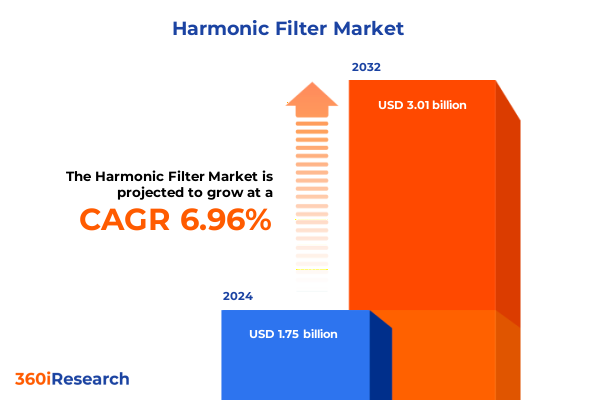

The Harmonic Filter Market size was estimated at USD 1.87 billion in 2025 and expected to reach USD 2.00 billion in 2026, at a CAGR of 6.97% to reach USD 3.01 billion by 2032.

Setting the Stage with Harmonic Filter Fundamentals, Market Drivers, Regulatory Pressures, and Technological Advances Defining Modern Power Quality Management

In today’s rapidly evolving energy and electronics landscape, maintaining power quality and mitigating harmonic distortion have become paramount concerns for a broad array of industries. Harmonic filters, which serve to attenuate unwanted frequencies and safeguard equipment integrity, are integral to ensuring operational reliability and efficiency. This report provides a foundational overview of harmonic filters, exploring their technical principles and the critical roles they perform across modern power systems.

Traditional passive filters have long been relied upon for their simplicity and robustness, but the rise of power electronics in renewable energy integration and industrial automation has underscored the limitations of conventional approaches. As power grids become increasingly complex, the need for advanced filter solutions that can dynamically adapt to fluctuating harmonics has intensified. This introduction sets the stage for understanding how harmonic filters have evolved beyond basic passive topologies, addressing both transient and steady-state distortion through improved control strategies.

Moreover, regulatory bodies worldwide are imposing stricter power quality standards, compelling manufacturers and end users alike to adopt more sophisticated filters to meet compliance requirements. With the proliferation of sensitive electronic equipment and the exponential growth of data centers, even minor deviations in waveform purity can result in significant performance losses and operational disruptions. This section establishes the critical context for the subsequent analysis, highlighting both the technological drivers and regulatory forces propelling the harmonic filter market forward.

Charting the Transformative Shifts in the Harmonic Filter Landscape, from Traditional Passive Architectures to Advanced Digital Solutions and Smart Grid Integration Trends

The harmonic filter landscape has witnessed transformative shifts as industries pursue higher efficiency and digital integration. While passive configurations remain cost-effective for mitigating lower-order harmonics, active filters leveraging digital signal processing have surged in popularity due to their real-time adaptability. Digital active filters enable precise compensation across a broad frequency spectrum, rendering them indispensable in applications where harmonic profiles are highly variable and demand agility.

Simultaneously, the convergence of power electronics and communication networks has catalyzed the development of smart filters embedded with monitoring and control capabilities. These intelligent solutions can detect harmonic anomalies and adjust compensation parameters autonomously, empowering operators to maintain optimal power quality without manual intervention. Cloud-based analytics further enhance predictive maintenance by identifying emerging distortion trends before they escalate into failures.

Another notable shift is the growing adoption of hybrid filter systems, which combine passive and active elements to balance cost and performance. By integrating passive components for stable base-load filtering and active modules for dynamic compensation, hybrid designs offer a versatile approach that addresses a wide range of harmonic challenges. As grid codes become more stringent and distributed generation resources proliferate, these transformative trends are reshaping the industry, heralding a new era of power quality management that intertwines robust hardware with intelligent software

Analyzing the Cumulative Impact of 2025 United States Tariffs on Harmonic Filter Supply Chains, Sourcing Strategies, Cost Structures, and Competitive Positioning

The introduction of a new tranche of tariffs by the United States in early 2025 has had a multifaceted impact on the harmonic filter sector. These measures, aimed at technologies deemed critical to energy infrastructure, have exerted upward pressure on component costs, particularly for semiconductor and passive filter substrates sourced from overseas. Consequently, many filter manufacturers have had to reassess sourcing strategies, balancing immediate cost increases against the long-term benefits of supply chain diversification.

In response to tariff-induced cost escalation, a number of companies have accelerated localization initiatives, establishing assembly facilities closer to key markets within North America. This has not only mitigated duty burdens but also shortened lead times and enhanced supply chain resilience. At the same time, suppliers have explored alternative material compositions and packaging methods to qualify for lower tariff categories, illustrating the industry’s agility in navigating regulatory complexity.

Despite these adjustments, the overall competitive landscape has become more polarized. Established players with robust global footprints have been better equipped to absorb cost shocks and maintain price stability, while smaller entities have faced margin compression and intensified pressure to innovate. As a result, tariff-driven realignment has emerged as a critical strategic consideration, prompting harmonics solution providers to refine their value propositions through both technology differentiation and operational efficiency.

Revealing Key Segmentation Insights by Filter Type, Application, Technology, Frequency Range, and Deployment for Holistic Understanding of the Harmonic Filter Market

Segmenting the harmonic filter market reveals nuanced insights across multiple dimensions that collectively shape product development and commercialization strategies. Based on filter type, active filters bifurcate into DSP filter and op amp filter configurations, each offering distinct advantages in terms of response speed and control precision. Passive filters encompass EMI filter, LC filter, and RC filter variants, addressing a spectrum of harmonic attenuation requirements through varied impedance characteristics and frequency roll-off profiles.

When viewed through the lens of application, aerospace and defense systems prioritize reliability and ruggedness, favoring filter solutions that can endure extreme environmental conditions. The automotive sector, increasingly electrified, demands compact, high-performance filters to ensure the seamless operation of inverters and charging infrastructure. In consumer electronics, the proliferation of smartphones and wearables underscores the need for lightweight, low-noise filtering modules. Industrial applications bifurcate into manufacturing and power generation domains, where harmonic mitigation supports both high-throughput production lines and grid-connected generator stability. Telecommunications infrastructure, with its critical uptime requirements, also relies on filter designs that maintain signal integrity under continuous operation.

Evaluating technology segmentation, analog filters retain appeal for cost-sensitive deployments, while digital filters-comprising DSP and FPGA-based solutions-are leveraged where adaptive compensation is paramount. Hybrid technology bridges these approaches, combining passive networks with active digital control to deliver adaptable, efficient performance. Across all solutions, frequency range segmentation-spanning all pass, band pass, band stop, high pass, and low pass filters-enables precise harmonic targeting. Deployment modalities further differentiate offerings, with hardware implementations delivered at board level or chip level, and software-centric solutions available via cloud platforms or on-premise installations. These segmentation insights inform tailored strategies for product roadmaps and market entry plans.

This comprehensive research report categorizes the Harmonic Filter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Filter Type

- Application

- Technology

- Frequency Range

- Deployment Type

Unveiling Key Regional Insights Across the Americas, Europe Middle East and Africa, and Asia-Pacific to Illuminate Geographic Trends in Harmonic Filter Demand and Innovation

Examining the harmonic filter market through a regional prism highlights divergent growth drivers and adoption patterns. In the Americas, robust infrastructure investments and accelerated deployment of renewable energy resources have propelled demand for advanced filter solutions. The United States’ emphasis on grid modernization and microgrid development has particularly spurred innovation in digital active filter offerings and hybrid systems that can interface with distributed generation assets.

The Europe, Middle East & Africa region is characterized by stringent power quality regulations and ambitious decarbonization targets. Countries across Western Europe are mandating tighter harmonic emission thresholds, prompting manufacturers to introduce high-precision filters compliant with international standards. In the Middle East, rapid urbanization and large-scale solar projects are increasing reliance on power electronics, driving interest in scalable filter architectures. African markets, while still emerging, are adopting modular filter solutions to address local grid instability and support electrification initiatives in remote areas.

In the Asia-Pacific, the convergence of manufacturing expansion and technological innovation underpins a dynamic landscape. China’s investment in electric vehicle infrastructure and smart factories has heightened the need for both passive and active filtering solutions. Japan and South Korea, with their advanced semiconductor ecosystems, are pioneering compact chip-level filters integrated directly into power conversion modules. Southeast Asian nations, balancing cost considerations with performance demands, are gravitating toward hybrid filters that offer versatility in rapidly evolving grid environments.

This comprehensive research report examines key regions that drive the evolution of the Harmonic Filter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Company Insights That Highlight Leading Players’ Strategic Moves, Portfolio Innovations, and Ecosystem Collaborations Shaping the Harmonic Filter Industry

A diverse array of companies is actively shaping the harmonic filter market through strategic partnerships, targeted acquisitions, and portfolio expansions. Established global conglomerates have focused on integrating digital control capabilities into their existing passive filter lines, leveraging internal semiconductor expertise to accelerate time-to-market. Conversely, specialist filter manufacturers are differentiating through granular innovation, developing proprietary DSP algorithms that optimize compensation across multiple harmonics simultaneously.

Collaborations between power electronics firms and software providers have also gained traction, resulting in integrated solutions that merge real-time monitoring with cloud-based analytics. This convergence has empowered users to transition from reactive maintenance models to proactive health management, reducing downtime and extending equipment lifespan. Meanwhile, several organizations have pursued bolt-on acquisitions of emerging filter startups to bolster capabilities in FPGA-based control and edge diagnostics.

In competitive landscapes, companies with vertically integrated supply chains have leveraged economies of scale to offer cost-competitive hardware solutions, while those emphasizing modular software architectures have captured interest among end users seeking scalable licensing models. As market participants navigate geopolitical uncertainties and evolving customer requirements, the ability to align technical differentiation with operational agility will be a key determinant of long-term leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Harmonic Filter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Arteche

- Comsys AB

- Danfoss A/S

- Delta Electronics Inc

- Eaton Corporation plc

- Emerson Electric Co

- General Electric Company

- Hitachi Energy Ltd

- KYOCERA AVX Components Corporation

- Larsen & Toubro Limited

- LPINZ

- Mesta Electronics LLC

- Mirus International Inc

- Mitsubishi Electric Corporation

- MTE Corporation

- Omron Corporation

- Phoenix Contact GmbH & Co KG

- REO AG

- Rockwell Automation Inc

- Schaffner Holding AG

- Schneider Electric SE

- Siemens AG

- TCI An Allient Company

- TDK Corporation

Providing Actionable Recommendations for Industry Leaders to Capitalize on Market Dynamics, Technology Advancements, and Regulatory Shifts in the Harmonic Filter Sector

Industry leaders seeking to capitalize on emerging market dynamics should prioritize the development of hybrid filter platforms that seamlessly integrate passive and active elements. By combining stable base-load attenuation with adaptive compensation capabilities, companies can offer versatile solutions tailored to diverse applications from renewable energy microgrids to industrial automation.

Diversification of manufacturing and assembly locations will be critical to mitigating the impact of trade-related cost fluctuations. Establishing localized production hubs in tariff-exposed regions will not only streamline logistics but also foster closer alignment with end-user requirements and regulatory conditions. In parallel, forging strategic alliances with semiconductor suppliers can secure preferential access to key power electronics components, preserving margin stability.

Investment in software-defined filtering, leveraging cloud-native analytics and machine learning, will unlock new revenue streams through predictive maintenance services and performance-based contracts. Organizations should also engage proactively with industry consortia and standards bodies to influence evolving power quality regulations, ensuring that emerging product roadmaps remain compliant and competitive. Through these targeted actions, companies can position themselves at the vanguard of harmonic filter innovation, driving sustainable growth in an increasingly complex market landscape.

Outlining the Research Methodology Employing Rigorous Data Collection, Qualitative Interviews, and Analytical Frameworks Underpinning the Harmonic Filter Market Study

This study employs a comprehensive research methodology that integrates primary and secondary data sources, ensuring robust and objective market analysis. Primary research involved in-depth interviews with senior executives from power electronics manufacturers, end-users in critical industries, and policy experts engaged in grid regulation. These qualitative insights were triangulated with quantitative data collected from public filings, technical whitepapers, and industry association reports to validate market trends and segmentation parameters.

Secondary research encompassed a thorough review of regulatory documents, standards publications, and conference proceedings to capture the latest developments in harmonic mitigation requirements. Proprietary databases and patent filings were analyzed to identify directional shifts in technological innovation, while trade statistics provided visibility into tariff dynamics and cross-border supply flows. The data synthesis process incorporated structured frameworks to assess drivers, restraints, opportunities, and threats, enabling a balanced view of market dynamics.

Analytical models were then applied to segment the market by filter type, application, technology, frequency range, and deployment type, ensuring that each category’s growth implications and competitive landscapes were accurately profiled. Rigorous validation steps, including peer reviews and sensitivity analyses, were conducted to confirm the reliability of findings. This multi-faceted approach underpins the credibility and depth of the insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Harmonic Filter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Harmonic Filter Market, by Filter Type

- Harmonic Filter Market, by Application

- Harmonic Filter Market, by Technology

- Harmonic Filter Market, by Frequency Range

- Harmonic Filter Market, by Deployment Type

- Harmonic Filter Market, by Region

- Harmonic Filter Market, by Group

- Harmonic Filter Market, by Country

- United States Harmonic Filter Market

- China Harmonic Filter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Crafting a Compelling Conclusion That Synthesizes Core Findings, Market Implications, and Forward-Looking Perspectives for Harmonic Filter Stakeholders

As industries worldwide grapple with escalating power quality challenges and tightening regulatory landscapes, harmonic filters have emerged as critical enablers of operational resilience and efficiency. The convergence of digital technologies, smart grid initiatives, and renewable energy integration has elevated the importance of dynamic compensation techniques, catalyzing innovation across active, passive, and hybrid filter solutions.

Moreover, the evolving tariff environment has underscored the necessity for agile supply chain strategies and localized manufacturing footprints. Companies that wield robust control over their component sourcing and production networks are better positioned to sustain cost competitiveness while delivering advanced filtering capabilities. Regional diversity in adoption patterns further indicates that market participants must tailor their offerings to meet distinct geographic requirements, from stringent European emission standards to Asia-Pacific’s manufacturing-led demand.

Collectively, the insights detailed in this report illuminate a market at a pivotal inflection point, where technological differentiation, regulatory compliance, and strategic agility converge. Stakeholders that internalize these findings and implement the recommended actions will be well-equipped to navigate uncertainty, harness growth opportunities, and steer the harmonic filter market toward a more resilient and innovative future.

Empowering Purchase Decisions with Expert Consultation from Ketan Rohom to Secure Comprehensive Harmonic Filter Market Intelligence and Strategic Guidance

Engaging with Ketan Rohom provides unparalleled access to in-depth expertise and tailored consultation for organizations seeking to harness actionable insights from the harmonic filter market. With a seasoned background in sales and marketing within technology research, Ketan can guide executives through the report’s comprehensive analysis, helping to align findings with your strategic objectives. By leveraging his strategic foresight and deep understanding of market dynamics, stakeholders will gain clarity on optimal entry points, sourcing strategies, and partnership opportunities.

Whether you are exploring digital filter architectures, evaluating supply chain resilience in light of recent tariff measures, or assessing emerging regional demand patterns, Ketan Rohom stands ready to provide personalized recommendations. His collaborative approach ensures that your organization can translate data-driven intelligence into practical initiatives, mitigating risks and capitalizing on growth opportunities. To secure this critical advisory service and access the full market research report, contact Ketan Rohom today and position your business to lead in power quality innovation.

- How big is the Harmonic Filter Market?

- What is the Harmonic Filter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?