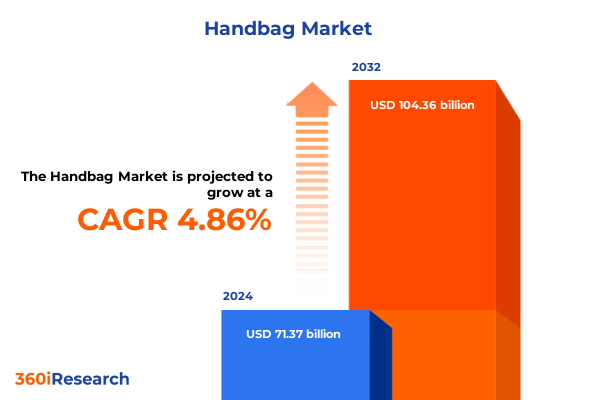

The Handbag Market size was estimated at USD 74.32 billion in 2025 and expected to reach USD 77.39 billion in 2026, at a CAGR of 4.96% to reach USD 104.36 billion by 2032.

Setting the Stage for the Handbag Market’s Modern Evolution Amid Consumer Empowerment, Digital Disruption, and Sustainable Innovation Trends

The global handbag industry sits at a fascinating crossroads where traditional craftsmanship converges with rapid technological innovation, shaping a market that demands both heritage and agility. Consumer expectations have transformed, prioritizing brands that not only deliver quality and style but also reflect values such as environmental stewardship and social responsibility. As digitization continues to redefine purchasing journeys, leading players are experimenting with immersive experiences, leveraging augmented reality and virtual showrooms to engage customers in ways previously unimaginable. At the same time, the resurgence of artisan techniques and limited-edition collections highlights a renewed appreciation for authenticity and personal expression.

Against this backdrop, companies must navigate a complex ecosystem of supply chain disruptions, evolving distribution channels, and shifting consumer demographics. Emerging markets are rising in prominence, altering global demand patterns, while established regions remain vital proving grounds for innovation in product design and marketing. Sustainability has moved from a peripheral concern to a central pillar of brand identity, inspiring investments across materials sourcing, production processes, and packaging solutions. This introduction sets the stage for a deeper exploration of the forces propelling the handbag sector forward, offering executives the context needed to interpret subsequent insights and recommendations with precision and clarity.

Identifying the Pivotal Forces Reshaping Handbag Market Dynamics Through Technology Adoption and Changing Consumer Behaviors

The handbag landscape has undergone seismic shifts in recent years, driven by a confluence of technological advancements and consumer behavior changes. Digital engagement now sits at the core of brand-to-consumer interactions, with social media platforms and influencer collaborations dictating trends as much as traditional fashion shows once did. Brands that invest in robust e-commerce infrastructures and personalized marketing campaigns are outpacing peers, creating seamless omnichannel experiences that blend physical and virtual touchpoints. Meanwhile, mobile commerce and emerging payment solutions have reconfigured the checkout process, enabling brands to capture impulse purchases at any time and place.

Simultaneously, sustainability has transitioned from a niche positioning strategy to a mainstream imperative. Consumers now expect transparency around the lifecycle of each bag, prompting designers to integrate recycled fabrics, responsibly tanned leathers, and biodegradable synthetics from the earliest stages of concept development. This heightened scrutiny extends to packaging, logistics, and end-of-life programs, compelling industry players to adopt circularity principles. At the same time, global supply chains are being redesigned for greater resilience, leveraging nearshoring and diversified supplier portfolios to mitigate the impact of geopolitical uncertainties and transportation bottlenecks.

Innovations in materials science and digital manufacturing techniques, such as 3D printing and laser cutting, are unlocking new possibilities for customization and rapid prototyping. These tools empower smaller brands and startups to compete alongside established houses, democratizing entry and fueling a surge of entrepreneurial creativity. As the industry chart shifts in real time, companies that embrace agility, transparency, and technological enablement will set the benchmark for the next era of handbag evolution.

Examining How 2025 Tariff Adjustments on Imports Have Reshaped Supply Chains, Pricing Strategies, and Competitive Positioning for Handbag Makers

In 2025, the introduction of adjusted import tariffs on handbag components and finished products has had far-reaching consequences for manufacturers and retailers alike. Suppliers that once relied heavily on cost-efficient production hubs have faced new pressures to reassess their sourcing strategies. Many have responded by diversifying supplier networks, seeking partnerships in alternative regions to balance cost constraints with quality standards. Other companies have accelerated investments in local and near-shore manufacturing facilities to reduce exposure to import levies and to gain closer oversight of production processes.

These tariff modifications have prompted brands to reevaluate pricing frameworks, resulting in strategic repositioning across price tiers. Luxury labels have absorbed a portion of new costs to preserve brand equity, while mass and mid-range brands have explored value engineering, optimizing material usage and trimming non-essential embellishments. Across the board, supply chain transparency has emerged as a competitive differentiator, with brands more openly communicating the impact of trade policies on product pricing and delivery timelines.

Distribution strategies have also evolved in response to tariff-induced volatility. Retailers are placing greater emphasis on local inventory holdings and dynamic replenishment models to mitigate stockouts tied to international shipping delays. Concurrently, digital channels have served as both a pressure valve and an opportunity playground, enabling brands to maintain continuity of supply through direct-to-consumer platforms and to capture shifting demand in real time. As 2025 unfolds, the cumulative effects of tariff adjustments continue to reverberate through strategic planning cycles, compelling industry stakeholders to balance cost optimization with resilience and customer expectations.

Unlocking Critical Segmentation Insights That Reveal Distinct Consumer Needs and Product Preferences Across Diverse Handbag Categories and Channels

A nuanced examination of market segmentation reveals the interplay between consumer profiles and product offerings across the handbag landscape. When considering the end user channel, retailers have harnessed direct consumer touchpoints to foster brand loyalty, while wholesale partners focus on bulk distribution and strategic retail placements. Gender segmentation underscores that women’s collections remain the centerpiece of most portfolios, even as an increasing number of unisex designs gain traction among consumers seeking versatility. Men’s lines, while smaller in scale, have carved out a space driven by functional and minimalist aesthetics.

Material distinctions further differentiate offerings, with leather retaining its status as the premium benchmark even as synthetic materials appeal to eco-conscious shoppers. Fabric variants, often seen in casual and travel-oriented designs, provide affordability and lightweight convenience. Price range segmentation highlights four distinct tiers: accessible introductory lines aimed at trend-driven purchases, premium ranges that balance quality features with attainable luxury, mid-range portfolios that cater to aspirational buyers, and high-end collections that showcase intricate craftsmanship.

Usage segmentation clarifies that business and formal categories command a strong presence in professional and special occasion contexts, while casual and travel styles cater to on-the-go lifestyles. Age-based preferences reveal that millennials and Generation Z consumers prioritize digital engagement and sustainable credentials, whereas Generation X and baby boomer cohorts often gravitate toward classic silhouettes and heritage brands. Product-type distinctions showcase how backpacks meet urban mobility needs, clutches and evening bags accentuate formal attire, crossbody and shoulder styles offer hands-free convenience, and satchels, totes, and hobo bags serve as all-purpose daily companions. Distribution channels further guide purchasing behavior: brand stores create an immersive environment for flagship experiences, department stores and multi-brand retailers drive discovery, specialty stores deliver curated expertise, and online platforms-both direct-to-consumer and marketplace-deliver unmatched convenience and reach.

This comprehensive research report categorizes the Handbag market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Gender

- Usage

- Age Group

- Distribution Channel

- End User

Revealing Regional Dynamics That Drive Handbag Demand and Innovation Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics play a pivotal role in shaping strategic priorities and product development roadmaps for handbag companies around the world. In the Americas, consumer demand is fueled by a robust appetite for digital engagement and omnichannel convenience, encouraging brands to refine their e-commerce platforms and offer seamless integration with physical retail outlets. North American shoppers often seek a balance between price efficiency and design innovation, prompting manufacturers to tailor collections that resonate with both urban professionals and suburban family segments. Latin America’s evolving middle class presents opportunities for mid-range and premium offerings, underscoring the importance of localized marketing strategies and flexible distribution networks.

Across Europe, the Middle East & Africa, established heritage brands continue to reinforce their dominance through artisanal craftsmanship and sustainability initiatives that reflect evolving regulatory and consumer expectations. In Western Europe, stringent environmental regulations drive material innovation, whereas the Middle East’s luxury market emphasizes exclusivity and bespoke services. Meanwhile, selective growth in Africa is propelled by urbanization trends, digital payments proliferation, and a burgeoning class of style-savvy consumers seeking aspirational brands.

The Asia Pacific region showcases some of the fastest growth trajectories, with digital-native consumers embracing mobile commerce and social shopping experiences. Influencer-led collaborations and limited-edition drops have become cornerstones of regional marketing campaigns, fueling demand for both international luxury houses and homegrown labels. Price sensitivity in emerging Asia is counterbalanced by demand for high-quality craftsmanship, encouraging brands to introduce tiered offerings that cater to affordability without compromising on aesthetics. Collectively, these diverse regional landscapes demand tailored approaches that reconcile global brand identities with local preferences and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Handbag market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Handbag Brands and Innovators That Are Shaping Industry Trends Through Design Excellence, Sustainability, and Digital Engagement

Leading handbag companies demonstrate a wide spectrum of strategic approaches, ranging from heritage-driven luxury houses to digitally native emerging brands. Established fashion conglomerates leverage decades of brand equity and distribution muscle to expand their omni-channel footprints, integrating flagship experiences with immersive digital storytelling. These players often spearhead innovation in materials, collaborating with sustainable technology firms to pilot eco-friendly leathers and plant-based synthetics that resonate with conscientious consumers.

Concurrently, direct-to-consumer pure plays are disrupting legacy models by bypassing traditional retail markups and investing heavily in customer data analytics. These brands excel in rapid trend responsiveness, employing micro-influencers and social media activations to refine product development cycles. Strategic partnerships between established names and these challengers illustrate a symbiotic exchange of design expertise and digital prowess.

Regional specialists are also rising, capitalizing on localized consumer insights to capture niche segments. By focusing on specific geographies or use-case categories, these companies can deliver highly tailored propositions, from luxury travel accessories to technical business totes. Collaborative ventures between fashion houses and tech startups are further shaping the landscape, enabling features such as integrated smart tracking, modular storage solutions, and AI-driven personalization. As these competitive dynamics continue to evolve, the market composition will increasingly favor nimble innovators and those that seamlessly blend legacy craftsmanship with forward-looking digital and sustainable initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Handbag market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ATP Atelier

- Baggit, Inc.

- Burberry Group PLC

- Caprese by VIP Industries Ltd.

- Cartier SA by the Swiss Richemont Group

- Chanel S.A.

- Da Milano Leathers Pvt. Ltd.

- Derek Alexander

- Dolce & Gabbana S.R.L.

- Fossil Group, Inc.

- Giorgio Armani S.P.A.

- Guccio Gucci S.p.A.

- H&M Hennes & Mauritz AB

- Hermès International S.A.

- Hidesign

- Lavie by Bagzone Lifestyles Private Limited

- Louis Vuitton Malletier SAS

- Michael Kors by CAPRI HOLDINGS LIMITED

- My Ladida Ltd.

- Myer Pty Ltd.

- Phillip Lim

- Prada S.P.A.

- Proenza Schouler

- PVH Corp.

- Ralph Lauren Corporation

- Rebecca Minkoff LLC

- Stella McCartney Group

- Strandbags Group Pty Ltd

- Sussan Group

- Tapestry Inc.

Driving Future Growth With Actionable Strategies That Enhance Operational Agility, Customer Engagement, and Sustainable Value Creation in Handbag Businesses

To thrive in today’s rapidly evolving handbag landscape, industry leaders must adopt a multi-pronged strategy that balances agility with long-term vision. Embracing digital transformation is paramount: brands should invest in advanced analytics to glean real-time consumer insights, enabling dynamic assortment planning and personalized marketing journeys. Deploying AI-powered recommendation engines across e-commerce platforms can enhance conversion rates and foster deeper customer loyalty. Simultaneously, expanding omnichannel reach through seamless integration of brick-and-mortar experiences and virtual showrooms will capture a broader share of consumer attention and drive incremental revenue streams.

Sustainability initiatives should be woven into every facet of operations, from material sourcing to end-of-life take-back programs. Companies can differentiate by obtaining credible third-party certifications and partnering with circular economy platforms that repurpose returned products. Supply chain resilience can be bolstered through diversified sourcing strategies, including nearshore manufacturing and strategic inventory allocations in key markets. These measures not only mitigate tariff and logistic risks but also strengthen brand narratives around ethical and responsible practices.

Finally, fostering collaborative innovation ecosystems will position brands at the forefront of market evolution. By co-creating with independent designers, material scientists, and technology startups, companies can unlock breakthrough features and tailored experiences that resonate with emerging consumer segments. Cultivating talent through cross-disciplinary teams ensures a steady flow of fresh ideas, while pilot programs allow rapid validation of new concepts before scaling. Executives who align these strategic imperatives with rigorous execution frameworks will secure sustainable growth and maintain a competitive edge in the dynamic handbag market.

Establishing Rigorous Methodological Frameworks That Ensure Data Integrity, Analytical Rigor, and Comprehensive Coverage in Handbag Market Research

Our research methodology integrates a combination of primary and secondary data collection techniques to ensure robust and reliable insights into the handbag sector. We conducted in-depth interviews with senior executives across manufacturing, retail, and distribution channels, complemented by consultations with material science experts and sustainability practitioners. These qualitative insights were reinforced by a comprehensive review of publicly available information, including industry publications, financial reports, and regulatory filings. To validate emerging trends and strategic pivots, we hosted expert roundtables that brought together designers, supply chain professionals, and digital commerce specialists.

Quantitative data points were triangulated through a multi-stage process involving cross-verification of import-export statistics, consumer surveys, and retail audit findings. Our analysis prioritizes accuracy and relevance, applying standardized quality-control protocols at each phase, from data acquisition to final reporting. The geographic scope spans key regions-covering North America, Latin America, Western Europe, Middle East & Africa, and Asia Pacific-to capture a holistic view of market dynamics and regional nuances. Through these rigorous methodological frameworks, the study delivers actionable insights and credible guidance for stakeholders seeking to navigate the handbag industry’s evolving landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Handbag market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Handbag Market, by Product Type

- Handbag Market, by Material

- Handbag Market, by Gender

- Handbag Market, by Usage

- Handbag Market, by Age Group

- Handbag Market, by Distribution Channel

- Handbag Market, by End User

- Handbag Market, by Region

- Handbag Market, by Group

- Handbag Market, by Country

- United States Handbag Market

- China Handbag Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Summarizing Strategic Insights and Market Implications to Guide Decision Makers and Stakeholders in the Handbag Industry Landscape

This executive summary has unpacked the critical forces shaping the handbag industry today, from technological disruption and shifting consumer behaviors to tariff-driven supply chain recalibrations. We explored how segmentation insights illuminate distinct preferences across end user channels, gender, materials, price tiers, usage occasions, age cohorts, product types, and distribution strategies, providing a detailed backdrop for targeted decision making. Regional deep dives highlighted the unique drivers at play in the Americas, Europe Middle East & Africa, and Asia Pacific, underscoring the need for tailored approaches that respect local market dynamics while maintaining cohesive brand narratives.

We have also highlighted leading companies that are successfully blending heritage craftsmanship with next-gen digital and sustainability initiatives, demonstrating the strategic value of innovation ecosystems. Actionable recommendations for executives emphasize the importance of advanced analytics, omnichannel integration, resilient supply chains, and circular economy partnerships. These imperatives, when aligned with rigorous methodology and continuous market monitoring, will enable organizations to seize emerging opportunities and mitigate evolving risks.

Ultimately, the handbag market’s complexity presents both challenges and potential for high-impact differentiation. By leveraging the insights and strategies outlined here, industry stakeholders can chart a course toward sustainable growth, enhanced brand equity, and lasting consumer loyalty in an ever-more competitive landscape.

Empowering Your Next Strategic Move in the Handbag Market With Expert Guidance and Exclusive Insights From Our Associate Director

For personalized guidance on translating these insights into tangible growth initiatives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His deep knowledge of handbag market dynamics and hands-on experience in crafting strategic partnerships will ensure you receive tailored recommendations that address your organization’s unique challenges. By collaborating with Ketan, you gain direct access to proprietary analyses and expert perspectives that can accelerate your decision-making process. Engage with an industry specialist who understands how to align product innovation, channel strategies, and consumer trends to maximize your competitive edge. Contact Ketan today to secure an exclusive preview of the full research report and plan your next steps toward sustainable success in the evolving handbag market.

- How big is the Handbag Market?

- What is the Handbag Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?