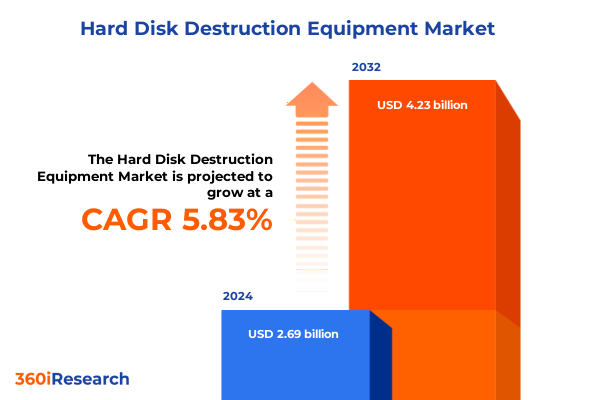

The Hard Disk Destruction Equipment Market size was estimated at USD 2.85 billion in 2025 and expected to reach USD 3.01 billion in 2026, at a CAGR of 5.81% to reach USD 4.23 billion by 2032.

Strategic Overview of Hard Disk Destruction Equipment Emphasizing the Critical Need for Secure End-of-Life Data Disposal in Modern Enterprises

The explosion of digital data across enterprises of all sizes has elevated the importance of secure end-of-life asset handling to an unprecedented level. Data breaches, cyber-theft, and corporate espionage pose severe financial and reputational risks, prompting organizations to adopt rigorous data destruction processes. In response, hard disk destruction equipment has emerged as a critical component of an overarching data security framework, helping businesses mitigate vulnerability exposure and comply with stringent privacy regulations.

As global regulatory bodies tighten requirements for protecting personally identifiable information and corporate intellectual property, the spotlight on hard disk disposal has intensified. Industries ranging from finance and healthcare to government and defense must ensure that decommissioned drives cannot be reconstructed or repurposed by malicious actors. Consequently, investment in robust infrastructure and proven destruction methodologies is now a top priority for security-minded decision-makers.

Drawing on a range of technologies, from mechanical shredding to magnetic degaussing, specialized equipment providers are innovating to deliver scalable, reliable, and cost-effective solutions. Against this backdrop of rising data volumes and evolving threat vectors, this report establishes the strategic context for understanding the trajectory of the hard disk destruction equipment market, setting the stage for an in-depth analysis of transformative shifts and emerging opportunities.

Emerging Technological, Regulatory, and Market Dynamics Reshaping the Hard Disk Destruction Industry’s Competitive and Operational Landscape

Over the past few years, the hard disk destruction equipment industry has witnessed a series of transformative shifts driven by advancements in automation, sustainability mandates, and heightened regulatory scrutiny. Innovative automation features, such as integrated feed systems and real-time diagnostic controls, are streamlining throughput and minimizing manual intervention. This increased efficiency is not only reducing operational costs but also enabling organizations to scale destruction services in response to growing data retirement demands.

In parallel, environmental considerations have become central to equipment design. Manufacturers are incorporating energy-efficient motors, recycled material construction, and eco-friendly lubricant systems to align with corporate sustainability goals. These green initiatives are complemented by strengthened global regulations, which now require certified disposal chains and documented audit trails. Meanwhile, rising geopolitical tensions have injected new complexity into supply chains, prompting buyers to seek diversified sourcing strategies to mitigate tariff volatility and component shortages.

Consequently, the competitive landscape is evolving toward strategic partnerships and consolidated service offerings. Companies capable of delivering turnkey solutions-complete with project management, compliance auditing, and equipment upkeep-are capturing a larger portion of enterprise contracts. This convergence of technology, regulation, and service integration is redefining market expectations and establishing new benchmarks for secure, efficient, and environmentally responsible data destruction.

Assessing the Comprehensive Effects of the 2025 United States Tariff Measures on Production Costs, Supply Chains, and Vendor Pricing Strategies

The implementation of new United States tariff measures in early 2025 has had a tangible impact on the hard disk destruction equipment market, particularly for devices and subsystems sourced from overseas manufacturers. As duty rates increased on key mechanical components and high-precision electronic modules, production costs for a broad range of shredders, degaussers, and disintegrators have risen. These incremental expenses have forced equipment vendors to reevaluate their global supplier networks and, in many cases, to pass a portion of the added costs onto end users.

Supply chain constraints have further compounded the situation, with some importers experiencing lead-time extensions due to customs processing delays. This has accelerated demand for domestically produced units and prompted certain manufacturers to invest in localized assembly lines. These strategic adjustments are aimed at buffering the impact of ongoing trade frictions and ensuring continuity of product availability for critical infrastructure operators.

Despite these headwinds, many suppliers are leveraging long-term contracts and hedging mechanisms to stabilize pricing. In addition, enhanced collaboration between procurement teams and equipment vendors is facilitating flexible pricing models that allow for volume discounts and maintenance-inclusive service plans. Moving forward, the ability of market participants to optimize supply chains and maintain transparent cost structures will be essential to preserving competitiveness under the current tariff regime.

Illustrating How Product Type, Operational Method, Drive Compatibility, Sales Channel, and Application Segmentation Reveal Nuanced Value Drivers in the Market

Segmenting the hard disk destruction equipment market by product type reveals distinct operational value propositions across crushers, degaussers, disintegrators, and shredders. Crushers offer a compact footprint suitable for on-premises destruction, while degaussers employ magnetic fields to eradicate data on high-density drives without physical fragmentation. Disintegrators combine mechanical and aspiration techniques to produce particulate output that is irreversible, and shredders excel at handling bulk volumes of mixed media, making them indispensable for large-scale data centers.

When examining operational methods, the contrast between automatic and manual equipment underscores a trade-off between throughput and human oversight. Automated solutions reduce the potential for handling errors and accelerate processing speeds, whereas manual devices allow for closer inspection and targeted destruction of specialized media. This dichotomy informs buyer decisions, with smaller organizations favoring manual flexibility and enterprise accounts gravitating toward automated, high-capacity lines.

Drive compatibility further refines market differentiation, with consumer-grade drives typically processed through mid-range degaussing and shredding apparatus, while enterprise-grade drives require heavy-duty disintegrators or multi-stage systems that guarantee complete data annihilation. Meanwhile, sales channels bifurcate into offline retail, where buyers can inspect equipment firsthand, and online retail, which streamlines procurement through digital storefronts and allows for comprehensive comparison shopping. Finally, applications span commercial use cases-such as financial and healthcare record disposal-and industrial environments that demand rugged equipment capable of handling non-standard media formats. These segmentation lenses collectively illuminate the nuanced drivers of purchase behavior and operational preferences across the market.

This comprehensive research report categorizes the Hard Disk Destruction Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Operational Method

- Drive Compatibility

- Technology

- Sales Channel

- Application

Uncovering Market Trends and Growth Catalysts Across the Americas, Europe Middle East and Africa, and Asia-Pacific Regions Driving Demand Differently

Regional dynamics across the Americas reflect a mature market driven by stringent data privacy laws and cost-efficiency imperatives. North American enterprises are rapidly adopting automated shredders and degaussers, supported by an ecosystem of service providers that offer end-to-end destruction and compliance verification. Latin American demand is emerging in response to rising cybersecurity threats and regional data sovereignty regulations, although budget constraints often steer organizations toward lower-cost, manual devices.

In Europe, the Middle East and Africa, regulatory coherence under frameworks such as GDPR is propelling consistent investment in certified destruction protocols. European companies frequently opt for disintegrators equipped with multi-stage filtration to meet zero-remnant standards, while Middle Eastern and African markets display a preference for modular crushers and degaussers that can be integrated into existing recycling workflows. Regional supply chain robustness varies, however, with some African markets still reliant on imports and subject to longer delivery timelines.

Asia-Pacific markets are characterized by dynamic growth as governments and large corporates in China, Japan, and Australia implement comprehensive data retention and destruction mandates. Automated, high-throughput shredders are especially popular in densely populated urban centers where data volumes are soaring. Simultaneously, cross-border trade complexities and local content requirements have driven international vendors to establish regional manufacturing hubs, enhancing availability and reducing lead times. Understanding these geographic nuances is critical for stakeholders planning market entry and channel strategies in each distinct zone.

This comprehensive research report examines key regions that drive the evolution of the Hard Disk Destruction Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positioning and Innovation Portfolios of Leading Manufacturers and Service Providers in Hard Disk Destruction Solutions

Leading organizations in hard disk destruction solutions have distinguished themselves through technology differentiation, service integration, and global distribution networks. Garner stands out for its modular crusher and shredder series that cater to both in-house and outsourced destruction models, supported by a strong network of certified maintenance partners. Shred-It, operating under Stericycle, provides a comprehensive suite of on-site destruction services that combine fleet-mounted shredders with digital chain-of-custody platforms, appealing to highly regulated sectors.

Hobart Shredders has invested heavily in R&D, introducing dual-mode systems that switch seamlessly between manual feed and automated bulk processing. This hybrid approach addresses the needs of mixed-media disposal while offering operational scalability. Sims Lifecycle Services, leveraging a global footprint, delivers an integrated asset management platform that tracks each drive from collection through final disposition, enabling detailed compliance reporting for multinational enterprises.

Emerging vendors such as G3 Systems are gaining traction with disruptive degaussing technology that reduces processing times by up to 30 percent. Meanwhile, EDL Technology’s portfolio emphasizes low-noise, high-efficiency motors, appealing to environments where acoustic and energy consumption considerations are paramount. Collectively, these companies are forging new pathways in product innovation and customer experience, setting benchmarks that will influence the trajectory of the market over the coming years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hard Disk Destruction Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ameri-Shred Corporation

- Data Security, Inc. by Telesis, Inc.

- ELCOMAN S.r.l.

- Enerpat

- Formax

- Garner Products, Inc.

- HSM GmbH + Co. KG.

- intimus International GmbH

- Multishred Inc.

- Nanjing Shanduan CNC Machine Tool Co.,ltd.

- Ontrack by KLDiscovery

- Phiston Technologies, Inc.

- Proton Data Security, LLC

- Pure Leverage Crushers

- SatrindTech Srl

- Schutte-Buffalo Hammermill, LLC

- Security Engineered Machinery Company, Inc.

- Shanghai Depei Security Technology Co., Ltd.

- Shred-Tech Corporation

- Shredders and Shredding Company

- SSI Shredding Systems, Inc.

- Suzhou Jiarui Machinery Co., Ltd.

- UNTHA shredding technology GmbH

- Vecoplan AG by M.A.X. Automation AG

- VS Security Products Ltd.

- Whitaker Brothers

- Zhejiang Supu Technology Co.,Ltd

Prioritized Strategic Initiatives for Industry Leaders to Optimize Security, Cost Efficiency, and Compliance in Hard Disk Destruction Operations

Industry leaders should prioritize investment in fully automated destruction lines to achieve both scale and consistency, reducing manual handling risks while improving throughput. By integrating real-time monitoring and diagnostic software, organizations can proactively address maintenance needs and prevent operational downtime. At the same time, adopting modular equipment architectures will enable nimble reconfiguration in response to shifting media types and volumetric demands.

To mitigate external cost pressures and tariff uncertainties, procurement teams must cultivate a diversified supplier ecosystem that includes domestic assembly capabilities and regional component suppliers. Establishing long-term agreements with multiple vendors can unlock volume incentives and minimize exposure to single-source dependencies. Additionally, forming strategic partnerships with certified destruction service providers offers a hybrid approach for organizations seeking rapid deployment without up-front capital expenditures.

Finally, embedding sustainability criteria into equipment selection-such as energy consumption metrics and end-of-life recyclability-will align data destruction operations with corporate environmental objectives. By maintaining rigorous documentation of destruction processes and leveraging digital chain-of-custody solutions, companies can demonstrate compliance with evolving regulations and foster trust among stakeholders. These prioritized strategic initiatives will drive greater security, cost efficiency, and regulatory confidence in hard disk destruction practices.

Detailed Overview of Research Design Including Data Collection, Stakeholder Consultations, and Analytical Techniques Underpinning Market Insights

The research underpinning this report combined extensive primary and secondary data collection to ensure robust and balanced insights. Primary research involved in-depth interviews with key stakeholders, including security officers, procurement managers, and technical specialists across multiple industries. These qualitative discussions provided firsthand perspectives on operational challenges, technology preferences, and purchasing rationales.

Secondary research encompassed a comprehensive review of industry publications, regulatory documents, and trade association guidelines. This phase also included analysis of patent filings and technical white papers to map emerging equipment capabilities. To validate findings, quantitative surveys were distributed to a representative sample of end users and channel partners, capturing data on deployment volumes, feature adoption, and service utilization patterns.

Data triangulation techniques were applied to reconcile information from disparate sources, while an advisory panel of subject-matter experts reviewed interim conclusions and offered contextual feedback. Analytical methods such as SWOT assessments, competitive benchmarking, and scenario planning were employed to interpret market dynamics. Together, these methodological pillars uphold the credibility and practical relevance of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hard Disk Destruction Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hard Disk Destruction Equipment Market, by Product Type

- Hard Disk Destruction Equipment Market, by Operational Method

- Hard Disk Destruction Equipment Market, by Drive Compatibility

- Hard Disk Destruction Equipment Market, by Technology

- Hard Disk Destruction Equipment Market, by Sales Channel

- Hard Disk Destruction Equipment Market, by Application

- Hard Disk Destruction Equipment Market, by Region

- Hard Disk Destruction Equipment Market, by Group

- Hard Disk Destruction Equipment Market, by Country

- United States Hard Disk Destruction Equipment Market

- China Hard Disk Destruction Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Core Findings Emphasizing the Imperatives of Security, Efficiency, and Strategic Adaptation in Hard Disk Destruction Practices

The overarching narrative of this market analysis underscores the imperative for organizations to balance the imperatives of security, efficiency, and compliance in hard disk destruction. Robust equipment selection, whether through crushers, degaussers, disintegrators, or shredders, must align with specific operational needs and regulatory frameworks. At the same time, the shift toward automation and sustainable design is reshaping vendor offerings and buyer expectations alike.

United States tariff measures introduced in 2025 have generated cost and supply chain complexities, yet they have equally catalyzed localized manufacturing and supplier diversification. The granular segmentation insights reveal that product type, operational method, drive compatibility, sales channel, and application all play critical roles in shaping purchasing decisions. Furthermore, regional variations across the Americas, Europe Middle East & Africa, and Asia-Pacific require tailored market approaches to address unique regulatory and infrastructure considerations.

Leading companies have responded with innovative portfolios and integrated service models, establishing new performance benchmarks for reliability, throughput, and sustainability. As the landscape continues to evolve, industry leaders must adopt strategic initiatives that reinforce security hardening, streamline cost structures, and ensure unwavering compliance. This synthesis of core findings offers a clear framework for decision-makers seeking to optimize data destruction operations in an era of heightened risk and regulatory complexity.

Connect with Ketan Rohom to Acquire the Comprehensive Hard Disk Destruction Equipment Market Research Report and Drive Your Secure Data Disposal Strategy

To seize a competitive edge and ensure the integrity of your organization’s data destruction strategy, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report on hard disk destruction equipment. Ketan will guide you through the report’s unique insights into technology adoption, regulatory landscapes, and regional demand dynamics that shape best-in-class data disposal operations.

Partnering with Ketan will provide you with bespoke advice on interpreting the report’s detailed analysis, enabling you to tailor procurement decisions, optimize operational workflows, and align security policies with the latest industry standards. Whether you seek to evaluate specific equipment innovations, navigate United States tariff implications, or benchmark vendor performance across multiple regions, this report is your definitive roadmap for practical implementation.

Don’t miss the opportunity to translate actionable intelligence into measurable outcomes-reach out to Ketan today to discuss pricing options, customization requests, and exclusive volume licensing arrangements. With his expertise and commitment to client success, you’ll gain not only a rich repository of market data but also a strategic partner dedicated to advancing your secure data disposal objectives. Elevate your data security posture now by engaging with Ketan Rohom and taking the first step toward a more resilient and cost-effective hard disk destruction program.

- How big is the Hard Disk Destruction Equipment Market?

- What is the Hard Disk Destruction Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?