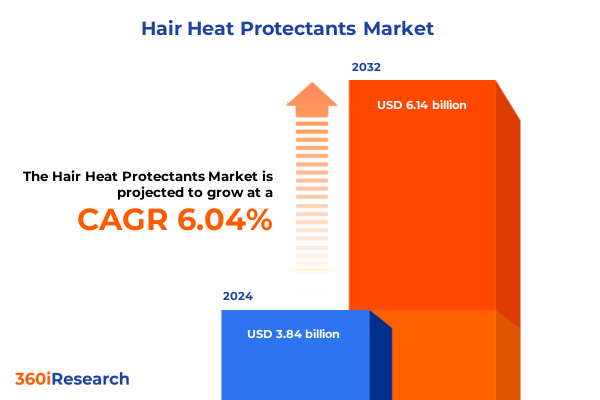

The Hair Heat Protectants Market size was estimated at USD 4.06 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 6.09% to reach USD 6.14 billion by 2032.

Unveiling the Strategic Role of Heat Protection Solutions in Modern Haircare Regimens to Navigate Evolving Consumer Preferences

Heat styling tools have become indispensable in personal grooming routines, yet their intensive use poses significant risks to hair health. As daily thermal treatments surge in popularity, the need for advanced formulations capable of mitigating damage while enhancing styling efficacy has never been greater. The opening section introduces the fundamental dynamics of heat protectants, emphasizing how these products are positioned at the intersection of performance and hair wellness.

Innovation in polymer technology and the rise of multifunctional ingredients have propelled heat protectants beyond mere safety measures into transformative styling aids. Beyond shielding hair from high temperatures, modern formulations aim to fortify cuticles, improve manageability, and impart gloss. This introduction explores how emerging consumer expectations around hair integrity and aesthetic results are shaping product development, distribution strategies, and brand narratives in what has become a fiercely competitive market. By framing the discussion in this context, readers gain clarity on why heat protectants are now a vital component of both everyday haircare regimens and professional styling arsenals.

Charting the Paradigm Shift in Hair Heat Defense as Technological Innovation and Sustainability Demands Reshape the Market Landscape

The landscape of hair heat protection has undergone seismic shifts driven by ever-evolving consumer demands and technological breakthroughs. What began as simple silicone-based sprays and serums has transformed into cutting-edge systems that leverage biopolymer blends, encapsulated silicones, and responsive-phase materials to deliver targeted defense. This section charts the trajectory of these developments, tracing how early generations of heat barrier products gave way to advanced formulations that address multiple dimensions of hair health.

Moreover, consumer awareness around ingredient provenance and sustainability has further catalyzed transformative change. Brands are now reformulating heat protectants to exclude controversial additives while incorporating plant-derived oils, antioxidant-rich extracts, and vegan-friendly polymers. Consequently, laboratory innovation is converging with green chemistry principles, redefining performance benchmarks and compelling legacy players to adapt or cede ground to nimble challengers. By examining these dual axes of technological innovation and ethical sourcing, this analysis highlights the market’s ongoing metamorphosis and sets the stage for understanding emerging competitive advantages.

Assessing the Multifaceted Effect of New United States 2025 Tariffs on the Dynamics of Hair Heat Protectant Sourcing and Pricing Structures

The implementation of new United States tariffs in 2025 has introduced a complex layer of considerations for manufacturers, distributors, and end users of heat protectant products. Tariffs applied to imported polymers, specialty silicones, and select botanical extracts have altered cost structures, prompting supply chain recalibrations. As a result, companies reliant on global sourcing networks face the dual challenges of mitigating price increases while preserving product efficacy and quality.

To navigate these headwinds, industry stakeholders are exploring alternative sourcing routes and intensifying domestic partnerships. Domestic polymer producers and regional ingredient suppliers have gained prominence, enabling certain brands to insulate themselves from external cost volatility. At the same time, R&D teams are accelerating efforts to reformulate without compromising performance, leveraging novel hydrocolloids, plant-based polymers, and advanced emulsification techniques. Ultimately, the tariff impetus is catalyzing greater agility and innovation, compelling manufacturers to rethink procurement strategies and prioritize resilient supply chains.

Illuminating Key Segmentation Perspectives to Understand Product Typologies Ingredient Innovations and Demographic Preferences in Heat Protection Market

An in-depth segmentation analysis reveals nuanced consumer preferences and performance expectations that vary across product formats, ingredient compositions, demographic cohorts, gender identities, and distribution channels. Product typologies encompassing cream, lotion, serum, and spray formats each deliver distinct tactile and application experiences, with creams and lotions often favored by those seeking leave-in conditioning benefits and serums or sprays preferred for lightweight, humidity-resistant finishes. Meanwhile, ingredient innovations such as antioxidants, botanical extracts, moisturizing and conditioning agents, protein and amino acids, and thermal barrier materials are driving differentiation. Within the moisturizing and conditioning category, conditioning agents provide structural support and manageability, while emollient oils offer slip and sheen. The thermal barrier segment is powered by advanced polymers that create invisible films, as well as specialized silicones that enhance heat dispersion.

Demographic segmentation further enriches market understanding. The 18–30 age group often prioritizes multifunctional products that can streamline complex styling routines, whereas the 31–50 segment values reparative benefits to counteract cumulative heat damage. Consumers above 50 increasingly seek scalp-friendly formulations that safeguard thinning strands, and under-18 users gravitate toward lightweight, non-sticky options that simplify styling without weighing down fine hair. Gender preferences also shape purchasing behavior: female consumers drive innovation in color-safe protectants that preserve vibrancy, while male consumers are fueling demand for quick-apply, non-greasy sprays aligned with minimalist grooming routines.

Finally, distribution channels play a pivotal role in product accessibility and positioning. Offline avenues such as convenience stores deliver impulse-driven purchases, whereas hypermarkets and supermarkets offer a broad array of mass-market heat protectants and promotional displays. Concurrently, online retail platforms provide extensive choice, subscription models, and direct-to-consumer personalization, empowering brands to engage digitally native shoppers. These combined segmentation insights equip industry leaders with a granular roadmap for tailoring product portfolios, messaging strategies, and channel investments to optimize market resonance.

This comprehensive research report categorizes the Hair Heat Protectants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Products Type

- Ingredients

- Age Group

- Gender

- Distribution Channel

Exploring Regional Nuances Across Americas Europe Middle East Africa and Asia Pacific to Uncover Local Drivers and Adoption Patterns

Regional dynamics exert a profound influence on how hair heat protectants are formulated, marketed, and consumed. In the Americas, demand is characterized by fast-paced innovation cycles, with North American consumers exhibiting high brand loyalty and receptiveness to premium, salon-quality formulations. Latin American markets, by contrast, show strong growth potential driven by emerging middle classes and a thriving professional salon ecosystem that values multifunctional protectants.

Within Europe, Middle East, and Africa, legislative frameworks around cosmetic safety and sustainability shape product development. Companies operating in EMEA often prioritize compliance with rigorous regulatory standards, leading to heat protectant lines that emphasize clean formulations and recyclable packaging. In the Middle East, hot climate considerations drive the formulation of humidity-resistant sprays, while in urban African markets, lightweight serums with UV protection are particularly valued.

Asia-Pacific presents a kaleidoscope of consumer needs, from the K-Beauty influences in South Korea that spotlight lightweight, water-based textures to the popularity of oil-enriched formulations in Southeast Asia’s humidity-intensive regions. Japan’s advanced research into novel silicones and encapsulation technologies often informs global innovation trends, whereas markets in India and Australia reveal a growing preference for botanical-infused formulations suited to diverse hair textures. These regional nuances underscore the importance of tailoring product attributes and marketing narratives to local expectations and environmental factors.

This comprehensive research report examines key regions that drive the evolution of the Hair Heat Protectants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Shaping the Evolution of Hair Heat Protectant Formulations and Market Strategies

The competitive arena for heat protectants is anchored by a blend of multinational corporations, specialized boutique brands, and disruptive startups. Major players with formidable R&D infrastructure continue to advance polymer science, scale multi-ingredient platforms, and secure strategic partnerships with salon chains to reinforce their market dominance. Concurrently, nimble innovators leverage agility to introduce cutting-edge natural extracts, proprietary encapsulation techniques, and high-impact social media campaigns that resonate with younger demographics.

Emerging companies are carving out differentiated positions through hyper-targeted formulations, such as vegan-certified, gluten-free, or fragrance-free protectants that address niche consumer concerns. Strategic alliances between ingredient suppliers and brand owners are accelerating the commercialization of next-generation thermal barrier agents, while contract manufacturers specializing in microemulsion technologies are enabling rapid product iteration. As the competitive landscape intensifies, brand equity is increasingly built on demonstrable efficacy, transparent ingredient sourcing, and immersive consumer experiences delivered through both digital and experiential marketing channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hair Heat Protectants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amika Beauty, Inc.

- CHI Corporation

- COLOR WOW Hair, Inc.

- Davines S.p.A.

- Farouk Systems, Inc.

- ghd Ltd.

- Henkel AG & Co. KGaA

- JD Williams and Company Limited

- Johnson & Johnson Consumer Inc.

- Kao Corporation

- Kevin Murphy Ltd.

- L’Oréal S.A.

- Moroccanoil Holdings Ltd.

- Nexxus, Inc.

- Paul Mitchell Systems, Inc.

- R+Co Inc.

- Revlon, Inc.

- Sebastian Professional, Inc.

- Shiseido Company, Limited

- The Estée Lauder Companies

- Unilever PLC

- VERB Products, LLC

- Wella AG

Crafting Actionable Strategies for Industry Leaders to Leverage Innovation Regulatory Trends and Consumer Insights in Heat Protectant Development

Industry leaders must adopt a proactive stance to capture value and outpace rivals in the dynamic heat protectant segment. Companies should consider investing in collaborative R&D ecosystems that unite material scientists, sustainability experts, and consumer behavior analysts to drive breakthrough formulations with minimized environmental footprints. Additionally, forging strategic alliances with domestic suppliers can reduce tariff exposure and enhance supply chain resilience, thereby preserving profitability in the face of geopolitical uncertainties.

Brands should refine their consumer engagement strategies by deploying data-driven personalization tools to recommend heat protectant formats tailored to individual styling routines and hair characteristics. Embracing omnichannel storytelling-leveraging in-salon demonstrations, targeted e-commerce content, and influencer partnerships-will amplify product visibility and foster brand authenticity. Furthermore, ongoing market scans for regulatory shifts and raw material innovations will ensure that product pipelines remain aligned with evolving standards and consumer expectations. By implementing these recommendations, industry players can strengthen competitive differentiation and sustain growth trajectories.

Detailing Rigorous Mixed Methodology Approaches to Data Collection Analysis and Validation Ensuring Comprehensive Insights Into Heat Protectant Trends

This research integrates both qualitative and quantitative methodologies to deliver a robust analysis of the hair heat protectant market. Primary data collection involved structured interviews with senior R&D executives, salon professionals, and brand strategists, complemented by surveys of end-users across key demographic segments. To ensure representativeness, fieldwork spanned multiple regions and distribution channels, with data quotas aligned to demographic and usage-frequency profiles.

Secondary research encompassed a thorough review of scientific literature on polymer science, clinical studies assessing ingredient efficacy, and public regulatory filings related to cosmetic safety. Competitive intelligence was gathered through patent analysis, investor presentations, and social media sentiment tracking. Data triangulation and validation processes were employed to reconcile discrepancies and enhance reliability, while statistical techniques such as regression analysis and conjoint modeling were applied to uncover purchase drivers and performance benchmarks. This mixed-methodology approach ensures that findings are grounded in empirical evidence and offer actionable insights for diverse stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hair Heat Protectants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hair Heat Protectants Market, by Products Type

- Hair Heat Protectants Market, by Ingredients

- Hair Heat Protectants Market, by Age Group

- Hair Heat Protectants Market, by Gender

- Hair Heat Protectants Market, by Distribution Channel

- Hair Heat Protectants Market, by Region

- Hair Heat Protectants Market, by Group

- Hair Heat Protectants Market, by Country

- United States Hair Heat Protectants Market

- China Hair Heat Protectants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Critical Takeaways on Market Dynamics Consumer Behavior and Innovation Pathways in the Hair Heat Protection Industry

The hair heat protection sector is at an inflection point where consumer expectations, regulatory landscapes, and technological capabilities converge to define the next wave of innovation. Key takeaways highlight the importance of advanced polymer blends and multifunctional ingredients that offer both protective and cosmetic benefits, as well as the critical role of ingredient provenance in building consumer trust. Additionally, the 2025 tariff environment underscores the necessity of adaptive sourcing strategies and domestic partnerships to preserve margins and maintain uninterrupted production.

Moreover, segmentation insights reveal that success hinges on aligning product formats and ingredient portfolios with specific demographic and usage patterns, while regional nuances demand localized formulation and marketing approaches. Competitive pressures from agile startups and established conglomerates alike call for a balanced emphasis on R&D collaboration, streamlined go-to-market strategies, and data-driven consumer engagement. In sum, companies equipped to integrate these strategic imperatives will be poised to lead the hair heat protectant industry into its next chapter of sustainable growth and innovation.

Engage with Ketan Rohom to Unlock Expert Guidance and Tailored Insights That Drive Strategic Decisions in Hair Heat Protection Purchasing

To secure a comprehensive understanding of the hair heat protection market and gain access to the full in-depth research report, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise ensures you receive tailored guidance on strategic positioning, competitor benchmarking, and consumer profiling, allowing you to translate insights into measurable business outcomes. Acts now to transform these findings into actionable plans that will fortify your brand’s competitive edge and accelerate growth in this dynamic sector.

- How big is the Hair Heat Protectants Market?

- What is the Hair Heat Protectants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?