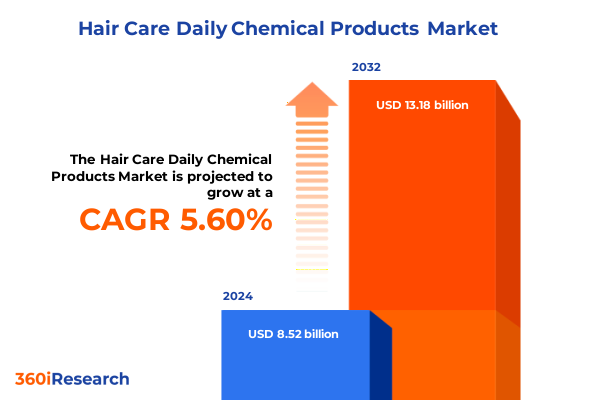

The Hair Care Daily Chemical Products Market size was estimated at USD 8.91 billion in 2025 and expected to reach USD 9.46 billion in 2026, at a CAGR of 5.75% to reach USD 13.18 billion by 2032.

Setting the Stage for the Future of Daily Chemical Haircare with Consumer Demands, Industry Innovations, Regulatory Pressures, and Market Dynamics

The daily chemical haircare sector encompasses the shampoos, conditioners, serums, and styling products that consumers incorporate into their routines to cleanse, nurture, and style their hair. Driven by evolving expectations around performance, safety, and sensory experience, these formulations have undergone a profound transformation over the past decade. What once served primarily as cleansing and styling agents now integrates advanced actives targeting scalp balance, strand reinforcement, and environmental defense.

Today’s consumers demand more than superficial benefits; they seek products that deliver measurable improvements in hair health and appearance, mirroring the science-backed efficacy long associated with skincare. This “skinification” of haircare has fueled the adoption of ingredients like peptides, salicylic acid, and ketoconazole, repurposed to address challenges such as dandruff, hair loss, and irritation while elevating daily rituals into holistic self-care moments.

Alongside performance, safety and sustainability have ascended in importance. Legislation such as the Toxic-Free Cosmetics Act, which took effect in 2025 and restricts several harmful substances, underscores the regulatory pressures shaping formulations and ingredient sourcing strategies. Research and development teams now navigate a complex landscape of compliance, efficacy testing, and consumer transparency, setting the stage for the strategic insights explored in this report.

Navigating the Transformative Landscape of Daily Chemical Haircare Innovation Driven by Biotech, Personalization, Sustainability, and Advanced Formulation Technologies

The daily chemical haircare industry is undergoing a paradigm shift as brands harness data and advanced technologies to deliver hyper-personalized experiences. AI-powered platforms now assess scalp and strand metrics in real time, enabling tailored product recommendations and regimen optimizations. This evolution from one-size-fits-all solutions to individualized approaches leverages machine learning to decode complex hair profiles, ensuring formulations precisely match consumer needs and lifestyle factors.

Simultaneously, breakthroughs in biotechnology and green chemistry are redefining ingredient sourcing and formulation processes. Fermentation-based actives and lab-grown compounds offer sustainable alternatives to scarce natural extracts, reducing environmental footprints without compromising efficacy. These innovations allow for consistent quality and scalability, aligning with consumer demands for transparency and ethical stewardship while mitigating supply chain risks.

Moreover, the convergence of digital commerce and omnichannel strategies has transformed how consumers discover, evaluate, and purchase daily chemical haircare. From AI-powered diagnostic tools embedded in e-commerce platforms to virtual consultations within salon ecosystems, brands are creating seamless journeys that bridge online and offline touchpoints. This integration enhances consumer engagement, drives loyalty, and accelerates product adoption in a market where convenience and connectivity are paramount.

Assessing the Cumulative Impacts of the 2025 U.S. Trade Tariffs on Daily Chemical Haircare Products Supply Chains and Pricing Disruptions

In March 2025, the U.S. implemented 25% tariffs on hair preparations (HS codes 3305.10.00–3305.90.00) affecting shampoos, conditioners, and styling products, significantly raising import costs and straining manufacturer margins.

On April 5, 2025, a baseline 10% tariff on all imports took effect under Section 301, with haircare ingredients from China facing rates up to 54%, compounding cost pressures and prompting reformulation or price adjustments by industry leaders.

The subsequent judicial ruling in V.O.S. Selections, Inc. v. Trump on May 28, 2025, suspended these broad-based “Liberation Day” tariffs, creating uncertainty and disrupting supply chain planning as manufacturers and distributors scrambled to recalibrate sourcing strategies.

Throughout this period of tariff volatility, haircare brands have responded by diversifying supplier bases, exploring regional ingredient hubs, and negotiating longer-term contracts to stabilize input costs and safeguard consumer access to affordable daily care products.

Unveiling Key Consumer, Product, Ingredient, Pricing, Channel, and Hair Concern Segmentation Drivers in the Daily Chemical Haircare Sector

Analysis of the daily chemical haircare market reveals that consumer preferences vary significantly based on the nature of the formulation. Products categorized under purely chemical formulations continue to dominate price-sensitive portfolios, while free-from variants-spanning paraben-free, silicone-free, and sulfate-free options-command stronger loyalty among health-conscious consumers. Natural organic lines, enriched with botanical extracts or plant oils, resonate particularly well with ethically driven segments, underscoring the enduring appeal of plant-derived actives and clean formulations.

Meanwhile, pricing tiers delineate distinct market strata, with mass offerings capturing broad volume, premium lines delivering elevated performance experiences, and luxury brands emphasizing indulgence and prestige. Consumer engagement channels also shape purchasing behaviors: convenience stores and pharmacies attract quick-need purchases, salons and specialty stores drive professional recommendations, online platforms deliver personalized discovery and subscription models, and large-format retailers cater to routine stocking. This multifaceted distribution landscape intersects with targeted product categories-from anti-dandruff and color protection treatments to damage repair, moisturizing, and volumizing solutions-to create nuanced portfolio strategies. Finally, gender segmentation underscores the growth of unisex formats and men’s-specific lines, reflecting evolving attitudes toward inclusivity and self-care across demographic groups.

This comprehensive research report categorizes the Hair Care Daily Chemical Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Price Tier

- Consumer Gender

- Distribution Channel

- Hair Concern

Regional Dynamics and Emerging Opportunities Shaping the Americas, EMEA, and Asia-Pacific Daily Haircare Chemical Product Markets

In the Americas, the daily chemical haircare market thrives on high consumer engagement with science-backed everyday essentials tailored to comfort and efficacy. Drugstore staples are being reformulated with elevated sensorial profiles, while mainstream brands integrate peptides and scalp-targeted actives to address diverse hair concerns. These trends have driven robust performance across mass and premium segments, with strong growth observed in omnichannel retail environments as digital and in-store experiences converge.

Across Europe, the Middle East, and Africa, regulatory frameworks and sustainability commitments have steered formulators toward greener chemistries and circular packaging models. In Western Europe, refillable salon programs and salon-professionally tested ranges underscore the region’s emphasis on quality assurance and environmental stewardship. Investment in automated R&D facilities, such as Unilever’s advanced robotics hub in Liverpool, further accelerates innovation while reducing time-to-market for bio-engineered ingredients and eco-friendly formats.

Asia-Pacific stands out as the fastest-growing region, where digital-first strategies and AI-powered diagnostic tools are rapidly proliferating. Consumers in markets such as the Philippines and Thailand have embraced virtual hair health assessments and personalized recommendations, boosting average basket values and repeat purchases. E-commerce platforms and social commerce channels anchor growth, enabling brands to scale customized offerings and subscription models with unprecedented agility.

This comprehensive research report examines key regions that drive the evolution of the Hair Care Daily Chemical Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Insights Highlighting Innovation, M&A, and Technology Leadership of Leading Daily Chemical Haircare Companies

L’Oréal Group has fortified its leadership in daily chemical haircare through strategic acquisitions and product innovations. The recent acquisition of the cult-favorite Color Wow brand enhances its science-driven portfolio, bringing high-performance formulations that leverage amino acids and peptides into mainstream distribution channels. Simultaneously, L’Oréal Paris Elvive’s Glycolic + Gloss collection underscores the company’s agility in translating skincare ingredients into haircare, delivering salon-quality shine via glycolic acid-infused systems exclusively through major retailers. Beyond product launches, L’Oréal Professionnel’s sustainable Source Essentielle line exemplifies the shift toward refillable salon-centric solutions with high naturally-derived ingredient content.

Unilever continues to harness its extensive R&D capabilities and brand equity to drive category growth. The Dove brand’s AI-powered Scalp + Hair Therapist offers personalized diagnostic experiences underpinned by dermatological expertise, while fiber-repair technologies powered by patented protein chaperones deliver progressive bond-strengthening benefits in shampoos, conditioners, and serums. These innovations are bolstered by Unilever’s Product Innovation Lab, where Smart Fibre Shield and Fibre Active Repair Science enable targeted delivery to reinforce vulnerable hair structures and sustain shine, setting a benchmark for efficacy and evidence-based claims.

Procter & Gamble, a stalwart of the mainstream segment, is accelerating its sustainability agenda and experimentations with format innovations. The recently launched Gemz waterless haircare system reimagines wash routines through single-dose, water-activated “gems” that minimize packaging waste and logistical burdens. Concurrently, Head & Shoulders’ BARE shampoo packaging uses 45% less plastic, exemplifying P&G’s commitment to circular design, while its Pantene brand continues to capture consumer attention and market share through targeted digital campaigns on high-growth platforms like Douyin.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hair Care Daily Chemical Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Amway Corp.

- Beiersdorf AG

- Church & Dwight Co., Inc.

- Coty Inc.

- Dabur India Ltd.

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Himalaya Wellness Company

- Johnson & Johnson Services, Inc.

- Kao Corporation

- Kenvue Inc.

- L'Oréal S.A.

- Marico Limited

- Natura & Co Holding S.A.

- Revlon, Inc.

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

Actionable Recommendations for Industry Leaders to Capitalize on Innovation, Resilient Supply Chains, Regulatory Compliance, and Sustainable Growth in Daily Chemical Haircare

To navigate the evolving landscape and sustain competitive advantage, industry leaders should diversify ingredient sourcing by establishing regional supply hubs and forging strategic partnerships with biotech innovators. Proactive investments in fermentation-based and lab-cultured actives will not only buffer against geopolitical tariff shocks but also align product portfolios with consumer demands for sustainable and ethically sourced formulations.

Companies must also accelerate compliance with emerging regulations by integrating rigorous safety assessments and transparent labeling practices into their development workflows. Early alignment with frameworks like the Toxic-Free Cosmetics Act will safeguard against reformulation disruptions and strengthen consumer trust in performance-driven free-from offerings.

Finally, embracing digital transformation is critical for both R&D and go-to-market strategies. Leveraging AI-driven diagnostics, personalized formulation platforms, and virtual consultation tools can drive deeper consumer engagement and streamline product innovation cycles. By coupling advanced analytics with omnichannel execution, brands can deliver differentiated experiences that resonate in a market defined by personalized efficacy and environmental accountability.

Comprehensive Research Methodology Leveraging Multi-Source Data Collection, Expert Interviews, and Rigorous Validation for the Daily Chemical Haircare Study

This study integrates a robust blend of secondary and primary research methodologies to ensure comprehensive and unbiased insights. Secondary research entailed a systematic review of reputable industry publications, regulatory filings, trade press, and company reports to capture macro-level trends, tariff developments, and innovation benchmarks across daily chemical haircare. This foundation was supplemented by real-time market intelligence platforms and publicly available import-export databases.

Primary research comprised structured interviews with key stakeholders, including formulation scientists, salon professionals, supply chain executives, and consumer advocates, to validate and enrich secondary findings. This qualitative engagement provided nuanced perspectives on product performance, regulatory readiness, and evolving consumer behaviors.

Data triangulation and rigorous validation processes underpinned the analysis, ensuring consistency across diverse sources. Findings were cross-checked against patent filings, regulatory updates, and cited real-world case studies to uphold accuracy. An editorial review by technical experts finalized the deliverable, guaranteeing that this report reflects the latest verifiable industry insights and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hair Care Daily Chemical Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hair Care Daily Chemical Products Market, by Product Type

- Hair Care Daily Chemical Products Market, by Ingredient Type

- Hair Care Daily Chemical Products Market, by Price Tier

- Hair Care Daily Chemical Products Market, by Consumer Gender

- Hair Care Daily Chemical Products Market, by Distribution Channel

- Hair Care Daily Chemical Products Market, by Hair Concern

- Hair Care Daily Chemical Products Market, by Region

- Hair Care Daily Chemical Products Market, by Group

- Hair Care Daily Chemical Products Market, by Country

- United States Hair Care Daily Chemical Products Market

- China Hair Care Daily Chemical Products Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding Insights on the Interplay of Innovation, Regulation, and Consumer Trends Shaping the Daily Chemical Haircare Market Trajectory

In conclusion, the daily chemical haircare sector stands at the intersection of technological innovation, regulatory evolution, and shifting consumer values. The integration of biotech-derived actives, AI-enabled personalization, and sustainable formulation practices has redefined product performance and consumer expectations. Regulatory milestones, such as the 2025 Toxic-Free Cosmetics Act and fluctuating tariff regimes, have introduced new imperatives around compliance and supply chain resilience.

Regionally tailored strategies and segmentation-informed portfolio planning will remain vital as brands navigate diverse market dynamics across the Americas, EMEA, and Asia-Pacific. Leading companies-L’Oréal, Unilever, and Procter & Gamble-have demonstrated the efficacy of combining strategic M&A, R&D investment, and digital engagement to maintain growth and drive category leadership.

Moving forward, stakeholders must embrace agility, prioritize ethical sourcing, and foster deeper consumer connections through transparency and performance. This balanced approach will empower industry players to capitalize on emerging opportunities and sustain long-term value creation in the competitive daily chemical haircare landscape.

Discover How to Access the Full Market Research Report and Engage Ketan Rohom for Customized Strategic Insights and Purchase Guidance

To secure the full market research report, which offers in-depth analysis, proprietary trend data, and strategic recommendations tailored to daily chemical haircare, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise can guide you through report highlights, answer any specific inquiries, and facilitate the purchase process. Unlock comprehensive insights to inform your strategic planning and maintain a competitive edge in this dynamic market.

- How big is the Hair Care Daily Chemical Products Market?

- What is the Hair Care Daily Chemical Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?