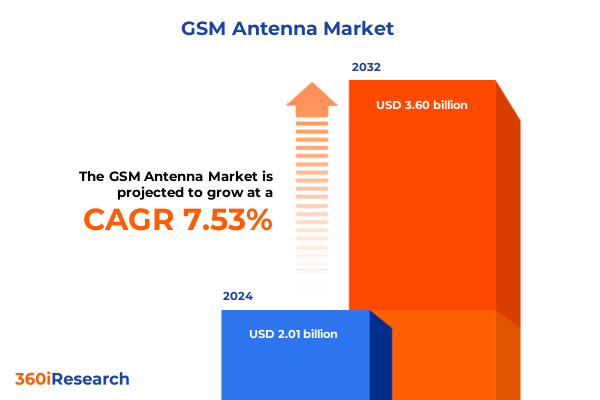

The GSM Antenna Market size was estimated at USD 2.14 billion in 2025 and expected to reach USD 2.28 billion in 2026, at a CAGR of 7.69% to reach USD 3.60 billion by 2032.

Introduction to Evolving Dynamics in the Global GSM Antenna Market Capturing Technological Progress and Emerging Communications Demands

The global GSM antenna industry stands at a pivotal juncture as rapid advancements in wireless communication technologies intersect with evolving connectivity demands. Over the past decade, the proliferation of smartphones, the Internet of Things, and the push for ubiquitous coverage have transformed the once-stable arena of GSM antennas into a dynamic environment characterized by constant innovation and strategic realignment. Manufacturers and operators alike are increasingly focusing on delivering solutions that balance high performance with scalability and cost efficiency. Against this backdrop, an in-depth understanding of evolving market drivers, technological breakthroughs, and shifting stakeholder priorities has never been more critical.

In this report, readers will discover a comprehensive overview of the forces shaping current market trajectories, ranging from technological innovation cycles to policy and regulatory developments. This introduction outlines the fundamental context for subsequent analysis, charting the evolution of GSM antenna solutions from early cellular networks to today’s sophisticated architectures that support seamless connectivity across diverse applications. By laying out the key dynamics at play, this section prepares decision-makers to navigate the challenges and opportunities that lie ahead.

Revolutionary Technological Breakthroughs and Competitive Disruptions Reshaping GSM Antenna Innovation Strategies Across Industry Stakeholders

The GSM antenna landscape has undergone transformative shifts fueled by breakthroughs in materials science, signal processing, and network architecture. These advances have enabled the emergence of software-driven antenna arrays and adaptive beamforming techniques that optimize signal quality in real time. As multi-element antenna systems become increasingly common, providers are leveraging artificial intelligence and machine learning algorithms to dynamically reconfigure radiation patterns, thereby enhancing coverage and reducing interference in densely populated areas.

Simultaneously, the integration of massive MIMO architectures with existing GSM infrastructure has extended the capacity and reliability of legacy networks. By retrofitting traditional antenna towers with modular MIMO panels, operators can achieve significant throughput gains without the need for complete site overhauls. Furthermore, the shift toward open radio access networks has promoted vendor diversity, lowering barriers to entry for specialized antenna designers and fostering collaborative innovation across the ecosystem.

In parallel, sustainability considerations are reshaping product roadmaps, with a growing emphasis on energy-efficient designs and the use of recyclable composite materials. Manufacturers are introducing antennas with optimized power consumption profiles that align with broader industry commitments to reduce carbon footprints. As a result, the GSM antenna market is witnessing a convergence of performance imperatives and environmental stewardship, driving new business models centered on lifecycle management and circular economy principles.

Assessing the Far Reaching Consequences of United States Tariff Policies in 2025 on GSM Antenna Supply Chains and Cost Structures Worldwide

In March 2025, the United States enacted a new tranche of tariffs targeting imported steel and aluminum components crucial to antenna fabrication. These measures have exerted upward pressure on raw material costs and forced many assembly operations to reassess their upstream dependencies. As a consequence, manufacturers faced with higher input costs have explored alternative sourcing strategies, including reallocating orders to non-U.S. jurisdictions and negotiating longer-term contracts with domestic suppliers to achieve price stability.

Meanwhile, the ripple effects of these tariffs have highlighted the vulnerability of just-in-time production models in the antenna sector. Lead times for critical structural elements, such as precision-formed radomes and metallic support brackets, have extended beyond typical planning horizons. Providers have responded by redesigning component inventories, establishing buffer stocks, and prioritizing vertical integration for key fabrication steps. At the same time, some stakeholders have accelerated research into advanced polymeric composites to reduce reliance on tariff-impacted metals.

Despite these pressures, the reshaping of cost structures has also catalyzed innovation. Several antenna suppliers have leveraged the impetus for change to drive R&D investments in lightweight materials and additive manufacturing techniques. Consequently, the industry is charting a path toward more agile supply chains and flexible production platforms. Going forward, resilience and adaptability will remain central themes as organizations navigate the ongoing impact of U.S. trade policy adjustments.

Uncovering Critical Insights from Antenna Type Cell Size End User and Installation Dimensions Driving Market Differentiation and Product Development

Insights derived from antenna type segmentation reveal pronounced differentiation in performance and application suitability. Directional antennas, which encompass both dish and Yagi variants, continue to deliver high-gain coverage for point-to-point links in rural and remote deployments. Conversely, omnidirectional antennas, available in broadband and narrowband iterations, have become essential for providing uniform signal distribution in urban microcell and femtocell configurations. Panel antennas, leveraging multiband and sector panel designs, are increasingly preferred for macrocell sites, where spatial diversity and frequency agility drive network densification efforts.

Analysis across cell size segments underscores distinct adoption patterns. Femtocell solutions are gaining traction in enterprise and residential environments, addressing localized capacity demands with compact, plug-and-play form factors. Macrocell antennas remain the backbone of wide-area networks, benefitting from robust design standards and reliability metrics that support extensive carrier deployments. Microcell implementations facilitate targeted capacity enhancements in urban hotspots, while picocell configurations serve specialized indoor venues, such as shopping malls and transportation hubs, where precise coverage control is paramount.

End user segmentation provides further clarity on demand drivers and solution customization. Enterprise customers are seeking integrated antenna systems that support private LTE and emerging fixed wireless access applications, whereas government entities prioritize hardened designs compliant with stringent security and environmental regulations. Telecom operators continue to invest in scalable antenna portfolios that align with multi-technology roadmaps, and utilities markets are leveraging antennas for critical infrastructure monitoring and smart grid connectivity.

Installation-based segmentation highlights the distinct requirements of indoor and outdoor deployments. Indoor applications, which include distributed antenna systems and inbuilding solutions, focus on seamless signal integration within complex structures. Outdoor installations emphasize environmental resilience and mechanical robustness, driving innovations in radome coatings and mounting hardware optimized for extreme weather and long service life.

This comprehensive research report categorizes the GSM Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Antenna Type

- Cell Size

- Installation

- End User

Deep Dive into Regional Variances in GSM Antenna Demand Patterns and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

The Americas region exhibits a mature GSM antenna ecosystem characterized by extensive infrastructure rollouts and a strong retrofit market for legacy network enhancements. In North America, service providers are completing transitions to digital beamforming systems while maintaining backward compatibility with existing GSM networks. Latin America presents growth opportunities driven by rural connectivity projects and government initiatives to bridge the digital divide, prompting investment in low-cost omnidirectional and panel antenna solutions.

In Europe, the Middle East, and Africa, diverse deployment scenarios underscore the need for adaptable antenna portfolios. Western European markets emphasize sustainability and spectral efficiency, leading to widespread deployment of multi-element antenna arrays and recyclable composite radomes. In the Middle East, rapid urbanization drives demand for high-density microcell and picocell installations, while Africa benefits from international development programs that fund low-power omnidirectional antennas tailored for rural village networks.

Asia-Pacific demonstrates the most dynamic expansion, fueled by aggressive 5G rollouts and the densification of urban corridors. Major metropolitan centers in East Asia are adopting integrated macrocell and small cell antennas with software-defined capabilities to manage traffic surges. Southeast Asian economies are prioritizing cost-effective panel and omnidirectional antennas for public Wi-Fi and smart city applications, reflecting a commitment to digital infrastructure development. Across the region, local manufacturing initiatives and government incentives are further accelerating antenna production volumes and technology transfer.

This comprehensive research report examines key regions that drive the evolution of the GSM Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Market Leading and Emerging Players Shaping Innovation Partnerships and Competitive Dynamics in the GSM Antenna Industry

Leading companies in the GSM antenna space are differentiating through targeted R&D, strategic partnerships, and acquisitions. Several established players have reinforced their market positions by expanding manufacturing footprints and investing in next-generation materials that improve antenna efficiency and reduce weight. Collaborative ventures between antenna specialists and chipset providers have enabled integrated radio units with optimized performance contours, facilitating faster time to market for turnkey solutions.

Emerging entrants are disrupting traditional value chains with vertical integration strategies that encompass design, tooling, and assembly under a single roof. These agile manufacturers are capitalizing on digital design tools and advanced manufacturing methods to deliver customized antennas with shorter lead times. Partnerships between component fabricators and systems integrators are fostering co-development of modular antenna platforms that support rapid frequency reconfiguration, catering to operators seeking multi-band compatibility.

Competitive dynamics are further influenced by investor-backed start-ups focusing on novel antenna form factors, such as conformal and wearable designs, which address specialized use cases in industrial automation and defense sectors. While these niche players command smaller production volumes, their innovations often drive mainstream adoption through licensing agreements and joint ventures. Consequently, the industry is witnessing an increasingly layered competitive landscape where incumbent scale meets start-up agility in pursuit of technological leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the GSM Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced RF Technologies, Inc.

- Airspan Networks Inc.

- Anderson Antenna Solution

- Anokiwave, Inc.

- Antcom Corporation

- Bird Technologies

- Boldyn Networks Global Limited

- C&T RF Antennas Inc.

- Cobham Satcom

- Comba Telecom

- CommScope, Inc.

- Communication Components Inc.

- Eteily Technologies India Private Limited

- Evercom Communication Technology Co., Ltd.

- Gleam Light India

- Huawei Technologies Co., Ltd.

- KATHREIN-Werke

- Kinsun Industries Inc.

- Laird Connectivity

- Metabee (Chengdu) Technology Co., Ltd.

- Mobile Mark, Inc.

- Movandi Corporation

- Siretta Ltd.

- Telefonaktiebolaget LM Ericsson

- Wellshow Technology

Implementing Forward Looking Strategies for Infrastructure Optimization Cost Efficiency and Collaborative Innovation to Enhance GSM Antenna Market Positioning

Industry leaders should prioritize investments in modular, software-enabled antenna architectures that can adapt to evolving network protocols and spectrum allocations. By integrating digital control elements at the hardware level, companies will achieve greater flexibility in beam steering and frequency switching without extensive hardware replacement. In addition, establishing design for manufacturability processes will drive cost efficiencies, enabling scalable production runs that meet diverse deployment scales from femtocell units to large-scale macrocell arrays.

Cost optimization strategies should extend beyond component sourcing to encompass automation in assembly and testing workflows. Deploying robotic calibration rigs and automated quality assurance systems can significantly reduce time to market while maintaining stringent reliability standards. Simultaneously, forging collaborative partnerships with telecom operators and infrastructure providers can secure long-term engagement models, ensuring that antenna roadmaps align with carrier network upgrade cycles and service level agreements.

Supply chain resilience remains critical. Leaders are advised to diversify material suppliers across multiple geographies and invest in alternative composite research to mitigate exposure to tariff fluctuations. Moreover, adopting a lifecycle services mindset-offering maintenance, performance monitoring, and upgrade pathways-can generate recurring revenue streams and deepen customer relationships. By implementing these forward-looking strategies, organizations will position themselves to capture emerging opportunities in both mature and developing network environments.

Comprehensive Research Framework Outlining Systematic Data Collection Analytical Techniques and Validation Processes Underpinning the GSM Antenna Market Study

This study employed a multi-faceted research framework combining primary and secondary data sources to ensure rigorous analysis. Initially, extensive secondary research was conducted utilizing industry publications, technical whitepapers, regulatory filings, and patent databases to map the historical evolution and current state of antenna technologies. This desk-based effort laid the groundwork for identifying key technological inflection points and market drivers.

Subsequently, a series of in-depth interviews and surveys were carried out with antenna manufacturers, telecom operators, system integrators, and regulatory experts to gather market intelligence on strategic priorities, product roadmaps, and deployment challenges. These insights were then triangulated against quantitative inputs derived from trade data and public procurement records.

Analytical techniques, including SWOT analysis to assess strengths, weaknesses, opportunities, and threats, as well as PESTLE analysis to evaluate political, economic, social, technological, legal, and environmental factors, provided a structured evaluation of external influences. Porter’s Five Forces framework further elucidated industry competitiveness and supplier dynamics. Finally, validation workshops with subject matter experts ensured that findings accurately reflected current market realities and stakeholder perspectives, culminating in a robust, defensible research outcome.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our GSM Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- GSM Antenna Market, by Antenna Type

- GSM Antenna Market, by Cell Size

- GSM Antenna Market, by Installation

- GSM Antenna Market, by End User

- GSM Antenna Market, by Region

- GSM Antenna Market, by Group

- GSM Antenna Market, by Country

- United States GSM Antenna Market

- China GSM Antenna Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Industry Implications and Strategic Opportunities Highlighting the Evolutionary Trajectory of the Global GSM Antenna Landscape

This analysis synthesizes the convergence of technological innovation, regulatory shifts, and supply chain realignment that define the contemporary GSM antenna landscape. Key advancements in adaptive beamforming, modular MIMO integration, and sustainable materials have collectively expanded the functional capabilities of antenna solutions, enabling operators to meet escalating connectivity demands across both urban and rural deployments. Concurrently, the imposition of U.S. tariffs in 2025 has underscored the strategic importance of supply chain diversification and cost management, prompting manufacturers to explore alternative materials and production geographies.

Segment-specific insights reveal nuanced demand profiles across antenna types, cell sizes, end users, and installation environments, highlighting the critical need for tailored product roadmaps. Regional analyses further emphasize the variability of market drivers from mature North American refurbishments to dynamic Asia-Pacific rollouts, with Europe, the Middle East, and Africa exhibiting distinct investment trajectories tied to sustainability priorities and infrastructure funding models.

Competitive dynamics remain in flux as established incumbents bolster R&D capabilities and emerging players introduce disruptive form factors. The interplay between scale and agility suggests that collaboration and co-development will be central to future market leadership. Collectively, these findings provide a comprehensive understanding of current trends and strategic imperatives, equipping stakeholders with the insights necessary to chart a clear path forward in an increasingly complex ecosystem.

Engage with Associate Director of Sales and Marketing to Secure Exclusive Access to the Definitive GSM Antenna Market Research Report

Engaging with the Associate Director of Sales and Marketing provides an unparalleled opportunity to gain immediate access to the comprehensive GSM antenna market research report. This definitive report offers deep industry insights, robust analysis, and strategic perspectives designed to inform critical decisions across product development, investment planning, and partnership strategies. By connecting with Ketan Rohom, readers can explore tailored solutions, receive personalized briefings, and secure licensing arrangements aligned with organizational goals. The report’s structured findings and actionable recommendations will empower stakeholders to navigate market complexities, capitalize on emerging trends, and mitigate potential risks effectively. Reach out today to initiate a consultative dialogue and obtain exclusive authorization for the report. This engagement will ensure your organization stays ahead of competitive dynamics and technology shifts by leveraging the most up-to-date intelligence in the GSM antenna sector.

- How big is the GSM Antenna Market?

- What is the GSM Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?