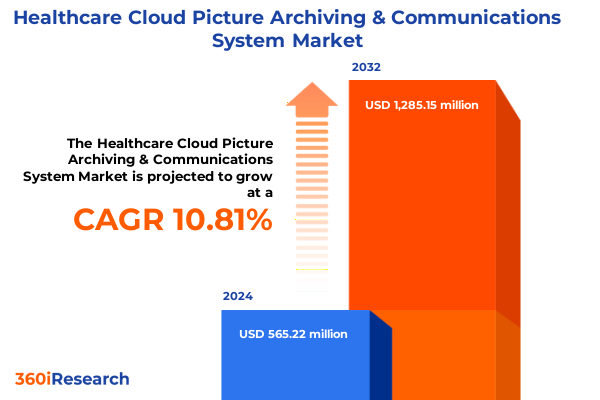

The Healthcare Cloud Picture Archiving & Communications System Market size was estimated at USD 620.16 million in 2025 and expected to reach USD 681.98 million in 2026, at a CAGR of 10.97% to reach USD 1,285.15 million by 2032.

Exploring the Evolution of Cloud-Based Picture Archiving and Communications Systems Transforming Healthcare Imaging Workflows

The landscape of healthcare imaging has undergone a transformative journey in recent years, driven by the convergence of digital innovation and evolving clinical needs. As healthcare providers grapple with mounting volumes of diagnostic images and the imperative for seamless collaboration among multidisciplinary teams, cloud-delivered picture archiving and communications solutions have emerged as a pivotal enabler. These systems unify disparate imaging modalities under a distributed architecture, eliminating silos and streamlining access to critical patient data.

In addition, the migration from traditional on-premises architectures to cloud platforms has been propelled by a demand for greater scalability and agility. Healthcare organizations no longer face the constraints of legacy infrastructure capacity planning, as cloud elasticity accommodates fluctuating imaging workloads without upfront capital expenditure. Moreover, distributed workforces and telehealth initiatives have underscored the value of remote image access, enabling specialists to collaborate in real time irrespective of geographic boundaries.

However, this shift is not without its complexities. Ensuring robust cybersecurity measures, achieving regulatory compliance across diverse jurisdictions, and maintaining acceptable latency for high-resolution image rendering remain top priorities. Consequently, stakeholders across the imaging ecosystem are reexamining their technology road maps and forging partnerships that balance innovation with the stringent demands of clinical operations and patient privacy.

Analyzing the Key Technological and Regulatory Shifts Reshaping Cloud-Based Medical Imaging Infrastructure Across the Healthcare Industry

Healthcare imaging technology continues to evolve at a rapid pace, reshaping the standards for clinical diagnostics and operational efficiency. Artificial intelligence algorithms now augment image interpretation, offering automated detection and advanced analytics capabilities that were once confined to research settings. Furthermore, edge computing solutions are being deployed to preprocess imaging data closer to acquisition points, thereby reducing bandwidth requirements and improving throughput for cloud-based archives.

Simultaneously, the regulatory landscape has adapted to the intricacies of cloud-native deployments. Amendments to data protection frameworks such as the Health Insurance Portability and Accountability Act emphasize encryption standards and audit trails, while emerging guidelines around data residency have prompted providers to consider hybrid and multi-cloud architectures. Interoperability protocols like DICOMweb and HL7 FHIR have gained traction, fostering integration between electronic health record systems, diagnostic modalities, and third-party analytics platforms.

Beyond technology and compliance, market dynamics are also in flux as major cloud service providers expand strategic alliances with imaging vendors. This convergence accelerates development of turnkey solutions, combining managed services, professional support, and continuous software enhancements. As a result, healthcare organizations are experiencing a paradigm shift-from managing discrete hardware and licensing fees to embracing subscription-based, outcome-driven models.

Examining the Cumulative Effects of Newly Imposed United States Tariffs on Healthcare Cloud Imaging Equipment and Software Supply Chains

The imposition of targeted tariffs on imported medical imaging hardware and software components in early 2025 has introduced new considerations for healthcare cloud imaging initiatives. As supply chains recalibrate, manufacturers and integrators face increased input costs that can reverberate through procurement cycles. Consequently, healthcare providers evaluating cloud PACS deployments are reassessing total cost of ownership to account for potential surcharges on equipment refreshes and software licensing renewals.

Moreover, service providers have responded by strengthening domestic partnerships, sourcing alternative component suppliers, and revising maintenance agreements to mitigate exposure to tariff-related fluctuations. In addition, some cloud imaging vendors are exploring onshore manufacturing collaborations and localized support centers to ensure continuity of critical maintenance and upgrades. These adaptations not only address immediate cost pressures but also reinforce system resilience and service-level commitments.

As a result, organizations must balance the benefits of cloud delivery-such as scalability and simplified upgrades-against supply chain uncertainties. In this context, selecting providers with diversified procurement strategies and robust contractual safeguards becomes imperative. Ultimately, tariff-related challenges are reshaping both vendor road maps and provider decision frameworks, underscoring the importance of agility in an increasingly complex geopolitical environment.

Uncovering Critical Segmentation Insights Across Deployment Modes, Components, Applications, and End Users in Cloud-Based Medical Imaging Markets

Insights drawn from segmentation by deployment mode, component, application, and end user elucidate the differentiated pathways driving cloud PACS adoption. For example, cloud deployments have gained traction among diagnostic centers and specialty clinics seeking to avoid large capital investments, whereas on-premises solutions remain prevalent in large hospital systems prioritizing direct control over data and infrastructure. This duality reflects a broader trend in which hybrid strategies combine the flexibility of cloud hosting with the familiarity of local systems.

Regarding system components, the interplay between software capabilities and services delivery is critical. Integration and training services ensure that new cloud platforms seamlessly interface with existing electronic health records and vendor-neutral archives, while technical support and upgrade services maintain uninterrupted access to evolving imaging functionalities. In parallel, professional service offerings differ in focus: some specialize in workflow optimization tailored to high-volume radiology departments, while others emphasize change management for multi-site clinic networks.

Application-driven segmentation reveals concentrated use cases in cardiology, dentistry, and general radiology. Cardiology practices leverage CT angiography and echocardiography modules with advanced visualization tools, and dental professionals increasingly adopt cone beam CT and intraoral imaging workflows that integrate with cloud storage for collaborative treatment planning. Meanwhile, radiology groups deploy CT, MRI, ultrasound, and X-ray imaging modalities via unified cloud consoles to enhance multidisciplinary diagnostics.

Across end users, outpatient and specialty clinics prioritize rapid clinical turnaround and minimal IT overhead, imaging centers focus on standardized operational protocols to support high patient throughput, and hospital systems-both large and mid-sized-balance enterprise-level data governance with the need for scalable imaging platforms that accommodate diverse departmental requirements.

This comprehensive research report categorizes the Healthcare Cloud Picture Archiving & Communications System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Component

- Application

- End User

Highlighting Regional Dynamics Influencing Adoption of Cloud Picture Archiving Solutions Throughout the Americas, EMEA, and Asia-Pacific Industries

Regional dynamics exhibit distinct patterns in the assimilation of cloud-based imaging architectures. In the Americas, advanced digital infrastructure and supportive reimbursement frameworks have driven robust uptake, particularly in the United States and Canada. Providers in these markets benefit from mature cloud ecosystems, extensive fiber networks, and well-established data protection regulations, enabling rapid scalability of imaging services. Additionally, Latin American nations are progressively initiating pilot programs that leverage cloud PACS to expand diagnostic access in underserved areas.

Conversely, Europe, the Middle East, and Africa present a mosaic of adoption velocities. Western European countries demonstrate high penetration rates fueled by coordinated digital health strategies and interoperable national health records. However, data sovereignty requirements and fragmented regulatory environments in some jurisdictions present obstacles that necessitate tailored deployment approaches. In the Middle East, accelerated infrastructure investments and government-driven e-health visions are catalyzing cloud PACS projects, while select African markets leverage mobile connectivity and cloud platforms to bridge gaps in radiology services.

Asia-Pacific stands out as a high-growth frontier, propelled by extensive public and private sector investments. Nations such as Australia, Japan, and South Korea have established rigorous cloud certification frameworks, fostering confidence among large hospital chains. Meanwhile, emerging economies across Southeast Asia and the Indian subcontinent are embracing digital health initiatives that prioritize scalable, cost-effective imaging solutions. In these regions, evolving reimbursement models and telehealth regulations are accelerating the shift toward cloud-native PACS offerings.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Cloud Picture Archiving & Communications System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Vendors Driving Innovation Strategic Partnerships and Comprehensive Ecosystem Development in Cloud-Based Medical Imaging Services

Leading vendors in cloud-based medical imaging have coalesced around strategic partnerships and platform integrations that address the full spectrum of provider needs. Major cloud service providers have extended their core infrastructure offerings with dedicated imaging workflows, embedding advanced analytics and compliance assurance into their platforms. These alliances have enabled nimble deployment models and facilitated continuous innovation through frequent software updates.

Specialized imaging software developers have responded by deepening capabilities in areas such as volumetric rendering, AI-driven detection, and vendor-neutral archiving. By collaborating with global technology partners, these firms ensure that their solutions adhere to emerging interoperability standards while optimizing performance across distributed cloud environments. Simultaneously, professional services organizations have carved out niches in integration, training, and change management, delivering tailored enablement programs that accelerate return on investment.

Moreover, the competitive landscape is shaped by ongoing M&A activity and ecosystem consolidation. Large-scale incumbents are acquiring specialized imaging startups to bolster their cloud portfolios, and new entrants are leveraging open-source frameworks to deliver cost-conscious alternatives. In this context, providers evaluate potential partners not only on product capabilities but also on financial stability, long-term innovation strategies, and the capacity to deliver end-to-end managed services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Cloud Picture Archiving & Communications System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Amazon Web Services, Inc.

- BridgeHead Software Ltd.

- Carestream Health, Inc.

- Change Healthcare Holdings, Inc.

- Deep Cognition Inc.

- Dell Technologies Inc.

- Fujifilm Holdings Corporation

- GE Healthcare

- Google LLC

- Hyland Software, Inc.

- IBM Corporation

- Intelerad Medical Systems Incorporated

- Microsoft Corporation

- Novarad Corporation

- Oracle Corporation

- PaxeraHealth Corp.

- Philips Healthcare

- PostDICOM Limited

- RamSoft, Inc.

- Sectra AB

- Siemens Healthineers AG

- Visage Imaging, Inc.

Actionable Strategies for Healthcare Stakeholders to Maximize Value Extraction and Operational Efficiency in Cloud-Based Imaging Deployments

Industry leaders seeking to maximize the benefits of cloud PACS deployments should embrace a proactive cloud-first strategy that aligns with broader digital transformation objectives. This involves establishing cross-functional governance teams to oversee vendor evaluations, data migration road maps, and service-level agreement negotiations. By adopting standardized interoperability frameworks, organizations can future-proof integrations with emerging AI tools and mobile diagnostics platforms.

Additionally, prioritizing cybersecurity measures-from zero-trust network architectures to continuous vulnerability assessments-will safeguard sensitive imaging data and uphold patient confidentiality. Investing in comprehensive training and change management programs is equally important to ensure that clinical staff leverage advanced imaging functionalities effectively. As healthcare providers adjust to tariff-induced supply chain shifts, forming strategic alliances with vendors that demonstrate procurement diversity and localized support can mitigate unforeseen cost escalations.

Finally, embedding data analytics into operational workflows enables real-time monitoring of imaging utilization, system performance, and cost drivers. By harnessing cloud-native analytic dashboards and predictive maintenance alerts, stakeholders can streamline capacity planning and preempt potential service disruptions. These actionable steps collectively enhance clinical outcomes, drive operational efficiency, and reinforce the strategic value of cloud-based imaging infrastructure.

Outlining Rigorous Research Methodology Underpinning the Analysis of Cloud PACS Adoption Drivers and Market Ecosystem Assessment

The research underpinning this analysis integrates comprehensive secondary and primary methodologies to deliver robust, validated insights. Initially, an extensive review of industry publications, regulatory filings, and vendor white papers provided foundational context on technological trends, tariff developments, and regional adoption patterns. Publicly available guidelines and standardization frameworks informed the evaluation of interoperability and compliance considerations.

This baseline was enriched through in-depth interviews with senior executives, IT directors, and clinical leaders across a diverse set of hospitals, diagnostic centers, and specialty clinics. These conversations yielded nuanced perspectives on deployment challenges, service-level priorities, and partner selection criteria. Survey data collected from imaging department administrators further quantified preferences for deployment modes, service models, and feature sets.

Data triangulation ensured consistency across multiple inputs, while a rigorous validation process cross-checked findings against third-party analytics and independent expert consultations. Segmentation analyses were structured around deployment mode, component scope, application focus, and end-user profiles, enabling granular insights without relying on proprietary market size estimates. Throughout the study, ethical guidelines and data privacy standards were strictly observed, reinforcing the integrity and relevance of conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Cloud Picture Archiving & Communications System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Cloud Picture Archiving & Communications System Market, by Deployment Mode

- Healthcare Cloud Picture Archiving & Communications System Market, by Component

- Healthcare Cloud Picture Archiving & Communications System Market, by Application

- Healthcare Cloud Picture Archiving & Communications System Market, by End User

- Healthcare Cloud Picture Archiving & Communications System Market, by Region

- Healthcare Cloud Picture Archiving & Communications System Market, by Group

- Healthcare Cloud Picture Archiving & Communications System Market, by Country

- United States Healthcare Cloud Picture Archiving & Communications System Market

- China Healthcare Cloud Picture Archiving & Communications System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Summarizing Key Findings and Strategic Imperatives Emerging from the Comprehensive Study of Healthcare Cloud Imaging Solutions

This comprehensive study reveals that cloud-based picture archiving and communications systems have transcended early adopter status to become a strategic imperative for modern healthcare providers. Key findings highlight the interplay between advanced analytics, evolving regulatory environments, and the need for resilient supply chains in an era marked by tariff fluctuations. In particular, segmentation-driven insights demonstrate how deployment preferences vary significantly across diagnostic centers, clinics, and hospital systems, while regional analyses underscore the unique drivers shaping adoption in the Americas, EMEA, and Asia-Pacific regions.

The strategic imperatives that emerge from these conclusions call for a balanced emphasis on cybersecurity, interoperability, and workforce enablement. Organizations that adopt a cloud-first mindset, engage in proactive vendor governance, and integrate continuous operational analytics will be best positioned to leverage the full spectrum of cloud PACS benefits. Moreover, adaptability in the face of geopolitical and supply chain uncertainties remains a critical differentiator for healthcare entities striving to optimize imaging workflows.

Overall, these insights converge to inform actionable recommendations that guide healthcare stakeholders through the complexities of cloud imaging transformation. By synthesizing technological, regulatory, and market dynamics, this report furnishes a coherent blueprint for executives seeking to enhance diagnostic capabilities, improve patient outcomes, and secure long-term operational resilience.

Engage with Associate Director Ketan Rohom for Tailored Insights and Exclusive Access to the Comprehensive Healthcare Cloud PACS Research Report

To explore tailored implementation strategies, secure exclusive excerpts, and discuss customized licensing options for the full healthcare cloud PACS market report, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging with Ketan enables organizations to align strategic imaging initiatives with the latest industry intelligence, ensuring a seamless transition to advanced cloud-based infrastructures. His expertise can guide procurement, technology integration, and stakeholder engagement to accelerate digital transformation and optimize return on investment. Connect today to gain privileged access to comprehensive analyses and data-driven recommendations that will inform critical executive decision-making and drive measurable improvements in imaging operations.

- How big is the Healthcare Cloud Picture Archiving & Communications System Market?

- What is the Healthcare Cloud Picture Archiving & Communications System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?