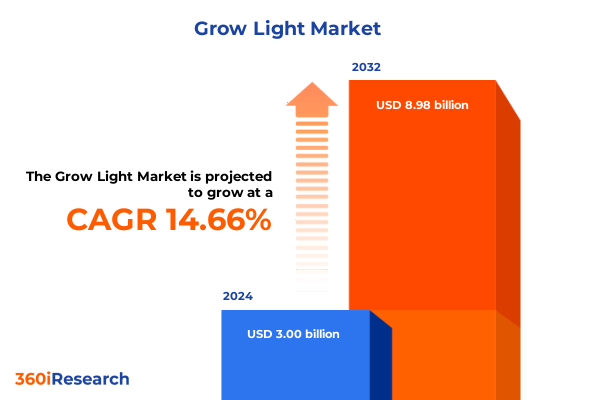

The Grow Light Market size was estimated at USD 3.44 billion in 2025 and expected to reach USD 3.93 billion in 2026, at a CAGR of 14.69% to reach USD 8.98 billion by 2032.

Unveiling the pivotal influence of advanced grow light technologies on controlled-environment agriculture and sustainable plant production strategies

Controlled-environment agriculture has undergone a profound transformation, driven by the emergence of specialized grow lights designed to optimize plant development. As a critical component of modern horticulture, advanced lighting systems have eclipsed traditional fluorescent and high-intensity discharge options by delivering tailored light spectra that enhance photosynthetic activity. Their superior energy efficiency not only reduces operational costs but also supports sustainability goals within greenhouse and indoor cultivation settings. By harnessing customizable light recipes, growers can precisely target growth stages from seedling to flowering, fostering uniform plant health and robust yields.

Moreover, the integration of digital controls and connectivity has elevated these systems from static fixtures to dynamic growth platforms. Internet-enabled sensors and automation algorithms now allow real-time adjustments of light intensity and spectral composition, adapting to changing environmental conditions and crop requirements. This convergence of horticultural science and smart technology empowers operators to refine cultivation protocols, minimize energy consumption, and accelerate return on investment across diverse production models.

Discover how energy-efficient designs, spectral customization, and smart integrations are redefining grow light solutions for modern agricultural applications

The landscape of grow light solutions has been reshaped by a decisive pivot toward energy-smart designs that outperform legacy systems in both efficiency and reliability. Whereas earlier fixtures, such as high-pressure sodium and fluorescent lamps, generated excess heat and consumed substantial power, modern LED assemblies deliver cooler operation with markedly lower electrical draw. This evolution enables growers to reduce cooling loads and extend lighting schedules without compromising crop integrity, laying the groundwork for more consistent yield outcomes and operational scalability.

Concurrently, innovations in spectral customization and control platforms have unlocked new possibilities for plant optimization. Adjustable multi-channel lighting architectures allow operators to dial in precise wavelengths relevant to chlorophyll absorption peaks, while hybrid approaches that blend natural sunlight with artificial illumination support seamless transitions across growth stages. These transformative shifts are further amplified by cloud-based management systems, which centralize data analytics and remote oversight, allowing horticulturalists to calibrate light regimens with unprecedented precision and agility.

Analyzing the multifaceted consequences of newly imposed United States import tariffs on grow light supply chains and cost structures in 2025

The introduction of new import duties on lighting components in early 2025 has exerted significant pressure across grow light supply chains. U.S. tariffs on key Chinese-manufactured LED modules, drivers, and aluminum housings now cascade through each stage of production, prompting manufacturers to absorb higher input costs or pass them along to end users. These measures have exacerbated lead-time volatility, as importers contend with additional customs clearances and compliance demands. In turn, many growers face delays in fixture deployment and must re-evaluate budget allocations for lighting upgrades.

Faced with this shifting trade environment, several industry leaders have responded by diversifying manufacturing footprints and optimizing supply networks. A notable example is Signify, which announced its ability to mitigate tariff impacts by leveraging assembly operations in regions outside China. By balancing component sourcing across multiple jurisdictions and adjusting pricing strategies, the company has maintained resilience in its North American business without significant disruption to product availability.

Interpreting essential segmentation findings across light source types, spectrum variations, power classes, applications, end users, and distribution pathways

An examination of market segmentation reveals that LED technology overwhelmingly outpaces traditional sources such as fluorescent and high-intensity discharge, driven by its substantial reductions in energy use and heat generation. Within LED offerings, distinctions among single-spectrum, full-spectrum, and adjustable spectrum designs further define solution fit-for-purpose, with many growers now favoring tunable fixtures that accommodate varying crop cycles. At the same time, wattage classifications ranging from compact under-300-watt units to robust systems exceeding 600 watts reflect a spectrum of cultivation scales, from hobbyist setups to large-scale commercial installations.

Application contexts further refine these insights, as greenhouse operations-whether in glass-paneled or polycarbonate structures-continue to dominate adoption, even as indoor cultivation and vertical farming environments claim escalating interest. End-user groups display nuanced preferences: commercial growers specializing in both cannabis and traditional horticulture invest heavily in high-performance fixtures, research institutions including private labs and universities prioritize precise spectral control, and residential enthusiasts opt for user-friendly kits. Distribution channels mirror this diversity, with online retail platforms offering extensive product ranges alongside specialty garden centers and hydroponic stores, while wholesale distributors and B2B e-commerce networks serve professional procurement needs.

This comprehensive research report categorizes the Grow Light market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Light Source Type

- Spectrum Type

- Wattage

- Application

- End User

- Distribution Channel

Examining crucial regional dynamics across the Americas, EMEA territories, and Asia-Pacific hubs shaping the global grow light environment

In the Americas, North American markets benefit from robust infrastructure development and targeted incentive programs that support energy-efficient agricultural investments. Federal and state grants aimed at sustainable food production foster rapid LED adoption, particularly within controlled-environment greenhouse projects. Moreover, the legalization of certain high-value crops has spurred specialized lighting solutions tailored to nuanced photobiological requirements, amplifying the role of strategic lighting in competitive cultivation operations. This regional momentum underscores the Americas’ position as a leading hub for grow light innovation.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing carbon reduction and circular economy principles drive demand for low-emission lighting platforms. European Union directives on energy performance and environmental impact have encouraged greenhouse operators to retrofit legacy systems with advanced LED fixtures, aligning cultivation practices with sustainability targets. Meanwhile, emerging markets in the Gulf and sub-Saharan regions are exploring vertical farming solutions that rely on modular lighting banks, establishing a growing foothold for specialized providers. In Asia-Pacific, a combination of government subsidies, technological partnerships, and high urban density has accelerated the uptake of smart lighting systems. Countries such as Japan, Australia, and India are integrating IoT-enabled grow lights into commercial farms and research facilities, forging a dynamic ecosystem for controlled-environment agriculture across the region.

This comprehensive research report examines key regions that drive the evolution of the Grow Light market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic initiatives and competitive positioning of leading companies driving innovation and expansion in the grow light arena

Leading enterprises in the grow light sector have adopted differentiated strategies to fortify their market positions. Signify, recognized for its global lighting expertise, has emphasized production flexibility to navigate tariff fluctuations while expanding its portfolio of spectrum-tunable fixtures. Simultaneously, companies such as Philips and Fluence have pursued collaborations with agricultural research institutions, validating their spectral recipes through empirical trials. This alignment of product development with scientific rigor enhances grower confidence and underscores a commitment to innovation.

Specialized manufacturers like Gavita and Heliospectra have differentiated through targeted offerings for vertical farming and high-intensity greenhouse applications, respectively. Gavita’s high-output fixtures cater to large canopies while minimizing footprint, and Heliospectra’s modular systems support adaptive spectrum control. Complementing these, firms such as Lumatek and California Lightworks have leveraged software integration to deliver user-centric control interfaces, enabling precise schedule programming and remote monitoring. Collectively, these competitive advances underscore a vibrant landscape of technology leadership and strategic focus among top-tier providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Grow Light market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerofarms

- Black Dog Horticulture Technologies & Consulting

- Bowery Farming, Inc.

- California Lightworks

- Emium Lighting, LLC

- Epistar Corporation

- Everlight Electronics Co., Ltd.

- FLEXSTAR INC.

- Fluortronix Innovations Pvt. Ltd

- Gavita International B.V.

- General Electric Company

- Heliospectra AB

- Iwasaki Electric Co. Ltd.

- Kessil

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Mars Hydro

- Nexsel Tech Pvt Ltd

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Savant Systems Inc.

- Scotts Miracle-Gro Company

- SHENZHEN TUBU TECH CO., LTD

- Thrive Agritech Inc.

- Valoya Ltd.

Proposing targeted strategic measures for industry leaders to strengthen resilience, drive innovation, and capitalize on emerging grow light opportunities

Industry leaders should actively pursue supply-chain diversification to reduce reliance on any single manufacturing hub and mitigate the impact of evolving trade policies. By establishing production and assembly partnerships in regions with favorable tariff treatments, companies can balance cost pressures while maintaining product quality. This approach not only enhances operational resilience but also fosters strategic agility in responding to future regulatory changes.

Investment in next-generation lighting research represents another critical imperative. Prioritizing developments in adjustable spectrum control and integrating AI-driven optimization algorithms can yield differentiated solutions that cater to specific crop profiles. Collaborative R&D partnerships with academic institutions and technology providers will accelerate innovation cycles, delivering fixtures that meet escalating grower demands for precision, energy conservation, and ease of integration. Finally, enterprises should engage proactively with incentive programs and sustainability initiatives to reinforce market credibility and unlock funding opportunities that offset deployment costs.

Outlining the comprehensive research methodology integrating primary insights, secondary sources, and analytical rigor for robust market understanding

This research relies on a dual-phase approach that synthesizes primary insights with rigorous secondary analysis. Initially, in-depth interviews were conducted with horticulture specialists, facility managers, and technical engineers to capture firsthand perspectives on operational challenges, technology preferences, and emerging requirements. These qualitative findings provided a foundation for identifying critical themes and validating hypothesis frameworks.

Subsequently, comprehensive secondary research was performed across industry reports, policy publications, and scholarly articles. Data triangulation ensured consistency and reliability, while cross-referencing multiple sources safeguarded accuracy. Analytical techniques such as thematic mapping and trend correlation were applied to distill actionable intelligence. Together, these methodological steps underpin a robust, evidence-based understanding of the grow light landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Grow Light market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Grow Light Market, by Light Source Type

- Grow Light Market, by Spectrum Type

- Grow Light Market, by Wattage

- Grow Light Market, by Application

- Grow Light Market, by End User

- Grow Light Market, by Distribution Channel

- Grow Light Market, by Region

- Grow Light Market, by Group

- Grow Light Market, by Country

- United States Grow Light Market

- China Grow Light Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding perspectives on the evolving grow light landscape and its implications for stakeholders across controlled-environment agriculture

The grow light industry stands at a crossroads defined by technological innovation, shifting regulatory landscapes, and evolving cultivation paradigms. As LED systems continue to displace conventional technologies, the focus on spectral control and energy management intensifies, presenting both opportunities and competitive challenges for providers and end users alike. Coupled with the complexities of international trade policies, stakeholders must navigate a nuanced environment where adaptability and foresight are paramount.

Looking ahead, the convergence of digital agriculture platforms and advanced lighting technologies promises to reshape controlled-environment cultivation. Companies that invest strategically in R&D, diversify their supply networks, and align with sustainability imperatives will be best positioned to lead the next wave of market expansion. Ultimately, a balanced blend of innovation, operational resilience, and customer-centric solutions will define success in an increasingly dynamic grow light ecosystem.

Engage with Associate Director Ketan Rohom for tailored insights and to secure your comprehensive market intelligence report on grow lights

To discover how these insights translate into actionable strategies tailored to your organization’s needs, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in controlled-environment agriculture and grow light market dynamics, ensuring you receive customized guidance and in-depth data analysis. Engage with him to secure your comprehensive market research report, unlock exclusive industry intelligence, and position your company at the forefront of grow light innovation. Take the next step toward strategic growth by contacting Ketan Rohom today and transform your understanding of the global grow light landscape

- How big is the Grow Light Market?

- What is the Grow Light Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?