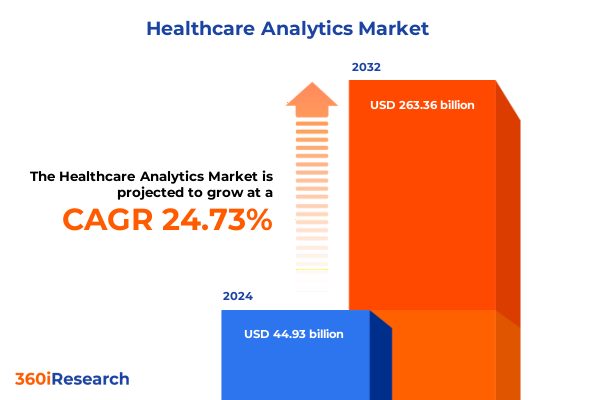

The Healthcare Analytics Market size was estimated at USD 55.70 billion in 2025 and expected to reach USD 69.12 billion in 2026, at a CAGR of 24.84% to reach USD 263.36 billion by 2032.

Harnessing Data-Driven Innovation to Unlock Actionable Insights and Elevate Patient Outcomes in a Rapidly Evolving Healthcare Ecosystem

In today’s healthcare ecosystem, data-driven innovation has emerged as the cornerstone of organizational excellence and clinical transformation. A combination of advances in electronic health records, the proliferation of connected medical devices and the integration of genomics data has created an unprecedented volume and variety of information. Healthcare leaders are responding to mounting pressure to reduce costs, improve patient safety and deliver personalized care by harnessing advanced analytics platforms that can distill insights from this complex data landscape.

Amid rising regulatory requirements and shifting reimbursement models, providers and payers alike are recognizing that raw data alone cannot achieve meaningful impact. Analytics solutions must translate information into actionable intelligence, enabling stakeholders to identify high-risk populations, monitor quality metrics and forecast resource utilization. The intellectual property embedded within predictive models and prescriptive algorithms is increasingly viewed as a strategic asset rather than a mere operational tool.

As the market matures, organizations are shifting from proof-of-concept pilots to enterprise-wide deployments that align technology initiatives with clinical, financial and operational goals. Strategic partnerships, vendor consolidation and accelerated innovation cycles have reshaped the competitive landscape. This introduction sets the stage for a comprehensive examination of transformative trends, tariff implications, segmentation dynamics, regional nuances and actionable recommendations designed to empower decision makers across the healthcare continuum.

Embracing Digital Disruption and Interoperability Advancements to Accelerate Value-Based Care and Predictive Intelligence Adoption across Healthcare

Healthcare analytics is experiencing a wave of digital disruption driven by advancements in machine learning, natural language processing and cloud-native platforms. Organizations are moving beyond retrospective reporting to embrace real-time intelligence that supports proactive interventions and continuous performance improvement. Integration of open application programming interfaces and adoption of industry standards have accelerated interoperability, enabling data to flow seamlessly across disparate systems and care settings.

As value-based care initiatives gain momentum, stakeholders are increasingly focused on measuring outcomes rather than volume. Predictive models now incorporate social determinants of health, genomic markers and patient-generated data from wearable sensors to identify emerging risk patterns and guide personalized care pathways. More recently, prescriptive analytics has matured to offer optimized treatment suggestions and dynamic resource allocation strategies, heralding a shift from descriptive dashboards to closed-loop decision support.

Regulatory mandates such as the 21st Century Cures Act and evolving industry guidelines continue to shape data governance frameworks, ensuring that patient privacy and data security remain paramount. In this environment, healthcare organizations are forging cross-functional teams that blend clinical expertise, data science skills and IT acumen to navigate the complexities of digital transformation. The result is an analytics landscape defined by agility, collaboration and relentless pursuit of value.

Assessing the Financial and Operational Repercussions of 2025 United States Tariff Measures on Healthcare Analytics Procurement and Implementation Strategies

In 2025, the United States introduced new tariff measures targeting imported hardware and specialized software components integral to advanced healthcare analytics deployments. These levies, which include a 10 percent tariff on analytics-optimized servers and storage arrays as well as incremental duties of 5 percent to 10 percent on enterprise reporting and AI-driven software licenses, have substantially increased the total cost of ownership for providers and payers seeking to expand or modernize their analytics infrastructures.

The ripple effects of these tariffs have manifested in multiple operational dimensions. Capital budgets originally earmarked for expanding on-premise data centers have been reallocated toward cloud subscriptions and managed services to circumvent import duties. Concurrently, total cost of ownership analyses have grown more complex as organizations weigh upfront tariff-adjusted equipment costs against long-term vendor support agreements and service level commitments. Some health systems have renegotiated with domestic integrators to bundle consulting, professional services and support and maintenance under fixed-price contracts that help mitigate tariff-related budget volatility.

Moreover, the tariff environment has elevated the strategic importance of software-as-a-service deployments, which remain tariff-exempt, and has prompted accelerated partnerships between healthcare organizations and major cloud service providers. By shifting workload processing and data storage to cloud-based environments, industry players are optimizing tariff avoidance while gaining scalable performance and advanced security features. These tactical adjustments underscore the intersection of policy shifts and technological strategy in today’s healthcare analytics market.

Unveiling Strategic Pathways through Component Type Deployment Model Application and End User Perspectives to Optimize Healthcare Analytics Performance

Healthcare analytics solutions are composed of two primary components: services and software. Services offerings encompass consulting services that guide strategic roadmaps, professional services that oversee deployment and integration, and support and maintenance functions that ensure solution reliability. Software platforms range from visualization tools to machine learning frameworks and decision support engines, each delivering unique capabilities that drive data-driven insights.

Across the spectrum of analytic maturity, four distinct types of analytics have emerged. Descriptive analytics continues to provide foundational reporting, while diagnostic analytics uncovers root causes and performance deviations. Predictive analytics leverages historical and real-time data to forecast outcomes, and prescriptive analytics drives automated recommendations for resource optimization and clinical intervention.

When it comes to deployment, organizations balance cloud-based and on-premise models based on cost, latency, regulatory compliance and integration needs. Cloud-based architectures offer rapid scalability and elastic compute power, whereas on-premise installations deliver greater control over data residency and tailored environments. Hybrid approaches are increasingly common as health systems strive to blend the strengths of both models.

The breadth of analytics applications spans clinical analytics focused on patient safety and quality improvement, financial analytics aimed at claims management and revenue cycle optimization, operational and administrative analytics addressing strategic planning, supply chain efficiency and workforce optimization, and population health management interventions targeting chronic disease prevention and patient engagement strategies.

End users of these analytics solutions include healthcare payers seeking risk stratification and cost containment, healthcare providers aiming to enhance care delivery, medical device and pharmaceutical industries leveraging data for product innovation, and pharmacies optimizing formulary management and patient adherence.

This comprehensive research report categorizes the Healthcare Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Deployment Model

- Application

- End User

Navigating Regional Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Healthcare Analytics Markets

Across the Americas, healthcare analytics adoption has been propelled by robust government funding initiatives, a mature private payer ecosystem and the widespread modernization of health information technology. National interoperability frameworks and incentive programs have accelerated the migration to value-based care models, while leading health systems invest heavily in predictive patient monitoring and real-time clinical decision support.

In Europe, Middle East and Africa, regulatory emphasis on data privacy under frameworks such as GDPR combined with efforts to strengthen cross-border health data exchange has shaped analytics strategies. Many public health agencies are leveraging analytics for pandemic preparedness and population health surveillance, while private provider networks focus on cost pressures and quality accreditation to drive adoption of advanced analytics solutions.

The Asia-Pacific region is characterized by rapid digital health initiatives, substantial venture capital investment and an expanding middle class demanding higher standards of care. Emerging economies are leapfrogging to cloud-native analytics platforms, integrating mobile health data and artificial intelligence to extend access to remote communities. In more developed markets, analytics efforts are centered on genomics-enabled oncology insights and smart hospital frameworks that optimize clinical workflows and asset management.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping Competitive Advantage and Technical Excellence in Healthcare Analytics Solutions

Major technology providers and specialized analytics firms are competing to deliver end-to-end healthcare intelligence platforms. Industry pioneers such as IBM have integrated cognitive computing capabilities into clinical decision support, enabling real-time interpretation of medical images and natural language processing for unstructured data. SAS continues to excel in advanced statistical modeling and risk adjustment, while Oracle Health builds on enterprise resource planning strengths to support large-scale data warehousing and interoperability.

Leading electronic health record vendors have augmented their core offerings with embedded analytics modules. Oracle’s acquisition of Cerner has enabled tighter integration of patient data with financial and operational insights, while Epic Systems has expanded its U.S. footprint by embedding predictive modeling tools directly into clinical workflows. Simultaneously, cloud hyperscalers such as Microsoft Azure, Google Cloud and Amazon Web Services are partnering with healthcare organizations to offer secure, compliant analytics environments and specialized AI toolkits.

Pharmaceutical and medical device manufacturers are collaborating with analytics firms to develop real-world evidence platforms that inform clinical trial design and post-market surveillance. Health management organizations and pharmacy chains are deploying proprietary analytics engines to optimize formulary decisions, adherence programs and population health initiatives. These strategic alliances highlight the shifting competitive landscape, where value creation through data partnerships and solution ecosystems is increasingly paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Allscripts Healthcare, LLC

- Change Healthcare LLC

- Cognizant Technology Solutions Corporation

- Epic Systems Corporation

- Flatiron Health, Inc.

- GE HealthCare Technologies Inc.

- Health Catalyst, Inc.

- IBM Corporation

- Koninklijke Philips N.V.

- McKesson Corporation

- MedeAnalytics, Inc.

- Optum, Inc.

- Oracle Corporation

- Palantir Technologies, Inc.

- Prognos, Inc.

- SAP SE

- SAS Institute, Inc.

- Siemens Healthineers AG

- Truveta, Inc.

Implementing Actionable Strategic Frameworks Empowering Industry Leaders to Drive Digital Transformation and Revenue Excellence in Healthcare Analytics

Industry leaders should pursue a data governance strategy that prioritizes interoperability and standardized data models, ensuring seamless exchange across clinical, financial and operational systems. By investing in cloud-first architectures and agile development methodologies, organizations can reduce time to insight and adapt rapidly to evolving regulatory and business requirements.

To mitigate the impact of tariff policies, stakeholders are advised to partner with domestic technology integrators and leverage software-as-a-service solutions that remain exempt from import duties. In parallel, analytics leaders should develop comprehensive total cost of ownership frameworks that capture capital, operational and compliance expenses, enabling more accurate strategic planning.

Investing in talent development is critical: cross-functional teams with expertise in data science, clinical informatics and change management can bridge the gap between technical capabilities and user adoption. Embracing a center-of-excellence model fosters continuous improvement, while clear performance metrics reinforce accountability and measure return on analytics investments.

Finally, forged alliances with academic institutions, research consortia and patient advocacy groups can accelerate innovation and enhance the relevance of analytics solutions. By co-creating use cases and validating outcomes through clinical trials and pilot programs, organizations can de-risk deployments and build credibility across stakeholder communities.

Articulating Rigorous Research Approaches Combining Qualitative and Quantitative Techniques to Ensure Robust and Insightful Healthcare Analytics Intelligence

This analysis was conducted using a structured, multi-step methodology designed to deliver comprehensive and reliable insights. Initial secondary research included a review of peer-reviewed academic articles, government health agency publications and publicly available vendor documentation to establish foundational market definitions and identify prevailing technology standards.

Building on this foundation, primary data was collected through in-depth interviews with senior executives, health system CIOs, clinical informatics leaders and analytics solution architects. These conversations provided firsthand perspectives on deployment challenges, value realization and evolving priorities. Quantitative surveys were then administered to procurement officers and departmental managers across provider, payer and life sciences segments to validate qualitative findings and assess adoption rates.

Data triangulation techniques were applied to reconcile discrepancies between primary and secondary sources, ensuring that the insights presented reflect a balanced view of market dynamics. Segmentation analysis leveraged component, type, deployment model, application and end user categorizations to uncover patterns of growth and investment. Regional mapping and comparative analysis highlighted differences in regulatory landscapes and infrastructure maturity.

Finally, findings were subjected to a validation workshop with industry experts, where hypotheses were tested and refined. The resulting insights are grounded in rigorous evidence, delivering a robust intelligence framework to inform strategic decision making among healthcare analytics stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Analytics Market, by Component

- Healthcare Analytics Market, by Type

- Healthcare Analytics Market, by Deployment Model

- Healthcare Analytics Market, by Application

- Healthcare Analytics Market, by End User

- Healthcare Analytics Market, by Region

- Healthcare Analytics Market, by Group

- Healthcare Analytics Market, by Country

- United States Healthcare Analytics Market

- China Healthcare Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings and Strategic Imperatives to Inform Stakeholder Decision Making and Drive Sustainable Healthcare Analytics Advancements

Healthcare analytics continues to redefine how organizations harness information to achieve clinical excellence, financial resilience and operational efficiency. The convergence of artificial intelligence, cloud-native deployment and open standards has shifted the landscape from siloed reporting to integrated, outcome-driven decision support. At the same time, the introduction of targeted tariffs in 2025 has underscored the need for agile sourcing strategies and cost-mitigation frameworks.

Segmentation analysis reveals that services and software components must function in tandem to deliver end-to-end value, while the full analytics spectrum-from descriptive dashboards to prescriptive guidance-offers new pathways to optimize patient care and resource management. Regional variations reflect unique regulatory and infrastructure contexts across the Americas, EMEA and Asia-Pacific, highlighting the importance of customized go-to-market strategies.

Leading companies are forging strategic alliances, embedding advanced analytics into core platforms and leveraging cloud partnerships to stay ahead of emerging requirements. Moving forward, industry leaders that invest in interoperability, talent development and collaborative innovation will be best positioned to translate data into actionable insights and sustainable competitive advantage.

Engaging with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Market Intelligence and Accelerate Informed Strategic Investments

To gain an in-depth understanding of emerging opportunities and risks within the healthcare analytics domain, connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Leveraging his expertise, you can secure a tailored market research report that equips your organization with the intelligence needed to drive data-driven decision making, optimize resource allocation, and enhance competitive positioning. Reach out today to explore customized options and accelerate your strategic endeavors in this rapidly evolving landscape.

- How big is the Healthcare Analytics Market?

- What is the Healthcare Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?