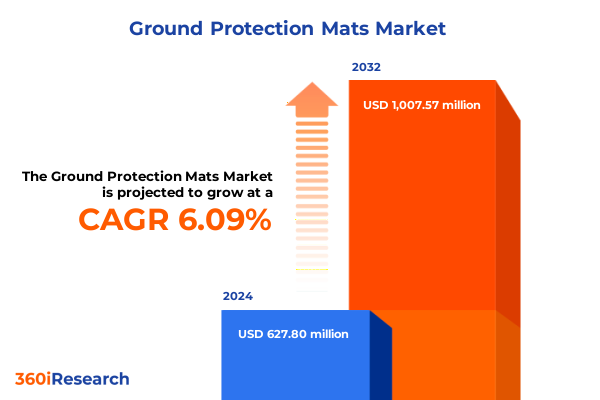

The Ground Protection Mats Market size was estimated at USD 663.02 million in 2025 and expected to reach USD 701.74 million in 2026, at a CAGR of 6.16% to reach USD 1,007.57 million by 2032.

Setting the Stage for Comprehensive Ground Protection Mat Market Understanding and Strategic Implications for Infrastructure and Utility Sectors

In today’s rapidly evolving infrastructure landscape, ground protection mats have become indispensable assets for ensuring safe, efficient, and sustainable operations across a multitude of industries. The foundational layer of any successful project-from major construction sites to critical utility maintenance-hinges on the reliability of temporary roadways, robust trench shoring systems, and versatile work site flooring solutions. By stabilizing the ground surface, these mats mitigate soil compaction, enhance equipment mobility, and offer resilient protection against environmental hazards, thereby enabling projects to proceed without delays or undue risk. As we explore this dynamic market, it becomes clear that understanding material innovation, regulatory influences, and strategic segmentation is essential for stakeholders aiming to capitalize on emerging opportunities.

This executive summary distills key trends, tariff implications, segmentation insights, regional variations, corporate strategies, and forward-looking recommendations within the ground protection mat domain. Drawing on extensive primary and secondary research, the analysis provides readers with a holistic view of transformative shifts, trade policy impact, and segmentation-led opportunities without delving into granular market sizing or projections. It lays the groundwork for decision-makers seeking a cohesive narrative that ties together material advancements, industry applications, and competitive landscapes, setting the stage for strategic investments and operational excellence.

Exploring the Convergence of Material Innovation, Digital Integration, and Sustainability Driving Market Evolution in Ground Protection Solutions

Over the past several years, the ground protection mat market has undergone profound transformation driven by material science breakthroughs, digital integration, and heightened environmental imperatives. Advanced composite mats, leveraging blends of fiberglass and polyester polymers, have emerged as the leading choice for projects demanding high load-bearing capacity combined with reduced weight. Meanwhile, innovations in high-density polyethylene and ultra-high-molecular-weight polyethylene formulations have addressed durability concerns, extending service life even under the most abrasive site conditions. Concurrently, manufacturers are embedding Internet of Things sensors to monitor mat stress and environmental exposure in real time, enabling predictive maintenance and maximizing asset utilization.

Additionally, the landscape is being reshaped by growing sustainability mandates and circular economy initiatives. Companies are increasingly prioritizing recyclable and bio-based materials, fostering partnerships with waste management firms to establish end-of-life repurposing programs. This convergence of technological advancement and environmental stewardship is not only elevating product performance but also aligning market offerings with corporate social responsibility targets. As a result, stakeholders are compelled to re-evaluate procurement strategies and supply chain resilience, recognizing that adaptability to these transformative shifts will define competitive positioning in the years ahead.

Analyzing the Multifaceted Effects of Recent U.S. Trade Measures on Supply Chain Dynamics and Cost Structures for Ground Protection Mats

Tariff policies enacted by the United States in early 2025 have introduced new layers of complexity for both domestic manufacturers and importers of ground protection mats. The imposition of additional duties on aluminum and certain composite imports has led suppliers to reassess sourcing strategies and production footprints. Domestic producers of high-strength aluminum mats have gained a competitive edge, witnessing a stabilization in pricing and order volumes as end users redirect purchases away from higher-cost import alternatives. However, sectors reliant on specialized fiberglass composites have experienced tighter supply availability, as premium segments of the market navigate between rising costs and delivery timelines.

Beyond immediate cost implications, these tariff measures have catalyzed a broader strategic shift toward nearshoring and onshore manufacturing investment. Several major fabricators have announced capacity expansions within the United States, securing domestic feedstock agreements to mitigate future trade policy volatility. In parallel, end users in oil and gas, petrochemicals, and utilities are forging long-term supplier partnerships to lock in stable pricing and service commitments. The cumulative impact of these tariffs is thus driving a recalibrated supply chain framework, one that emphasizes proximity, agility, and risk diversification to uphold project timelines and budgetary constraints.

Unraveling the Interplay Between Material Types, Industry Verticals, Application Niches, and Distribution Models Influencing Market Opportunities

A nuanced understanding of market segmentation reveals where growth trajectories intersect with material preferences, end use demands, application requirements, and evolving distribution paradigms. When evaluating material type, certain end users prioritize high-strength aluminum mats for critical load-bearing operations, while others adopt standard-grade aluminum for less-intensive tasks. Composite offerings selected span from fiberglass variants in environments requiring enhanced electrical insulation to polyester composites delivering cost-effective abrasion resistance. The polyethylene family addresses a spectrum of durability specifications, with HDPE favored for general-purpose applications and UHMWPE for extreme-impact scenarios. Rubber formulations, both natural and synthetic, serve projects demanding superior traction and vibration dampening, whereas wood mats-categorized into hardwood and softwood-preserve site aesthetics and meet budget-conscious requirements.

Across end use industries, construction stakeholders in commercial, infrastructure, and residential projects demonstrate differentiated procurement patterns, with infrastructure initiatives often allocating premium budgets for advanced composite mats. Oil and gas operators navigate requirements across downstream, midstream, and upstream operations, balancing corrosion resistance with logistic feasibility. Petrochemical facilities select feedstock-focused mat solutions for processing areas and refining zones, while telecommunications projects invest in specialized mats for cell tower access and data center installations. Utilities, encompassing power transmission and renewable energy sectors, increasingly deploy mats to protect sensitive ground ecosystems during maintenance operations.

When considering application, emergency response teams demand rapid-deployment mats for disaster relief and firefighting scenarios, whereas temporary roadway projects emphasize land access solutions. Trench shoring for pipeline installations draws on mats engineered for lateral stability, and diverse work site environments-from construction sites to mining sites-call for tailored surface protection systems. Distribution channels also shape market accessibility: direct sales facilitate bespoke procurement and service agreements, distributors extend regional reach through inventory stocking, and e-commerce platforms deliver cost efficiencies for standardized offerings.

This comprehensive research report categorizes the Ground Protection Mats market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User Industry

- Sales Channel

Examining Regional Variations in Demand Drivers, Supply Chain Strategies, and Regulatory Influences Across Global Markets

Regional dynamics underscore the importance of geographic context in shaping material adoption patterns and supply chain strategies. In the Americas, infrastructure investment across North and South America has propelled demand for aluminum and composite mats, with tropical climates in certain Latin American territories elevating emphasis on UV-stable polymeric solutions. Construction activity in the United States and Canada has spurred manufacturer commitments to local warehousing, thereby reducing lead times and logistical complexities.

In Europe, the Middle East, and Africa, diverse environmental conditions-from arid desert operations to temperate industrial zones-drive a broad spectrum of product requirements. Renewable energy deployments in Middle Eastern solar farms and North African wind projects have stimulated innovation in corrosion-resistant composite mats, while stringent environmental regulations in the European Union accelerate the adoption of recyclable rubber and bio-based wood mat solutions. Moreover, geopolitical considerations and shifting trade alliances within the EMEA region have prompted stakeholders to cultivate multi-sourcing frameworks to maintain supply continuity.

Asia-Pacific markets reflect rapid urbanization and extensive resource extraction endeavors, fueling strong uptake of polyethylene-based mats in heavy-duty work sites such as mining operations. Growth in large-scale infrastructure in Southeast Asia, along with robust telecommunications expansion in countries like India and China, has generated significant volume requirements for temporary roadway and cell tower access mats. Regional manufacturers are increasingly integrating sensor technologies and smart tracking features to cater to digitally advanced markets and support sophisticated asset management initiatives.

This comprehensive research report examines key regions that drive the evolution of the Ground Protection Mats market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning, Innovation Strategies, and Partnership Models Driving Leadership in Ground Mat Manufacturing

The competitive landscape is characterized by a blend of global manufacturers and specialized regional players, each leveraging unique strengths to capture market share. Leading firms are distinguishing themselves through integrated service offerings that combine product customization, on-site technical support, and digital asset tracking platforms. Several established conglomerates have solidified their positions by investing heavily in R&D, focusing particularly on next-generation composite materials and sustainable product lines.

Mid-sized enterprises are carving out niche leadership by specializing in rapid-deployment systems for emergency response and trench shoring, building reputations on responsiveness and tailored engineering services. At the same time, emerging entrants are disrupting traditional distribution paradigms by developing direct-to-end-user e-commerce channels that streamline procurement and introduce dynamic pricing models. Collaborative partnerships between manufacturers and technology firms are also proliferating, resulting in co-developed IoT-enabled mats that enhance real-time monitoring of load distribution and environmental conditions. Collectively, these developments underscore an increasingly competitive environment where differentiation hinges on innovation, service depth, and adaptive go-to-market strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ground Protection Mats market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abosn (Dezhou) New Material Co., Ltd.

- Centriforce Products Ltd.

- CGK Group

- Checkers by Justrite Safety Group

- First Mats Ltd

- Grassform Group

- Groundtrax Systems Ltd by Origin Enterprises PLC

- Ground‑Guards Ltd.

- Hangzhou POLYTECH Plastic Machinery Co., Ltd.

- Henan Yiqi Plastic Products Co., Ltd.

- LODAX

- Newpark Drilling Fluids, LLC. by SCF Partners, Inc.

- Oxford Plastic Systems Ltd.

- Qingdao Ketian Materials Co., Ltd.

- Qingdao Waytop Industry Co., Ltd.

- Quality Mat Company

- Shandong Huao Plastic Co., Ltd.

- Signature Systems Group

- Sterling Solutions, LLC

- Tangyin Sanyou Engineering Plastic Co., Ltd.

- Technix Rubber & Plastics Ltd

- The Jaybro Group

- The Rubber Company Limited

Implementing Agile Manufacturing, Digitalization, Sustainability, and Collaborative Standards to Strengthen Market Resilience and Drive Growth

To thrive amidst material shifts, trade policy fluctuations, and intensifying competition, industry leaders must adopt a multi-pronged strategic approach. First, investing in agile manufacturing capabilities-such as modular production lines that can switch between aluminum, composite, and polymer outputs-will enable rapid responsiveness to tariff-induced sourcing changes. Simultaneously, establishing strategic alliances with regional distributors and logistics providers can mitigate supply chain disruptions and optimize last-mile delivery economics.

Second, embedding digital technologies across the asset lifecycle-from pre-deployment stress testing to post-use condition monitoring-will deliver actionable data to clients and create opportunities for service-based revenue models. Third, prioritizing sustainable materials and end-of-life recycling initiatives will not only meet evolving regulatory requirements but also resonate with corporate responsibility commitments of major end users. Finally, fostering deep industry collaboration through consortiums focused on standardization and best practices will cultivate trust and position manufacturers as thought leaders. By implementing these recommendations, organizations can secure resilient market positions and unlock long-term growth in a dynamic operating environment.

Detailing a Comprehensive Mixed-Methods Approach Combining Executive Interviews, Targeted Surveys, and Secondary Data Analytics to Ensure Robustness

The insights presented in this report are grounded in a rigorous research methodology that combines primary interviews with senior executives, engineering specialists, and procurement managers across key industry verticals. These qualitative engagements were complemented by an extensive review of public filings, industry white papers, and technical journals to triangulate data on material performance and supply chain dynamics.

Quantitative validation was achieved through targeted surveys distributed to end users in construction, oil and gas, petrochemicals, telecommunications, and utilities, ensuring representation across geographies such as the Americas, EMEA, and Asia-Pacific. Secondary data sources, including international trade databases and environmental regulation repositories, provided additional context on tariff evolutions and sustainability mandates. Data synthesis involved sophisticated analytical techniques to identify correlation patterns between segment adoption rates, regional infrastructure development indicators, and competitive positioning metrics. This multi-layered approach ensures a balanced, actionable perspective that aligns with both strategic and operational decision-making needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ground Protection Mats market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ground Protection Mats Market, by Product Type

- Ground Protection Mats Market, by Material

- Ground Protection Mats Market, by End User Industry

- Ground Protection Mats Market, by Sales Channel

- Ground Protection Mats Market, by Region

- Ground Protection Mats Market, by Group

- Ground Protection Mats Market, by Country

- United States Ground Protection Mats Market

- China Ground Protection Mats Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Material, Technological, and Strategic Imperatives to Chart a Path Forward for Sustainable Market Leadership in Ground Protection

As the ground protection mat market continues to evolve, success will hinge on the ability to navigate complex trade landscapes, leverage material innovations, and tailor solutions to diverse industry applications. Stakeholders who proactively align their offerings with sustainability goals and digital service models will secure leadership positions and foster deeper client partnerships. Moreover, regional adaptability and strategic supply chain structuring will remain critical in managing cost pressures and ensuring uninterrupted project execution.

Ultimately, the convergence of advanced materials, real-time monitoring technologies, and collaborative industry frameworks presents a generational opportunity to optimize equipment protection, minimize environmental impact, and drive operational excellence. Organizations that integrate these elements into their strategic planning will not only deliver immediate project benefits but also establish resilient foundations for future market disruptions and growth trajectories.

Engage with Ketan Rohom to Unlock Tailored Market Insights and Drive Your Ground Protection Mat Strategy with a Comprehensive Research Report

Are you ready to gain unparalleled insights and actionable strategies tailored to the evolving ground protection mat market? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how our comprehensive report can empower your organization to navigate trade dynamics, segment opportunities, and regional nuances. Ketan’s expertise in articulating complex market intelligence into targeted growth initiatives ensures that your investment in this research will translate into informed decisions and competitive advantage. Reach out now to unlock exclusive executive briefings, receive a customized consultation, and secure your copy of the full market research report today

- How big is the Ground Protection Mats Market?

- What is the Ground Protection Mats Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?