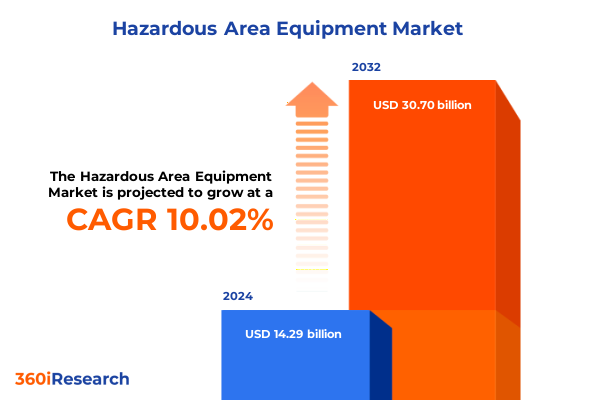

The Hazardous Area Equipment Market size was estimated at USD 15.72 billion in 2025 and expected to reach USD 17.29 billion in 2026, at a CAGR of 10.53% to reach USD 31.70 billion by 2032.

Framing the Evolution of Hazardous Area Equipment Through Safety Imperatives, Market Drivers, Fundamental Context, and Strategic Scope

Across industries ranging from oil and gas to pharmaceuticals, equipment engineered for hazardous environments forms the bedrock of operational resilience and personnel safety. These specialized solutions, encompassing robust enclosures, explosion-proof components, and intrinsically safe designs, function as critical barriers against fire, explosive atmospheres, and chemical risks. As global operations expand into more stringent regulatory territories, the foundational role of hazardous area equipment has never been more pronounced.

In recent years, technological advancements such as digital sensors embedded within explosionproof housings, real-time condition monitoring platforms, and integrated IIoT analytics have shifted the performance paradigm. Simultaneously, regulatory bodies including the National Electrical Code in the United States and updates to international standards like IECEx continue to raise safety benchmarks. Stakeholders must navigate this interplay of innovation and compliance, recognizing that effective equipment selection directly impacts both risk mitigation and long-term cost efficiency.

Strategic investment decisions today require a nuanced understanding of supply chain intricacies, component sourcing challenges, and the evolving vendor landscape. Manufacturers and end users alike are evaluating trade-offs between onshore production to circumvent tariff volatility and globally diversified procurement to leverage competitive pricing. By framing these considerations within the broader context of environmental sustainability and digital transformation, decision makers can better align procurement, engineering, and maintenance strategies.

This executive summary sets the stage for a comprehensive exploration of the hazardous area equipment sector. It unfolds key transformative shifts, examines recent tariff implications in the United States, uncovers segmentation and regional insights, highlights leading company strategies, and concludes with actionable recommendations alongside a concise methodology overview to guide stakeholders toward informed, strategic decisions.

Exploring How Digital Transformation, Evolving Safety Regulations, and Sustainability Imperatives are Redefining Hazardous Area Equipment Landscapes

In the wake of the fourth industrial revolution, the hazardous area equipment sector has experienced a marked integration of advanced digital technologies. Remote monitoring platforms now deliver continuous data streams from intrinsic safety sensors installed in high-risk zones, enabling predictive maintenance protocols that drastically reduce unplanned downtime. Likewise, networked explosion-proof lighting and control panels incorporate edge computing capabilities to analyze anomalies at the device level, ensuring faster response and enhanced reliability in mission-critical operations.

Parallel to technological acceleration, regulatory frameworks have undergone substantial revisions to address emergent hazards and align with international safety harmonization efforts. The latest National Electrical Code updates extend classification requirements to encompass battery energy storage systems in explosive atmospheres, while recent revisions to ATEX guidelines in Europe underscore the necessity for improved documentation and manufacturer traceability. These regulatory evolutions have prompted manufacturers to adopt modular design principles, facilitating rapid certification updates and streamlined compliance across multiple jurisdictions.

Moreover, environmental and sustainability imperatives are reshaping product design philosophies within the hazardous area equipment domain. Lower-carbon manufacturing processes, recyclable materials for enclosure construction, and energy-efficient LED-based explosionproof lighting reflect a growing commitment to reducing the sector’s environmental footprint. In addition, the rising demand for equipment compatible with hydrogen and ammonia-based process environments has driven materials innovation, ensuring resistance to embrittlement and corrosion under novel operating conditions.

Collectively, these transformative shifts are redefining competitive parameters, with digitalization, regulatory convergence, and sustainability acting as interlocking forces. As a result, stakeholders are increasingly prioritizing vendors that demonstrate agility in technology integration, proactive compliance management, and a clear environmental agenda. This confluence of factors establishes a new benchmark for product development and market differentiation in the hazardous area equipment landscape.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on the Supply Chain and Cost Structures of Hazardous Area Equipment

In early 2025, the United States government enacted additional tariff measures on imported electrical and mechanical components crucial for hazardous area equipment. These measures target aluminum enclosures, stainless steel fittings, and electronic control modules, raising import duties by up to twenty percent. As a consequence, original equipment manufacturers and system integrators face elevated procurement costs, compelling them to reassess vendor contracts and reevaluate total landed cost across their global supply chains.

Amid these developments, many stakeholders have accelerated onshoring initiatives to mitigate exposure to tariff volatility. By relocating certain production processes to North American facilities, manufacturers benefit from lower logistical complexity and reduced lead times. Nevertheless, this strategic pivot often comes at the expense of higher labor and compliance costs, particularly in regions with stringent occupational health and safety regulations. Consequently, firms are balancing the trade-off between tariff avoidance and the incremental expenses of domestic manufacturing.

Furthermore, distributors and end users must contend with potential price pass-through effects that could strain operational budgets in capital-intensive industries such as oil and gas and chemical processing. To preserve project viability, procurement teams are exploring alternative specification pathways-such as selecting protection techniques that rely on standardized components less affected by tariffs-or negotiating long-term supply agreements to lock in favorable pricing. These approaches require close collaboration between engineering, procurement, and finance functions to align technical requirements with evolving cost constraints.

Overall, the 2025 tariff landscape has triggered a strategic reevaluation of sourcing strategies, cost allocation, and supply chain resilience. By proactively analyzing component origin, tariff classifications, and manufacturing footprints, industry participants can develop more robust approaches to maintain competitive positioning while safeguarding operational continuity. In parallel, collaborative discussions between industry associations and trade authorities have emerged, seeking to classify critical component imports under less punitive tariff codes. These advocacy efforts aim to reduce the burden on safety-critical equipment and ensure continuity of essential services.

Unveiling Crucial Segmentation Insights Across Equipment Types, Protection Techniques, Industries, Certifications, and Area Classifications

Detailed examination across equipment categories reveals that demand for control panels and switchgear has surged as facilities streamline centralized monitoring and safety interlocks under unified management systems. Simultaneously, enclosures and barriers are increasingly tailored with customizable dimensions and modular clip-on assemblies, facilitating rapid deployment in retrofit projects. Innovation in explosionproof lighting solutions has prioritized energy efficiency and extended service life, while the integration of intelligent motors with real-time feedback loops has elevated asset performance in remote or automated processes. Furthermore, sensors leveraging intrinsic safety principles have become indispensable for detecting hazardous gas concentrations, and sophisticated valves and actuators enable precise flow control in volatile chemical environments.

When evaluated through the lens of protection techniques, encapsulation remains a foundational approach for sealing sensitive components against ingress, while explosionproof designs continue to dominate applications with the highest risk thresholds. Increased safety adaptations are gaining traction in jurisdictions where certification pathways favor mass-produced equipment with documented safety margins. Intrinsically safe circuits, which limit energy to prevent ignition, are particularly prevalent in wearable and portable device segments. Oil immersion enclosures serve niche high-voltage motor applications, and purged and pressurized systems have carved out a critical role in ensuring safe operations within enclosures housing complex electronics.

Analysis by end use industry highlights that the chemical and petrochemical sector maintains the largest installed base of hazardous area equipment, driven by stringent process safety standards. In food and beverage operations, stringent hygiene requirements have catalyzed adoption of stainless steel explosionproof solutions that facilitate washdown procedures. Mining operations rely on intrinsically safe sensors and motors to safeguard personnel in deep-earth and methane-prone environments. The oil and gas sector remains a cornerstone market, while pharmaceutical manufacturers demand rigorous traceability and cleanroom compatibility. Power generation facilities utilize robust protective enclosures for turbine control systems, and water and wastewater treatment plants deploy specialized pumps and actuators resistant to corrosive treatment chemicals.

Segmentation by certification underscores the competitive importance of ATEX accreditation in European markets, providing a gateway to cross-border compliance. CSA certification facilitates market access in North America, and IECEx approval offers a universally recognized benchmark for exporters. In addition, UL listings confer enhanced buyer confidence, particularly among end users seeking conformity with recognized safety standards.

Finally, classification insights reveal that equipment designed for Zone 1 environments captures the predominant share of installations, as this classification balances risk mitigation with installation cost considerations. Growth in Zone 2 equipment configurations reflects increased adoption in lower-risk peripheral zones, where preventative sensing and control strategies are evolving. Zone 0 applications, while limited to the most hazardous operations, nonetheless drive cutting-edge research into ultra-small form factor protective devices capable of continuous operation in the highest risk areas.

This comprehensive research report categorizes the Hazardous Area Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Protection Technique

- Area Classification

- End Use Industry

Mapping Strategic Regional Dynamics and Growth Drivers Shaping Hazardous Area Equipment Markets in the Americas, EMEA, and Asia-Pacific

Market dynamics within the Americas region are shaped by a robust emphasis on domestic energy production and infrastructure modernization. The United States leads demand for explosionproof control panels and intrinsically safe sensors, particularly in shale gas and petrochemical expansions. Canada’s stringent environmental regulations drive uptake of energy-efficient motors and enclosures designed for harsh arctic conditions. Meanwhile, industrial activities in Mexico have spurred investments in modular safety systems and prefabricated enclosures, as multinational firms seek to capitalize on nearshore manufacturing benefits while maintaining compliance with North American safety standards.

In Europe, Middle East, and Africa, regulatory convergence under ATEX directives continues to underpin market transformations. Germany and the United Kingdom, as technology hubs, are investing heavily in digital twin implementations for hazardous area equipment, pairing sensor-rich valves and actuators with advanced simulation platforms. In the Middle East, rapid growth in petrochemical and water desalination projects has fueled demand for explosionproof lighting and purging systems, often procured through turnkey EPC contracts. South Africa’s mining sector, grappling with deep-level operations, relies on intrinsically safe motors and monitoring systems to enhance worker safety and optimize extraction processes.

Asia-Pacific displays the most diverse growth drivers, where China’s manufacturing renaissance is augmented by domestic innovation in oil immersion transformers and modular barrier enclosures. India’s expanding pharmaceutical and chemical processing facilities generate demand for ATEX-equivalent certification pathways, prompting global vendors to establish local testing protocols. Southeast Asian economies invest in water and wastewater treatment infrastructure, incorporating corrosion-resistant sensors and actuators into evolving regulatory frameworks. Australia maintains leadership in resource extraction safety, with end users prioritizing intrinsically safe communication devices in remote mining sites, while Japan integrates industry 4.0 practices into power generation control systems.

Across all regions, emerging market participants are leveraging local partnerships, joint ventures, and licensing agreements to navigate complex certification requirements and optimize supply chain resilience. This geographically nuanced landscape underscores the importance of region-specific strategies and localized innovation to capture market opportunities and drive competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Hazardous Area Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global Manufacturer Strategies and Competitive Differentiators Driving Innovation in Hazardous Area Equipment

Global industry leaders have adopted distinct strategic approaches to capitalize on evolving customer needs and regulatory landscapes. ABB has expanded its portfolio of explosionproof motors and switchgear by integrating digital monitoring modules, enabling remote diagnostics and predictive analytics within a unified control ecosystem. The company’s investments in ultra-low power sensors align with current sustainability mandates by minimizing energy consumption across zoned applications.

Schneider Electric has prioritized modularity and interoperability as core differentiators, launching a plug-and-play enclosure system that accommodates diverse protection techniques without extensive rewiring. By embedding digital communication standards such as IEC 62443 within its control platforms, the firm ensures that cybersecurity and safety compliance requirements are addressed concurrently, providing a compelling value proposition to end users in critical infrastructure segments.

Siemens has focused on leveraging digital twin technology to accelerate product development cycles and optimize lifecycle management for hazardous area equipment. Through cloud-based simulation tools, the company offers clients the ability to validate system performance under varying operational scenarios, reducing time-to-market and enabling proactive maintenance strategies. This approach resonates strongly in sectors where unplanned downtime carries significant safety and financial implications.

Honeywell’s strategy emphasizes comprehensive service offerings, bundling equipment installations with remote monitoring agreements and certification support services. This full-spectrum model addresses common end user pain points associated with regulatory audits and maintenance scheduling. Eaton has differentiated its offerings by enhancing enclosure materials and sealing techniques, improving corrosion resistance and extending service intervals in harsh industrial environments. Emerson has introduced advanced valve control packages with embedded machine learning algorithms to refine process control in real time, reflecting a broader shift toward intelligent automation.

These leading companies illustrate a competitive landscape driven by digitalization, service innovation, and strategic product enhancements, setting benchmarks for market participants aiming to achieve sustainable growth and resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Hazardous Area Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Adalet

- Bartec GmbH

- Cortem Group

- E2S Warning Signals

- Eaton Corporation plc

- Emerson Electric Co.

- Extronics Ltd

- Federal Signal Corporation

- G.M. International S.r.l.

- General Electric Company

- Honeywell International Inc.

- Hubbell Incorporated

- Intertek Group plc

- Marechal Electric Group

- Mitsubishi Electric Corporation

- NHP Electrical Engineering Products Pty Ltd

- PATLITE Corporation

- Pepperl+Fuchs GmbH

- Phoenix Contact GmbH & Co. KG

- Phoenix Mecano AG

- R. Stahl AG

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- TE Connectivity Ltd

- Warom Technology Incorporated Company

- WERMA Signaltechnik GmbH + Co. KG

Delivering Actionable Strategies and Practical Roadmaps for Industry Leaders to Optimize Performance, Safety, and Compliance in Hazardous Area Equipment

Industry leaders should first evaluate the integration of smart sensor networks and predictive analytics within their existing hazardous area equipment portfolios. By retrofitting legacy enclosures with wireless-enabled sensor modules, organizations can unlock real-time visibility into environmental conditions and equipment health, reducing the likelihood of equipment failure and enhancing operational safety protocols. Early adoption of machine learning–driven anomaly detection can further streamline maintenance schedules and improve uptime.

Simultaneously, executives are advised to establish cross-functional committees that bring together procurement, engineering, and compliance teams to monitor tariff developments and certification updates. This collaborative approach ensures that design specifications remain aligned with shifting trade policies, mitigating cost escalation risks. Companies may also benefit from diversifying component sourcing by identifying suppliers in low-tariff jurisdictions or exploring in-region production partnerships to balance cost effectiveness with logistical agility.

Moreover, bolstering certification capabilities across ATEX, IECEx, CSA, and UL standards is critical. Investing in in-house testing facilities or securing priority partnerships with accredited laboratories can shorten product launch timelines and facilitate entry into new geographical markets. To complement technical measures, firms should engage in joint industry research initiatives addressing emerging hazards-such as hydrogen embrittlement-to future-proof product development roadmaps.

Finally, sustainability should be woven into every strategic decision. Transitioning to recyclable enclosure materials, optimizing energy consumption in lighting and motor systems, and aligning with environmental metrics will not only satisfy regulatory requirements but also resonate with ESG-minded stakeholders. By combining digital innovation, resilient supply chain strategies, rigorous compliance management, and sustainability commitments, organizations can drive operational excellence and secure competitive advantage.

Detailing Comprehensive Research Methodologies Including Data Collection, Expert Validation, and Analytical Frameworks for Insightful Outcomes

This research relies on a structured approach combining primary and secondary sources to ensure depth and accuracy. Primary investigation involved in-depth interviews with safety engineers, procurement managers, and regulatory specialists across key end use industries. These conversations provided firsthand insights into equipment performance challenges, sourcing considerations, and evolving certification priorities, underpinning the strategic analysis.

Secondary research encompassed a systematic review of regulatory documents, standards revisions, and technical publications. Key sources included the National Electrical Code updates, ATEX and IECEx guidelines, and white papers from industry associations. This phase validated qualitative inputs and offered a comprehensive overview of current regulatory trajectories and technological benchmarks without relying on restricted industry research portals.

Data triangulation formed a critical component of the methodology. Qualitative findings were cross-referenced against publicly available corporate filings, product catalogs, and case studies to verify claims and identify discrepancies. Quantitative data points-such as reported installation figures and component cost ranges-were collated from open source financial reports and government procurement records, ensuring transparency and reproducibility.

Analytical frameworks, including SWOT analysis, Porter’s Five Forces, and PESTLE evaluation, structured the interpretive aspects of the study. These models guided the assessment of market dynamics, competitive intensity, and macroeconomic influences, yielding actionable insights. Finally, iterative validation workshops with domain experts provided peer review, refining the conclusions and reinforcing the robustness of the research outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Hazardous Area Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Hazardous Area Equipment Market, by Equipment Type

- Hazardous Area Equipment Market, by Protection Technique

- Hazardous Area Equipment Market, by Area Classification

- Hazardous Area Equipment Market, by End Use Industry

- Hazardous Area Equipment Market, by Region

- Hazardous Area Equipment Market, by Group

- Hazardous Area Equipment Market, by Country

- United States Hazardous Area Equipment Market

- China Hazardous Area Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Future Decisions and Innovation in the Hazardous Area Equipment Sector

The overarching analysis underscores the convergence of digital transformation, tightening regulatory frameworks, and environmental sustainability as pivotal forces reshaping the hazardous area equipment landscape. Technological innovations-ranging from IoT-enabled sensors to modular control systems-drive new operational efficiencies while demanding agile compliance strategies to navigate evolving certification regimes. Simultaneously, trade policy shifts such as the 2025 United States tariffs have elevated supply chain considerations to the forefront of strategic planning.

Segmentation insights reveal that product differentiation based on equipment type, protection technique, industry application, certification, and area classification is crucial for targeting niche requirements and maximizing asset performance. Regional dynamics further emphasize the need for localized approaches, as market drivers and regulatory complexities vary significantly across the Americas, EMEA, and Asia-Pacific. Leading manufacturers demonstrate that competitive advantage stems from integrating digital services, expanding certification capabilities, and fostering sustainable practices.

The recommended strategic imperatives for industry leaders coalesce around four central themes: digital innovation, resilient sourcing, rigorous compliance management, and environmental stewardship. By aligning investments with these pillars, organizations can enhance safety outcomes, control costs, and unlock new market opportunities. As end users escalate performance and sustainability benchmarks, suppliers that proactively address these multifaceted demands will be positioned for enduring success.

In essence, this executive summary provides a cohesive framework for decision-makers to navigate the complex interplay of technology, regulation, and market forces. It serves as a roadmap for orchestrating informed strategies, accelerating innovation, and safeguarding competitive positioning in a rapidly evolving sector.

Connect with Associate Director Ketan Rohom today to Access the Full Market Research Report and Empower Strategic Decision-Making

To capitalize on the insights presented and gain comprehensive visibility into the hazardous area equipment sector, engage with Associate Director Ketan Rohom at your earliest convenience. Leveraging extensive industry expertise, Ketan can provide tailored guidance, facilitate access to proprietary data models, and arrange a detailed walkthrough of the full market research report. This collaboration will equip your organization with the actionable intelligence needed to refine procurement strategies, optimize product development roadmaps, and enhance regulatory compliance across multiple jurisdictions. Secure your competitive edge by partnering directly with Ketan Rohom to acquire the complete report, empowering your teams to make informed, strategic decisions that drive safety, efficiency, and long-term growth.

- How big is the Hazardous Area Equipment Market?

- What is the Hazardous Area Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?