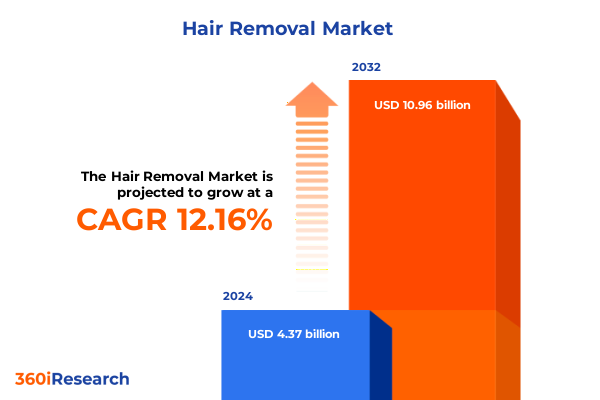

The Hair Removal Market size was estimated at USD 4.91 billion in 2025 and expected to reach USD 5.42 billion in 2026, at a CAGR of 12.14% to reach USD 10.96 billion by 2032.

Understanding the Dynamic Convergence of Consumer Preferences Technological Innovation and Market Complexity in Hair Removal

In an era where personal grooming and wellness have become essential aspects of everyday life, the hair removal sector stands at the forefront of innovation and consumer engagement. Heightened consumer awareness around aesthetics combined with a willingness to invest in advanced solutions has set the stage for a dynamic evolution across professional services and at-home technologies. As personal care routines shift from purely functional necessities to extensions of individual identity and self-expression, the demand for sophisticated and effective hair removal options is intensifying. Consumers today seek not only reliability but also convenience, safety, and alignment with broader lifestyle values such as sustainability and wellness.

Moreover, the proliferation of digital platforms has dramatically altered how hair removal products and services are researched, evaluated, and purchased. Social media influencers, online communities, and user-generated reviews play an outsized role in shaping consumer perceptions and driving trial. At the same time, professional clinics are leveraging digital channels to extend their reach through teleconsultations and subscription models that blend in-clinic expertise with at-home upkeep. Consequently, brands and service providers must navigate a complex ecosystem that spans retail, clinical practice, e-commerce, and digital content to capture the modern consumer’s attention and loyalty.

Transitioning from broad market observations to in-depth analysis, this executive summary will unpack the transformative shifts driving the industry, the cumulative impact of recent trade policy changes, critical segmentation nuances, regional dynamics, company strategies, and actionable recommendations. By synthesizing these insights, decision makers will be equipped to chart a forward-looking strategy that anticipates the next wave of innovation and consumer expectations.

How Technological Breakthroughs And Omnichannel Delivery Models Are Redefining Professional And At-Home Hair Removal Experiences

The hair removal landscape has witnessed profound shifts as technology, consumer behavior, and service delivery models intersect in novel ways. On one hand, established professional treatments like laser-based and electrolysis procedures have become more accessible as clinic operators invest in next-generation equipment boasting enhanced precision, reduced downtime, and integrated cooling systems. These clinical improvements have spurred increased adoption among consumers seeking long-term solutions, thereby raising the overall performance expectations across the market.

Simultaneously, the home-use segment has experienced a surge in innovation, with compact laser and IPL devices offering efficacy levels that were once exclusive to professional environments. Enhanced safety protocols, ergonomic design, and connectivity features that enable personalized settings have elevated the user experience, effectively blurring the lines between at-home convenience and professional-grade outcomes. Furthermore, the rise of smart grooming appliances-from epilators with skin-sensing technology to app-enabled electric shavers-demonstrates how the Internet of Things and artificial intelligence are being harnessed to deliver tailored treatments and real-time feedback.

Another pivotal transformation is occurring in distribution and service models. Direct-to-consumer brands are leveraging subscription and replenishment services for consumables like depilatory creams and pre-waxed strips, creating ongoing engagement and fostering brand loyalty. Meanwhile, omnichannel retailers are integrating in-store demonstrations, pop-up events, and digital try-on experiences to bridge the gap between physical and virtual shopping. As regulatory frameworks adapt to these new delivery paradigms, stakeholders must remain vigilant about compliance, data privacy, and professional accreditation requirements.

These converging trends are reshaping consumer touchpoints and raising the bar for quality, convenience, and personalization. In the sections that follow, we delve deeper into the specific drivers and strategic implications of these transformative shifts.

Examining The Broad Economic Consequences Of 2025 Trade Policy Adjustments On Hair Removal Supply Chains Pricing And Market Accessibility

In 2025, the United States implemented a series of tariff increases affecting a broad array of imported hair removal products and devices, from advanced laser modules to depilatory creams. Over the past year, these measures have cumulatively added import duties across multiple tariff lines, prompting supply chain recalibrations and cost-recovery strategies among manufacturers and distributors. Initially introduced to bolster domestic production and address trade imbalances, the tariffs have exerted upward pressure on landed costs, compelling stakeholders to reassess pricing structures and profit margins.

Consequently, several multinational brands have opted to absorb part of the additional costs to maintain competitive shelf pricing, leveraging economies of scale and vertically integrated manufacturing facilities. Others have expedited plans to relocate assembly operations closer to end markets or to source critical components from tariff-exempt partner countries. These strategic shifts, while mitigating immediate fiscal impacts, also require substantial capital investment and operational realignment. As a result, emerging and smaller players have faced heightened barriers to entry, with some realigning their portfolios toward lower-cost, non-tariffed consumables and services.

Moreover, distributors and specialty salons have adapted by recalibrating order volumes, extending payment terms, and renegotiating contracts to manage working capital more effectively. In parallel, trade associations have lobbied for tariff exclusions on specific medical-grade devices, arguing that such measures hinder innovation and patient access to advanced care. While legislative outcomes remain uncertain, the current policy environment has underscored the importance of supply chain resilience and strategic sourcing. Looking ahead, industry leaders must continue to evaluate the long-term implications of sustained tariff pressures, balancing cost management with the imperative to deliver value and maintain service excellence.

Uncovering Layered Market Segmentation Across Diverse Product Categories Delivery Formats Distribution Pathways And Distinct End-User Verticals

Comprehensive segmentation analysis serves as a vital lens through which market participants can align product development, marketing, and distribution strategies with evolving consumer needs. Based on product type, the landscape spans depilatory cream, electrolysis services, epilators, laser and IPL devices, shaving, and waxing. Electrolysis services are further categorized into home devices, which cater to consumers seeking permanent solutions in private settings, and professional services offered by certified technicians. Epilators similarly bifurcate into home devices designed for personal use and professional devices that deliver higher-intensity treatments. Laser and IPL devices encompass clinic-based installations that benefit from expert operation and home-use variants that prioritize safety and user-friendliness. Shaving is distinguished between electric shavers offering advanced blade technology and manual razors preferred for precision trimming. Waxing completes the product segmentation with hard wax, pre-waxed strips that simplify application, and soft wax favored for its adaptability to varied hair textures.

Based on procedure type, the dichotomy between permanent hair reduction and temporary hair removal reveals distinct consumer investment patterns and treatment cycles. Permanent hair reduction options, including electrolysis and laser-based systems, attract consumers willing to commit to multi-session regimens for enduring outcomes. Conversely, temporary removal methods such as shaving and waxing appeal to those prioritizing immediacy and minimal commitment, often fueling repeat purchases of consumables.

Based on distribution channel, the market extends across hypermarkets and supermarkets that offer mass-market visibility, online retail comprising brand websites, e-commerce platforms, and social commerce channels that drive digital engagement, pharmacies and drug stores that serve health-conscious consumers, salons and clinics that combine service delivery with product retail, and specialty stores that curate premium offerings. Each channel presents unique trade-offs between reach, experiential engagement, and margin structures.

Based on end user, segmentation differentiates between home use, where convenience and ease of adoption are paramount, and professional use, which incorporates aesthetic clinics, beauty salons, dermatology clinics, and medical spas. Providers serving professional use cases emphasize regulatory compliance, training, and equipment reliability, while home-use offerings prioritize intuitive design and thorough safety features.

This nuanced segmentation framework illuminates varied competitive dynamics and highlights opportunities for targeted innovation, tailored messaging, and optimized go-to-market strategies.

This comprehensive research report categorizes the Hair Removal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedure Type

- Distribution Channel

- End User

Analyzing Distinct Regional Market Drivers And Consumer Behaviors Spanning The Americas Europe Middle East & Africa And Asia-Pacific Markets

Regional dynamics within the hair removal sector are deeply influenced by cultural preferences, regulatory environments, and distribution ecosystems across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, elevated consumer spending power and extensive networks of dermatology clinics and med spas have fueled demand for professional-grade laser and IPL treatments. At the same time, retail channels ranging from large-format supermarkets to rapidly growing e-commerce platforms ensure broad access to both entry-level and premium home-use solutions.

Transitioning to Europe Middle East & Africa, diverse consumer attitudes toward hair removal-shaped by aesthetic norms and religious considerations-drive a complex market mosaic. Western European markets emphasize regulatory compliance and sustainability claims, prompting manufacturers to innovate with biodegradable waxes and dermatologically tested emulsions. Meanwhile, Middle Eastern markets, where hair removal holds significant cultural importance, exhibit high receptivity to premium salon services and emerging technologies, supported by fashion-forward urban cohorts. In Africa, nascent professional service networks and growing urbanization present an emerging opportunity for both portable devices and salon-based treatments.

In the Asia-Pacific region, rapid digital adoption and increasing beauty consciousness among younger demographics have accelerated uptake of home-use devices. Brands that integrate social commerce strategies and influencer partnerships effectively capture attention in markets with strong mobile-first behavior. Furthermore, evolving regulatory frameworks in key markets such as China, India, and Southeast Asian nations are beginning to standardize safety requirements for laser and IPL devices, fostering greater consumer confidence. Consequently, Asia-Pacific remains a hotspot for both multinational entrants and agile domestic innovators, as they compete on price, performance, and digital user experiences.

Collectively, these regional insights highlight the importance of customizing product features, marketing narratives, and channel strategies to local preferences and regulatory conditions while maintaining a cohesive global brand identity.

This comprehensive research report examines key regions that drive the evolution of the Hair Removal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Innovation Initiatives Partnerships And Competitive Positioning Among Leading Hair Removal Brands And Device Manufacturers

Leading players in the hair removal sector are differentiating themselves through a combination of technological innovation, strategic partnerships, and targeted brand positioning. Prominent consumer goods brands have expanded their grooming portfolios by integrating advanced components such as skin-sensing AI modules and rechargeable power systems into epilators and electric shavers, thereby enhancing performance and convenience. Simultaneously, specialized device manufacturers are forging alliances with aesthetic clinics to co-develop training programs and certification pathways, cementing their presence within professional channels.

In the realm of laser and IPL treatments, established medical device companies are investing in research and development to introduce next-generation pulse modulation and real-time epidermal cooling systems. These enhancements not only improve patient comfort and safety but also optimize energy efficiency, appealing to clinics seeking to reduce operating costs and environmental impact. At the same time, savvy consumer brands are leveraging direct-to-consumer platforms to launch competitively priced home-use laser devices that mirror professional capabilities, supported by robust digital tutorials and teleconsultation services.

Meanwhile, leaders in depilatory creams and waxing solutions have broadened their assortments by incorporating botanical extracts and hypoallergenic formulations, responding to heightened consumer demand for clean-label and dermatologist-recommended products. Driven by omnichannel marketing playbooks, these brands are harnessing social media influencers and targeted content marketing to cultivate brand communities and drive trial. Beauty salons and medical spas have reciprocated by bundling complementary product lines with service packages, fostering integrated consumer experiences that span purchase, application, and maintenance.

Collectively, these strategic maneuvers underscore a marketplace where convergence between consumer packaged goods companies and medical device innovators continues to accelerate, raising the competitive bar and catalyzing cross-industry collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hair Removal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerolase Corp.

- Alma Lasers Ltd.

- Asclepion Laser Technologies GmbH

- Candela Corporation

- Cutera Inc.

- Cynosure LLC

- Fotona d.o.o.

- InMode Ltd.

- Lasea Inc.

- Lumenis Inc.

- Lumenis Ltd.

- Lutronic Corporation

- Quanta System S.p.A.

- Rohrer Aesthetics

- Sciton Inc.

- SharpLight Technologies Inc.

- Solta Medical

- Syneron Medical Ltd.

- Vela Shape Inc.

- Venus Concept Inc.

- Viora Ltd.

Crafting A Holistic Growth Blueprint Through Innovation Supply Chain Resilience Sustainability And Digital-Centric Consumer Engagement

To thrive in this intricate hair removal ecosystem, industry participants must adopt a multifaceted approach that balances innovation, operational resilience, and consumer-centricity. Prioritizing research and development in user-friendly home devices that integrate advanced safety features and digital connectivity can unlock new revenue streams while addressing evolving consumer expectations for at-home experiences. At the same time, investing in certification programs and collaborative workshops with professional practitioners will deepen relationships within aesthetic and dermatological channels, reinforcing brand credibility.

Additionally, supply chain diversification is critical to mitigating the lingering effects of the 2025 tariff measures. Establishing regional assembly hubs and cultivating relationships with trusted component suppliers in tariff-exempt jurisdictions can reduce cost volatility and enhance agility. Parallel to these efforts, marketers should leverage data analytics and consumer insights platforms to refine segmentation strategies, delivering personalized messaging that resonates with both permanent and temporary hair removal audiences.

Operationally, embracing sustainability-through eco-friendly product formulations, energy-efficient device design, and reduced packaging waste-aligns with broader social expectations and can serve as a powerful differentiator. Moreover, forging digital-first omnichannel journeys, from social commerce activations to virtual try-on experiences, will be essential for capturing younger, digitally native cohorts. Finally, embedding voice-of-customer loops into product development and service delivery will ensure that businesses remain responsive to emerging pain points and preferences, fostering long-term loyalty.

By executing these strategic priorities in concert, industry leaders can position themselves to navigate regulatory headwinds, capitalize on technological breakthroughs, and deliver compelling value propositions across both consumer and professional markets.

Leveraging An Integrated Mix Of Qualitative Interviews Quantitative Surveys And Secondary Data Validation To Ensure Insight Accuracy

This research effort is grounded in a rigorous methodological framework designed to deliver robust, actionable insights. Primary research components include in-depth interviews with key stakeholders such as dermatologists, aesthetic clinic operators, salon owners, device manufacturers, and digital retail executives. These dialogues provided qualitative depth, uncovering nuanced perspectives on technology adoption, channel performance, and consumer behavior drivers.

Complementing these interviews, quantitative surveys were conducted among a representative sample of end consumers across major regions, capturing attitudes toward permanent and temporary hair removal solutions, purchase triggers, and brand perceptions. Secondary research leveraged authoritative sources including industry publications, regulatory filings, patent databases, and trade association reports to validate emerging trends and contextualize tariff policy developments. Publicly available customs and trade statistics were systematically analyzed to quantify the volume and value shifts precipitated by the 2025 tariff adjustments.

Data triangulation techniques were employed throughout the study to reconcile findings from primary and secondary sources, ensuring consistency and reliability. Segmentation frameworks were iteratively refined based on cross-validation exercises, while regional analyses were calibrated against macroeconomic indicators and localized regulatory standards. Finally, a series of expert review panels provided critical verification of key insights and ensured that the research narrative accurately reflects market realities and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hair Removal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hair Removal Market, by Product Type

- Hair Removal Market, by Procedure Type

- Hair Removal Market, by Distribution Channel

- Hair Removal Market, by End User

- Hair Removal Market, by Region

- Hair Removal Market, by Group

- Hair Removal Market, by Country

- United States Hair Removal Market

- China Hair Removal Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Discoveries To Illuminate The Strategic Imperatives Shaping The Future Of Hair Removal Solutions

The hair removal sector is undergoing a period of transformative evolution driven by technological breakthroughs, shifting consumer preferences, and complex trade policy environments. As professional and at-home solutions converge through innovations in laser, IPL, and smart grooming devices, the lines between clinical-grade performance and personal convenience are increasingly blurred. Segment-specific opportunities-from premium epilator launches to eco-conscious waxing formulations-underscore the imperative for stakeholders to adopt nuanced strategies that cater to both permanent and temporary hair removal modalities.

Regional variations in regulatory frameworks, cultural attitudes, and distribution networks highlight the importance of localized go-to-market approaches, while the ripple effects of 2025 tariff adjustments underscore the need for supply chain agility and strategic sourcing decisions. Leading companies are responding with partnerships that bridge consumer packaged goods and medical device expertise, as well as digital initiatives that enhance consumer engagement and professional training.

In sum, the roadmap ahead demands a balanced focus on innovation, operational resilience, and consumer-centricity. Stakeholders who align their portfolios with these strategic pillars-while leveraging robust segmentation and regional insights-will be best positioned to capture value and drive sustainable growth.

Seize the opportunity to elevate your competitive advantage by connecting with Ketan Rohom for tailored hair removal market intelligence

Are you ready to gain a competitive edge in the rapidly shifting hair removal environment? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure detailed insights that will power your strategic roadmap. By engaging directly with Ketan, you’ll receive personalized guidance on how this comprehensive market intelligence addresses your specific business challenges and growth opportunities. Don’t miss the chance to transform raw data into actionable strategy-connect today and unlock the full potential of your ambitions in the hair removal sector.

- How big is the Hair Removal Market?

- What is the Hair Removal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?