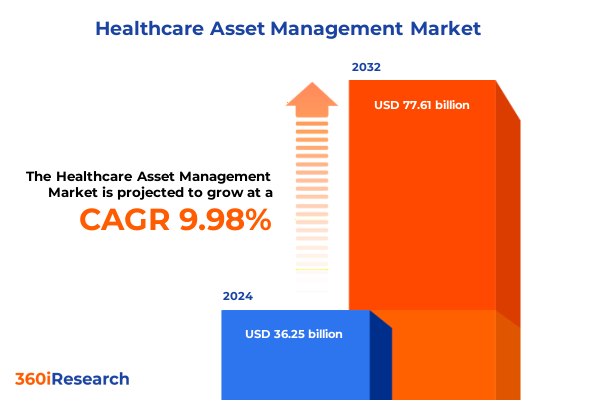

The Healthcare Asset Management Market size was estimated at USD 39.38 billion in 2025 and expected to reach USD 42.80 billion in 2026, at a CAGR of 10.17% to reach USD 77.61 billion by 2032.

Setting the Stage for Healthcare Asset Management: Market Dynamics, Growth Drivers, and Emerging Challenges in a Post-Pandemic Environment

The healthcare ecosystem has entered a phase of heightened complexity, driven by an aging population, evolving regulatory landscapes, and sustained cost pressures. With expenditures reaching 17.6% of U.S. GDP in 2023, stakeholders-from hospital administrators to policymakers-face unprecedented challenges in balancing quality of care with financial sustainability. Rising labor costs, supply chain disruptions, and demographic shifts toward chronic disease management further complicate asset lifecycle planning.

In this dynamic environment, precision in managing high-value equipment and critical supplies has become paramount. Hospitals are under increasing scrutiny from payers and regulators to justify capital investments and demonstrate operational efficiencies. Concurrently, the rapid digital transformation of care delivery models demands seamless integration of clinical operations with back-end asset management systems. As organizations pivot to value-based care, the strategic alignment of asset performance, maintenance protocols, and utilization metrics emerges as a key differentiator in achieving both clinical excellence and cost containment.

Embracing Technological Innovation and Operational Resilience to Drive Transformative Shifts in Healthcare Asset Management and Supply Chain Optimization

Healthcare asset management is undergoing a profound evolution, fueled by the confluence of advanced analytics, digital twin technologies, and the Internet of Things. AI-enabled digital twins now replicate the behavior of critical medical devices throughout their lifecycle, offering real-time condition monitoring and predictive maintenance recommendations. This shift from reactive to proactive asset management not only reduces downtime but also extends equipment lifespans, translating into tangible cost savings and enhanced patient outcomes.

Simultaneously, IoT-driven sensors embedded in imaging systems, laboratory instruments, and facility infrastructure generate continuous data streams that inform resource allocation and utilization strategies. By integrating these data feeds with cloud-based asset management platforms, healthcare providers can orchestrate maintenance schedules, automate workflows, and ensure compliance with stringent regulatory standards. As a result, the industry is witnessing an unprecedented leap in operational resilience, where data-driven insights underpin strategic decision-making and drive transformative efficiencies.

Assessing the Cumulative Impact of 2025 United States Tariffs on Medical Equipment Supply Chains, Cost Structures, and Hospital Procurement Strategies

The introduction of new U.S. tariffs in 2025 imposes a layered impact on the procurement and total cost of ownership for medical equipment. Tariffs on Chinese-manufactured critical components such as semiconductors, syringes, and key medical supplies have risen to 50%, while duties on batteries, gloves, and other essential products have increased to 25%. This realignment places additional cost burdens on hospitals, which typically allocate over 10% of their budgets to medical supplies and equipment.

Compounding these challenges is the imposition of 15% tariffs on European medical device imports under a pending U.S.-EU trade agreement. Although key exemptions are anticipated for implants and diagnostic imaging systems, the broader 15% levy will elevate the upfront capital costs for computed tomography and magnetic resonance imaging machines, as well as surgical instruments sourced from leading OEMs. Healthcare organizations are now reevaluating supply contracts, expanding domestic sourcing partnerships, and leveraging long-term agreements to mitigate price volatility, a strategy already proving effective for major hospital operators.

The cumulative effect of these tariff measures drives shifts in procurement strategies and spurs investments in domestic manufacturing. Hospitals and integrated delivery networks are proactively diversifying supplier portfolios, exploring joint ventures with U.S.-based manufacturers, and adjusting capital expenditure plans to preserve asset availability while managing cost inflation.

Leveraging Comprehensive Segmentation Across Medical Equipment, IT Infrastructure, Facilities, Pharmaceuticals, and Laboratory Instruments for Strategic Insights

Insight into the market emerges from a five-layer segmentation framework, beginning with the critical realm of medical equipment. Within this domain, imaging systems such as CT scanners and MRIs command attention for their high capital intensity and clinical importance, while patient monitoring platforms and surgical instrument sets-ranging from conventional surgical tools to minimally invasive devices-shape the operating room’s technological backbone. Understanding the nuanced performance and maintenance requirements of each equipment category is crucial for optimizing operational continuity.

Parallel to equipment, information technology infrastructure forms the digital spine of modern healthcare facilities. Networking hardware and server arrays serve as the foundation for data flow, whereas analytics and dedicated asset management software enable real-time visibility into utilization trends. Services that bridge these hardware and software components further enhance system uptime and ensure regulatory compliance.

Facilities management underpins the physical environment in which care is delivered, encompassing building automation systems such as HVAC and advanced lighting controls, along with essential housekeeping operations and security mechanisms-including access control and surveillance technologies. These interconnected systems directly influence asset performance by providing stable operating conditions and safeguarding sensitive equipment.

Pharmaceutical assets, encompassing biopharmaceuticals like monoclonal antibodies and recombinant proteins, branded drugs across cardiovascular and oncology therapies, and the expansive portfolio of generics, constitute a significant segment with distinct cold-chain and storage requirements. Finally, laboratory instruments from chromatography systems to cell analysis platforms complete the holistic asset landscape, each demanding specialized calibration, maintenance, and inventory control to deliver precise diagnostics.

This comprehensive research report categorizes the Healthcare Asset Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Medical Equipment

- Information Technology Infrastructure

- Facilities Management

- Pharmaceuticals

- Laboratory Instruments

Unveiling Regional Healthcare Asset Management Insights Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets for Tailored Strategies

Regional dynamics in healthcare asset management vary notably across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, legacy systems and high-cost equipment inventories drive demand for refurbishing services and comprehensive maintenance contracts to extend asset lifecycles. The United States, in particular, accelerates adoption of predictive analytics and digital twin technology, whereas Latin American markets prioritize modular and cloud-based solutions that circumvent infrastructure constraints.

Across Europe, the Middle East, and Africa, heterogeneous regulatory environments and divergent economic capabilities shape procurement strategies. Western European nations emphasize sustainability and circular economy principles, integrating energy-efficient facility controls and eco-friendly disposals into their asset programs. In Gulf states, rapid hospital expansions spur robust demand for turnkey asset management platforms, while Sub-Saharan Africa focuses on rugged, low-maintenance equipment and capacity-building partnerships to strengthen supply chains.

The Asia-Pacific region presents a spectrum of opportunities, from China’s domestic manufacturing growth in imaging and diagnostics to Southeast Asia’s investment in cloud-native asset management services. Australia and New Zealand demonstrate early adoption of interoperability standards, linking electronic health records with facility management systems to optimize resource allocation. Overall, regional strategies converge on digital integration, yet remain tailored to local infrastructure maturity and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Asset Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Driving Innovation in Healthcare Asset Management Through Technology Partnerships, Service Models, and Global Footprints

Leading players in healthcare asset management are rapidly expanding their footprints through technological collaborations, service innovations, and strategic acquisitions. General Electric’s healthcare division, for instance, has deepened its commitment to advanced analytics by integrating AI-driven monitoring solutions into its imaging systems, enhancing uptime for critical equipment. Siemens Healthineers continues to refine its digital services, offering cloud-based platforms that unify asset performance data across multi-facility networks.

Philips Healthcare has invested in remote maintenance programs that leverage augmented reality to guide on-site technicians, reducing mean time to repair by up to 30%. Thermo Fisher Scientific’s expansion in laboratory instrumentation is complemented by robust lifecycle service offerings, ensuring calibration and validation protocols adhere to evolving regulatory standards. Legacy equipment specialists, such as Stryker and Baxter, are reconceptualizing maintenance models, shifting from break-fix contracts to outcome-based agreements that tie service fees to asset availability and clinical throughput.

Emerging technology vendors, including IBM’s Watson Health and niche digital twin providers, are partnering with major OEMs and health systems to pilot end-to-end asset management solutions. These collaborations emphasize interoperability and data integrity, enabling seamless integration of facility controls, IT infrastructure, and clinical devices within unified digital ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Asset Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Accruent, LLC

- Baxter International Inc.

- Cardinal Health, Inc.

- GE HealthCare Technologies Inc.

- International Business Machines Corporation

- Koninklijke Philips N.V.

- McKesson Corporation

- Oracle Corporation

- Securitas Healthcare, LLC

- Sepio Inc.

- Siemens Healthineers AG

- Sonitor Technologies

- SPM Assets by Planon Corporation

- Vizzia Technologies

- Zebra Technologies Corp.

Implementing Data-Driven, Technology-Enabled, and Collaborative Strategies to Empower Industry Leaders in Optimizing Healthcare Asset Management Operations

Industry leaders must prioritize end-to-end visibility across asset lifecycles by adopting integrated digital platforms that consolidate data from equipment sensors, IT systems, and facility controls. By implementing predictive maintenance algorithms powered by AI, organizations can proactively address equipment failures and allocate budgets more efficiently, shifting capital reserves toward strategic innovations.

Collaboration with OEMs and service providers is critical to securing long-term support contracts that mitigate tariff-induced price volatility. Engaging in public-private partnerships to bolster domestic manufacturing capabilities can further insulate supply chains against geopolitical disruptions. Additionally, establishing center-of-excellence frameworks within health systems can accelerate best-practice sharing and standardized processes for asset procurement, maintenance, and retirement.

Finally, embedding sustainability goals into asset management strategies-such as optimizing energy consumption in building automation systems and implementing circular economy principles for equipment disposal-will enhance regulatory compliance and support broader environmental objectives without compromising clinical performance.

Outlining a Robust Research Methodology Integrating Secondary Data Analysis, Expert Interviews, Segmentation Frameworks, and Rigorous Validation Techniques

This study synthesizes findings from a rigorous research framework that blends secondary data analysis with primary insights. Secondary sources included industry reports, government databases, and financial disclosures to establish baseline trends and market drivers. Primary research entailed in-depth interviews with C-suite executives, supply chain directors, and technology partners, providing qualitative perspectives on operational challenges and strategic priorities.

A five-layer segmentation model was deployed to deconstruct market dynamics across medical equipment, IT infrastructure, facilities management, pharmaceuticals, and laboratory instruments. Quantitative data was triangulated using a top-down approach, validated against macroeconomic indicators and spend patterns. Scenario analysis assessed the impact of 2025 tariff changes, while sensitivity testing evaluated alternate procurement strategies and technology adoption rates.

To ensure the robustness of insights, findings were subjected to peer review by healthcare asset management experts and refined through iterative feedback loops. The final deliverable underwent quality control audits to confirm accuracy, relevance, and alignment with client objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Asset Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Asset Management Market, by Medical Equipment

- Healthcare Asset Management Market, by Information Technology Infrastructure

- Healthcare Asset Management Market, by Facilities Management

- Healthcare Asset Management Market, by Pharmaceuticals

- Healthcare Asset Management Market, by Laboratory Instruments

- Healthcare Asset Management Market, by Region

- Healthcare Asset Management Market, by Group

- Healthcare Asset Management Market, by Country

- United States Healthcare Asset Management Market

- China Healthcare Asset Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings and Strategic Implications to Navigate the Evolving Landscape of Healthcare Asset Management with Clarity and Confidence

The convergence of digital innovation, shifting regulatory pressures, and evolving procurement paradigms underscores the critical role of strategic asset management in healthcare. By embracing AI-driven predictive maintenance and digital twin technologies, health systems can unlock new efficiencies while safeguarding patient care standards. Simultaneously, navigating tariff-induced cost pressures demands agile supply chain strategies and collaborative partnerships with domestic manufacturers.

Segmentation across equipment, IT, facilities, pharmaceuticals, and laboratory instruments reveals opportunities for targeted interventions that optimize lifecycle costs and enhance asset performance. Regional insights highlight the necessity of tailoring approaches to local market conditions, regulatory landscapes, and technological maturity levels. Leading companies are setting benchmarks through outcome-based service models and interoperable digital platforms, demonstrating the transformative potential of integrated solutions.

Moving forward, organizations that align strategic priorities with robust data analytics, sustainability objectives, and adaptability to geopolitical shifts will be best positioned to thrive in the dynamic healthcare ecosystem. The insights presented herein provide a clear roadmap for decision-makers seeking to elevate their asset management capabilities and drive sustainable growth.

Connect with Ketan Rohom to Unlock Actionable Healthcare Asset Management Insights and Secure Your Comprehensive 2025 Market Research Report Today

To explore how these insights can translate into impactful strategies for your organization, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in healthcare asset management research and client collaboration ensures you receive tailored guidance that aligns with your strategic objectives. Connect now to gain early access to detailed findings, in-depth analyses, and actionable recommendations drawn from our comprehensive 2025 market research. Let’s partner to empower your decision-making and drive sustainable growth in today’s complex healthcare environment.

- How big is the Healthcare Asset Management Market?

- What is the Healthcare Asset Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?