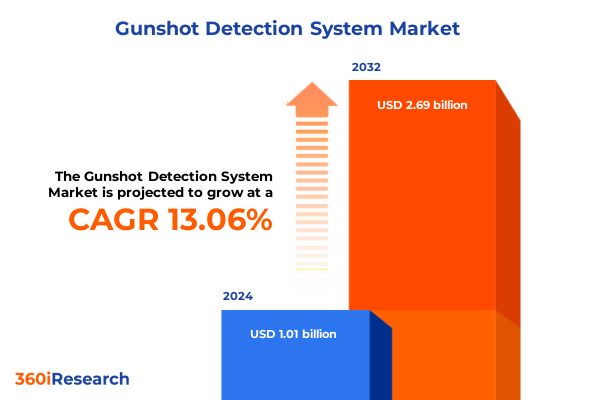

The Gunshot Detection System Market size was estimated at USD 1.14 billion in 2025 and expected to reach USD 1.28 billion in 2026, at a CAGR of 13.09% to reach USD 2.69 billion by 2032.

Innovative Integration of Acoustic Intelligence and Real-Time Analytics Reshaping Urban and Defense Security Ecosystems Worldwide

The convergence of urban safety imperatives and technological innovation has elevated gunshot detection systems from niche defense applications to essential components of smart city resilience programs. Rapid advances in sensor accuracy, coupled with the proliferation of networked communication infrastructure, have transformed how municipalities, law enforcement agencies, and private security firms monitor and respond to active threats. In this dynamic environment, the balance between predictive intelligence and real-time response serves as the cornerstone of effective public safety strategy.

As communities increasingly demand transparency and speed in emergency response, gunshot detection has become a critical enabler of situational awareness. Leading solutions now integrate acoustic sensors with sophisticated detection algorithms and user interfaces, empowering operators to verify incidents, coordinate field teams, and engage first responders within seconds of a discharge event. This introduction outlines the evolving landscape, setting the stage for a deep dive into transformative shifts, regulatory impacts, segmentation insights, regional dynamics, competitive positioning, and actionable recommendations geared toward decision-makers charged with safeguarding lives and assets.

Emergence of Artificial Intelligence and Edge Computing Driving Unprecedented Evolution in Gunshot Detection Architecture and Deployment Strategies

Emerging technologies have catalyzed a paradigm shift in the design and deployment of gunshot detection systems, extending their capabilities far beyond passive listening posts. Artificial intelligence models trained on vast acoustic datasets now distinguish gunfire from ambient noises with unparalleled accuracy, dramatically reducing false alarms in complex urban environments. Meanwhile, the advent of edge computing hardware has decentralized processing, enabling sensors to pre-validate acoustic signatures and prioritize critical alerts before transmission to central command hubs.

Simultaneously, the integration of sensor fusion techniques has given rise to multi-sensor configurations that leverage acoustic, infrared, and microwave inputs to corroborate detection events and enhance localization precision. Cloud-based analytic platforms further bolster this architecture, providing scalable processing power and enabling seamless firmware updates and algorithm enhancements across geographically dispersed installations. As a result, system operators can now access historical incident data, real-time heat maps, and predictive analytics, facilitating proactive resource allocation and community engagement strategies.

Analysis of the 2025 United States Tariffs Unveiling Significant Cost Pressures and Supply Chain Realignments in Gunshot Detection System Manufacturing

The implementation of new tariffs by the United States in early 2025 introduced significant cost variables for manufacturers of gunshot detection hardware and sensor components imported from key trading partners. Levies on microelectromechanical system (MEMS) sensors and digital signal processors have directly influenced bill of materials costs, compelling system integrators to reevaluate supplier contracts and explore alternative domestic sourcing options. These shifts, in turn, have reverberated through the broader supply chain, prompting inventory buybacks and accelerating the qualification of secondary vendors.

While short-term price pressures have challenged stakeholder budgets, a longer-term benefit has emerged from expanded onshore manufacturing capacity. Investment in localized production facilities has spurred innovation clusters around sensor design and acoustic modeling, enhancing collaborative research among technology vendors, academic institutions, and federal research laboratories. Consequently, despite elevated import duties, the tariff landscape has reshaped competitive dynamics by incentivizing supply chain resilience and fostering a more diversified ecosystem of component and service providers.

Comprehensive Examination of Hardware Components, Software Algorithms, Service Offerings and Diverse Application Domains in Gunshot Detection Market Structure

The market for gunshot detection systems exhibits a complex structure defined by distinct component categories encompassing hardware, services, and software offerings. Hardware segments include acoustic output modules, digital processors, and precision sensors, each representing critical nodes in the detection architecture. Services expand beyond initial system installation to encompass ongoing maintenance contracts designed to optimize sensor calibration and network health. Software platforms deliver advanced analytics, detection algorithms, and operator-facing user interfaces that transform raw acoustic inputs into actionable intelligence.

Across application contexts, these systems address the unique demands of commercial environments such as hospitality venues and retail outlets, where crowd dynamics and acoustic variability challenge detection fidelity. Defense implementations focus on border security checkpoints and counter-terrorism operations, where rapid localization and integration with existing surveillance networks are imperative. Public safety deployments span indoor facilities like government buildings and outdoor public spaces, each requiring tailored sensor placement and environmental adaptation. Transportation scenarios bring specialized requirements, with airports emphasizing expansive coverage and railways necessitating robust performance amid high ambient noise and vibration.

End users span government agencies, dedicated law enforcement divisions, military commands, and private security firms, each leveraging gunshot detection to reinforce broader asset protection and crisis response protocols. Sensing technology choices further diversify offerings, with acoustic-only systems providing cost-effective coverage, infrared modalities enabling optical confirmation, and multi-sensor frameworks combining acoustic and microwave channels to maximize detection confidence in challenging environments. The market also distinguishes between integrated system types that coalesce hardware, software, and services under unified support agreements and standalone units favored by organizations seeking modular upgrade paths without full-scale integration commitments.

This comprehensive research report categorizes the Gunshot Detection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Sensing Technology

- Application

- End User

Regional Dynamics Illustrating How Regulatory Frameworks, Infrastructure Maturity and Security Priorities Differ Across Americas, EMEA and Asia-Pacific Markets

Regional dynamics in the Americas illustrate a robust investment climate driven by federal grants, municipal safety initiatives, and private sector partnerships. The United States leads adoption with extensive urban sensor networks and academic collaborations exploring predictive analytics, while Canada’s focus on smart city interoperability fosters cross-border pilot programs. Latin American jurisdictions are increasingly commissioning turnkey systems to modernize policing infrastructure and address escalating public safety concerns through evidence-based response frameworks.

In Europe, Middle East, and Africa (EMEA), regulatory directives emphasizing data protection and public accountability inform deployment strategies. Western European nations integrate gunshot detection with broader security ecosystems encompassing video surveillance and access control, while Middle Eastern governments prioritize large-scale perimeter monitoring for critical infrastructure. African installations, although nascent, are driven by donor-funded programs targeting urban safety enhancements, often leveraging solar-powered sensor nodes to overcome grid stability challenges.

Asia-Pacific markets exhibit a heterogeneous landscape, with metropolitan centers in Japan and South Korea advancing sensor fusion research in collaboration with local technology giants. Southeast Asian nations focus on airport and port security amid evolving regional trade flows, while Australasian jurisdictions pilot integrated emergency response platforms that blend acoustic detection with mobile alert systems. Across these varied contexts, regional priorities-from regulatory compliance to infrastructure readiness-shape procurement timelines and system configurations.

This comprehensive research report examines key regions that drive the evolution of the Gunshot Detection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Overview Highlighting Strategic Partnerships, Technological Leadership and Market Differentiation Among Top Gunshot Detection Providers

The competitive arena for gunshot detection systems features specialized technology firms, legacy defense contractors, and emergent entrants forging strategic alliances. Sensor-focused companies concentrate on refining acoustic transducer sensitivity and miniaturization, while software developers differentiate through machine learning-driven classification engines and intuitive user dashboards. Established defense contractors leverage existing government relationships to bundle detection capabilities with integrated command-and-control suites, providing turnkey solutions for border and critical infrastructure protection.

Collaborations between hardware innovators and communications providers have given rise to robust networked platforms that ensure low-latency alert delivery over private LTE and 5G infrastructures. Simultaneously, a wave of mergers and acquisitions underscores the importance of end-to-end service portfolios, as acquirers seek to assimilate niche sensor technologies and expand their global footprint. Start-ups with specialized infrared or microwave fusion techniques are attracting venture capital, accelerating proof-of-concept trials with major municipal clients. Collectively, these competitive moves and strategic partnerships are reshaping market positioning and driving a continuous cycle of innovation across the ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gunshot Detection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Elta Systems Ltd.

- HENSOLDT AG

- Leonardo S.p.A.

- Lockheed Martin Corporation

- QinetiQ Group plc

- Raytheon Technologies Corporation

- SoundThinking, Inc.

- SoundThinking, Inc.

- Thales Group

Strategic Blueprint for Industry Stakeholders Emphasizing Innovation Pathways, Collaboration Models and Policy Engagement to Accelerate Gunshot Detection Adoption

To navigate the complexities of this evolving market, industry leaders must prioritize interoperability standards that facilitate seamless integration of acoustic, optical, and radio frequency sensors within unified security architectures. Aligning product roadmaps with emerging edge computing platforms will reduce latency and enhance on-device processing capabilities, enabling actionable notifications even under constrained network conditions. Furthermore, establishing collaborative research initiatives with academic institutions and end-user organizations can accelerate the refinement of detection algorithms and promote the adoption of evidence-based validation methodologies.

Service providers should diversify maintenance offerings by incorporating predictive diagnostics powered by artificial intelligence, thereby shifting from reactive support to proactive system health management. Simultaneously, executive teams must engage with policymakers to harmonize calibration and data privacy frameworks, ensuring rapid procurement cycles and broad public acceptance. Finally, cultivating strategic alliances with telecommunications carriers and IoT integrators will expand deployment channels and unlock new revenue streams through subscription-based monitoring services, positioning organizations to capitalize on the growing demand for holistic security solutions.

Robust Research Approach Combining Primary Stakeholder Engagement, Secondary Data Triangulation and Rigorous Validation to Ensure Comprehensive Market Insights

Our research synthesized insights through a dual-track approach combining in-depth primary engagements with security directors, system integrators, and standards bodies alongside a rigorous secondary review of open-source technical papers, patent filings, and regulatory filings. Data triangulation ensured consistency across diverse inputs, while quantitative surveys validated service adoption trends and end-user satisfaction benchmarks. To further enhance credibility, vendor briefings were conducted under non-disclosure agreements, granting access to forthcoming product roadmaps and feature specifications.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gunshot Detection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gunshot Detection System Market, by Component

- Gunshot Detection System Market, by System Type

- Gunshot Detection System Market, by Sensing Technology

- Gunshot Detection System Market, by Application

- Gunshot Detection System Market, by End User

- Gunshot Detection System Market, by Region

- Gunshot Detection System Market, by Group

- Gunshot Detection System Market, by Country

- United States Gunshot Detection System Market

- China Gunshot Detection System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Future Trajectory of Gunshot Detection Systems in Modern Security Frameworks

The synthesis of technological advancements, regulatory influences, and competitive dynamics underscores a pivotal moment for gunshot detection systems. As artificial intelligence and sensor fusion capabilities mature, stakeholders can anticipate more precise threat localization and reduced operational overhead. Concurrently, tariff-induced supply chain realignments are forging a more resilient manufacturing landscape while spurring local innovation. These converging forces create fertile ground for both established market leaders and agile newcomers to deliver impactful public safety solutions.

Ultimately, the strategic recommendations and segmentation insights presented herein furnish a roadmap for organizations to align product development, service offerings, and policy engagement with evolving security imperatives. By embracing interoperability, investing in research collaborations, and prioritizing end-user experience, industry participants can secure a competitive edge and contribute to safer, more responsive communities worldwide.

Engage with Ketan Rohom to Secure In-Depth Insights and Empower Decision-Making Through the Definitive Gunshot Detection Systems Market Research Report

Elevate your strategic planning by connecting directly with Ketan Rohom, Associate Director of Sales and Marketing, to explore tailored licensing and customization options for the definitive Gunshot Detection Systems Market Research Report. Whether you require deeper insights into specific component technologies, regional dynamics, or competitive strategies, this conversation will unlock proprietary data and expert guidance indispensable for informed investment and deployment decisions. Don’t miss the opportunity to harness our comprehensive analysis to position your organization at the forefront of security innovation. Reach out today to secure your copy and gain exclusive access to the critical intelligence that will shape the future of public safety and defense operations.

- How big is the Gunshot Detection System Market?

- What is the Gunshot Detection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?