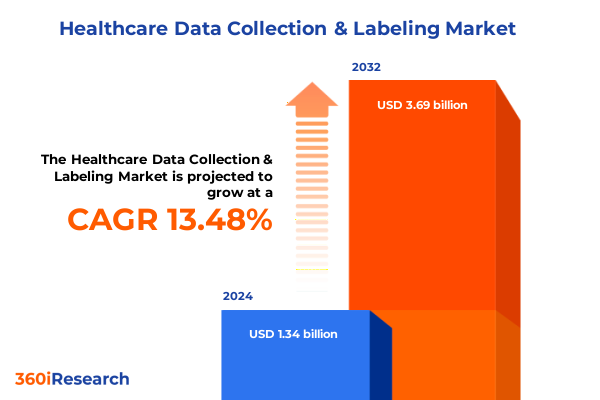

The Healthcare Data Collection & Labeling Market size was estimated at USD 1.51 billion in 2025 and expected to reach USD 1.70 billion in 2026, at a CAGR of 13.34% to reach USD 3.63 billion by 2032.

Exploring the Vital Role of Healthcare Data Collection and Labeling in Transforming Patient Outcomes and Driving Next-Generation Medical Innovations

The evolution of healthcare delivery is inextricably linked to the precision and reliability of collected data, making the processes of data collection and labeling foundational to modern medical innovation. As healthcare ecosystems become increasingly digitized, the ability to accurately annotate and organize vast troves of clinical information-from electronic health records and imaging studies to unstructured clinical notes-has emerged as a core determinant of research quality and patient outcomes. This report provides an in-depth examination of the technologies, workflows, and regulatory frameworks that underpin healthcare data collection and labeling, charting the trajectory of advancements that have propelled the sector forward. It also delineates the challenges decision-makers face in balancing the demand for high-quality annotated datasets with stringent compliance requirements, offering strategic context for both technology providers and end users seeking to optimize their data strategies. Looking ahead, stakeholders across the healthcare spectrum must navigate a landscape shaped by artificial intelligence, evolving privacy standards, and shifting geopolitical dynamics. Our executive summary distills key insights and emerging trends, equipping readers with an authoritative overview of the forces reshaping healthcare data annotation today.

Unveiling the Pivotal Technological and Regulatory Shifts Reshaping Healthcare Data Collection and Labeling Ecosystems Across Global Markets

The healthcare data labeling arena has undergone a profound transformation driven by breakthroughs in machine learning, tightened regulatory oversight, and the imperative for interoperability across diverse health information systems. AI-assisted labeling solutions now leverage advanced natural language processing and computer vision algorithms to accelerate annotation while maintaining high levels of accuracy and consistency in labeling tasks. Concurrently, annotation platforms have introduced modular architectures that accommodate customizable workflows, enabling organizations to seamlessly integrate manual review stages where human expertise is essential. On the regulatory front, compliance-focused tools have emerged to ensure adherence to patient privacy mandates such as HIPAA and evolving state-level data privacy laws; these solutions incorporate automated de-identification and audit trail capabilities that streamline governance processes.

Moreover, the balance between in-house and outsourced services is shifting as healthcare entities explore semi-automated annotation models that combine proprietary algorithmic pre-labeling with expert validation. This hybrid approach enhances scalability without compromising the contextual understanding that only domain-specialized annotators can provide. In parallel, the demand for annotation services has expanded beyond traditional clinical research into operational and administrative use cases, reflecting a broader recognition of data’s strategic value. Altogether, these technological and regulatory shifts are redefining the healthcare data collection and labeling ecosystem, driving a new era of efficiency and compliance.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Healthcare Data Annotation Workflows and Cross-Border Service Dynamics

The introduction of targeted tariff measures by the United States in early 2025 has reverberated through the healthcare data labeling value chain, introducing new cost considerations for hardware and outsourced service imports. Tariffs on specialized imaging devices and annotation hardware components used by offshore service providers have strained the traditional cost arbitrage model that healthcare organizations have relied upon. As a result, many labeling service firms have reevaluated geographic sourcing strategies, opting to diversify their operational footprint or negotiate pass-through cost structures with clients to mitigate margin erosion.

Furthermore, these tariff policies have indirectly influenced the adoption of cloud-based labeling platforms, as organizations seek to minimize dependency on physical equipment imports and capitalize on virtualized annotation environments. This trend has accelerated investments in domestic data centers and cloud service offerings certified for healthcare compliance, reducing exposure to cross-border trade complexities. Health systems and research institutions now face decisions regarding whether to internalize more of the annotation workflow-thereby gaining greater control over compliance and costs-or to engage in hybrid partnerships that distribute data labeling workloads across multiple regions. In either scenario, the 2025 tariff environment has underscored the importance of agility in supply chain planning and the need for robust scenario analysis when structuring long-term annotation initiatives.

Decoding Core Segmentation Dimensions to Uncover Strategic Insights for Healthcare Data Labeling Platforms Software Services and Applications

A nuanced understanding of the healthcare data labeling market requires dissecting the ecosystem by offering, data type, data source, labeling type, application, and end user. Within the offering segment, platforms and software have matured to include AI-assisted labeling tools, advanced annotation platforms, and specialized compliance modules, while the services component has bifurcated into purely manual annotation and semi-automated services that integrate algorithmic preprocessing. Analysis of data type segmentation reveals distinct quality requirements for audio transcriptions, image annotations, text labeling, and video frame tagging, each demanding tailored workflows and validation protocols. Data source segmentation highlights the complexity of working with structured electronic health records compared to the high-resolution demands of medical imaging and the contextual nuances found within patient surveys. When examining labeling type, the divergence between fully automated labeling and manual review spotlights trade-offs in scalability versus domain expertise. In application segmentation, the classification of use cases into clinical research, operational efficiency, patient care enhancement, and personalized medicine underscores the breadth of annotation’s impact across healthcare delivery and innovation pathways. Finally, end user segmentation maps critical differences in requirements among hospitals and clinics, pharmaceutical and biotechnology firms, and research and academic institutes, illuminating where specialized annotation investments are prioritized.

This comprehensive research report categorizes the Healthcare Data Collection & Labeling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Labeling Type

- Data Type

- Application

- End User

Navigating Regional Dynamics to Highlight Unique Drivers and Challenges Across Americas Europe Middle East Africa and Asia-Pacific Healthcare Labeling Markets

Regional dynamics play a pivotal role in shaping the adoption and evolution of healthcare data labeling solutions. In the Americas, robust investments in digital health infrastructure and a mature regulatory framework have created fertile ground for both domestic and international annotation providers, with an emphasis on scalable AI platforms and compliance-driven tools. Elsewhere, Europe, the Middle East, and Africa are characterized by a mosaic of data privacy regulations and healthcare funding models, driving demand for modular software that can adapt to diverse legislative regimes and emerging interoperability standards. Across the Asia-Pacific region, rapid digital transformation initiatives and government support for AI-driven health solutions have spurred significant uptake of both in-house and outsourced labeling services, with particular growth in markets focused on clinical trial recruitment and population health analytics. Despite varying regulatory landscapes and technological maturities, all regions share a common imperative: to harness high-quality labeled data as a strategic asset for improving patient outcomes, reducing operational inefficiencies, and accelerating research breakthroughs.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Data Collection & Labeling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Driving Competitive Differentiation in the Healthcare Data Collection and Labeling Landscape

The competitive landscape of healthcare data collection and labeling features a diverse assembly of established technology firms and agile startups. Leading cloud providers have enhanced their healthcare offerings with integrated labeling modules that leverage proprietary AI engines and maintain compliance through built-in de-identification workflows. Specialized annotation platforms have differentiated themselves by offering industry-specific ontologies, customizable module libraries, and advanced quality control dashboards. On the services side, global outsourcing firms with deep domain expertise continue to expand their footprints, blending manual annotation capabilities with semi-automated pre-labeling to address high-volume projects. Meanwhile, novel entrants are targeting niche segments such as pathology image analysis and natural language processing for clinical trial documentation, applying vertical specialization as a means to achieve deeper insight accuracy and faster turnaround. This dynamic competitive environment drives continuous innovation, compelling all players to invest in strategic partnerships, strategic acquisitions, and the development of industry-tailored compliance solutions to maintain differentiation and capture emerging opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Data Collection & Labeling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alegion, Inc.

- Anolytics

- Appen Limited

- Athenahealth

- CapeStart Inc.

- Centaur Labs Inc.

- CloudFactory Limited

- Co One OÜ

- Cogito Tech LLC

- DataLabeler Inc.

- Five Splash Infotech Pvt. Ltd.

- iMerit Inc.

- Infolks Private Limited

- Innodata Inc.

- ISHIR

- Jotform Inc.

- Keymakr Inc.

- Labelbox, Inc.

- Mindy Support

- Shaip

- Sheyon Technologies

- Skyflow Inc.

- Snorkel AI, Inc.

- Summa Linguae Technologies

- TELUS International (Cda) Inc.

- V7 Ltd.

Strategic Imperatives for Industry Leaders to Optimize Healthcare Data Labeling Investments and Strengthen Competitive Positioning in Evolving Markets

To capitalize on the evolving healthcare data labeling market, industry leaders should prioritize investments in advanced AI-assisted tools that integrate seamlessly with existing data ecosystems, ensuring rapid scalability and high annotation quality. Embracing a hybrid service delivery model that combines automated pre-labeling with expert manual validation will enhance throughput while preserving domain accuracy. Organizations should also establish collaborative partnerships with compliance-focused technology providers to navigate complex privacy regulations and maintain robust governance frameworks. Building in-house annotation capabilities for mission-critical data streams can reduce reliance on external suppliers and streamline workflows, whereas partnering with specialized providers for high-volume or niche annotation tasks can optimize cost structures. Additionally, stakeholders should conduct periodic scenario analyses to assess the impact of policy shifts, such as tariff changes or new privacy laws, on their data annotation strategies. Finally, cultivating a multidisciplinary team with expertise in data science, clinical workflows, and regulatory affairs will foster a culture of continuous improvement, positioning leaders to leverage annotated data as a strategic asset for innovation and operational excellence.

Detailing the Rigorous Multi-Source Research Approach Employed to Ensure Data Integrity and Comprehensive Coverage in Healthcare Labeling Analysis

The insights presented in this report are the result of a rigorous multi-phase research methodology that blends primary and secondary investigation. Secondary research involved the systematic review of peer-reviewed journals, regulatory publications, and industry white papers to map key technological advancements and compliance requirements. Primary research comprised in-depth interviews with senior technology executives, data scientists, and clinical operations leaders across diverse healthcare organizations to validate emerging trends and capture real-world implementation nuances. Data triangulation was performed to reconcile differing viewpoints and ensure the accuracy of qualitative assessments. Additionally, our analysis incorporated case studies that demonstrate best practices in implementing labeling solutions across multiple data types and use cases. Quality assurance protocols, including peer reviews and iterative expert feedback sessions, were employed to maintain the highest standards of objectivity and reliability. This comprehensive approach underpins the actionable insights and strategic recommendations delineated throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Data Collection & Labeling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Data Collection & Labeling Market, by Offering

- Healthcare Data Collection & Labeling Market, by Labeling Type

- Healthcare Data Collection & Labeling Market, by Data Type

- Healthcare Data Collection & Labeling Market, by Application

- Healthcare Data Collection & Labeling Market, by End User

- Healthcare Data Collection & Labeling Market, by Region

- Healthcare Data Collection & Labeling Market, by Group

- Healthcare Data Collection & Labeling Market, by Country

- United States Healthcare Data Collection & Labeling Market

- China Healthcare Data Collection & Labeling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Critical Insights to Illuminate Future Pathways for Healthcare Data Collection Labeling Strategies and Stakeholder Collaboration

As healthcare systems continue to embrace digital transformation, high-quality data labeling has emerged as a cornerstone of evidence-based innovation and operational optimization. The convergence of AI-driven annotation platforms, compliance-centered tools, and hybrid service models offers a pathway to overcome traditional bottlenecks associated with large-scale data curation. Emerging regulatory and geopolitical factors, including tariffs and evolving privacy mandates, underscore the need for agile, resilient strategies that balance cost, control, and quality. By leveraging a nuanced understanding of segmentation dynamics-across offerings, data types, sources, applications, and end users-organizations can tailor their annotation investments to specific strategic objectives. Regional considerations further inform deployment approaches, ensuring solutions align with local regulatory and technological conditions. Ultimately, the healthcare sector’s capacity to deliver personalized medicine, enhance clinical research, and streamline operational workflows hinges on unlocking the full potential of annotated datasets. This report’s insights provide a clear roadmap for stakeholders seeking to harness the transformative power of data-driven decision-making in healthcare.

Engage with Ketan Rohom to Secure Exclusive Insights and Strategic Guidance from Our Comprehensive Healthcare Data Labeling Market Research Report

To access the full scope of findings and gain a competitive edge through actionable data labeling strategies, we invite you to reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Partner with a leading authority on healthcare data collection and labeling to customize insights for your organization’s unique needs. Explore how advanced methodologies, regulatory expertise, and targeted market intelligence can accelerate your innovation pipeline and enhance operational efficiencies. Securing this comprehensive market research report will equip your team with the strategic vision required to navigate rapidly evolving landscapes and capitalize on emerging opportunities. Engage with Ketan today to schedule a personalized briefing, discuss tailored solutions, and unlock the transformative potential of data-driven decision-making in healthcare.

- How big is the Healthcare Data Collection & Labeling Market?

- What is the Healthcare Data Collection & Labeling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?