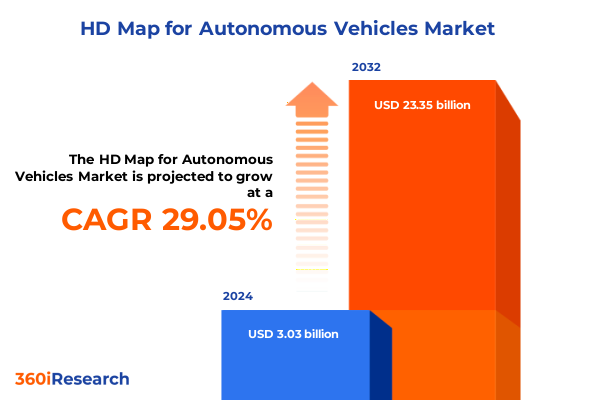

The HD Map for Autonomous Vehicles Market size was estimated at USD 3.85 billion in 2025 and expected to reach USD 4.90 billion in 2026, at a CAGR of 29.32% to reach USD 23.35 billion by 2032.

Understanding the Critical Role of High-Definition Mapping Infrastructure and Real-Time Data Integration in Enabling Safe and Precise Autonomous Vehicle Navigation

The advent of high-definition mapping represents a pivotal advancement in the journey toward fully autonomous mobility. By integrating centimeter-level accuracy with rich semantic data layers-encompassing road geometry, lane markings, traffic signage, and environmental context-HD maps empower vehicles to perceive and navigate the world with unprecedented precision. These sophisticated digital frameworks bridge the gap between raw sensor feeds and actionable driving intelligence, establishing a foundational infrastructure for safe and efficient autonomy.

Unlike conventional GPS-based navigation systems, HD maps are designed to augment onboard perception by providing advanced knowledge of upcoming road conditions, complex intersections, and dynamic traffic controls. As autonomous vehicles traverse ever-changing environments, the ability to refresh map data in real time ensures that the digital representation remains in lockstep with on-the-ground realities. This continuous synchronization is enabled through cloud connectivity and edge computing architectures, which funnel vast data streams from vehicle fleets into centralized map update platforms-ultimately enhancing the reliability of decision-making processes in live driving scenarios.

As we explore the multifaceted role of HD maps in autonomous vehicle ecosystems, the critical importance of robust data pipelines and resilient digital infrastructures becomes abundantly clear. With safety, scalability, and cost-efficiency at the forefront, understanding the underlying mechanisms and evolving capabilities of HD mapping is essential for stakeholders charting the future of mobility.

How Converging Technologies and Strategic Alliances Are Driving Transformative Shifts in the Autonomous Vehicle HD Mapping Landscape

The HD mapping landscape is being reshaped by a convergence of cutting-edge sensor technologies and strategic industry partnerships. Recent innovations in data pipelines have moved beyond traditional Gigabit Ethernet, with leading OEMs and technology providers adopting multi-Gigabit interfaces such as 2.5Gb Ethernet and Gigabit Multimedia Serial Link (GMSL) to accommodate the immense bandwidth demands of modern lidar and multi-camera arrays. These high-throughput connections ensure that vehicles can process high-resolution point clouds and image streams in real time, supporting continuous map updates and advanced perception functions without latency bottlenecks.

Simultaneously, the deployment of 5G networks is catalyzing a new era of HD mapping by delivering low-latency, high-bandwidth communications between vehicles and cloud-based map servers. This seamless connectivity enables on-demand retrieval of contextual road data and instantaneous uploading of newly sensed information-driving a dynamic, bidirectional flow of map intelligence that enhances situational awareness and route planning capabilities in densely populated urban centers and remote corridors alike.

Moreover, transformative alliances and mergers among automakers, tech firms, and mapping specialists are accelerating the fusion of domain expertise. By pooling resources, these collaborations are expanding global mapping footprints, refining semantic enrichment processes, and standardizing data formats to facilitate interoperability across multiple platforms. As a result, the HD map ecosystem is evolving into a cohesive, scalable network-one that underpins the next generation of autonomous services and mobility-as-a-service (MaaS) deployments.

Analyzing the Widespread Cumulative Impact of 2025 United States Tariff Policies on HD Map Components and Autonomous Vehicle Ecosystems

The cumulative impact of U.S. tariffs enacted in 2025 has reverberated across the HD map supply chain, exerting pressure on both component costs and strategic sourcing decisions. Major automakers like General Motors and Stellantis reported combined tariff-related hits exceeding $1.4 billion in the first half of the year, as duties on imported auto parts and electronics compressed profit margins despite robust domestic sales performance. Although many manufacturers have absorbed these costs for the time being, analysts warn that sustained tariff pressures will likely translate into higher prices for hardware-intensive systems, including HD mapping sensors and computing modules.

Tariffs levied under Section 301 on critical components such as LiDAR sensors, advanced radar modules, and semiconductor chips have increased procurement costs by an estimated 18–25%, further straining the business models of mapping service providers and system integrators. This escalation in input expenses has prompted several firms to reevaluate their global supply networks, shifting production toward tariff-exempt regions or investing in localized manufacturing partnerships to mitigate future duties.

In parallel, restrictive measures on automotive semiconductors are accelerating a broader trend toward regionalization of chip design and fabrication. While short-term disruptions may introduce pricing volatility and logistical complexity, industry leaders are leveraging this moment to deepen collaborations with domestic foundries and explore alternative architectures that reduce reliance on high-tariff components. These strategic responses underscore the resilience of the HD map sector but also signal a period of recalibration in global trade dynamics and technology sourcing strategies.

Comprehensive Insights into HD Map Market Segmentation Based on Application Data Source Service Type End User and Vehicle Type Dynamics

Insights into HD map market segmentation reveal a layered approach to understanding end-user requirements, technology preferences, and service demands within the autonomous vehicle domain. From an application standpoint, ADAS systems leverage lane-keeping, adaptive cruise control, and emergency braking modules to enhance driver safety, while Level 4 and Level 5 autonomous driving platforms depend on fully redundant, centimeter-level mapping for hands-free operation. Fleet management services focus on real-time asset tracking and route optimization, and emerging smart city projects employ infrastructure monitoring and traffic management solutions to integrate vehicle data with urban planning objectives.

Examining the market through the lens of data source types illustrates the vital interplay between hardware and crowdsourced intelligence. Infrared, mono, stereo, and surround cameras capture rich visual textures, whereas mobile phones and onboard sensors contribute vast volumes of crowd-sourced updates. GNSS constellations-including BeiDou, Galileo, GLONASS, and GPS-provide robust positioning backbones, complemented by mechanical, MEMS, and solid-state LiDAR platforms that generate detailed 3D point clouds. Long-range, mid-range, and short-range radar units offer redundancy, ensuring map reliability under adverse weather and lighting conditions.

Service-type segmentation underscores the critical importance of specialized expertise throughout the HD map lifecycle. Development activities encompass both custom solutions tailored to specific vehicle models and software toolkits designed for broad deployment. Hardware and system integration services bridge the gap between map data and vehicular platforms, while maintenance operations deliver ongoing feature enhancements and map refreshes that keep pace with evolving road environments.

End-user segmentation highlights distinct strategic needs: automotive OEMs-spanning both passenger car and commercial vehicle divisions-prioritize stringent quality and safety certifications, whereas government and municipal agencies leverage mapping insights for smart city initiatives and transportation department planning. Tech companies, including cloud providers and mapping service firms, focus on scalable data infrastructures, and Tier 1 suppliers such as sensor manufacturers and software vendors concentrate on modular solutions that integrate seamlessly into multiple vehicle architectures.

Finally, vehicle-type segmentation illustrates the diverse deployment scenarios for HD maps. Commercial vehicles, including buses and trucks, rely on optimized routing and highway automation functions. Logistics robots-ranging from delivery drones to warehouse AGVs-depend on precise indoor and outdoor positioning solutions, while passenger cars, including sedans and SUVs, demand an intuitive blend of safety features and user-centric navigation experiences.

This comprehensive research report categorizes the HD Map for Autonomous Vehicles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source Data Type

- Service Type

- Vehicle Type

- Application

- End User

Exploring Regional Dynamics Impacting HD Map Adoption Across the Americas Europe Middle East Africa and Asia-Pacific Autonomous Ecosystems

Regional dynamics play a pivotal role in shaping the adoption and evolution of HD maps for autonomous vehicles. In the Americas, the United States leads the charge, hosting over 250,000 paid robotaxi rides per week across multiple cities and serving as the proving ground for advanced mapping experiments. High-profile pilots by companies such as Waymo underscore the region’s commitment to data-driven mobility solutions, while Canadian and Mexican markets exhibit rapid growth fueled by government incentives and cross-border collaboration on smart infrastructure standards.

Across Europe, the Middle East, and Africa, regulatory frameworks and public investments are harmonizing to foster HD map integration within urban transportation ecosystems. Landmark initiatives like the European Union’s Intelligent Speed Assistance mandate have accelerated partnerships between automakers and mapping specialists, exemplified by the extended HERE–BMW collaboration that aligns SD, ADAS, and HD map layers to comply with NCAP safety protocols. Major metropolitan centers in Germany, France, and the UK are piloting real-time traffic management platforms that leverage map-derived insights for congestion reduction and environmental monitoring.

In the Asia-Pacific region, sweeping smart city deployments and large-scale autonomous vehicle trials are driving robust demand for high-definition mapping platforms. Government-backed pilot programs in China and South Korea are integrating HD map data into automated transit systems and logistics networks, while leading fleet operators in Japan are testing next-generation highway automation services. Growth projections exceed those of other regions, reflecting both the intensity of urbanization efforts and the strategic importance of HD mapping for regional mobility transformation.

This comprehensive research report examines key regions that drive the evolution of the HD Map for Autonomous Vehicles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Strategic Players and Innovation Leaders Shaping the Competitive HD Map Market for Autonomous Vehicle Navigation and Safety

The competitive landscape of the HD map market is defined by a combination of legacy mapping giants, semiconductor innovators, and AI-driven startups. HERE Technologies continues to dominate with its UniMap platform, providing unified SD, ADAS, and HD map layers to leading automotive brands while supporting compliance with evolving global safety regulations. As of early 2025, more than 220 million vehicles across Europe and North America rely on HERE’s AI-powered mapping stack for lane-level precision and real-time contextual updates.

NVIDIA has emerged as a key enabler through its DRIVE Mapping and DRIVE Localization solutions. By partnering with mapping leaders such as Baidu, TomTom, NavInfo, and Zenrin, NVIDIA’s multimodal engines fuse crowdsourced data and survey-grade ground truth to deliver continuous map updates. DRIVE Mapping’s MapStream interface facilitates over-the-air refreshes via vehicle sensor feeds, bolstering map freshness and operational safety for AV fleets worldwide.

Waymo leads in consumer-facing robotaxi services, averaging over a quarter-million rides weekly and leveraging proprietary mapping algorithms to optimize coverage across five U.S. cities. Its deep integration with Alphabet’s cloud infrastructure and OEM alliances accelerates the rollout of fully autonomous shuttles under controlled urban deployments.

Emerging innovators such as Wayve are challenging conventional mapping paradigms by focusing on AI-driven, camera-first localization that reduces dependence on LiDAR. The company’s partnerships with Nissan and Uber signal a potential shift toward lightweight, scalable mapping frameworks designed for rapid market entry and cost-effective deployment in Level 2 and Level 3 ADAS applications.

Intel-owned Mobileye is also making strategic advances in crowd-sourced map generation, leveraging its global ADAS installations to collect semantic data at scale. This combined hardware–software approach positions Mobileye as both an integrator and aggregator of real-world driving intelligence, offering a unique competitive edge in map accuracy and density.

This comprehensive research report delivers an in-depth overview of the principal market players in the HD Map for Autonomous Vehicles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Apple Inc.

- Aptiv PLC

- Autoliv, Inc.

- AutoNavi Software Co., Ltd.

- Baidu, Inc.

- Civil Maps, Inc.

- Dynamic Map Platform Co., Ltd.

- Esri, Inc.

- Fujitsu Limited

- HERE Global B.V.

- Hexagon AB

- Intel Corporation

- Mapbox, Inc.

- Momenta, Inc.

- NavInfo Co., Ltd.

- NVIDIA Corporation

- RMSI Ltd.

- Sanborn Map Company, Inc.

- Tencent Holdings Limited

- TomTom International B.V.

- Volkswagen AG

- Waymo LLC

- Woven Planet Holdings, Inc.

- Zenrin Co., Ltd.

Actionable Strategic Imperatives for Industry Leaders to Navigate Emerging HD Mapping Challenges and Capitalize on Autonomous Vehicle Opportunities

Industry leaders must diversify their sensor and data acquisition strategies to withstand ongoing trade tensions and component supply challenges. By establishing multi-regional procurement channels and partnering with domestic fabs for semiconductor and LiDAR production, firms can mitigate the impact of tariff-driven cost spikes while ensuring uninterrupted access to critical mapping hardware.

To maintain map relevance and rigor, organizations should invest in AI-powered update engines and edge-processing capabilities that enable continuous learning from vehicle fleets. Adopting scalable cloud architectures with integrated MapStream interfaces will help achieve near-real-time map refreshes and support dynamic rerouting, enhancing fleet efficiency and safety outcomes.

Cultivating alliances with both automotive OEMs and smart city agencies will unlock new data sources and regulatory support. Engaging in joint ventures for infrastructure monitoring, standardizing geospatial data exchange formats, and co-developing testbeds for HD map validation can accelerate technology commercialization and anchor long-term service agreements.

Finally, vendors should emphasize service excellence by offering modular integration toolkits, proactive maintenance packages, and feature enhancement roadmaps. This client-centric approach not only fosters retention among fleet operators and municipal authorities but also drives incremental revenue through specialized consulting, customized map layers, and ongoing performance benchmarking.

Rigorous Multi-Source Research Methodology Underpinning the High-Definition Map Market Analysis for Autonomous Vehicle Applications

This analysis draws on a hybrid research methodology that blends rigorous secondary data gathering with targeted primary investigations. Extensive desk research examined industry publications, regulatory filings, technology blogs, and financial disclosures to map the competitive terrain and identify prevailing technological trajectories.

Complementing this, primary interviews were conducted with senior executives from OEMs, Tier 1 suppliers, mapping specialists, and government transportation officials. These discussions provided qualitative insights into procurement strategies, integration hurdles, and future roadmap priorities across key markets.

Data triangulation techniques were employed to reconcile divergent market perspectives, ensuring that thematic conclusions are supported by multiple independent sources. Segmentation frameworks were validated through cross-referencing company-reported case studies, public pilot project reports, and industry consortium benchmarks.

Finally, an iterative review process involved peer evaluation by domain experts in autonomous systems, geospatial analytics, and trade policy. This quality assurance step affirms the accuracy, relevance, and strategic applicability of the findings presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our HD Map for Autonomous Vehicles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- HD Map for Autonomous Vehicles Market, by Source Data Type

- HD Map for Autonomous Vehicles Market, by Service Type

- HD Map for Autonomous Vehicles Market, by Vehicle Type

- HD Map for Autonomous Vehicles Market, by Application

- HD Map for Autonomous Vehicles Market, by End User

- HD Map for Autonomous Vehicles Market, by Region

- HD Map for Autonomous Vehicles Market, by Group

- HD Map for Autonomous Vehicles Market, by Country

- United States HD Map for Autonomous Vehicles Market

- China HD Map for Autonomous Vehicles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3975 ]

Concluding Reflections on the Future Trajectory and Strategic Imperatives of the HD Map Ecosystem in Autonomous Mobility

The HD map ecosystem stands at the crossroads of technological innovation, regulatory evolution, and strategic collaboration. As autonomous vehicles transition from controlled pilots to mainstream deployment, the imperative for precise, continuously updated mapping data has never been greater. Confronted with trade headwinds, competitive consolidation, and rapid sensor advances, stakeholders must navigate a complex interplay of cost pressures, performance demands, and integration challenges.

Looking ahead, success will hinge on the ability to engineer resilient, scalable mapping platforms that harmonize diverse data streams-ranging from lidar point clouds to crowd-sourced imagery-within unified, semantically enriched digital frameworks. Regulatory alignment, interoperability standards, and open data architectures will be essential to sustaining momentum and unlocking network effects across global AV ecosystems.

In this dynamic environment, the organizations that excel will be those that blend technical excellence with strategic foresight-investing in adaptive update mechanisms, forging cross-industry partnerships, and fostering agile innovation cultures. By anchoring their roadmaps in robust HD map infrastructures, they will be well-positioned to deliver safer, more efficient, and ultimately transformative autonomous mobility solutions.

Take the Next Step Toward Leveraging High-Definition Map Insights by Engaging with Ketan Rohom for Customized Market Research Solutions

For tailored insights that align directly with your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in high-definition mapping and deep understanding of autonomous vehicle ecosystems can help you unlock critical opportunities and address complex challenges. Engage with Ketan to explore customized market intelligence, discuss bespoke research options, and drive your organization’s next phase of growth through data-driven decision-making. Your journey toward leveraging comprehensive HD map insights begins with a conversation that could redefine your competitive edge and futureproof your autonomous mobility initiatives.

- How big is the HD Map for Autonomous Vehicles Market?

- What is the HD Map for Autonomous Vehicles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?