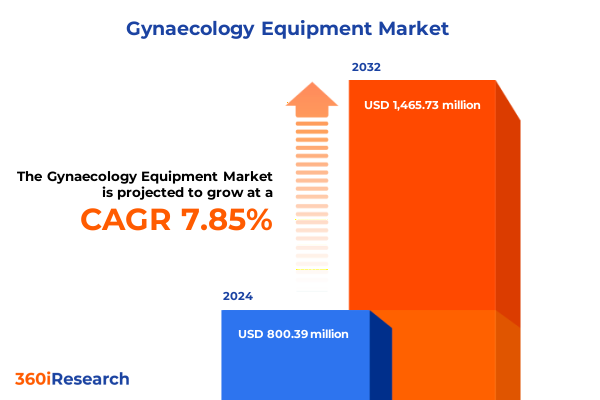

The Gynaecology Equipment Market size was estimated at USD 863.42 million in 2025 and expected to reach USD 926.39 million in 2026, at a CAGR of 7.85% to reach USD 1,465.73 million by 2032.

Discover the vital role of advanced gynecological equipment in transforming patient outcomes and elevating clinical excellence across healthcare settings

The gynecological equipment sector is at a pivotal juncture as healthcare providers, researchers, and technology innovators converge to elevate patient care. Medical professionals now demand tools that combine precision, safety, and flexibility to address a diverse spectrum of women’s health needs. Consequently, manufacturers are channeling investments into next-generation devices that support minimally invasive procedures, real-time diagnostics, and enhanced patient comfort. As emerging economies expand their healthcare infrastructure and developed markets prioritize value-based care, demand for advanced gynecological instruments continues to intensify.

Against this backdrop, clinical outcomes hinge on the seamless integration of cutting-edge technology with established protocols. The transition from analogue to digital platforms, coupled with the rise of artificial intelligence-driven imaging, underscores the imperative for gynecological equipment that adapts to evolving practice environments. As patient expectations rise and regulatory bodies enforce stricter quality benchmarks, stakeholders must remain vigilant to emerging trends, supply-chain disruptions, and reimbursement shifts. By acknowledging these imperatives, industry participants can harness the momentum to foster innovation, optimize operations, and ultimately enhance the standard of women’s healthcare globally.

Explore how digitalization, minimally invasive techniques, and interconnected medical solutions are reshaping gynecological care delivery

Over the past decade, the gynecological equipment landscape has undergone transformative shifts driven by technological breakthroughs, evolving clinical protocols, and patient-centric care models. The proliferation of minimally invasive procedures has reduced surgical trauma, recovery time, and hospital stays, prompting instrument developers to refine electrosurgical devices, hysteroscopes, and fluid management systems. In parallel, real-time imaging advancements in 3D/4D ultrasound and Doppler modalities have enhanced diagnostic accuracy, enabling clinicians to detect and manage complex conditions earlier in their progression.

Simultaneously, the emergence of telehealth and remote monitoring solutions has redefined care delivery. Fetal monitoring systems have expanded beyond hospital confines into home care settings, allowing expectant mothers to engage with healthcare providers virtually. Moreover, data analytics platforms now aggregate procedural metrics and patient outcomes, ushering in an era of evidence-based decision-making. The integration of portable and trolley-mounted equipment has further facilitated mobility and point-of-care diagnostics, particularly in ambulatory surgical centers and mobile clinics. These innovations collectively underscore a shift toward interconnected, patient-focused, and efficient gynecological services.

Unpack the ripple effects of 2025 United States tariffs on procurement strategies and domestic manufacturing trends in gynecological devices

In early 2025, newly implemented United States tariffs on imported gynecological instruments and their components introduced a layer of complexity to established procurement practices. These duties, targeting devices ranging from bipolar electrosurgical tools to real-time 4D ultrasound units, have elevated landed costs for healthcare facilities reliant on cross-border supply chains. As a consequence, purchasing departments are reassessing vendor agreements and considering alternate sourcing strategies to mitigate margin erosion.

This policy shift has also catalyzed domestic manufacturing initiatives, with original equipment manufacturers exploring onshore assembly and local component production. Although this transition requires significant capital allocation and time for scale-up, it promises to reduce long-term exposure to tariff volatility and logistical bottlenecks. In parallel, collaborative alliances between U.S. distributors and overseas innovators have emerged, blending global technical expertise with regional regulatory familiarity. These cooperative frameworks aim to strike a balance between cost containment and uninterrupted access to advanced gynecological instruments, ensuring uninterrupted patient care despite evolving trade regulations.

Gain deep insights into how product, end-user, sales channel, and portability segments define distinct value propositions throughout the gynecological equipment market

Detailed segmentation uncovers distinct value drivers across product categories, end-user settings, sales channels, and equipment portability within the gynecological arena. Product portfolios range from high-precision monopolar and bipolar electrosurgical devices to diagnostic platforms such as external and internal fetal monitoring systems, each underpinned by cardiotocography, ultrasound, scalp electrode, and intrauterine pressure catheter technologies. Fluid management systems bifurcate into closed and open architectures, while hysteroscopic solutions span both rigid and flexible scopes. Operating tables, whether manual or motorized, complement imaging equipment encompassing 2D transabdominal and transvaginal ultrasound, real-time 3D/4D volumetric imaging, and an array of color, power, and pulse wave Doppler modalities.

These product distinctions intersect with diverse application environments. Ambulatory surgical centers affiliated with hospitals and standalone facilities deploy advanced instrumentation for same-day procedures, while clinics specializing in fertility and gynecological care prioritize ease of use and patient comfort. Hospitals, both private and public, require integrated systems that support high throughput, and specialty centers focusing on obstetrics and reproductive treatments demand tailored diagnostic and therapeutic platforms. Sales channels further differentiate market access, with traditional offline distribution networks coexisting alongside growing online procurement. Portability preferences additionally shape purchasing decisions, splitting demand between handheld and trolley-mounted units versus console-based and floor-mounted installations.

This comprehensive research report categorizes the Gynaecology Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Sales Channel

- Portability

Uncover the diverse regional dynamics shaping adoption, innovation priorities, and investment strategies across global gynecological equipment markets

Regional dynamics reveal divergent adoption patterns and investment priorities for gynecological equipment across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, well-established healthcare infrastructures and favorable reimbursement frameworks drive sustained uptake of premium diagnostic and surgical devices. This region also leads in the integration of artificial intelligence into imaging systems, reinforcing its role as a technology pioneer.

Transitioning to Europe, the Middle East & Africa, stakeholders navigate a tapestry of regulatory regimes and economic variances. Western Europe’s stringent quality standards propel demand for minimally invasive platforms, whereas emerging markets in the Middle East and Africa focus on cost-effective portability and maintenance simplicity. Meanwhile, Asia-Pacific exhibits a dynamic growth trajectory stimulated by expanding medical tourism, rising prevalence of women’s health initiatives, and supportive government funding. Markets such as Japan and Australia emphasize precision diagnostics and high-end imaging solutions, while Southeast Asian nations prioritize scalable, mobile equipment to serve dispersed patient populations. These regional nuances underscore the importance of tailored market entry strategies and localized support mechanisms.

This comprehensive research report examines key regions that drive the evolution of the Gynaecology Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine how leading and emerging companies leverage collaboration, innovation, and agile development to capture specialized segments

Leading medical device companies actively redefine competitive boundaries through strategic collaborations, targeted R&D investments, and diversified product pipelines. Market incumbents renowned for electrosurgical instrumentation are expanding into advanced visualization and integrated fluid management suites, while imaging specialists are forging partnerships with AI firms to embed predictive analytics into ultrasound platforms. These cross-sector alliances underscore a collective focus on delivering comprehensive procedure ecosystems rather than standalone devices.

Simultaneously, mid-tier players and innovative start-ups are advancing niche technologies such as disposable hysteroscopes and ultra-portable fetal monitoring units. Their agility in rapid prototyping and regulatory navigation allows them to address unmet clinical needs and capture specialized segments. In response, established organizations are accelerating product lifecycle management, deploying modular designs that enable seamless upgrades. Collectively, these competitive maneuvers emphasize the criticality of balancing scale with innovation, leveraging global distribution networks while maintaining localized service excellence to strengthen market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Gynaecology Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Coloplast A/S

- Cook Medical Inc.

- CooperSurgical Inc.

- Fujifilm Holdings Corporation

- Gynemed GmbH & Co. KG

- Hologic Inc.

- Intuitive Surgical Inc.

- Johnson & Johnson

- Karl Storz SE & Co. KG

- LiNA Medical ApS

- MedGyn Products Inc.

- Medtronic plc

- Minerva Surgical Inc.

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- Teleflex Incorporated

Adopt integrated innovation, supply diversification, and comprehensive user enablement to secure sustainable growth and competitive resilience

To maintain market leadership and capitalize on evolving clinical demands, industry stakeholders should embrace a multi-faceted strategic framework. First, prioritizing R&D investment in interoperable platforms will facilitate seamless integration with electronic health records and analytics tools, enhancing procedural efficiency. Concurrently, diversifying procurement footprints by cultivating regional manufacturing partnerships can mitigate tariff risks and supply-chain disruptions, ensuring consistent device availability.

Furthermore, implementing robust training programs for end users-spanning surgeons, nurses, and technologists-will accelerate adoption of advanced equipment and optimize clinical outcomes. Embedding remote diagnostics and predictive maintenance services into the product offering can differentiate providers by reducing downtime and total cost of ownership. Finally, fostering alliances with digital health companies to expand telemedicine capabilities in fetal monitoring and postoperative care will meet the growing demand for decentralized, patient-centered services. By executing these actions in concert, leaders can drive sustainable growth and solidify their competitive differentiators.

Understand the comprehensive primary and secondary research protocols that ensure reliable, actionable intelligence throughout the report

A rigorous approach underpins the report’s findings, combining primary and secondary research methodologies to ensure depth and accuracy. Primary data stems from interviews with key opinion leaders, clinicians, and procurement specialists across diverse healthcare settings, capturing firsthand perspectives on device performance, purchasing criteria, and emerging requirements. These qualitative insights complement extensive secondary research, including peer-reviewed journals, regulatory filings, and industry white papers.

Data triangulation techniques validate market observations and mitigate bias, while a dedicated expert review panel assesses the robustness of conclusions. The research also incorporates analysis of patent filings, clinical trial registries, and trade statistics to map innovation trajectories and supply-chain trends. This methodological rigor ensures that the intelligence delivered is not only comprehensive but also actionable, providing stakeholders with a reliable foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Gynaecology Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Gynaecology Equipment Market, by Product Type

- Gynaecology Equipment Market, by End User

- Gynaecology Equipment Market, by Sales Channel

- Gynaecology Equipment Market, by Portability

- Gynaecology Equipment Market, by Region

- Gynaecology Equipment Market, by Group

- Gynaecology Equipment Market, by Country

- United States Gynaecology Equipment Market

- China Gynaecology Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Synthesize innovation, collaboration, and regional adaptability to navigate the evolving future of gynecological equipment with confidence

In an era defined by technological advancement and shifting regulatory landscapes, the gynecological equipment sector stands poised for continued transformation. Stakeholders who anticipate and adapt to emerging trends-from AI-enabled imaging to portable monitoring solutions-will drive more precise diagnostics and less invasive therapeutic pathways. Moreover, proactive management of supply-chain risks, coupled with collaboration across the value chain, will prove indispensable as trade policies evolve.

Ultimately, the insights presented in this summary underscore the importance of marrying innovation with practicality. By aligning product development with end-user workflows and regional imperatives, manufacturers and healthcare providers can collectively enhance the quality and accessibility of women’s healthcare. As this dynamic market advances, the ability to translate intelligence into decisive action will determine which organizations emerge as leaders in shaping the future of gynecological care.

Engage with an expert to secure comprehensive gynecological equipment market insights and elevate your strategic decision-making

To explore the complete market insights and gain a detailed understanding of the competitive landscape, segmentation nuances, and regional dynamics in gynecological equipment, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage with an expert who can guide you through the tailored findings and help you secure the comprehensive report that will empower your strategic mission and unlock growth opportunities in this rapidly evolving market.

- How big is the Gynaecology Equipment Market?

- What is the Gynaecology Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?