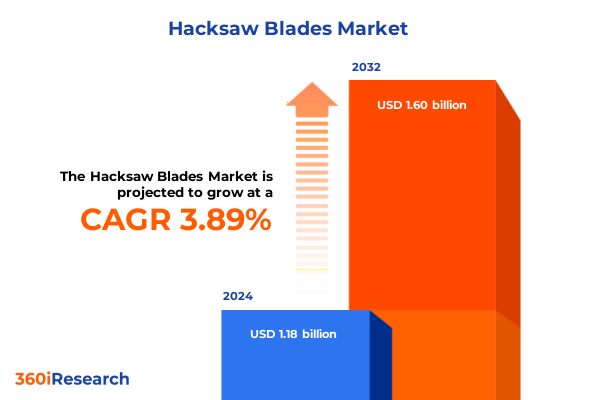

The Hacksaw Blades Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.26 billion in 2026, at a CAGR of 4.02% to reach USD 1.60 billion by 2032.

Revolutionizing Industrial and DIY Applications through Precision-Engineered Hacksaw Blades Offering Exceptional Efficiency, Durability, and Versatility

The market for hacksaw blades has experienced a notable surge in demand as a rising share of American homeowners embrace do-it-yourself home improvement projects. In 2024, approximately 62% of U.S. homeowners planned renovation initiatives, with 43% opting to complete these tasks independently - underscoring a growing reliance on accessible, high-quality hand tools like hacksaw blades in both residential and small-scale commercial settings.

Beyond DIY applications, industrial sectors continue to drive steady requirement for durable cutting solutions. Construction, automotive, and manufacturing enterprises depend on hacksaw blades for precision cutting of metals, plastics, and composite materials, where performance reliability directly impacts operational efficiency and safety protocols.

Simultaneously, advances in material science have led to wider adoption of high-carbon steel, bi-metal alloy, and high-speed steel formulations in blade manufacturing. These enhanced materials deliver significant improvements in wear resistance, cutting speed, and longevity, enabling professionals to undertake more demanding tasks without frequent blade replacement.

The increasing penetration of digital sales channels has also reshaped distribution strategies. E-commerce platforms and company websites now serve as critical conduits, complementing established offline networks of distributors and retailers. This omnichannel approach ensures end users can source the ideal blade specification for their application with greater convenience, transparency, and speed.

Disruptive Technological Advances and Channel Innovations Driving Sustainable, Smart, and Digitally-Enabled Transformation in the Hacksaw Blade Industry

The hacksaw blade landscape is undergoing a transformative shift as manufacturers integrate advanced smart features and sustainability principles into conventional cutting tools. Connectivity technologies are increasingly embedded in power hacksaws, enabling real-time performance monitoring and predictive maintenance capabilities that reduce unplanned downtime on job sites.

In parallel, cordless innovations propelled by next-generation lithium-ion chemistries have liberated professionals and hobbyists from fixed power sources. The result is enhanced portability and flexibility across applications, whether in remote construction zones or compact urban workshops. These cordless platforms now rival corded tools in power output and runtime, marking a fundamental change in equipment selection.

Sustainable design considerations have also emerged as a critical differentiator. Brands are turning to recycled bi-metal composites and eco-friendly coatings that reduce environmental footprint without compromising blade performance. This pivot toward greener manufacturing is driven by both regulatory pressures and end-user demand for more responsible sourcing practices.

Finally, the shift toward digital commerce channels continues to accelerate. E-commerce growth enables targeted product bundling, subscription-based blade replenishment services, and virtual tool-selection assistants that simplify specification matching. As digital adoption rises, manufacturers are forging strategic partnerships with online marketplaces to reach a broader customer base and capture real-time market intelligence.

Escalating US Steel and Aluminum Tariffs Fuel Increased Production Costs and Supply Chain Reconfigurations Affecting Hacksaw Blade Manufacturers and Importers

Since March 12, 2025, the United States has imposed a 25% tariff on all imported steel and aluminum, extending protection to domestic producers while affecting raw material costs for hacksaw blade manufacturers that rely on exported steel content. This measure applies to basic metal inputs as well as derivative products unless they meet domestic melt-and-pour requirements, leading many producers to reassess supply chain structures.

On June 4, 2025, the tariff rate for steel articles and derivative products nearly doubled from 25% to 50%, intensifying cost pressures. Tools and blade makers using carbon steel and alloy steel have felt the impact most acutely, prompting price adjustments or product reformulations to maintain margin levels. Companies are evaluating alternative materials such as high-speed steel and specialized bi-metal blends to mitigate exposure to escalating tariffs.

Component suppliers have also indicated increased overhead burdens. For instance, manufacturers of precision-machined parts have announced imminent cost hikes, arguing that even a 25% tariff still undercuts the expense of reshoring production to domestic facilities. In many cases, such manufacturers opt to pass incremental costs directly to end customers, impacting overall tool prices and end-user budgets.

Major stainless steel producers benefiting from tariff shielding, such as Acerinox, have signaled potential price increases later in the year. While seasonal demand factors may delay adjustments until autumn, the broader implication is clear: higher raw material costs are set to reshape product roadmaps and sourcing strategies throughout the hacksaw blade ecosystem.

Strategic Market Segmentation Reveals Critical Opportunities across Multiple Channels, Types, Applications, Materials, and End User Verticals

Market segmentation reveals critical insights across distribution channels, product types, application areas, material compositions, and end-user verticals. Although offline channels-comprising distributors and retail outlets-remain vital for professional customers requiring hands-on consultation, online channels hosted on company websites and e-commerce platforms are rapidly gaining share by offering greater convenience and product visibility.

Within the product-type spectrum, traditional hand hacksaws persist in smaller-scale and precision tasks, but power hacksaws are progressively capturing incremental volume in heavy-duty industrial settings. This shift underscores the imperative for blade manufacturers to optimize cutting geometries for motor-driven applications, delivering faster material removal rates and extended fatigue life.

Application segmentation further highlights the need for application-specific blade solutions. Metal-cutting remains the largest usage area, driving demand for bi-metal and high-speed steel blades engineered to withstand high abrasion and heat. Meanwhile, plastics and wood applications require distinct tooth forms and backing materials to reduce chipping and produce cleaner edges.

Material segmentation indicates alloy steel, carbon steel, and high-speed steel as the core metallurgical families. Each material offers a unique balance of hardness, toughness, and cost, enabling manufacturers to align blade specifications with performance requirements and price sensitivity. End-user segmentation spans automotive, construction, DIY, and manufacturing sectors, each presenting differentiated usage patterns and procurement cycles that shape targeted product development.

This comprehensive research report categorizes the Hacksaw Blades market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- End User

- Application

- Distribution Channel

Regional Market Dynamics Unveil Diverse Growth Drivers and Challenges across Americas, EMEA, and Asia-Pacific Hacksaw Blade Markets

Regional differences in demand and competitive dynamics are pronounced across the Americas, EMEA, and Asia-Pacific. In the Americas, sustained infrastructure investment and a robust home-renovation trend drive steady consumption of hacksaw blades. Domestic producers leverage local steel supply chains, but elevated tariff regimes have prompted leading brands to emphasize value-added services and bundled maintenance programs to retain customer loyalty.

In Europe, the Middle East, and Africa, regulatory requirements around environmental standards and workplace safety incentivize manufacturers to develop advanced blade coatings and sustainable production methods. Compliance with REACH regulations in Europe and evolving labor-safety mandates in the Gulf Cooperation Council underscores the importance of certified performance and durability.

The Asia-Pacific region demonstrates the highest growth trajectory, fueled by rapid industrialization and construction booms in Southeast Asia. Manufacturers such as AKE Knebel have successfully tapped these markets through lean production techniques and recycled bi-metal blades, reporting that more than one-third of their revenue now derives from Asia-Pacific customers seeking cost-effective solutions.

This comprehensive research report examines key regions that drive the evolution of the Hacksaw Blades market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Manufacturers Drive Innovation and Competitive Differentiation through Advanced Material Technologies, Strategic Partnerships, and Sustainability Initiatives

Leading manufacturers are differentiating through material innovation, strategic alliances, and sustainability commitments. Stanley Black & Decker maintains market leadership by leveraging its extensive brand portfolio, integrating premium offerings such as DeWalt and Irwin to address both consumer and industrial segments. The company’s global distribution network and emphasis on continuous product development underpin its competitive advantage.

Bosch focuses on precision engineering and advanced material science, exemplified by its laser-hardened Carbide Technology Division that achieves exceptional tooth retention rates and micron-level tolerances. Automated production lines in Germany and Brazil further reinforce Bosch’s capacity to meet stringent aerospace and automotive standards.

Irwin Industrial Tools, a Newell Brands subsidiary, differentiates through ergonomic design and high-performance bi-metal blade technology. Its close partnerships with distribution channels and subscription-based replenishment programs ensure consistent end-user engagement and recurring revenue streams. Meanwhile, Bahco takes a sustainability-led approach, incorporating eco-friendly manufacturing processes and carbon-neutral operations into its premium blade series.

Lenox, under the Apex Tool Group banner, commands premium segments with patented tri-material construction that couples cobalt-enriched teeth with vibration-dampening alloy backs. This innovation has demonstrated substantial reductions in blade breakage for high-volume automotive fabricators, reinforcing Lenox’s position in demanding industrial environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hacksaw Blades market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Tool Group, LLC

- Gedore Tool Group

- Hilti AG

- Klein Tools, Inc.

- Makita Corporation

- Newell Brands Inc.

- Ridge Tool Company

- Robert Bosch GmbH

- Sandvik AB

- SNA Europe AB

- Stanley Black & Decker, Inc.

- Techtronic Industries Co., Ltd.

- The L.S. Starrett Company

- Wiha Tools GmbH & Co. KG

Practical Strategic Imperatives for Innovating, Diversifying Supply Chains, and Maximizing Digital Engagement in the Hacksaw Blade Sector

To capitalize on evolving trends, industry leaders should accelerate development of bi-metal and high-speed steel formulations tailored for power hacksaws, focusing on enhanced heat resistance and fatigue strength. Such innovations can unlock new opportunities in heavy industrial and aerospace applications where performance margins are critical.

Diversifying raw material sourcing to mitigate tariff exposure is a strategic imperative. Stakeholders must evaluate domestic and alternative international supply options, leveraging tariff-free trade agreements when possible and establishing flexible contracts to absorb policy shifts. Proactive supply chain mapping and risk assessment can preserve margin stability amid ongoing trade volatility.

Strengthening digital engagement through direct-to-consumer e-commerce platforms and subscription-based blade replacement services will deepen customer relationships and provide actionable usage data. Investing in user-friendly online configurators that guide specification selection can reduce purchasing friction and drive higher conversion rates in both DIY and professional segments.

Finally, embedding sustainability into product development-from recycled materials to carbon-neutral manufacturing-will resonate with environmentally conscious buyers and align with regulatory trajectories. Leaders should pursue third-party certifications and transparent reporting to showcase commitment and differentiate their brand proposition in an increasingly eco-focused marketplace.

Comprehensive Mixed-Method Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Quality Validation Protocols

This research employed a comprehensive mixed-method approach, integrating secondary data gathered from government trade publications, company filings, and tariff notices with primary interviews conducted across manufacturers, distributors, and end-user organizations between January and July 2025. Publicly available tariff schedules from U.S. Customs and Border Protection and the White House executive proclamations formed the basis for analyzing trade policy impacts.

Secondary sources included industry press releases, professional association data, and domain-specific news outlets. Primary research consisted of in-depth, structured interviews with senior R&D and supply chain executives, enabling triangulation of strategic priorities and first-hand perspectives on material sourcing and product development ∪citeturn0search2.

Data were validated through a rigorous quality control process, encompassing peer reviews by subject-matter experts and cross-referencing with historical customs data to ensure accuracy and consistency. Analytical techniques included trend mapping, scenario planning, and sensitivity analysis to assess the resilience of strategic recommendations under varying tariff and regulatory environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hacksaw Blades market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hacksaw Blades Market, by Type

- Hacksaw Blades Market, by Material

- Hacksaw Blades Market, by End User

- Hacksaw Blades Market, by Application

- Hacksaw Blades Market, by Distribution Channel

- Hacksaw Blades Market, by Region

- Hacksaw Blades Market, by Group

- Hacksaw Blades Market, by Country

- United States Hacksaw Blades Market

- China Hacksaw Blades Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Market Dynamics and Strategic Opportunities to Illuminate the Future Trajectory of the Hacksaw Blade Industry

The global hacksaw blade market stands at a pivotal inflection point, driven by accelerating DIY adoption, industrial modernization, and complex trade policies. Technological innovations in smart tools, advanced material compositions, and sustainable production are redefining competitive benchmarks. Simultaneously, escalating tariffs on steel and aluminum compel manufacturers to reevaluate supply chains, adopt alternative materials, and implement agile sourcing models to safeguard profitability.

Robust segmentation insights reveal distinct channel and product dynamics, from the rise of power hacksaws in heavy industries to the proliferation of e-commerce in the DIY segment. Regional variances underscore that while the Americas leverage infrastructure spending and home-improvement trends, EMEA’s regulatory landscape and Asia-Pacific’s manufacturing surge present unique pathways for growth and differentiation.

Key players remain focused on portfolio expansion, material science breakthroughs, and sustainability commitments, yet market leaders must now align these initiatives with digital strategies and tariff-responsive procurement. By synthesizing these multifaceted forces into cohesive action plans, stakeholders can position themselves at the forefront of performance, reliability, and customer-centric innovation in the evolving hacksaw blade industry.

Engage Directly with Associate Director Ketan Rohom to Secure In-Depth Hacksaw Blade Market Insights and Drive Your Competitive Edge Today

To explore the comprehensive insights, nuanced regional breakdowns, and actionable strategies detailed in this market research report on hacksaw blades, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you’ll gain clarity on how these findings apply to your organization’s goals and discover tailored solutions to accelerate growth, optimize supply chains, and enhance product innovation. Connect with Ketan Rohom today to secure your access to the full report and empower your team with the depth of analysis needed to outperform competitors and navigate evolving market dynamics.

- How big is the Hacksaw Blades Market?

- What is the Hacksaw Blades Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?