuit boards, both domestic and international suppliers are grappling with cost-push inflation. This environment compels original equipment manufacturers to reassess procurement strategies, often shifting toward vertically integrated supply chains or sourcing from tariff-exempt jurisdictions.

In response, many vendors have accelerated investments in localized production facilities to circumvent punitive duties, reducing exposure to geopolitical volatility. At the same time, smaller equipment providers, lacking the capital to establish in-country manufacturing, are entering strategic partnerships or licensing agreements to retain market access. These alliances often encompass technology transfers and co-development initiatives, which not only mitigate tariff impacts but also foster the domestic innovation ecosystem.

From the end-user perspective, organizations reliant on ground penetrating radar services are adapting by incorporating total cost of ownership analyses into procurement decisions. Lifecycle maintenance models and equipment-as-a-service offerings have become more prevalent, enabling clients to leverage the latest subsurface imaging technologies without bearing the full brunt of upfront capital expenditures or escalating import duties. Consequently, the cumulative effect of 2025 tariffs is reshaping commercial arrangements across the value chain, driving both consolidation and new collaborative frameworks.

Diverse Technology and Application Segments Reveal Tailored Ground Penetrating Radar Solutions for Specialized Industry Use Cases

Ground penetrating radar market dynamics are deeply influenced by the spectrum of technological types and their corresponding applications. Traditional two-dimensional scanning systems continue to dominate entry-level applications, offering rapid surveys for utility detection and road condition assessments. However, as project complexity increases, there is a discernible pivot toward three-dimensional volumetric solutions that deliver enhanced spatial resolution, underpinning advanced engineering projects and geological investigations.

The choice between air coupled and ground coupled antenna configurations further dictates system suitability. Air coupled antennas, prized for their rapid deployment and minimal site preparation, are increasingly leveraged in transportation corridor inspections, especially over road surfaces. In contrast, ground coupled antennas, which require closer soil contact, excel in detecting subsurface anomalies in environments where signal fidelity is paramount, such as archaeological excavations and pipeline integrity surveys.

Frequency selection plays an equally critical role. High-frequency systems are the tool of choice for detecting shallow, small-scale targets in environmental and utility mapping, while low-frequency arrays penetrate greater depths, facilitating oil and gas exploration or deep geological assessments. Medium-frequency devices strike a balance, supporting general-purpose construction and infrastructure diagnostics where moderate depth and resolution are both required.

Across end-use scenarios, the technology is tailored to applications ranging from archaeological artifact identification to road and rail inspection, environmental remediation, military ordnance detection, and utility line mapping. This diverse usage panorama underscores the necessity for equipment providers to offer modular platforms that can be configured to specific operational profiles, ensuring both performance and cost effectiveness.

This comprehensive research report categorizes the Ground Penetrating RADAR market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Antenna Type

- Frequency Range

- Application

Distinct Regional Dynamics Are Driving Ground Penetrating Radar Adoption with Unique Infrastructure, Regulatory, and Investment Patterns Across Global Markets

Regional market characteristics for ground penetrating radar diverge significantly based on infrastructure renewal cycles, regulatory frameworks, and capital expenditure patterns. In the Americas, large-scale public works programs and municipal rehabilitation initiatives have spurred sustained investment in subsurface diagnostic technologies. This growth is particularly pronounced in North America, where legacy water and energy networks demand continuous monitoring and preventive maintenance.

Conversely, the Europe, Middle East & Africa region presents a mosaic of adoption drivers, including stringent safety regulations and extensive archaeological heritage preservation efforts. European nations have set ambitious decarbonization targets that necessitate comprehensive subsurface surveys for pipeline repurposing and renewable energy infrastructure. Meanwhile, Middle Eastern and African markets are witnessing opportunistic deployment of ground penetrating radar in oilfield expansion and infrastructure modernization projects.

In the Asia-Pacific zone, rapid urbanization and high-speed rail network expansions have created fertile grounds for ground penetrating radar applications. Governments are prioritizing underground utility mapping to mitigate the risk of accidental strikes during metro construction, and mining operations are adopting volumetric scanning solutions to optimize resource extraction. As these regional patterns illustrate, each geography demands customized engagement strategies, whether through local manufacturing partnerships, targeted service offerings, or compliance-driven product enhancements.

This comprehensive research report examines key regions that drive the evolution of the Ground Penetrating RADAR market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Fueled by Strategic Partnerships, Technological Innovation, and Portfolio Diversification Among Ground Penetrating Radar Providers

The competitive arena for ground penetrating radar is characterized by a blend of large multinational equipment manufacturers and specialized niche players. Leading firms have leveraged extensive R&D budgets to introduce next-generation transceiver modules, cloud-enabled analytics platforms, and advanced antenna arrays. Through strategic alliances with software providers, these corporations are offering end-to-end subsurface imaging solutions that integrate hardware, data processing, and visualization in a single package.

Simultaneously, emerging vendors are carving out market positions by focusing on modular hardware designs and open-architecture software frameworks. This approach enables rapid customization to meet sector-specific requirements, from military-grade detection systems to turnkey environmental survey kits. Many of these agile entrants are tapping into local service networks to deliver turnkey solutions, shortening sales cycles and responding swiftly to customer needs.

Mergers and acquisitions have also played a pivotal role in shaping the sector. Larger players have selectively acquired technology startups to bolster their product portfolios with niche features such as real-time machine learning analytics or drone-based deployment capabilities. These acquisitions not only accelerate time to market but also broaden the geographic footprint of the acquiring entities, enabling seamless entry into high-growth regions.

Together, these strategic maneuvers underscore the importance of continuous innovation, partnership ecosystems, and targeted acquisitions as the primary levers for competitive differentiation in the ground penetrating radar landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ground Penetrating RADAR market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D-Radar Ltd.

- BOVIAR S.r.l.

- Chemring Group plc

- ChinaGPR

- Geometrics, Inc.

- Geophysical Survey Systems, Inc.

- Geoscanners AB

- Guideline Geo AB

- Hexagon AB

- ImpulseRadar Sweden AB

- Ingegneria Dei Sistemi S.p.A.

- Japan Radio Co., Ltd.

- Kedian Reed

- Leica Geosystems AG

- MultiView, Inc.

- Novatest s.r.l.

- Penetradar Corporation

- PipeHawk plc

- Radiodetection Ltd.

- Sensors & Software Inc.

- SPX Corporation

- Utsi Electronics Ltd.

- Zond Georadar

Proactive Strategic Imperatives Encourage Industry Leaders to Embrace Digital Innovation, Supply Chain Resilience, and Sustainable Growth in Subsurface Imaging

Industry leaders seeking to capitalize on ground penetrating radar technology should incorporate digital transformation into their core strategies. By investing in AI-driven analytics and cloud computing infrastructure, organizations can unlock deeper insights from complex subsurface datasets and accelerate stakeholder decision cycles. In parallel, establishing collaborative consortiums with component suppliers can enhance supply chain resilience, ensuring access to critical hardware even amidst fluctuating tariff regimes.

Moreover, companies are encouraged to adopt outcome-based service models that align their revenue streams with client success metrics. This shift from transactional equipment sales to performance-driven contracts not only fosters long-term customer loyalty but also enables continuous feedback loops for product improvement. Concurrently, prioritizing sustainability through reduced site disturbance protocols and energy-efficient system designs can help enterprises meet evolving environmental regulations and corporate social responsibility objectives.

Finally, cultivating technical expertise through comprehensive training programs will be essential. Equipping field operators and data analysts with the latest methodologies in antenna calibration, signal interpretation, and report generation ensures that the full value of ground penetrating radar investments is realized. By integrating these recommendations into strategic roadmaps, leaders can not only navigate current market challenges but also pioneer new frontiers in subsurface imaging innovation.

Transparent and Rigorous Mixed-Method Research Approach Ensures Robust Insights Through Triangulated Data and Expert Validation

This research employed a rigorous mixed-methods framework designed to triangulate data from multiple sources and validate insights through expert consultations. Secondary research involved the systematic review of industry white papers, regulatory filings, and technical journals to establish foundational knowledge on technological trends, tariff developments, and regional adoption patterns.

Primary research was conducted through in-depth interviews with key stakeholders, including equipment manufacturers, service providers, and end users across critical sectors such as construction, utilities, and defense. These conversations delivered qualitative perspectives on strategic priorities, procurement challenges, and emerging use cases, which were cross-referenced against quantitative data to ensure consistency and accuracy.

Market segmentation analyses were developed using a combination of top-down and bottom-up approaches, mapping technology types, antenna configurations, frequency ranges, and application verticals to real-world deployment scenarios. Regional assessments incorporated macroeconomic indicators, infrastructure investment statistics, and policy landscapes to illustrate divergent regional dynamics.

Throughout the study, data validation measures such as cross-referencing vendor specifications, reviewing public procurement records, and reconciling disparate data sets were applied. This comprehensive methodology ensures that the conclusions and recommendations presented are both robust and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ground Penetrating RADAR market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ground Penetrating RADAR Market, by Type

- Ground Penetrating RADAR Market, by Antenna Type

- Ground Penetrating RADAR Market, by Frequency Range

- Ground Penetrating RADAR Market, by Application

- Ground Penetrating RADAR Market, by Region

- Ground Penetrating RADAR Market, by Group

- Ground Penetrating RADAR Market, by Country

- United States Ground Penetrating RADAR Market

- China Ground Penetrating RADAR Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Holistic Synthesis Highlights the Convergence of Technological, Economic, and Regulatory Forces Shaping the Future of Subsurface Radar Markets

In synthesizing the breadth of technological innovations, regulatory influences, and market dynamics, it becomes clear that ground penetrating radar is undergoing a profound evolution. Technological advances in three-dimensional imaging, AI-driven analytics, and autonomous deployment platforms have expanded the scope of applications, enabling more precise subsurface assessments across diverse industries.

Concurrently, the imposition of tariffs in 2025 has acted as both a challenge and a catalyst. While increased duties on imported components have elevated costs and disrupted traditional supply chains, they have also incentivized manufacturers to localize production, forge strategic partnerships, and explore alternative sourcing strategies. This realignment is likely to yield longer-term benefits in the form of enhanced domestic innovation and supply chain resilience.

Segmentation insights reveal a market that is not monolithic but rather highly differentiated by technology type, antenna configuration, frequency range, and end-use application. Regional analyses further underscore that strategic approaches must reflect local infrastructure priorities, regulatory environments, and investment climates. When viewed holistically, these intersecting factors paint a dynamic and rapidly maturing market.

As a result, organizations that proactively integrate digital innovation, sustainable practices, and flexible commercial models into their strategic roadmaps will be best positioned to harness the full potential of ground penetrating radar technologies. The recommendations outlined herein offer a clear pathway for industry participants to navigate complexity and seize emerging opportunities.

Engage with Our Expert to Access In-Depth Subsurface Radar Insights and Transform Your Strategic Decision-Making Today with Tailored Market Intelligence

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to unlock comprehensive market intelligence tailored to your organizational needs. Through a personalized consultation, you will gain deeper insights into cutting-edge ground penetrating radar innovations, competitive landscapes, and regional dynamics that are shaping strategic investments today.

By securing the full market research report, your team will benefit from granular segmentation analyses, tariff impact assessments, and actionable recommendations designed to accelerate decision cycles and reduce implementation risks. Ketan Rohom’s expertise in aligning technical capabilities with commercial objectives ensures that your organization receives targeted guidance on product selection, partnership opportunities, and supply chain optimization.

To initiate your engagement, simply reach out to schedule a briefing that will walk you through key findings and demonstrate how the report’s insights can be integrated into your current projects. This collaborative approach guarantees that you will extract maximum value from the data, with the flexibility to focus on specific applications, regions, and competitive scenarios. Connect with Ketan Rohom today to transform your strategic planning with authoritative, research-backed intelligence.

- How big is the Ground Penetrating RADAR Market?

- What is the Ground Penetrating RADAR Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?