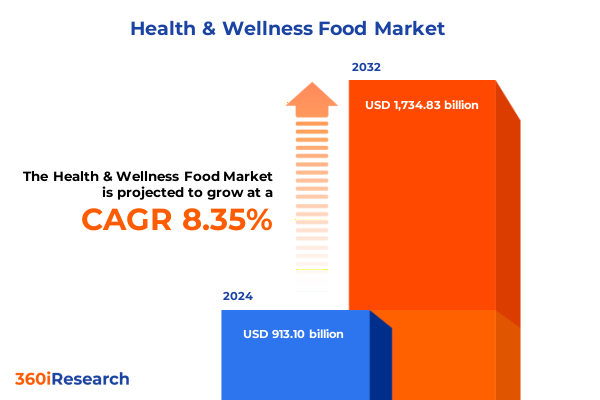

The Health & Wellness Food Market size was estimated at USD 985.97 billion in 2025 and expected to reach USD 1,065.34 billion in 2026, at a CAGR of 8.40% to reach USD 1,734.83 billion by 2032.

Exploring the Evolution of the Health and Wellness Food Sector Through Consumer Behavior, Innovation Drivers, and Regulatory Frameworks Shaping Industry Growth

The health and wellness food sector has entered a period of unprecedented convergence between evolving consumer lifestyles and rapidly advancing technological capabilities. In recent years, individuals have increasingly prioritized nutritional quality, preventive health measures, and personalized dietary solutions. This growing emphasis has propelled manufacturers and brands to rethink traditional approaches, ushering in a new era marked by targeted functional ingredients and tailored consumption experiences. As a result, the industry is now characterized by a dynamic interplay between innovation drivers and emerging regulatory frameworks that seek to balance product efficacy with safety and transparency.

Amid this transformation, a range of market forces is coalescing to shape the strategic landscape. On the supply side, advances in ingredient science and manufacturing processes are enabling the development of novel formulations, from microbiome-supporting prebiotics and probiotics to nutrient-enhanced beverages and fortified staples. Concurrently, digital health platforms and artificial intelligence tools are empowering consumers to make data-driven choices aligned with individual wellness goals. Regulatory bodies, meanwhile, are intensifying scrutiny on labeling claims and import protocols, reflecting rising concerns around efficacy and ingredient traceability.

By setting the stage with an overview of these core themes, this report provides a foundation for deeper exploration into the transformative trends, tariff impacts, segmentation nuances, regional differentiators, and competitive dynamics that define the health and wellness food ecosystem. Through a structured analysis, strategic recommendations and in-depth methodology, decision-makers will gain the clarity needed to navigate complexity and capitalize on growth opportunities.

Navigating the Pivotal Shifts Redefining Health and Wellness Food Markets: From Personalized Nutrition to Sustainable Sourcing and Digital Wellness Integration

Consumer expectations are rapidly redefining the health and wellness food landscape, prompting brands to pivot toward personalization and transparency like never before. Advanced analytics platforms now harness genomic and lifestyle data to deliver individualized nutrition plans, while ingredient traceability solutions leverage blockchain to foster trust and verify sourcing claims. These digital breakthroughs have given rise to an era in which product transparency is no longer a differentiator but a fundamental expectation.

Sustainability has emerged as another pivotal force, with players across the value chain integrating circular-economy principles to minimize waste and reduce carbon footprints. From compostable packaging innovations to regenerative agriculture practices, organizations are adopting holistic approaches that resonate with environmentally conscious consumers. At the same time, the growing prevalence of plant-based and alternative-protein formulations underscores a broader shift toward botanical ingredients, reflecting consumer demand for clean-label solutions and perceived health benefits.

Finally, strategic partnerships between food brands, technology providers, and research institutions are accelerating time-to-market for next-generation formulations. By co-innovating around novel delivery mechanisms-such as encapsulated bioactives and sustained-release matrices-industry leaders are charting new frontiers in efficacy and user experience. As the competition intensifies, agility in innovation and a commitment to sustainability will be the primary drivers of market leadership.

Assessing the Comprehensive Impact of 2025 United States Tariff Adjustments on Health and Wellness Food Import Dynamics and Supply Chains

The introduction of new United States tariff policies in early 2025 has substantially altered the cost calculus for imported health and wellness food ingredients. Tariffs applied across key categories-including botanical extracts, specialty oils, and functional additives-have reverberated through global supply chains, prompting both domestic and international stakeholders to reassess sourcing strategies. As import duties rose, manufacturers faced margin pressures that accelerated exploration of alternative origins and greater vertical integration of raw material production.

These tariff-induced cost pressures have yielded a notable uptick in regional ingredient sourcing partnerships. North American growers and processors are scaling rapidly to capture demand that formerly relied on lower-cost imports. While this localization trend enhances supply chain security, it has also sparked competition over limited cultivation capacity and premium-quality raw commodities. As a result, procurement teams must now navigate a more complex matrix of price volatility, quality variability, and logistical constraints.

In parallel, downstream effects are emerging among distributors and retailers, where pricing tensions have led to a flurry of promotional strategies aimed at maintaining consumer engagement. Reformulation efforts-driven by both cost considerations and label-cleanse initiatives-are underway, with R&D teams optimizing ingredient profiles to maintain product performance while mitigating expense. These cumulative impacts underscore the importance of agile sourcing, dynamic pricing models, and cross-functional collaboration in navigating the new tariff environment.

Uncovering Strategic Market Segmentation Insights Across Diverse Product Types, Ingredients, Packaging, Sources, Forms, Channels, End Users, and Applications

In examining market segmentation, it becomes clear that product type differentiation underpins strategic positioning, with dietary supplements, functional foods, and nutraceuticals each serving distinct consumer needs. Functional foods, for instance, extend beyond basic nourishment to encompass fortified staples, nutrient-enhanced beverages, and targeted prebiotic and probiotic solutions designed to support gut health. Ingredient sourcing further delineates market players, as brands align around animal-based proteins or plant-based alternatives to cater to evolving dietary preferences.

Packaging type also serves as a critical lever in consumer perception and brand identity, as choices between glass jars or bottles, metal cans, plastic containers, stand-up pouches, and tetra packs influence sustainability credentials and convenience factors. Meanwhile, product sourcing-whether from conventional agricultural systems or certified organic operations-adds another layer of consumer trust and willingness to pay premium prices. Form formats ranging from bars and capsules to liquids, powders, and tablets offer diversified consumption occasions, reinforcing engagement across different lifestyle contexts.

Choice of sales channel further fragments the market landscape, with offline routes such as convenience stores, pharmacies and drug stores, specialty food outlets, and supermarkets contrasted against online experiences delivered via both direct-to-consumer websites and third-party e-commerce platforms. End users span healthcare institutions-encompassing hospitals and wellness clinics-and individual consumers, including athletic enthusiasts and health-conscious individuals, each with unique purchasing drivers. From a functional perspective, applications cross clinical nutrition, general health maintenance, medical nutrition, sports performance, and weight management, while demographic segmentation captures adults, athletes, children, elderly consumers, and expectant mothers.

This comprehensive research report categorizes the Health & Wellness Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Packaging Type

- Source

- Form

- Sales Channels

- End User

- Application

- End User

Deciphering Regional Dynamics Shaping the Health and Wellness Food Ecosystem in the Americas, Europe Middle East Africa, and Asia Pacific Markets

A regional lens reveals distinct market dynamics shaping growth trajectories across major geographies. In the Americas, emphasis on clean-label transparency and sports nutrition continues to fuel innovation in the United States, while Canada’s aging demographic drives demand for clinical and medical nutrition solutions. Latin American markets, particularly Brazil and Mexico, are witnessing rapid expansion in online sales channels as digital infrastructure matures, opening new avenues for premium and niche wellness brands.

Within Europe, Middle East, and Africa, stringent regulatory frameworks around health claims and novel ingredients compel manufacturers to invest in robust scientific substantiation and local certification processes. Western European markets lead in sustainability adoption and fortified food integration, whereas Gulf Cooperation Council countries show strong interest in personalized nutrition initiatives. African markets, while more price-sensitive, present untapped potential in plant-based ingredient cultivation and functional beverage innovation.

Asia-Pacific dynamics are shaped by a confluence of demographic trends and cultural preferences. In China, functional foods fortified with traditional herbal ingredients are gaining traction among urban middle-class consumers. Japan’s mature market continues to invest in anti-aging and cognitive-support formulations, while India’s rising disposable incomes and growing health awareness drive an expanding supplements sector. Across the region, e-commerce platforms and social commerce integrations play a central role in consumer education and product trial.

This comprehensive research report examines key regions that drive the evolution of the Health & Wellness Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Enterprises Driving Innovation, Strategic Partnerships, and Competitive Positioning in the Health and Wellness Food Industry Landscape

Industry incumbents and emerging challengers alike are redefining competitive dynamics through strategic partnerships, portfolio diversification, and targeted acquisitions. Global ingredient conglomerates are leveraging R&D investments to introduce proprietary bioactive compounds, while co-manufacturers form alliances with biotech firms to expedite scale-up of novel delivery systems. At the same time, established food brands have entered the wellness arena via in-house innovation labs and venture arm investments focused on disruptive startups.

Smaller organizations are capitalizing on niche positioning by emphasizing specialized applications such as cognitive support and postbiotic formulations. These agile players frequently collaborate with academic institutions to validate efficacy claims, thus bolstering consumer confidence. Meanwhile, retailers and e-commerce platforms are forging exclusive product collaborations, tapping into direct-to-consumer models that offer rapid feedback loops and higher margins.

The competitive landscape is further influenced by M&A activity, as leading brands seek to fill portfolio gaps and accelerate entry into high-growth segments. Joint ventures with regional partners help navigate local compliance landscapes and adapt formulations to cultural preferences. Across organizational tiers, success hinges on the ability to integrate cross-functional capabilities-from ingredient sourcing and R&D to digital marketing and regulatory affairs-to deliver holistic solutions that resonate with diverse consumer cohorts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Health & Wellness Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Aleia's Gluten Free Foods, LLC

- Arla Foods Group

- Arnott’s Group

- Bob's Red Mill Natural Foods, Inc.

- Dairy Farmers of America, Inc

- Danone S.A.

- Dr. Schär AG / SPA

- Farmo S.P.A

- General Mills, Inc.

- Glanbia PLC

- Hearthside Food Solutions, LLC

- ITC Limited

- Laird Superfood, Inc.

- Mars, Incorporated

- McNeil Nutritionals, LLC by Johnson & Johnson Services, Inc.

- Meiji Holdings Co., Ltd.

- Nestlé S.A.

- Norside Foods Limited

- Nutri-Nation Functional Foods Inc.

- PepsiCo, Inc.

- Raisio Oyj

- Smithfield Foods, Inc. by WH Group Limited

- Tata Consumer Products Limited

- The Coca-Cola Company

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Unilever PLC

- United Natural Foods, Inc

- Yakult Honsha Co., Ltd.

Implementing Actionable Recommendations to Maximize Resilience, Innovate Product Portfolios, and Navigate Regulatory Challenges in Wellness Food Sector

To thrive in this dynamic environment, industry leaders must adopt agile sourcing strategies that mitigate tariff risk through diversified supplier networks and strategic inventory planning. By integrating digital supply chain visibility tools, organizations can anticipate disruptions, optimize logistics, and respond swiftly to cost fluctuations. Concurrently, investing in personalization platforms and data analytics capabilities will enable the delivery of tailored nutrition recommendations that meet rising consumer expectations.

Sustainability should be elevated from a marketing claim to an operational imperative. Companies can accelerate progress by partnering with regenerative agriculture projects, adopting circular packaging solutions, and transparently reporting environmental impact metrics. These measures not only bolster brand reputation but also unlock cost efficiencies over time. Additionally, forging research collaborations with academic and clinical institutions will strengthen product claims and expedite regulatory approvals, enhancing market credibility.

Finally, an omnichannel approach to distribution-balancing direct-to-consumer e-commerce models with strategic retail partnerships-will capture a broad spectrum of end users while maximizing margins. Leaders should also prioritize application-driven innovation in high-value areas such as sports performance, medical nutrition, and cognitive wellness, capitalizing on demographic shifts among aging and performance-focused populations. By aligning R&D, marketing, and operations around these priorities, organizations can secure competitive advantage and sustain long-term growth.

Illuminating the Research Methodology Behind Health and Wellness Food Trends Through Rigorous Qualitative and Quantitative Data Collection and Analysis

This analysis is grounded in a rigorous mixed-methods approach, beginning with extensive secondary research to map out industry structures, regulatory landscapes, and technology trends. Publicly available reports, trade statistics, and regulatory filings provided a comprehensive backdrop for understanding macro-level shifts and identifying critical data gaps.

To supplement these insights, in-depth primary research was conducted through structured interviews with a diverse range of stakeholders, including product developers, procurement specialists, retail buyers, and end-user focus groups. These qualitative discussions illuminated real-world challenges and validated thematic trends, offering nuanced perspectives that guided subsequent quantitative survey design.

Quantitative data collection involved a robust sampling strategy to ensure representation across company sizes, geographic regions, and application areas. Statistical analyses were performed to quantify adoption rates, feature preferences, and investment priorities, while cross-validation techniques reconciled primary findings with secondary benchmarks. Finally, a data triangulation process was applied to refine insights, ensuring that final conclusions and recommendations rest on a solid evidentiary foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Health & Wellness Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Health & Wellness Food Market, by Product Type

- Health & Wellness Food Market, by Ingredient Type

- Health & Wellness Food Market, by Packaging Type

- Health & Wellness Food Market, by Source

- Health & Wellness Food Market, by Form

- Health & Wellness Food Market, by Sales Channels

- Health & Wellness Food Market, by End User

- Health & Wellness Food Market, by Application

- Health & Wellness Food Market, by End User

- Health & Wellness Food Market, by Region

- Health & Wellness Food Market, by Group

- Health & Wellness Food Market, by Country

- United States Health & Wellness Food Market

- China Health & Wellness Food Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Concluding Insights Emphasizing Critical Themes, Strategic Imperatives, and Emerging Opportunities for Stakeholders in Health and Wellness Food Markets

As the health and wellness food sector continues to evolve, several critical themes emerge as drivers of future growth. Consumer demand for personalized, evidence-based nutrition is fostering deeper integration of data analytics and scientific validation into product development. Sustainability and ethical sourcing have transitioned from peripheral considerations to core strategic priorities, influencing decisions from ingredient selection to packaging design. Regulatory landscapes remain fluid, underscoring the need for proactive compliance and agility in formulation strategies.

Stakeholders should note the importance of granular segmentation, as product type, ingredient origin, form factor, and sales channel each present distinct pathways to value creation. Regional nuances highlight that local consumer preferences, demographic trends, and regulatory frameworks will shape product acceptance and success. Competitive dynamics reflect intensified collaboration between ingredient innovators, technology providers, and food brands, with agile players gaining traction through targeted niche positioning.

Ultimately, organizations that integrate holistic insights-from tariff impact analysis to segmentation deep dives and regional profiling-will be best positioned to anticipate market shifts and capitalize on emerging opportunities. By aligning strategic planning, operational execution, and investment priorities around these insights, industry leaders can establish resilient, forward-looking roadmaps that deliver sustainable performance.

Engage with Associate Director Sales Marketing to Secure Comprehensive Market Research Report Delivering Actionable Intelligence for Strategic Decision Making

If you’re ready to harness the full depth of insights into consumer behavior, regulatory shifts, and competitive dynamics shaping the health and wellness food sector, reach out today to secure your copy of the definitive market research report. Ketan Rohom, Associate Director of Sales & Marketing, is available to discuss how this comprehensive intelligence package can be tailored to your organization’s strategic priorities and provide the actionable guidance you need to drive growth, mitigate risk, and outperform competitors in this rapidly evolving marketplace.

- How big is the Health & Wellness Food Market?

- What is the Health & Wellness Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?