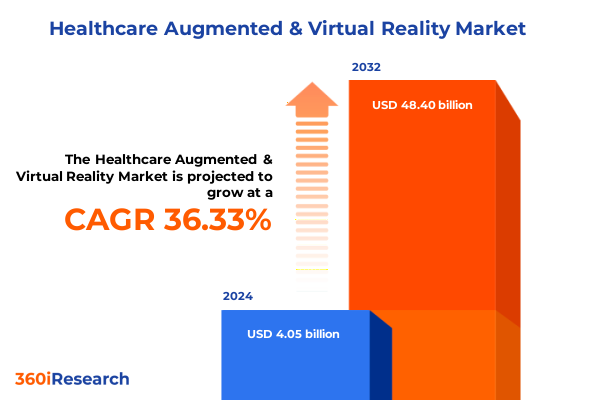

The Healthcare Augmented & Virtual Reality Market size was estimated at USD 5.51 billion in 2025 and expected to reach USD 7.42 billion in 2026, at a CAGR of 36.37% to reach USD 48.40 billion by 2032.

Transformative Healthcare Frontiers Through Augmented and Virtual Reality Innovations Elevating Patient Outcomes and Transforming Care Delivery

Augmented and virtual reality technologies are rapidly shifting paradigms across the healthcare sector, redefining how clinicians plan, diagnose, and deliver care. Emerging solutions are enabling surgeons to visualize patient anatomy in real time, empowering remote specialists to guide procedures via shared immersive environments. Simultaneously, patient engagement is being elevated through interactive rehabilitation programs that adapt to individual progress, showcasing the transformative potential of these digital tools in enhancing both efficacy and experience.

As the healthcare ecosystem evolves, stakeholders face the imperative to understand key drivers, enablers, and barriers influencing adoption. This executive summary distills critical insights into current applications, technological breakthroughs, and strategic considerations shaping this landscape. By examining regulatory developments, technological interoperability, and stakeholder readiness, this overview equips clinical leaders, technology vendors, and policy makers with the context required to navigate emerging opportunities. With clarity and depth, it sets the stage for informed decision-making as the industry moves toward integrated, immersive care solutions.

Revolutionary Shifts Shaping Healthcare Augmented and Virtual Reality Adoption Across Clinical Workflows Care Paradigms and Research Endeavors

Healthcare delivery is experiencing revolutionary shifts as augmented and virtual reality platforms transition from experimental pilots to mission-critical clinical tools. Across surgical suites, optical see-through overlays are guiding complex neurosurgeries, while fully immersive virtual reality environments are enabling realistic preoperative simulations that sharpen procedural skills. Markerless augmented reality, leveraging advanced computer vision, is breaking free from reliance on physical trackers, opening doors to wider clinical integration where real-time anatomical guidance becomes seamlessly embedded in routine workflows.

Beyond the operating room, extended reality solutions are reshaping patient care management by offering remote monitoring interfaces that present biometric data within intuitive 3D dashboards. Telemedicine consultations are augmented by shared interactive visualizations, fostering patient engagement and improving adherence. In rehabilitation settings, projection-based AR environments stimulate cognitive and physical exercises tailored to recovery milestones, illustrating how multimodal interaction paradigms are converging to enhance outcomes.

In parallel, the rise of mixed reality headsets featuring video see-through displays is supporting new models of interdisciplinary collaboration. By connecting specialists across geographic boundaries into a unified virtual space, these encounters are accelerating clinical decision-making and expanding access to expert care. As these technological shifts gain momentum, healthcare stakeholders must realign strategies to harness their full potential.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Healthcare Augmented and Virtual Reality Industry Dynamics

In 2025, the United States introduced new tariff measures on select electronic components, directly impacting the cost structures of hardware-dependent industries including healthcare augmented and virtual reality. Customs duties levied on headsets, sensors, and ancillary accessories have created an uptick in landed costs for manufacturers importing key parts. Consequently, original equipment manufacturers are reevaluating global supply chains to mitigate price pressures, exploring nearshoring options and strategic partnerships to preserve competitive pricing while maintaining product quality.

These tariff shifts have also had cascading effects on service providers and software developers within the AR/VR value chain. Integration and deployment firms, which rely on hardware margins to subsidize consulting and training engagements, are recalibrating contract models. This has spurred negotiations around bundled service offerings that reallocate risk and cost. Meanwhile, platform vendors and SDK developers are accelerating cloud-based delivery approaches to offset hardware dependency, emphasizing subscription frameworks that remain unaffected by import duties.

Regulatory agencies and industry coalitions are monitoring these developments closely, advocating for tariff exemptions on medical-grade hardware given its critical role in patient care. In response, several technology consortia have filed petitions to secure relief for devices classified under medical equipment categories. As policy dialogues evolve, stakeholders must remain agile in their sourcing strategies, balancing cost management against the imperative to sustain innovation and clinical efficacy.

Comprehensive Segmentation Analysis Revealing Component Technology Application and End User Perspectives in Healthcare Augmented and Virtual Reality

A nuanced examination of component segmentation reveals distinct dynamics across hardware, services, and software offerings. Within hardware, headset manufacturers face intensified competition, while accessories and sensor trackers are adapting to tighter component supplies by innovating modular designs that streamline integration. Service functions-from consulting and training to integration and deployment and ongoing maintenance-are shifting toward hybrid engagement models, blending remote support with on-site expertise to optimize resource allocation. Software ecosystems encompass content creation platforms and developer tools, as well as SDKs that promote interoperability, reflecting a maturing environment where ease of customization and scalability are paramount.

From a technology standpoint, augmented reality, mixed reality, and virtual reality each occupy unique niches. Marker-based AR retains relevance in controlled environments such as simulation labs, whereas markerless and projection-based AR are gaining traction in dynamic clinical settings. Optical see-through mixed reality headsets are preferred for hands-free assistance in surgery, while video see-through variants support immersive telepresence applications. In the virtual reality domain, fully immersive platforms are driving advanced preoperative training, non-immersive solutions are enabling accessible therapy modules, and semi-immersive systems are bridging the gap by combining affordability with sufficient immersion for routine clinical use.

Applications span patient care management through remote monitoring and telemedicine portals, pharmaceutical marketing via detailed product demonstrations, and rehabilitation programs targeting both cognitive and physical recovery. Surgical planning now encompasses cardiovascular, neurosurgery, and orthopedic modules, integrating anatomical scans into interactive models. Therapeutic interventions address mental health challenges alongside pain management, while training and simulation cultivate clinical skills, emergency response readiness, and preoperative competence. End users range from academic and research institutes driving proof-of-concept studies to home healthcare providers delivering patient-centric solutions and hospitals and clinics scaling enterprise-wide deployments.

This comprehensive research report categorizes the Healthcare Augmented & Virtual Reality market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Geostrategic Regional Dynamics Shaping Adoption Patterns for Healthcare Augmented and Virtual Reality Across Major Global Territories

Regional variations are shaping the trajectory of augmented and virtual reality adoption in healthcare across major global territories. In the Americas, robust investment in digital health infrastructure is accelerating pilot programs and full-scale integrations, especially in surgical planning and telemedicine. Healthcare systems in North America benefit from supportive reimbursement policies that incentivize remote monitoring and virtual rehabilitation, while Latin American markets, though nascent, are leveraging partnerships to access cost-effective hardware and tailor solutions for local care delivery models.

Europe, the Middle East, and Africa exhibit a diverse landscape where regulatory frameworks and funding environments vary significantly. Western European nations are advancing standards for medical device interoperability, enabling cross-border clinical collaborations and shared immersive training platforms. Meanwhile, the Middle East is deploying mixed reality demonstrations in flagship medical centers to attract medical tourism and showcase technological leadership. In African contexts, pilot deployments focus on telemedicine augmentation, with VR-based training programs enhancing the skills of community healthcare workers in regions with limited specialist access.

Asia-Pacific emerges as a dynamic region where government-led initiatives are fostering rapid commercialization of AR/VR healthcare tools. Countries such as Japan and South Korea are integrating immersive simulation into national training curricula for surgeons, whereas Southeast Asian markets are prioritizing scalable remote monitoring applications to address rural healthcare gaps. Across these territories, strategic collaborations between technology vendors, research institutions, and healthcare providers are critical to localizing solutions that meet diverse clinical and cultural requirements.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Augmented & Virtual Reality market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Profiles Highlighting Leading Companies Driving Innovation in Healthcare Augmented and Virtual Reality Solutions

Leading technology and healthcare companies are forging new pathways in the augmented and virtual reality domain, each advancing unique strategic approaches. A prominent enterprise technology provider has optimized its mixed reality headset for surgical guidance, partnering with major medical centers to integrate holographic overlays into operating suites. Simultaneously, a social technology platform has leveraged its consumer-grade VR headsets for therapeutic and mental health applications by collaborating with behavioral health specialists to co-develop immersive treatment modules.

A pioneer in spatial computing has targeted enterprise healthcare through strategic alliances with diagnostic imaging leaders, embedding AR visualization tools into radiology workflows. Concurrently, a veteran in gaming hardware has expanded into the medical segment, retrofitting its fully immersive VR system for preoperative simulations and emergency response drills. In parallel, established medical device manufacturers are investing in joint ventures to deliver integrated solutions, embedding AR capabilities into surgical robots and next-generation imaging platforms.

These competitive profiles illustrate an ecosystem where technology incumbents and healthcare innovators converge to address clinical challenges. By forming cross-industry partnerships, pursuing targeted acquisitions, and emphasizing developer ecosystems, these companies are accelerating commercialization and driving the evolution of patient-centric, immersive healthcare solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Augmented & Virtual Reality market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- Augmedics Ltd.

- Brainlab AG

- CAE Healthcare

- EchoPixel Inc.

- EON Reality Inc.

- FundamentalVR

- GE Healthcare

- Google LLC

- Health Scholars

- HTC Corporation

- ImmersiveTouch Inc.

- Medical Realities Ltd.

- Medivis Inc.

- Microsoft Corporation

- Oculus VR LLC

- Osso VR Inc.

- Philips Healthcare

- Proprio Vision Inc.

- Samsung Electronics Co. Ltd.

- Siemens Healthineers AG

- Sony Corporation

- Surgical Theater LLC

- VirtaMed AG

- Virti Ltd.

Pragmatic Strategic Recommendations Empowering Industry Leaders to Optimize Healthcare Augmented and Virtual Reality Implementation and Commercial Success

Industry leaders should prioritize the development of interoperable platforms that seamlessly integrate hardware, software, and services across clinical environments. Establishing open APIs and adhering to emerging interoperability standards will reduce integration friction and facilitate broader adoption among healthcare providers. Furthermore, forming cross-sector alliances between technology vendors, medical device manufacturers, and academic institutions can accelerate proof-of-concept projects and validate clinical efficacy through rigorous trial frameworks.

Investing in comprehensive training and certification programs is essential to ensure that clinicians and support staff can maximize the benefits of immersive technologies. By embedding these educational initiatives within existing professional development pathways, organizations can cultivate internal expertise and promote sustained engagement. Additionally, piloting modular deployment strategies that balance fully immersive installations with lower-cost, non-immersive deployments can enable phased adoption, manage budgetary constraints, and demonstrate measurable outcomes early in the implementation cycle.

Engaging proactively with regulatory bodies and reimbursement stakeholders will help shape favorable policies and secure pathways for coverage of augmented and virtual reality interventions. By collaborating on real-world evidence generation and health economics studies, industry actors can substantiate clinical value propositions and support adoption at scale. Through these strategic actions, stakeholders can optimize both clinical impact and commercial success in this rapidly evolving domain.

Robust Multi-Phase Research Methodology Integrating Qualitative and Quantitative Approaches to Uncover Insights in Healthcare Augmented and Virtual Reality

The research underpinning this report employed a multi-phase methodology that combined qualitative insights and quantitative validation. In the initial discovery phase, subject matter experts from healthcare providers, technology vendors, and regulatory agencies were interviewed to map the current state of adoption and identify emerging applications. These primary interviews were supplemented by desk research across academic publications, technical white papers, and policy briefs to ensure comprehensive coverage of technological advancements and regulatory trends.

In the second phase, a broad survey of healthcare organizations captured adoption drivers, investment priorities, and anticipated barriers. Survey data were analyzed using statistical techniques to detect patterns in component usage, technology preferences, and application domains. This quantitative layer was reinforced by scenario modeling workshops conducted with clinical and IT leadership teams, validating the practical implications of the findings and informing actionable recommendations.

Data triangulation was achieved by cross-referencing interview outcomes, survey metrics, and secondary research to enhance the reliability of insights. Ethical guidelines and data privacy standards were rigorously applied throughout the research process. This structured methodological framework ensures that the report’s conclusions accurately reflect the complex interplay of technological, regulatory, and market dynamics shaping the future of healthcare augmented and virtual reality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Augmented & Virtual Reality market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Augmented & Virtual Reality Market, by Component

- Healthcare Augmented & Virtual Reality Market, by Technology

- Healthcare Augmented & Virtual Reality Market, by Application

- Healthcare Augmented & Virtual Reality Market, by End User

- Healthcare Augmented & Virtual Reality Market, by Region

- Healthcare Augmented & Virtual Reality Market, by Group

- Healthcare Augmented & Virtual Reality Market, by Country

- United States Healthcare Augmented & Virtual Reality Market

- China Healthcare Augmented & Virtual Reality Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesis of Healthcare Augmented and Virtual Reality Transformations Guiding Future Innovations and Stakeholder Strategies for Enduring Impact

This executive summary has synthesized the transformative potential of augmented and virtual reality across clinical workflows, patient engagement strategies, and organizational imperatives. By dissecting component and technology segmentation, evaluating regional adoption patterns, and profiling leading industry players, the analysis illuminates pathways through which immersive solutions are reshaping care delivery. Moreover, it offers pragmatic guidance on navigating cost pressures, regulatory landscapes, and interoperability challenges that accompany the integration of these emerging platforms.

Looking ahead, stakeholders poised for success will be those that align strategic investments with robust evidence generation, foster cross-industry partnerships, and cultivate internal expertise. As immersive healthcare technologies mature, their fusion with artificial intelligence, wearable sensors, and digital therapeutics will further expand clinical capabilities. This convergence underscores the need for dynamic strategies that balance innovation ambition with operational feasibility, ultimately driving enhanced patient outcomes and sustainable growth in the evolving healthcare ecosystem.

Secure Access to the Comprehensive Healthcare Augmented and Virtual Reality Market Research Report by Reaching Out to Ketan Rohom for Exclusive Insights

To gain full access to the comprehensive healthcare augmented and virtual reality market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy and obtain exclusive insights tailored to your strategic needs

- How big is the Healthcare Augmented & Virtual Reality Market?

- What is the Healthcare Augmented & Virtual Reality Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?