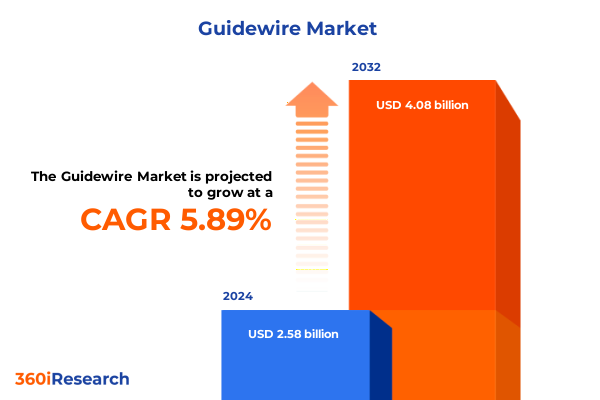

The Guidewire Market size was estimated at USD 2.72 billion in 2025 and expected to reach USD 2.86 billion in 2026, at a CAGR of 5.96% to reach USD 4.08 billion by 2032.

Building a Compelling Foundation for Understanding the Guidewire Market’s Strategic Landscape and Core Opportunities in Modern Interventions

The guidewire market represents a critical enabler for a broad array of minimally invasive procedures, forming the foundational element that ensures precision, control, and safety during device navigation within the human body. As the healthcare industry embraces less invasive techniques, the demand for guidewires with advanced material properties and enhanced handling characteristics has surged. Technological advances have empowered manufacturers to explore novel alloys and coatings, resulting in thinner, more flexible, and more durable products that cater to the intricate needs of various clinical specialties. These innovations not only facilitate complex interventions but also support improved patient outcomes by reducing procedure time, minimizing vascular trauma, and enhancing operator confidence.

Moreover, stakeholders across the value chain-from raw material suppliers to medical device companies and end users-have recognized the need for continuous collaboration to drive research and development. This cooperative ecosystem has fostered the sharing of clinical feedback, regulatory insights, and supply chain optimizations that collectively accelerate the pace of product evolution. In turn, this active engagement has set the stage for a dynamic market landscape where agility, innovation, and robust quality management serve as key differentiators. With these factors in mind, this executive summary provides a strategic lens into the foundational forces shaping the guidewire sector and highlights the core opportunities for decision-makers seeking to navigate and capitalize on emerging trends.

Examining the Intersection of Advanced Materials, Sensor Integration, and Regulatory Evolution Shaping the Guidewire Market

Over the past decade, the guidewire market has undergone transformative shifts driven by the convergence of advanced materials science and digital integration. Manufacturers have leveraged nitinol’s shape memory and superelastic characteristics to deliver guidewires that adeptly traverse tortuous anatomies. Simultaneously, hybrid material constructions have emerged, combining polymers and metal alloys to balance hydrophilicity with radiopacity. This material innovation has been complemented by the adoption of sensor-enabled guidewires, which integrate pressure and flow sensors for real-time physiological data capture. These next-generation devices elevate procedural precision and open avenues for remote monitoring and teleoperated interventions.

Equally important, regulatory agencies have streamlined approval pathways for incremental device enhancements, recognizing the value of iterative innovation in improving patient care. This favorable environment has encouraged smaller players to enter the market with niche offerings that address specific clinical challenges in cardiology, gastroenterology, and other specialties. Furthermore, strategic partnerships between device manufacturers and digital health firms have accelerated the co-development of software-driven solutions, ensuring that guidewire performance aligns with growing demands for data analytics and procedural automation. Together, these cross-industry collaborations and regulatory adaptations have redefined how clinical teams approach minimally invasive therapies, making interventions safer, more efficient, and increasingly personalized.

Unpacking the Cumulative Effects of 2025 U.S. Tariff Policies on Cost Structures and Supply Chain Strategies for Guidewire Manufacturers

The imposition of cumulative United States tariffs on key metals and components in 2025 has imposed pronounced cost pressures across the guidewire supply chain. Steel and nickel-based alloys, essential for stainless steel and nitinol guidewire manufacturing, have experienced duty escalations that translated into elevated raw material expenses. As a result, manufacturers faced the necessity of reassessing sourcing strategies and weighed the viability of alternative suppliers in regions not subject to these tariffs. In response, several firms accelerated negotiations with non-U.S. material providers while simultaneously optimizing alloy compositions to mitigate dependency on heavily taxed inputs.

At the same time, heightened import costs prompted device companies to revisit production footprints, with some increasing localized manufacturing capabilities within tariff-exempt regions. This strategic shift not only buffered against tariff volatility but also shortened lead times and improved supply chain resilience. Meanwhile, research and development budgets were realigned to prioritize cost-effective innovations, such as exploring high-performance polymers and composite materials that deliver comparable strength and flexibility without incurring steep import fees. Consequently, despite initial disruptions, the guidewire industry has demonstrated adaptability, leveraging diversified sourcing and material innovation to maintain product continuity and preserve margin stability in a complex trade environment.

Highlighting the Diverse Segmentation Landscape from Material Innovation to End-User Dynamics in the Guidewire Industry

Material selection remains a pivotal axis of differentiation within the guidewire market, where hybrid constructions strike a balance between polymer flexibility and metal strength, nitinol options offer superelasticity for tortuous vascular pathways, and stainless steel variants deliver robust torque control for more straightforward anatomy. Type distinctions underscore diagnostic guidewires optimized for sensitive imaging procedures and surgical guidewires engineered for enhanced pushability during therapeutic interventions. Application segmentation further refines market dynamics by focusing on cardiology’s demand for coronary intervention tools, the nuanced requirements of gastroenterological endoscopy, the precision-driven needs in neurology, oncology’s need for tumor access sheaths, otolaryngology’s delicate sinus and airway frameworks, urology’s urinary tract navigation, and vascular specialties where peripheral vessel access demands both flexibility and stability.

End-user categories accentuate the distinction between healthcare providers and third-party administrators, with hospitals, clinics, and ambulatory service centers each exhibiting unique purchasing patterns based on procedural volumes, budget constraints, and inventory management models. Hospitals often prioritize a broad portfolio to support diverse surgical suites, while clinics and ambulatory centers focus on cost-effective, high-throughput solutions. Third-party administrators, on the other hand, drive demand through value-based procurement practices that emphasize outcome-based pricing and standardized device preferences across their networks. These combined segmentation insights enable stakeholders to calibrate product development and marketing strategies that align with the specific performance attributes and purchasing behaviors of each subgroup.

This comprehensive research report categorizes the Guidewire market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- Application

- End-User

Assessing How Regional Regulatory Variations and Infrastructure Investments Drive Guidewire Demand Across Global Markets

Regional disparities in regulatory frameworks, healthcare infrastructure development, and provider preferences significantly influence the guidewire market’s trajectory across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a combination of established reimbursement models and robust clinical trial ecosystems fuels the rapid adoption of sensor-enabled and hydrophilic-coated guidewires, particularly within leading cardiovascular centers. Simultaneously, Latin American markets are emerging as opportunities for cost-efficient devices, with distributors tailoring portfolios to align with local procurement budgets.

In Europe, Middle East & Africa, the heterogeneous regulatory landscape-from stringent CE marking requirements to divergent national approval protocols-compels manufacturers to adopt market-specific compliance strategies. Western Europe’s emphasis on minimally invasive cardiology procedures has driven investments in premium nitinol and pushable stainless steel options, while emerging Middle East markets prioritize rapid delivery and support services. Meanwhile, in Africa, pilot programs facilitated by non-governmental organizations have introduced guidewire-based interventions in urology and vascular malformations.

Asia-Pacific stands out as a high-growth region characterized by government-led healthcare modernization initiatives and expanding private hospital networks. China’s regulatory streamlining has shortened approval cycles, enabling both domestic and international players to launch advanced guidewire platforms. India’s increasing procedural volumes in gastroenterology and cardiology are incentivizing manufacturers to develop cost-optimized variants. Additionally, Southeast Asia’s rising per capita healthcare expenditure underpins broader adoption of specialized surgical guidewires for oncology and neurosurgical applications.

This comprehensive research report examines key regions that drive the evolution of the Guidewire market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delineating the Competitive Dynamics Where Innovation Alliances and Specialized Producers Shape the Guidewire Market

The competitive landscape features a mix of global medical device conglomerates and agile specialized manufacturers vying for leadership through product differentiation and strategic partnerships. Major players have fortified their portfolios by integrating sensor technologies and hydrophilic coatings, driving performance claims around enhanced navigation and reduced friction. To complement these innovations, alliances with research institutions and digital health firms have produced proprietary platforms that offer pre-procedural simulation and intraoperative tracking capabilities.

Meanwhile, niche companies have carved out market share by addressing underserved procedural areas with bespoke guidewire designs, focusing on specific lumen sizes and taper profiles that cater to neurology or otolaryngology. These firms often leverage lean manufacturing footprints to deliver rapid product iterations and respond swiftly to clinician feedback. Furthermore, strategic mergers and acquisitions have consolidated regional distributors into broader networks, enhancing access to untapped markets while amplifying after-sales support. Together, these competitive maneuvers underscore a dynamic ecosystem where both scale and specialization coexist, requiring continuous assessment of partnerships, technology pipelines, and go-to-market efficiencies to sustain leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Guidewire market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AngioDynamics, Inc.

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Biosensors International Group, Ltd.

- BIOTRONIK SE & Co KG

- Boston Scientific Corporation

- Cardinal Health Inc.

- CONMED Corporation

- Cook Medical Inc.

- Galt Medical Corp.

- Integer Holdings Corporation

- Johnson & Johnson Services Inc.

- Koninklijke Philips N.V.

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Medtronic PLC

- Merit Medical Systems, Inc.

- MicroPort Scientific Corporation

- MicroVention, Inc.

- Olympus Corporation

- Stryker Corporation

- Teleflex Corporation

- Terumo Corporation

- Vilex, LLC

Crafting a Dual-Focused Strategy Centered on Supply Chain Resilience and Digital-Driven Clinical Collaboration to Drive Growth

Industry leaders should prioritize the diversification of raw material supply chains to mitigate cost volatility stemming from tariff fluctuations and geopolitical uncertainty. By establishing multi-regional sourcing agreements and qualifying alternative polymers and alloys, organizations can secure stable access to critical inputs while fostering innovation in lightweight, high-strength constructions. Concurrently, investing in digital integration-such as embedding pressure sensors and leveraging procedural analytics platforms-will differentiate product offerings and generate value-added services that enhance clinical decision-making.

In parallel, strengthening collaborations with clinical partners through co-development programs and real-world evidence initiatives can accelerate product validation and drive reimbursement acceptance. These partnerships should focus on demonstrating clinical outcomes improvements, such as reduced complication rates and shorter hospital stays, to support value-based contracting. Additionally, targeted market entry strategies that align with regional regulatory priorities and healthcare infrastructure goals will optimize launch efficiency. By adopting a dual approach of technological advancement and strategic partnership-building, manufacturers can navigate evolving market conditions and seize emerging opportunities in specialized procedural domains.

Embracing a Comprehensive Mixed-Methods Research Framework Integrating Clinical Insights with Global Regulatory and Procurement Data

This analysis draws upon a rigorous combination of primary and secondary research methodologies. The secondary research phase included a thorough review of peer-reviewed journals, regulatory documents, clinical trial registries, and industry white papers to capture material innovations, sensor integration trends, and tariff policy changes. Complementing this, primary research involved structured interviews with leading interventional clinicians, procurement specialists, and device engineers to validate emerging preferences in guidewire performance and procurement patterns.

Quantitative insights were gathered through targeted surveys distributed across hospitals, clinics, and ambulatory centers in North America, Europe, and Asia-Pacific, focusing on device selection criteria and supply chain considerations. Meanwhile, qualitative feedback from third-party administrators informed our understanding of value-based purchasing dynamics. Finally, the research team convened a series of expert panel discussions to reconcile divergent regional regulatory landscapes and forecast potential shifts in end-user adoption. This blended approach ensures a robust and comprehensive perspective on the guidewire market, reflecting both macroeconomic influences and ground-level clinical realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Guidewire market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Guidewire Market, by Material

- Guidewire Market, by Type

- Guidewire Market, by Application

- Guidewire Market, by End-User

- Guidewire Market, by Region

- Guidewire Market, by Group

- Guidewire Market, by Country

- United States Guidewire Market

- China Guidewire Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Technological Progress, Trade Policy Adaptation, and Partnership Imperatives as Pillars for Future Market Leadership

The guidewire market is at a pivotal juncture, propelled by technological breakthroughs in materials science and digital integration, as well as strategic responses to evolving trade policies. Material innovation has yielded hybrid and nitinol designs that enhance navigability across complex anatomies, while sensor-enabled guidewires are redefining the scope of real-time procedural intelligence. At the same time, tariff-driven cost pressures have highlighted the necessity of resilient supply chains and alternative sourcing strategies. These collective forces have reshaped competitive dynamics, with established players and specialized firms alike leveraging partnerships and targeted product differentiation to capture emerging clinical segments.

Looking ahead, success in this market will hinge on the capacity to align R&D investments with clinician-driven insights, navigate multifaceted regulatory terrains, and deliver value-based solutions that resonate with both healthcare providers and third-party administrators. By holistically addressing performance, cost, and data integration imperatives, stakeholders can chart a growth trajectory that not only meets present demands but also anticipates future procedural innovations. Ultimately, the confluence of material, digital, and strategic factors offers a roadmap for sustained leadership in a market defined by both complexity and transformative potential.

Secure an Exclusive Consultation with Ketan Rohom to Unlock the Full Insights and Tailored Recommendations from the Comprehensive Guidewire Market Report

For further inquiries about obtaining the full Guidewire market research report or exploring tailored insights for your organization, we invite you to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing. Leveraging his extensive expertise in guiding clients through data-driven decisions, Ketan can provide you with a customized overview of how the comprehensive findings align with your strategic objectives. Reach out to schedule a personal consultation where you can discuss detailed methodologies, exclusive market intelligence, and actionable growth pathways designed specifically for your enterprise’s needs. Secure your access to the latest Guidewire market analysis today and empower your leadership team with the knowledge to stay ahead in a competitive landscape.

- How big is the Guidewire Market?

- What is the Guidewire Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?