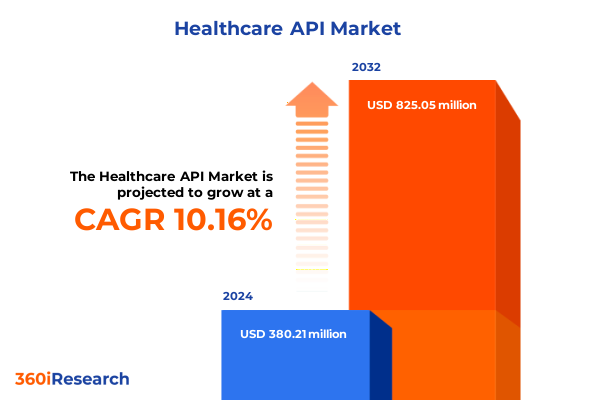

The Healthcare API Market size was estimated at USD 413.33 million in 2025 and expected to reach USD 453.57 million in 2026, at a CAGR of 10.37% to reach USD 825.05 million by 2032.

Setting the Stage for Healthcare API Evolution by Illuminating Market Forces and Stakeholder Expectations in Digital Health Integration

The healthcare industry is undergoing a pivotal transformation driven by the rapid proliferation of digital technologies and the imperative to improve patient outcomes while controlling costs. At the forefront of this shift, Application Programming Interfaces (APIs) are emerging as the foundational connectors that enable disparate systems and stakeholders to exchange critical data with greater speed, security, and precision. This executive summary offers a concise yet comprehensive introduction to the forces shaping the Healthcare API market, providing context for subsequent analysis and strategic guidance.

Over recent years, the convergence of clinical and non-clinical systems has underscored the need for interoperable architectures that can support real-time analytics, personalized patient engagement, and seamless care coordination. APIs play a central role in this evolution by offering standardized gateways through which electronic health records, billing platforms, telehealth applications, and population health tools can interoperate. Understanding the market dynamics and stakeholder expectations that are driving API adoption is crucial for healthcare organizations seeking to harness the full potential of digital health innovation.

This section frames the significance of Healthcare APIs in relation to broader industry objectives including care optimization, regulatory compliance, and enterprise agility. By illuminating the core market drivers and emerging challenges, this introduction sets the stage for a detailed exploration of transformative trends, tariff impacts, segmentation insights, regional dynamics, leading competitors, and strategic recommendations designed to help industry leaders capitalize on the growing demand for API-driven solutions.

Uncovering the Transformative Shifts Reshaping Healthcare API Landscape Across Technology Innovation, Regulatory Evolution, and Consumer-Centric Demands

Healthcare APIs are being reshaped by a series of transformative shifts that are redefining how technology, regulation, and consumer expectations intersect. One of the most pronounced changes is the maturation of regulatory frameworks that mandate interoperability and data accessibility. Policies aimed at eliminating information silos are compelling healthcare entities to adopt open API standards, thereby accelerating the integration of clinical, administrative, and patient-generated data.

Simultaneously, technological advancements are driving new opportunities for API innovation. The proliferation of cloud-native infrastructures, microservices architectures, and containerized deployments has reduced development cycles and enabled more scalable, resilient API ecosystems. Moreover, the integration of artificial intelligence and machine learning capabilities into APIs is empowering organizations to transform raw health data into predictive insights, personalized care recommendations, and automated workflows that enhance both clinical decision-making and operational efficiency.

Consumer-centric demands are also exerting a profound influence on API development. Patients are increasingly expecting on-demand access to their health records, remote monitoring capabilities, and seamless interactions with care providers through mobile applications. This shift toward patient empowerment requires API solutions that prioritize security, user experience, and real-time data exchange. As a result, developers are innovating to create more intuitive API endpoints, sophisticated authentication mechanisms, and interoperable frameworks that align with consumer-driven healthcare models.

Assessing the Cumulative Impact of 2025 United States Tariffs on Healthcare API Ecosystem with Supply Chain, Cost and Competitive Dynamics

The introduction of new United States tariffs in 2025 has introduced a layer of complexity to the Healthcare API market by influencing costs across hardware, software, and services components. Tariffs on imported servers, networking equipment, and semiconductor components have led to increased capital expenditures for healthcare institutions and cloud service providers. In turn, these cost pressures are prompting organizations to reevaluate procurement strategies, explore locally manufactured alternatives, and renegotiate vendor agreements.

Beyond hardware, the tariffs have also had ripple effects on cloud infrastructure costs. Service providers dependent on imported data center equipment have passed a portion of the increased expenses onto enterprise customers, impacting the total cost of ownership for API-driven platforms. Consequently, end users are seeking more flexible deployment arrangements, including hybrid cloud and on-premise configurations, to mitigate tariff-induced pricing volatility.

At the competitive level, domestic vendors have gained a relative advantage by leveraging localized supply chains to offer more stable pricing models. Meanwhile, international API providers are adapting through strategic partnerships with U.S. manufacturers or by shifting production to regions unaffected by the tariffs. This evolving competitive dynamic underscores the importance for healthcare organizations to conduct thorough vendor assessments, factoring in both technological capabilities and supply chain resilience when selecting API solutions.

Delivering Key Segmentation Insights by Synthesizing Product Types, Component Structures, Deployment Models and End User Profiles

An in-depth understanding of market segmentation offers valuable insights into where demand is concentrated and which product features are most compelling to different stakeholder groups. Product type segmentation reveals that Analytics & Reporting capabilities continue to dominate, with Descriptive Analytics providing foundational operational insights, Predictive Analytics enabling proactive care management, and Prescriptive Analytics guiding clinical decision support. Integration & Interoperability tools are essential for connecting siloed applications, while Patient Engagement solutions are gaining traction as providers strive to enhance patient satisfaction and adherence.

Population Health Management platforms are emerging as critical assets for payers and large healthcare networks seeking to manage risk and optimize outcomes across defined cohorts. Security & Authentication remains a top priority, given the sensitivity of personal health information and the need to comply with stringent data privacy regulations. Telehealth & Remote Monitoring has witnessed significant expansion, encompassing Mobile Health applications for on-the-go patient interactions, Remote Patient Monitoring devices for chronic condition management, and Video Consultation services that facilitate virtual visits.

Component-based segmentation further refines the analysis by distinguishing Hardware offerings, Services including Managed Services that deliver ongoing support and Professional Services that drive implementation, and Software solutions available in both Cloud and On-Premise variants. Deployment mode analysis highlights the growing preference for Cloud platforms due to their scalability and faster time-to-market, balanced by the enduring appeal of On-Premise installations for organizations with strict data residency requirements. End user segmentation frames the market through the lenses of Clinics & Physician Offices that prioritize ease of integration, Diagnostic & Imaging Centers that demand high-throughput data handling, Hospitals that require robust enterprise-grade solutions, and Pharmacies that focus on transaction efficiency and patient safety.

This comprehensive research report categorizes the Healthcare API market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Deployment Mode

- End User

Charting Critical Regional Insights by Contrasting Adoption Trends, Infrastructure Capacities and Regulatory Frameworks across Global Healthcare Markets

Regional dynamics play a pivotal role in determining the pace of Healthcare API adoption and the nature of market opportunities. In the Americas, the United States leads in API-driven innovation fueled by federal interoperability mandates and widespread cloud adoption. Latin America is following closely as governments invest in digital health infrastructure and seek to modernize legacy systems, presenting opportunities for API providers to establish early partnerships and pilot projects.

Europe, the Middle East, and Africa encompass a diverse spectrum of regulatory environments and market maturity levels. In Western Europe, stringent data privacy laws heighten the importance of secure API frameworks, while cross-border care initiatives drive demand for standardized interoperability solutions. The Middle East is experiencing rapid growth in telemedicine and digital health funding, creating a fertile environment for API-driven telehealth platforms. In Africa, constrained infrastructure challenges are motivating hybrid deployment strategies and mobile-first API solutions to overcome connectivity limitations.

Asia-Pacific exhibits a robust appetite for Healthcare APIs, particularly in countries like China and India where healthcare modernization is a national priority. Government-led programs are incentivizing the integration of digital health services, while burgeoning private sector investments are fueling innovation ecosystems. Across the region, a combination of high smartphone penetration and evolving regulatory landscapes is accelerating the adoption of mobile health APIs and secure data exchange protocols.

This comprehensive research report examines key regions that drive the evolution of the Healthcare API market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Company Insights to Highlight Strategic Partnerships, Innovation Pipelines and Competitive Positioning among Leading Industry Players

A close examination of leading companies within the Healthcare API space reveals distinct strategies that drive market leadership and competitive differentiation. Top-tier technology firms are focusing on enhancing their API portfolios through the integration of AI-powered analytics, real-time data pipelines, and developer-friendly SDKs that facilitate rapid application development. Strategic acquisitions of niche interoperability specialists are bolstering these vendors’ ability to deliver end-to-end solutions that span the full care continuum.

Emerging API pure-play providers are carving out market niches by addressing specialized use cases such as chronic disease management, patient engagement workflows, and secure identity verification. These agile players are forging partnerships with healthcare systems and third-party developers to co-create tailored solutions, often leveraging open-source frameworks and community-driven innovation models to accelerate adoption.

Systems integrators and managed service providers are also playing a critical role by offering consulting, implementation, and ongoing support services that complement API offerings. Their deep domain expertise in healthcare operations and regulatory compliance enables them to guide clients through complex integration projects, minimize implementation risks, and optimize total cost of ownership. Collaboration among technology vendors, integrators, and end users is emerging as a key competitive dynamic that shapes solution roadmaps and deployment strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare API market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarti Drugs Ltd.

- Alembic Pharmaceuticals Limited

- Amneal Pharmaceuticals LLC

- Aurobindo Pharma Ltd.

- Cipla Limited

- Divi's Laboratories Ltd.

- Dr. Reddy's Laboratories Ltd.

- FDC Limited

- Glenmark Pharmaceuticals Ltd.

- Granules India Ltd.

- Hetero Drugs Limited

- Jubilant Generics Limited

- Laurus Labs Ltd.

- Lupin Limited

- MSN Laboratories Private Limited

- Mylan N.V.

- Neuland Laboratories Ltd.

- Piramal Enterprises Ltd.

- Shilpa Medicare Ltd.

- Solara Active Pharma Sciences Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Unichem Laboratories Ltd.

- Wockhardt Ltd.

- Zydus Cadila

Formulating Actionable Strategic Recommendations for Enhanced Market Penetration, Technological Leadership and Sustainable Growth in Healthcare APIs

To capitalize on the momentum in Healthcare API adoption, industry leaders should prioritize investments in interoperability and developer experience. Establishing robust API governance frameworks and developer portals can accelerate integration timelines and foster a vibrant partner ecosystem. In tandem, organizations should allocate resources to incorporate advanced analytics and machine learning capabilities within their API layers, enabling more proactive patient care and operational efficiencies.

Risk mitigation strategies are essential in light of evolving regulatory mandates and geo-political trade dynamics. Businesses should conduct comprehensive supply chain audits to identify potential tariff exposures and build contingency plans with diversified vendor networks. Embracing hybrid deployment architectures allows for flexible workload distribution across cloud and on-premise environments, minimizing downtime and ensuring compliance with jurisdictional data residency requirements.

Finally, market participants must adopt a customer-centric mindset by engaging closely with healthcare providers, payers, and patient groups to co-create API solutions that address real-world challenges. By leveraging user feedback loops and agile development methodologies, companies can refine product roadmaps, achieve faster time-to-value, and secure long-term partnerships. A proactive approach to security, combined with transparent pricing models, will further reinforce trust and support sustainable growth.

Outlining a Rigorous Research Methodology Featuring Data Collection, Analytical Frameworks and Validation Techniques for In-Depth Health API Market Analysis

The research methodology underpinning this executive summary integrates both qualitative and quantitative approaches to ensure a comprehensive understanding of the Healthcare API landscape. Primary data collection involved in-depth interviews with senior technology executives, healthcare IT architects, and regulatory experts to surface emerging trends, pain points, and strategic priorities. These conversations provided direct insights into adoption barriers, innovation drivers, and competitive considerations across diverse healthcare settings.

Secondary research efforts included a thorough review of industry publications, regulatory filings, conference proceedings, and technical whitepapers to validate primary findings and identify macro-level market forces. This literature review was complemented by an analysis of public company disclosures, patent filings, and academic research to map the competitive ecosystem, track innovation pipelines, and understand the evolving frameworks for data security and interoperability.

Data triangulation was employed to cross-verify insights from multiple sources and ensure the robustness of conclusions. Validation workshops with domain specialists and client advisory boards provided additional context, enabling the refinement of strategic recommendations and ensuring alignment with real-world operational requirements. The combined methodological rigor guarantees that the insights presented are both actionable and reflective of the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare API market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare API Market, by Product Type

- Healthcare API Market, by Component

- Healthcare API Market, by Deployment Mode

- Healthcare API Market, by End User

- Healthcare API Market, by Region

- Healthcare API Market, by Group

- Healthcare API Market, by Country

- United States Healthcare API Market

- China Healthcare API Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusions on Healthcare API Market Readiness, Growth Drivers and Strategic Imperatives to Guide Informed Decision-Making

In conclusion, the Healthcare API market is poised to serve as a critical enabler of digital health transformation, underpinned by regulatory imperatives, technological advancements, and shifting consumer expectations. As interoperability mandates become more stringent and digital health models mature, APIs will increasingly drive innovation in clinical decision support, patient engagement, and operational efficiency.

Despite external headwinds such as new tariffs affecting supply chains and infrastructure costs, the industry has demonstrated resilience through strategic adaptation, including localized sourcing, hybrid cloud architectures, and flexible pricing strategies. By leveraging segmentation insights, companies can tailor their offerings to the unique needs of healthcare providers, payers, and patients, thereby optimizing market penetration and value delivery.

Looking ahead, organizations that invest in robust API governance, advanced analytics, and deep stakeholder collaboration will be best positioned to capture emerging opportunities. The strategic recommendations outlined herein provide a roadmap for navigating the evolving landscape, enabling market participants to accelerate innovation, mitigate risks, and drive sustainable growth in the rapidly expanding Healthcare API ecosystem.

Engage with Associate Director of Sales & Marketing to Acquire Comprehensive Healthcare API Market Analysis and Drive Strategic Business Decisions

We invite senior executives and strategic decision-makers to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full breadth of our Healthcare API market research report. Engaging with Ketan ensures you gain tailored insights that align with your organizational objectives, enabling you to craft data-driven strategies that capitalize on emerging opportunities and address pressing challenges.

By scheduling a consultation, you will receive a personalized overview of critical findings, including regulatory implications, competitive landscapes, and actionable recommendations designed to accelerate innovation and market expansion. This collaboration guarantees that your team is equipped with the precise intelligence needed to navigate complex market dynamics and strengthen your competitive positioning.

Seize this opportunity to secure your copy of the comprehensive report and empower your leadership with the foresight required for sustainable growth. Contact Ketan today to discuss pricing options, licensing models, and bespoke analytics packages that will transform your strategic planning process and unlock new avenues for revenue generation

- How big is the Healthcare API Market?

- What is the Healthcare API Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?