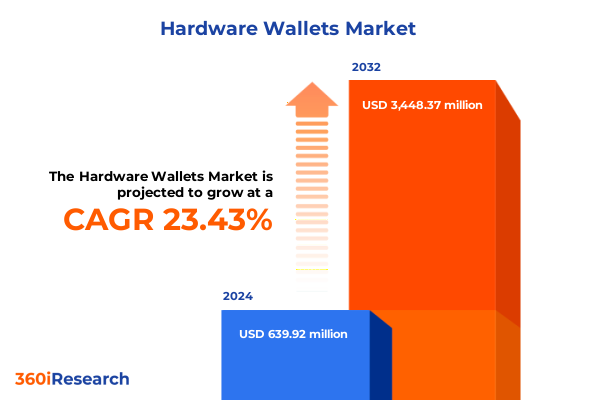

The Hardware Wallets Market size was estimated at USD 780.83 million in 2025 and expected to reach USD 956.91 million in 2026, at a CAGR of 23.63% to reach USD 3,448.37 million by 2032.

Setting the Stage for Security and Innovation as Hardware Wallets Become Cornerstones of Digital Asset Protection Worldwide

Over the past decade, hardware wallets have emerged as fundamental tools for securing digital assets against an increasingly sophisticated cyberthreat landscape. As decentralized finance protocols multiply and institutional participation intensifies, the demand for secure, user-friendly offline storage solutions has surged. This introduction outlines the critical role hardware wallets play in safeguarding private keys and complements software-based and custodial alternatives by offering an additional layer of isolation from potential network compromises.

By placing the emphasis on device-level security, hardware wallets have redefined best practices for asset protection. This section provides a concise overview of the evolution and significance of hardware wallets, framing the subsequent analysis of market drivers, regulatory impacts, segmentation insights, and regional dynamics. It sets the stage for understanding how manufacturers, service providers, and end users align in pursuit of robust cryptographic key management.

Accelerating Technological Advances and Consumer Demands Propel Hardware Wallets into a New Era of Decentralized Financial Security

In recent years, transformative shifts have reshaped the hardware wallet landscape in response to both technological breakthroughs and changing user expectations. Advances in microcontroller design have enabled manufacturers to integrate secure elements and tamper-resistant enclosures without compromising form factor or portability. At the same time, demand for seamless connectivity has led to the adoption of wireless communication standards, even as users continue to prize air-gapped isolation for the highest level of protection.

Concurrently, ecosystem-wide developments such as the proliferation of DeFi platforms and the tokenization of traditional assets have driven renewed interest in self-custody solutions. Hardware wallet providers have adapted by introducing multi-protocol support, enhanced user interfaces, and developer-friendly SDKs to facilitate broader integration. These trends underscore the dynamic interplay between security imperatives and usability enhancements that propel the market into its next growth phase.

Rising United States Tariffs in 2025 on Electronic Components Redefine Supply Chains and Cost Structures for Hardware Wallet Manufacturers

The imposition of higher tariffs on electronic components by the United States in 2025 has introduced new cost and supply chain considerations for hardware wallet manufacturers. With duties applied to imported semiconductors, printed circuit assemblies, and security chip modules, device producers must recalibrate sourcing strategies to mitigate margin pressures. In response, many have diversified procurement, seeking alternative suppliers in tariff-exempt regions and exploring domestic fabrication partnerships to maintain competitive pricing.

Moreover, the tariff environment has prompted a reevaluation of inventory management and logistics planning. Companies are increasing buffer stocks of critical components while negotiating long-term agreements to lock in favorable terms. Although these adjustments can add complexity, they also offer an opportunity to strengthen resilience and foster closer collaboration with upstream partners. As tariffs continue to influence cost structures, proactive supply chain optimization will remain a strategic priority for sustained operational efficiency.

Uncovering Diverse User Needs Through Multi-Dimensional Segmentation Across Device Types Connectivity Modes Form Factors Security Features End Users and Channels

A nuanced segmentation framework illuminates the full spectrum of user requirements and product capabilities within the hardware wallet market. When examining by type, the landscape is split between devices that are fully isolated from networks and those that maintain partial connectivity, enabling users to balance convenience with security. Connectivity modes further diversify offerings, encompassing wallets that leverage Bluetooth for mobile integration, NFC interfaces for tap-to-authenticate workflows, and traditional USB links for direct desktop communication.

Form factor distinctions cast light on usage scenarios, ranging from desktop units optimized for office setups to compact mobile formats designed for on-the-go transactions, as well as smartcard solutions that integrate seamlessly with existing security ecosystems. Meanwhile, security feature differentiation underscores the importance of biometric authentication, PIN protection, and two-factor authentication, each catering to varying tolerance levels for friction versus assurance. End user segmentation reveals divergent priorities: enterprise customers demand auditability, compliance, and multi-user management, whereas individuals seek intuitive interfaces and affordability. Finally, distribution channel analysis shows that offline purchases through authorized resellers and retail stores remain vital for trust-focused buyers, while online channels-whether via company websites or major e-commerce platforms-address the needs of digitally native customers.

This comprehensive research report categorizes the Hardware Wallets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Connectivity

- Form Factor

- Security Features

- End User

- Distribution Channel

Examining Regional Dynamics in Hardware Wallet Adoption Reveals Unique Growth Drivers Challenges and Strategic Imperatives Across Major Global Markets

Regional dynamics exert a profound influence on hardware wallet adoption patterns and strategic imperatives. In the Americas, robust institutional interest has spurred demand for enterprise-grade devices that integrate with cold storage vault services and custodial infrastructures. Regulatory clarity in key jurisdictions continues to bolster confidence among service providers and institutional advisors.

Across Europe, Middle East & Africa, a varied regulatory environment and heightened focus on data privacy have driven manufacturers to offer solutions compliant with stringent standards such as GDPR and local financial regulations. This patchwork of requirements has elevated the importance of customizable firmware and modular security architectures.

Meanwhile, Asia-Pacific markets are characterized by rapid consumer uptake, fueled by high mobile penetration and a proliferating retail ecosystem for digital assets. Partnerships with telecommunications providers and regional payment networks have accelerated integration, while localized support and multilingual interfaces underscore the region’s cultural diversity. Collectively, these regional insights highlight the need for tailored go-to-market approaches and product roadmaps calibrated to distinct regulatory, commercial, and consumer landscapes.

This comprehensive research report examines key regions that drive the evolution of the Hardware Wallets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Innovators and Strategic Partnerships Shape Competitive Advantage and Drive Differentiation Among Hardware Wallet Providers Worldwide

Within the competitive arena of hardware wallet providers, differentiation hinges on both technological innovation and strategic collaboration. Leading innovators have invested heavily in secure element R&D, forging partnerships with semiconductor foundries to co-develop customized chips that resist side-channel attacks. Others have pursued alliances with blockchain platforms to certify device compatibility and enhance support for emerging token standards.

Meanwhile, synergy between wallet manufacturers and cybersecurity firms has bolstered device vetting and penetration testing protocols, offering end users documented proof of resilience. Strategic alliances with key distribution partners-ranging from fintech platform integrators to premium electronics retailers-have allowed select companies to expand market reach and elevate brand visibility. As competition intensifies, these collaborative efforts and specialized product enhancements will continue to shape the competitive landscape and define the next frontier of differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hardware Wallets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anchor Labs, Inc.

- Ballet Global Inc.

- BitLox Limited

- Cobo Ltd.

- Coinkite Inc.

- CoolBitX Ltd.

- Cryptosteel Ltd.

- Cypherock

- Ellipal Limited

- GridPlus, Inc.

- HyperPAY Co. Ltd

- Ledger SAS

- Ngrave NV

- SafePal Ltd.

- SatoshiLabs s.r.o.

- SecuX Technology Inc.

- ShapeShift AG

- Tangem AG

- Tezos Foundation

- Trezor company s.r.o.

- Yanssie HK Limited

Strategic Roadmap for Industry Leaders to Enhance Security Integration Expand Market Reach and Foster Sustainable Growth in the Hardware Wallet Ecosystem

To navigate the evolving hardware wallet ecosystem, industry leaders should adopt a multifaceted strategic roadmap. Prioritizing the integration of advanced security modules such as biometric sensors and dedicated tamper detection will address the growing demand for zero-trust solutions. At the same time, expanding support for wireless protocols, including secure Bluetooth LE and NFC standards, will enhance user convenience without compromising device isolation.

Building resilient supply chains by forging relationships with geographically diverse component suppliers and qualifying secondary sources will help mitigate tariff-induced cost pressures. Additionally, segmenting go-to-market initiatives based on regional regulatory landscapes will ensure that product releases align with localization requirements and data protection mandates. Finally, investing in developer communities and open SDKs can drive third-party integration, creating ecosystem stickiness and unlocking new vertical use cases in sectors such as gaming, digital identity, and tokenized real estate.

Comprehensive Research Methodology Incorporating Primary Interviews Secondary Data Validation and Rigorous Triangulation Techniques for Robust Market Analysis

This analysis is grounded in a rigorous mixed-methods approach designed to ensure robustness and objectivity. Primary data were collected through in-depth interviews with hardware wallet executives, security researchers, and enterprise procurement officers, providing firsthand perspectives on product innovation and purchasing criteria. Supplementary primary research included structured surveys of end users across multiple geographies to gauge adoption drivers and barriers.

Secondary data validation drew upon public filings, white papers, patent databases, and academic publications to corroborate technology trends and component developments. To further strengthen findings, a triangulation process was employed, cross-referencing qualitative insights with industry event reporting and proprietary shipment databases. Throughout the methodology, adherence to strict data quality standards ensured that insights reflect the most current and relevant information available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hardware Wallets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hardware Wallets Market, by Type

- Hardware Wallets Market, by Connectivity

- Hardware Wallets Market, by Form Factor

- Hardware Wallets Market, by Security Features

- Hardware Wallets Market, by End User

- Hardware Wallets Market, by Distribution Channel

- Hardware Wallets Market, by Region

- Hardware Wallets Market, by Group

- Hardware Wallets Market, by Country

- United States Hardware Wallets Market

- China Hardware Wallets Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Key Findings Reinforcing the Strategic Imperative of Advanced Security Solutions and Outlining Future Paths for Hardware Wallet Innovation

In conclusion, hardware wallets occupy a pivotal position at the intersection of security, usability, and regulatory compliance within the digital asset ecosystem. The convergence of advanced enclaved processors, modular firmware, and evolving connectivity options underscores a market in the midst of maturation rather than infancy. As institutional adoption scales and consumer preferences diversify, hardware wallet providers must remain agile, balancing novel feature integration with supply chain resilience.

Key findings reinforce the strategic necessity of segmentation-driven product roadmaps that address distinct use cases-from enterprise vault solutions to mobile-first individual wallets-and underscore the importance of regional customization in both design and go-to-market execution. By adhering to best practices in security certification and partnership development, industry players can carve out sustainable competitive positions. Looking ahead, continued innovation in secure element architectures and ecosystem interoperability will chart the course for hardware wallet evolution.

Unlock Strategic Insights and Secure a Customized Hardware Wallet Market Report Today by Connecting with Ketan Rohom Associate Director Sales Marketing

To gain a competitive advantage and deepen strategic insights, connect directly with Ketan Rohom who can guide you through the full scope of the hardware wallet market report. By engaging with Ketan, you’ll receive tailored support in interpreting the analysis and identifying growth opportunities that align with your business objectives. Reach out today to secure your copy of the comprehensive research report and take the next step toward strengthening your market position

- How big is the Hardware Wallets Market?

- What is the Hardware Wallets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?