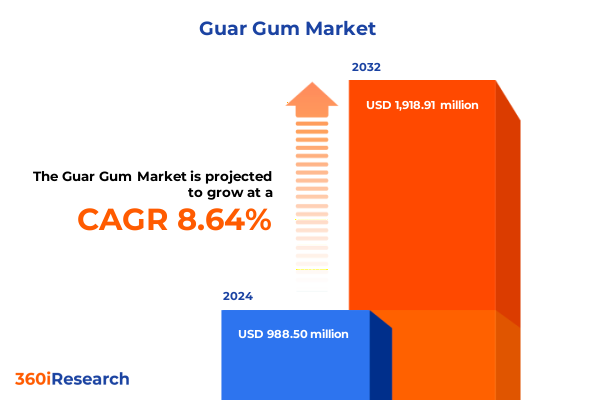

The Guar Gum Market size was estimated at USD 1.06 billion in 2025 and expected to reach USD 1.15 billion in 2026, at a CAGR of 8.76% to reach USD 1.91 billion by 2032.

Unveiling Guar Gum’s Role as a Versatile Hydrocolloid Revolutionizing Food, Pharmaceutical, Oil & Gas, and Emerging Industrial Applications in 2025

Guar gum, scientifically known as a galactomannan polysaccharide, is derived from the endosperm of the guar bean (Cyamopsis tetragonoloba). This naturally sourced hydrocolloid is mechanically dehusked, hydrated, milled, and screened to produce an off-white, free-flowing powder prized for its exceptional thickening and stabilizing properties. Due to its molecular structure, guar gum swells considerably in water at room temperature, imparting high viscosity at low concentrations and offering versatility across a broad range of applications.

Historically, guar cultivation dates back centuries in South Asia, with modern production concentrated primarily in India and Pakistan, which collectively account for approximately 80% of global output. Secondary production regions include the United States, Australia, and various African countries, though their volumes remain modest relative to the subcontinent’s dominant share. Over the last decade, fluctuations in weather patterns, particularly monsoonal variability in India, have underscored the vulnerability of supply, leading to periodic price spikes and heightened interest in supply chain resilience.

As a renewable, plant-based ingredient, guar gum has garnered increased attention among formulators seeking clean-label, gluten-free, and plant-based solutions. Its capacity to outperform traditional starches in thickening efficiency-often requiring one-eighth the amount by weight-translates into cost-effective formulations that meet evolving consumer demands for natural texturizing agents. Consequently, guar gum’s foundational role positions it as a strategic raw material in the pursuit of both product innovation and operational efficiency.

Charting the Transformative Shifts Reshaping the Guar Gum Landscape from Sustainability Demands to Technological Innovations and Supply Chain Dynamics

The guar gum landscape is undergoing a series of transformative shifts driven by the convergence of sustainability mandates, technological advancements, and evolving supply chain paradigms. First, the surge in consumer demand for plant-based and clean-label ingredients has elevated guar gum’s status as a preferred alternative to synthetic thickeners. Companies are expanding sourcing partnerships with sustainable growers in India, implementing traceability programs to secure consistent quality, and investing in regenerative agriculture practices. This emphasis on eco-friendly production has become a cornerstone for differentiating offering portfolios amidst intensifying competitive pressures.

Simultaneously, the industry is witnessing accelerated innovation in functional derivatives and cross-linked formulations tailored to high-performance sectors. Advances in enzymatic modification and micro-encapsulation have unlocked new rheological profiles, enabling guar-based viscosifiers that withstand elevated temperatures, extreme pH conditions, and prolonged shear. These cutting-edge developments are particularly critical in hydraulic fracturing and specialty polymer applications, where standard grades must be fortified to meet stringent operational benchmarks.

In parallel, heightened supply chain digitalization and data analytics are reshaping procurement strategies and risk management. Real-time monitoring of weather patterns, logistics bottlenecks, and inventory levels empowers stakeholders to anticipate disruptions and optimize sourcing decisions. Major ingredient providers are forging strategic alliances and pursuing acquisitions to bolster vertical integration. Notably, recent deals such as Cargill’s acquisition of TIC Gums and Ingredion’s strategic expansion reflect an industry-wide commitment to enhancing scale, broadening customer reach, and securing downstream capabilities.

Taken together, these converging forces are charting a new course for the guar gum sector, one defined by robust innovation pipelines, collaborative value chains, and a proactive stance toward sustainability and resiliency.

Assessing the Cumulative Impact of the 2025 United States Tariffs on Guar Gum Imports and Their Consequences for Supply Chains and Prices

The introduction of new United States tariffs in 2025 on select imported hydrocolloids, including guar gum, has exerted a cumulative impact on supply chains, cost structures, and downstream industries. Early in the second quarter, the U.S. government imposed duties on over $38 billion of agricultural and specialty ingredients, encompassing key hydrocolloids. These measures, ranging between 10% and 25% depending on origin, have translated directly into higher landed costs for formulators across food & beverage, pharmaceutical, and personal care segments.

Immediately following tariff implementation, importers reported a contraction in available inventories and an uptick in order lead times. Many U.S. buyers faced dilemmas over whether to absorb additional costs or pass them along through price increases, with evidence indicating a partial transfer to end-users. Food processors in particular have experienced squeeze on margins as synergistic inflationary pressures rippled through labor, packaging, and logistics. At the same time, reduced import volumes have compelled some formulators to explore alternative hydrocolloids or source from untariffed markets, often at the expense of performance or consistent supply.

Beyond immediate cost inflation, the tariffs have introduced broader strategic concerns. As domestic production of guar gum in the U.S. represents a marginal share of global output, the ability to cultivate resilient supplier networks is constrained. The ensuing scarcity risk has prompted leading manufacturers to negotiate long-term contracts with Indian producers, implement price-hedging strategies, and evaluate partial onshore processing to mitigate future trade policy volatility. These tactical shifts underscore the imperative for integrated risk management frameworks that account for geopolitical uncertainties and regulatory fluctuations.

Detailed Segmentation Insights Revealing How Grade, Product Type, Form, End Use Industries, and Distribution Channels Drive Guar Gum Market Dynamics

Insight into the guar gum market’s segmentation reveals nuanced drivers that inform product development and distribution strategies. When evaluated by grade, the bifurcation between food grade and industrial grade underscores distinct use cases: food grade dominates applications requiring stringent purity and regulatory compliance, while industrial grade addresses performance criteria for oilfield and textile processing environments.

Examining product type, the market divides into refined and unrefined guar gum. Refined guar gum, subjected to additional purification steps, finds preference in applications demanding clarity and minimal color impact, such as high-end cosmetics and food formulations. Unrefined guar gum retains natural constituents and is leveraged where cost efficiency and functional viscosity take precedence, notably in drilling fluids and sizing agents.

The form factor also shapes market dynamics, with granules offering measured dosing and ease of handling in industrial contexts, whereas powder variants provide rapid hydration and consistent dispersion critical to high-precision food and pharmaceutical processes. Each form influences equipment requirements, mixing protocols, and final product attributes.

End use industry segmentation further refines opportunity landscapes. In cosmetics and personal care, guar gum’s efficacy in hair care, personal hygiene, and skin care formulations drives research into novel gel networks. Within food and beverage, applications span bakery, beverages, confectionery, dairy & frozen, and soups & sauces, with formulators exploiting guar’s synergistic interactions with proteins and starches to enhance texture and shelf life. The oil & gas sector relies on guar gum in drilling fluids and enhanced oil recovery, while pharmaceuticals utilize it across suspensions & emulsions and tablets & capsules. Textile applications focus on fabric processing and sizing agents, where viscosity control influences printing resolution and fabric strength.

Finally, distribution channel segmentation between direct sales and distributors reflects strategic priorities: direct sales facilitate bespoke solutions and volume contracts, whereas distributor networks enable market reach and logistical flexibility.

This comprehensive research report categorizes the Guar Gum market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Grade

- Form

- End Use Industry

- Distribution Channel

Key Regional Insights Highlighting Guar Gum Market Drivers, Consumption Patterns, and Growth Opportunities Across the Americas, EMEA, and Asia-Pacific

The Americas region is characterized by robust end-use demand in food, beverage, and oil & gas applications, with the United States leading consumption. Despite limited domestic cultivation-averaging 4,600 to 14,000 tonnes annually-U.S. formulators rely heavily on imports, primarily from India, to meet industrial and food grade requirements. In particular, shale oil and gas operations in the Permian Basin and Appalachia drive intensive demand for high-performance grades of guar gum in hydraulic fracturing, accounting for nearly ninety percent of oilfield usage worldwide.

Europe, Middle East & Africa exhibits a diverse market landscape driven by stringent food additive regulations and burgeoning petrochemical developments. In the European Union, guar gum, labeled as E412, is a staple in gluten-free and clean-label product portfolios, with adoption fueled by consumer preferences for natural ingredients. Middle Eastern markets, notably the UAE and Saudi Arabia, have seen guar gum consumption surge, with over 12,000 metric tons deployed in upstream petroleum projects for drilling and enhanced oil recovery in 2023. African markets remain nascent but are gaining traction through investments in food processing and personal care sectors.

Asia-Pacific continues to dominate production and export activity, with India supplying over eighty percent of global guar gum output. The region’s expansive cultivation areas in Rajasthan and Gujarat benefit from evolving agronomic practices and favorable monsoon cycles. Concurrently, rising demand in China, Japan, and South Korea for cosmetic formulations and pharmaceutical excipients is driving incremental value in refined and specialty guar derivatives. Australia and Southeast Asian markets are also contributing to regional growth through food ingredient innovations and emerging shale gas exploration initiatives.

This comprehensive research report examines key regions that drive the evolution of the Guar Gum market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Strategies and Competitive Positioning Shaping the Global Guar Gum Industry Through Innovation, Integration, and Market Expansion

Global guar gum supply remains anchored by Indian producers leveraging vertical integration from farm to export terminals. Leading domestic players-Hindustan Gums & Chemicals Ltd., India Glycols Ltd., Dabur India Ltd., and Lucid Colloids Ltd.-command significant processing capacity and maintain expansive distribution networks across North America, Europe, and Asia-Pacific. These entities continue to invest in infrastructure upgrades and quality control systems to sustain leadership in both food grade and industrial grade segments.

Complementing this, specialist ingredient providers such as Cargill Corporation and Ingredion Incorporated have expanded their guar portfolios through strategic acquisitions. Cargill’s procurement of TIC Gums has fortified its texture systems capabilities, while Ingredion’s integration of Western Polymer has broadened its access to specialty guar derivatives tailored for personal care and pharmaceutical applications. These moves underscore a broader trend of convergence between raw material producers and global ingredient suppliers, driving innovation and full-chain offerings.

Other prominent companies-including Vikas WSP Ltd., Rama Industries, and Altrafine Gums-distinguish themselves through proprietary R&D in hydration kinetics and gelling characteristics. Partnerships with oilfield service giants such as Halliburton and Schlumberger illustrate the strategic importance of high-brew hydrophobic grade formulations for enhanced oil recovery. Meanwhile, emerging entrants from Pakistan and Africa are leveraging niche product lines and competitive pricing to capture regional market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Guar Gum market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agro Gums Ltd.

- Altrafine Gums Pvt. Ltd.

- Amba Gums & Feeds Products Pvt. Ltd.

- Cargill, Incorporated

- Guangrao Liuhe Chemical Co., Ltd.

- Hindustan Gum & Chemicals Ltd.

- India Glycols Limited

- Ingredion Incorporated

- Jai Bharat Gum & Chemicals Ltd.

- K C India Ltd.

- Lotus Gums & Chemicals Pvt. Ltd.

- Neelkanth Polymers Ltd.

- Penford Corporation

- Polygal AG

- Rama Gum Industries Ltd.

- Shandong Dongda Commerce Co., Ltd.

- Shree Ram Industries

- Sunita Hydrocolloids Pvt. Ltd.

- Supreme Gums Pvt. Ltd.

- The Lucid Group Ltd.

- TIC Gums, Inc.

- Vasundhara Gums & Chemicals Ltd.

- Vikas WSP Limited

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Supply Volatility, Enhance Value Chains, and Drive Sustainable Growth

To navigate the complexities of a market buffeted by tariff shifts, supply chain uncertainties, and evolving end-use demands, industry leaders should implement a multifaceted strategy. Prioritize supplier diversification by establishing long-term contracts with multiple high-quality guar growers in India and emerging cultivation zones in Africa. This approach mitigates weather-related yield risks and enhances negotiating leverage on pricing and delivery schedules.

Invest in application-driven R&D to amplify product differentiation. Focus on developing cross-linked guar derivatives and synergistic blends with other hydrocolloids to meet specialized viscosity requirements in fracking, high-protein dairy formulations, and advanced pharmaceutical excipients. Leveraging targeted innovation can secure premium positioning and insulating brand equity against commodity-grade volatility.

Strengthen supply chain transparency through digital traceability platforms that monitor growth conditions, processing parameters, and logistics in real time. Integrate blockchain or distributed ledger technologies to assure customers of consistent quality and sustainable sourcing credentials, aligning with clean-label and ESG commitments.

Finally, explore nearshore or localized processing facilities in key consuming regions to reduce freight costs, shorten lead times, and provide tailored technical support. Collaborative ventures or joint ventures with regional distributors can accelerate market entry while balancing capital expenditures and operational complexity.

Robust Research Methodology Underpinning the Comprehensive Analysis of the Guar Gum Market Through Integrated Primary and Secondary Data Sources

The research underpinning this analysis integrated both primary and secondary methodologies to ensure a holistic perspective on the global guar gum market. Secondary research entailed a comprehensive review of peer-reviewed journals, industry news outlets, regulatory filings, and company annual reports. Government databases and trade statistics provided quantitative insights into production volumes, import-export flows, and pricing trends.

Primary research comprised structured interviews and surveys with key stakeholders, including growers in India’s Rajasthan and Gujarat regions, procurement managers at major ingredient suppliers, and formulation scientists within leading food and oilfield companies. These dialogues yielded qualitative insights into evolving purchasing criteria, quality benchmarks, and the strategic rationale behind supply chain adjustments.

Quantitative data points were subjected to triangulation through cross-referencing multiple sources to validate consistency. Statistical techniques, such as scenario modeling and sensitivity analysis, were applied to assess the impacts of tariff variations and supply disruptions on cost structures and lead times. Additionally, thematic analysis of interview transcripts illuminated emerging trends in sustainability and innovation, informing the actionable recommendations.

This mixed-methods approach enabled the development of robust insights that balance empirical data with expert perspectives, ensuring the report’s relevance to decision-makers across the guar gum value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Guar Gum market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Guar Gum Market, by Product Type

- Guar Gum Market, by Grade

- Guar Gum Market, by Form

- Guar Gum Market, by End Use Industry

- Guar Gum Market, by Distribution Channel

- Guar Gum Market, by Region

- Guar Gum Market, by Group

- Guar Gum Market, by Country

- United States Guar Gum Market

- China Guar Gum Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives Emphasizing Critical Challenges and Opportunities Shaping the Future Trajectory of the Global Guar Gum Market

As we conclude the executive summary, it is evident that guar gum maintains its position as an indispensable hydrocolloid across multiple industries. The interplay of sustainability pressures, technological advancements in functional derivatives, and evolving supply chain practices defines the current market dynamic. Meanwhile, the introduction of 2025 U.S. tariffs has accentuated the necessity for strategic supplier diversification and risk mitigation frameworks.

Key segmentation insights illuminate the differentiated value propositions across grades, product types, forms, and end-use applications, empowering stakeholders to align portfolio strategies with specific market requirements. Regional analysis underscores the Americas’ reliance on imports for both food and infrastructure sectors, EMEA’s regulatory and petrochemical drivers, and the Asia-Pacific’s production dominance and emergent demand for refined derivatives.

In this context, leading companies are leveraging acquisitions, R&D investments, and integrated supply chain models to capture growth opportunities and defend against volatility. To thrive amid these developments, formulators and producers must adopt proactive strategies in innovation, logistics optimization, and digital traceability.

Collectively, these insights coalesce into a clear mandate: stakeholders who anticipate market shifts, reinforce operational resilience, and invest in sustainable differentiation will secure a competitive edge in the evolving guar gum landscape.

Secure Your Comprehensive Guar Gum Market Research Report Today by Connecting with Ketan Rohom to Unlock In-Depth Analysis and Strategic Insights

To explore the full breadth of our in-depth analysis on the global guar gum market and gain actionable intelligence tailored to your strategic objectives, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan Rohom can guide you through the report’s detailed findings, discuss customized data requirements, and facilitate immediate delivery of the comprehensive market research report. Engage with an industry expert today to secure competitive advantages, anticipate market shifts, and drive informed decision-making across your organization.

- How big is the Guar Gum Market?

- What is the Guar Gum Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?