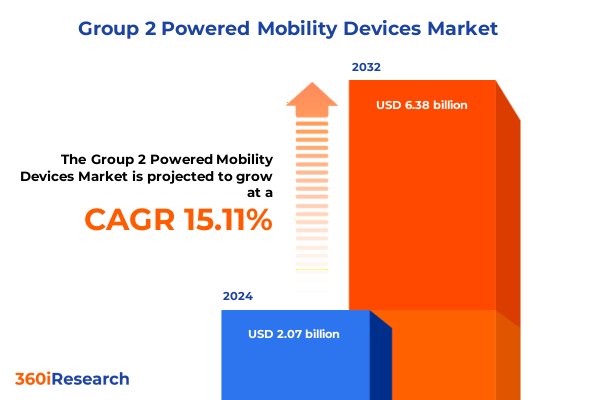

The Group 2 Powered Mobility Devices Market size was estimated at USD 2.38 billion in 2025 and expected to reach USD 2.74 billion in 2026, at a CAGR of 15.13% to reach USD 6.38 billion by 2032.

Exploring the Convergence of Innovation and Accessibility in the Modern Powered Mobility Device Market Amidst Shifting Demands and Technological Breakthroughs

In an era marked by rapid demographic shifts and technological breakthroughs, powered mobility devices have emerged as critical enablers of independence, comfort, and enhanced quality of life for millions. From individual consumers seeking greater freedom in daily living to healthcare institutions striving to improve patient outcomes and operational efficiency, the scope of these devices has expanded well beyond simple mobility solutions. New entrants and established players alike face a dynamic environment characterized by evolving regulatory frameworks, heightened consumer expectations, and escalating competitive pressures. These factors collectively underscore the urgency for stakeholders to stay informed of the latest technological innovations, user preferences, and market dynamics.

Against this backdrop, this executive summary synthesizes the most pertinent trends, disruptions, and strategic insights that define the powered mobility device landscape today. It distills complex data into easily digestible analysis, revealing how shifts in battery technology, distribution channels, and end-use applications are reshaping industry paradigms. Furthermore, it examines emerging regulatory measures and international trade policies that influence supply chains and pricing structures. By weaving these threads together, the introduction sets the stage for a comprehensive exploration of transformative forces, regional contrasts, and actionable recommendations that will guide decision-makers in harnessing opportunities and mitigating risks in this competitive sector.

Examining the Profound Technological and Consumer Behavior Shifts Reshaping the Powered Mobility Device Sector with Unprecedented Momentum

Recent years have witnessed profound shifts in the powered mobility device landscape, driven by rapid advancements in propulsion systems, user-centric design philosophies, and digital connectivity. New battery chemistries and energy management systems have significantly extended operational range and reduced charging times, enabling devices to serve both indoor and outdoor applications with unprecedented reliability. Parallel to these hardware developments, the integration of smart diagnostics and telematics has created pathways for predictive maintenance and remote monitoring, effectively transforming devices into linked nodes within broader healthcare ecosystems.

Shifting consumer expectations have further accelerated change, as end users increasingly seek customizable features, aesthetic appeal, and simplified interfaces. This evolution in user preferences has encouraged manufacturers to adopt modular designs that accommodate different functional modules, such as seating ergonomics, control systems, and environmental sensors. At the same time, digital health platforms are interfacing directly with mobility devices to capture usage data and inform personalized rehabilitation protocols. As a result, powered mobility solutions are transcending their traditional role as standalone equipment, becoming foundational elements in value-based care models.

Moreover, as investors and market entrants gravitate toward opportunities in accessibility tech, mergers and acquisitions have surged, consolidating expertise across mechanical engineering, software development, and distribution networks. This wave of strategic partnerships and capital influx has not only expanded the competitive arena but has also fostered the emergence of niche players specializing in bespoke device configurations. Collectively, these transformative shifts underscore the critical importance of agility and innovation as companies navigate an increasingly complex and interconnected mobility ecosystem.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on the Global Flow and Cost Structures of Powered Mobility Devices

The introduction of new United States tariff measures in early 2025 has generated significant ripples throughout the global supply chain for powered mobility devices. Tariffs imposed on key components such as electric motors, battery cells, and precision chassis parts have elevated import costs, prompting manufacturers to reassess sourcing strategies and negotiate with alternative suppliers. In response, several device producers have explored nearshoring initiatives to mitigate exposure to steep levies, relocating assembly operations to regions with favorable trade terms or local manufacturing incentives. These relocation efforts carry their own set of operational challenges, including workforce training and infrastructure investment, yet they offer a hedge against persistent tariff volatility.

In addition, the tariff adjustments have catalyzed a more competitive pricing environment, compelling companies to streamline product portfolios and optimize production workflows. Some organizations have accelerated the adoption of automation technologies in assembly lines to reduce labor dependency, while others have renegotiated long-term purchase agreements to secure volume discounts that offset additional duties. On the procurement front, distributors and dealers are exercising greater strategic planning with inventory buffers and dynamic pricing algorithms to manage margin erosions.

Furthermore, end retailers and healthcare providers are scrutinizing total cost of ownership more closely, factoring in inflated component costs, freight charges, and potential restocking delays into their procurement decisions. This heightened cost awareness is influencing device specifications and feature prioritization, driving demand for adaptable platforms that can accommodate cost-effective component swaps without compromising functional integrity. Consequently, the industry is entering a phase of intensified supply-chain resilience building, where tariff-driven challenges serve as catalysts for smarter risk management and operational optimization.

Uncovering Distinct Segmentation Perspectives to Illuminate Diverse Consumer Needs and Technology Adoption Patterns Across the Mobility Device Market

A nuanced understanding of market segmentation is indispensable for tailoring product development, marketing strategies, and distribution tactics to distinct consumer cohorts. When examining product type segmentation, the category of powered mobility devices bifurcates into mobility scooters and wheelchairs, with the former subdivided into four-wheeler and three-wheeler configurations and the latter classified into front wheel drive, mid wheel drive, and rear wheel drive variants. Each configuration addresses specific user requirements, from enhanced stability in larger scooters to tighter turning radius in agile, compact chairs. Battery type segmentation distinguishes between traditional lead acid solutions and the increasingly favored lithium ion chemistry, with the latter offering superior energy density and lifecycle performance, spurring manufacturers to integrate advanced battery management systems.

With regard to end users, the market encompasses home users seeking intuitive, at-ease mobility options as well as institutional buyers such as hospitals and rehabilitation centers that demand high durability and specialized functionalities. Application segmentation further differentiates indoor models engineered for constrained spaces and smooth surfaces from outdoor units optimized for variable terrains and weather resilience. Distribution channel segmentation spans direct sales models, independent dealers operating through local dealers and specialty stores, and online retailers that leverage brand websites alongside third party marketplaces to enhance accessibility and streamline purchasing processes. Insights derived from this layered segmentation framework enable stakeholders to pinpoint growth pockets, invest in targeted innovation, and calibrate messaging that resonates with each distinct audience segment.

This comprehensive research report categorizes the Group 2 Powered Mobility Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Battery Type

- Application

- End User

- Distribution Channel

Delineating Regional Dynamics Driving Growth and Innovation in Americas, Europe Middle East & Africa, and Asia-Pacific Markets for Mobility Devices

Regional dynamics play a pivotal role in shaping competitive intensity, regulatory climates, and consumer adoption rates for powered mobility devices. In the Americas, robust investment in infrastructure and expansive home healthcare programs have fueled demand for both four-wheeler scooters designed for extended outdoor excursions and indoor wheelchairs engineered for constrained living spaces. Conversely, shifting reimbursement policies and mounting pressure to reduce hospital readmission rates are prompting healthcare providers to seek integrated device-to-platform solutions, forging closer collaboration between device manufacturers and telehealth service providers.

Within Europe, Middle East and Africa, diverse regulatory frameworks present both challenges and opportunities. Stringent safety and sustainability regulations in Western Europe have accelerated the adoption of eco-friendly materials and energy-efficient designs, while emerging markets in the Middle East and Africa are characterized by growing demand for cost-effective models capable of handling rugged conditions and minimal maintenance support. Meanwhile, the Asia-Pacific region is witnessing an unprecedented surge in investments toward smart cities and aging-in-place initiatives. Countries across this region are prioritizing urban accessibility infrastructure, which in turn has elevated interest in compact, technologically integrated mobility devices that facilitate seamless indoor-outdoor transitions and digital health integration.

Collectively, these regional variances underscore the importance of a differentiated go-to-market approach, one that aligns product features, pricing strategies, and channel partnerships with localized demand drivers and regulatory stipulations. By doing so, stakeholders can effectively capitalize on growth pockets while navigating region-specific challenges in compliance, distribution, and consumer education.

This comprehensive research report examines key regions that drive the evolution of the Group 2 Powered Mobility Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning and Innovation Portfolios of Leading Manufacturers Shaping the Powered Mobility Device Ecosystem in 2025

Leading enterprises in the powered mobility device sphere have been rapidly refining their strategic positioning and harnessing innovation to secure competitive advantage. Several incumbents have expanded their product portfolios to include modular, upgradable platforms that allow end users to customize seating systems, control interfaces, and sensor packages over time. This modular philosophy enhances device longevity and creates recurring aftermarket revenue streams for manufacturers through optional accessories and software upgrades. Concurrently, strategic partnerships between device makers and technology firms have led to the integration of artificial intelligence-enabled navigation aids, voice control functionalities, and fall-detection sensors, thereby broadening the spectrum of users who can safely benefit from powered mobility solutions.

New entrants and specialized niche players have also gained traction by focusing on underserved market needs. Some innovators are developing ultra-lightweight designs using advanced composite materials to cater to highly active users who require portability. Others are targeting rehabilitation facilities with devices embedded with programmable resistance and haptic feedback, streamlining recovery protocols for patients with neurological conditions. Moreover, prominent firms have been active in establishing digital service ecosystems, offering subscription-based remote support, predictive maintenance, and usage analytics. This shift toward service-oriented business models reflects a broader industry trend toward lifecycle management and outcome-based value propositions.

Intense research and development investments, along with venture capital inflows, continue to accelerate technological maturation. Leaders in this landscape are those that can not only innovate in terms of hardware and software but also cultivate robust distribution networks and forge alliances with healthcare payers. By doing so, these organizations reinforce their market presence and ensure that their offerings remain front and center as regulatory requirements evolve and consumer expectations climb.

This comprehensive research report delivers an in-depth overview of the principal market players in the Group 2 Powered Mobility Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1800Wheelchair.com, LLC

- 21st Century Scientific, Inc.

- Amigo Mobility International, Inc.

- Drive DeVilbiss Healthcare, LLC

- Electric Mobility Euro Ltd.

- EZ Lite Cruiser, Inc.

- GF Health Products, Inc.

- Golden Technologies, Inc.

- Handicare Group AB

- Heartway Medical Products Co., Ltd.

- Hoveround Corporation

- Invacare Corporation

- Karman Healthcare, Inc.

- Kymco Healthcare

- LEVO AG

- Magic Mobility Pty Ltd

- Merits Health Products Co., Ltd.

- MEYRA GmbH

- National Seating & Mobility, Inc.

- Numotion, Inc.

- Ottobock SE & Co. KGaA

- Permobil AB

- Pride Mobility Products Corporation

- Shoprider Mobility Products, Inc.

- Sunrise Medical GmbH

Formulating Pragmatic Strategies and Innovative Roadmaps for Industry Stakeholders to Capitalize on Emerging Trends in Powered Mobility Device Markets

Industry participants must adopt a multifaceted strategic posture to navigate the rapidly evolving powered mobility device market. First, investing in adaptable manufacturing and supply-chain structures will enable swift responses to tariff fluctuations and component shortages. By fostering collaborative supplier relationships and exploring near-shore production sites, companies can mitigate cost pressures and strengthen operational resilience. Simultaneously, product roadmaps should emphasize modular, software-defined architectures that allow continuous feature enhancements and personalization without necessitating full device replacement.

Next, forging partnerships across the healthcare and technology domains will be critical. Co-development agreements with digital health platforms can unlock advanced data analytics capabilities, facilitating more precise patient monitoring and tailored therapy regimens. Moreover, strategic alliances with tier-one rehabilitation centers and home healthcare providers can expedite real-world testing, accelerate time to market, and bolster credibility among decision-makers. Parallel to these collaborations, manufacturers should explore outcome-based contracting models, positioning their devices as integral components of value-based care ecosystems.

Finally, channel strategies must be reconsidered to reflect shifting purchasing behaviors. Direct sales teams should be augmented by digital engagement tools that offer immersive product demonstrations, virtual fittings, and streamlined order tracking. Meanwhile, independent dealers must evolve their value proposition by incorporating service and maintenance expertise, while online retail channels should be optimized for user experience and post-purchase support. By implementing these targeted initiatives, industry leaders can capture new market segments, enhance customer loyalty, and drive sustainable growth.

Detailing the Rigorous Research Framework and Analytical Approaches Underpinning Comprehensive Insights into the Powered Mobility Device Landscape

A rigorous methodology underpins the insights presented in this report, leveraging both primary and secondary research to ensure comprehensive coverage of the powered mobility device domain. Extensive stakeholder interviews with device manufacturers, ancillary component suppliers, healthcare providers, and distribution channel experts provided firsthand perspectives on challenges, opportunities, and emerging best practices. These qualitative inputs were complemented by a detailed review of regulatory filings, patent databases, and industry white papers to map technological trajectories and compliance trends.

Secondary research featured an exhaustive analysis of trade association reports, governmental policy announcements, and financial disclosures from publicly traded companies. This enabled cross-validation of tariffs, trade flow patterns, and investment flows affecting the supply chain. Additionally, a structured process was employed to categorize devices by product architecture, propulsion systems, user demographics, and distribution pathways, thereby illuminating nuanced segmentation-based insights. Data triangulation techniques were used to reconcile potential inconsistencies, ensuring that findings reflect both macroeconomic influences and granular operational realities.

Quantitative data modeling and thematic analysis tools further refined the perspective on competitive dynamics, pricing pressures, and adoption trends. This dual approach of in-depth qualitative dialogue and robust quantitative analytics has yielded an integrated viewpoint, equipping stakeholders with actionable intelligence. By maintaining methodological rigor and transparency, the research delivers reliable, forward-looking guidance for informed decision-making within the powered mobility device sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Group 2 Powered Mobility Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Group 2 Powered Mobility Devices Market, by Product Type

- Group 2 Powered Mobility Devices Market, by Battery Type

- Group 2 Powered Mobility Devices Market, by Application

- Group 2 Powered Mobility Devices Market, by End User

- Group 2 Powered Mobility Devices Market, by Distribution Channel

- Group 2 Powered Mobility Devices Market, by Region

- Group 2 Powered Mobility Devices Market, by Group

- Group 2 Powered Mobility Devices Market, by Country

- United States Group 2 Powered Mobility Devices Market

- China Group 2 Powered Mobility Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Future Trajectory of the Powered Mobility Device Sector in a Competitive Environment

The collective analysis underscores a pivotal moment for the powered mobility device sector, where convergence of advanced battery technologies, digital connectivity, and shifting policy landscapes is redefining the competitive playbook. Companies that embrace modular innovation and cultivate symbiotic partnerships across the healthcare and technology ecosystems are poised to outpace peers. Likewise, organizations that preemptively address tariff-induced cost challenges by optimizing supply-chain footprints and leveraging automation stand to bolster margin resilience.

Segmentation insights reveal that tailoring device configurations to specific user needs-from indoor maneuverability for home environments to robust outdoor readiness in rehabilitation centers-remains a critical differentiator. Regional contrasts highlight the necessity of aligning product attributes and distribution models with localized regulatory requirements and consumer expectations across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. Meanwhile, the shift toward service-based revenue models, anchored in predictive maintenance and data-driven care protocols, signals a departure from traditional transactional approaches.

Looking ahead, strategic imperatives will revolve around creating scalable, technology-driven platforms that seamlessly integrate hardware and software, as well as forging outcome-oriented partnerships with payers and healthcare institutions. In this dynamic environment, the organizations that can generate holistic value through innovation, operational dexterity, and stakeholder collaboration will chart the course for the future of powered mobility.

Partner with Associate Director of Sales & Marketing to Unlock Exclusive Insights and Drive Strategic Growth with Our Comprehensive Market Research Report

To delve deeper into unlocking strategic advantages within the powered mobility device arena and to secure your organization’s competitive positioning, connect with Ketan Rohom, Associate Director of Sales & Marketing. Leverage his expertise to gain tailored guidance and complementary insights that align closely with your unique operational needs. Engage in a consultative dialogue that illuminates the most pressing market dynamics, emerging growth vectors, and strategic imperatives distilled from the comprehensive report.

Your decision to invest in this analysis will empower cross-functional teams, from product development to go-to-market strategy, to translate data-driven findings into actionable initiatives. Reach out today and navigate the next phase of innovation and market expansion with a trusted thought partner committed to your success. Elevate your roadmap, anticipate competitor moves, and capitalize on untapped opportunities by obtaining the full report now.

- How big is the Group 2 Powered Mobility Devices Market?

- What is the Group 2 Powered Mobility Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?