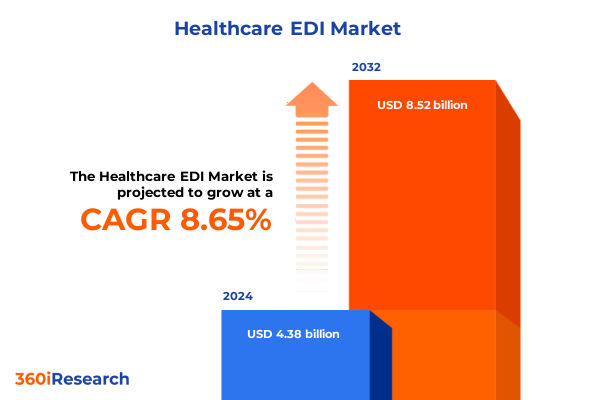

The Healthcare EDI Market size was estimated at USD 4.74 billion in 2025 and expected to reach USD 5.14 billion in 2026, at a CAGR of 8.72% to reach USD 8.52 billion by 2032.

Building a Robust Foundation for Healthcare Data Exchange Through Electronic Data Interchange Innovations to Drive Seamless Industry Integration

The escalating complexity of healthcare networks and the imperative for seamless coordination have elevated electronic data interchange to the forefront of industry transformation. As providers, payers, and ancillary stakeholders navigate evolving regulations and rising demands for efficiency, mastering the fundamentals of data exchange has become a strategic priority rather than a technical nicety. This introduction establishes the critical context in which EDI solutions drive improvements in claims processing, patient care coordination, and supply chain transparency across the ecosystem.

In recent years, healthcare organizations have confronted mounting pressure to reduce operational costs, accelerate revenue cycles, and adhere to strict compliance standards. Simultaneously, the push for interoperability and patient-centric care models compels enterprises to seek robust EDI frameworks that can securely transmit standardized transaction sets. By setting the stage with a clear overview of industry drivers-ranging from regulatory mandates like HIPAA and the 21st Century Cures Act to the fiscal realities of shrinking reimbursements-this section underscores why organizations must view EDI not just as a technical protocol, but as a catalyst for broader digital transformation.

Analyzing the Transformative Shifts in Healthcare Electronic Data Interchange Landscape Amidst Technological Advances and Regulatory Evolutions

The healthcare electronic data interchange landscape has undergone significant metamorphosis, propelled by advances in cloud computing, API-driven architectures, and heightened regulatory scrutiny. No longer confined to on-premise solutions, modern EDI platforms leverage cloud-native deployments to deliver scalable integration, real-time analytics, and high availability. This shift has enabled smaller provider networks and emerging payers to harness enterprise-grade EDI capabilities without the traditional capital expenditure burden.

Regulatory evolutions, including the latest interoperability rules and mandated use of standardized FHIR resources, have further redefined the EDI paradigm. Stakeholders are now compelled to adopt hybrid integration strategies that blend conventional transaction sets with API-based endpoints. This convergence has stimulated investment in middleware and integration platforms that can orchestrate diverse data formats while ensuring strict adherence to both existing HIPAA standards and emerging CMS provisions. As a result, the market is witnessing robust growth in platforms capable of bridging legacy systems with next-generation applications, thereby streamlining data workflows across claims management, eligibility verification, and electronic remittance.

Evaluating the Cumulative Impact of United States 2025 Tariff Adjustments on Healthcare Electronic Data Interchange Ecosystem and Service Delivery

Recent tariff adjustments enacted by the United States in 2025 have introduced new cost pressures across the healthcare IT ecosystem, particularly in the import of networking hardware, specialized servers, and integration appliances. These tariffs, applied under broader trade measures, have affected both on-premise solution costs and the supply chains of key components used in private data centers. Consequently, some organizations have delayed hardware refresh cycles, favoring cloud deployments to mitigate upfront capital requirements and circumvent import duties.

The cumulative effect of these tariffs has also reverberated through vendor pricing strategies. Service-oriented providers have had to recalibrate implementation and support fee structures to account for elevated equipment costs. At the same time, cloud-native EDI platform vendors have gained traction as clients pivot away from capital-intensive infrastructure investments. Although the total duty burden varies by hardware classification, the net result is clear: tariff-driven cost escalations have accelerated migration toward subscription-based, cloud-hosted EDI models, reshaping the competitive dynamics between traditional on-premise vendors and emerging integration platform-as-a-service entrants.

Unlocking Key Market Segmentation Insights Across Component, Function, Process Type, Deployment, and End User Dynamics in Healthcare EDI

A multi-faceted view of the market reveals distinct trajectories across component and function categories. Within the component domain, services such as consulting, implementation, and ongoing support have experienced heightened demand as organizations seek expertise to navigate complex compliance requirements. Simultaneously, EDI software suites and integration platforms have evolved to accommodate both legacy transaction sets and modern API-based exchanges. When examining functional segmentation, claims management modules encompass everything from payment reconciliation and status inquiries to advanced eligibility verification and referral certification, underscoring the centrality of transaction accuracy and speed.

Process type segmentation further highlights the diversity of EDI delivery models. Direct point-to-point connections maintain relevance for high-volume trading partners, while AS2-based exchanges have become the de facto standard for secure, internet-based transfers. Value-added networks continue to serve organizations requiring guaranteed delivery and managed services, yet Web EDI portals offer a low-barrier entry for smaller providers or pharmacies. Deployment considerations underscore the trade-offs between on-cloud solutions that deliver rapid scalability and on-premise configurations that provide greater control over data residency. Lastly, end-user categories-from payers and providers to medical device manufacturers, pharmaceutical organizations, and retail pharmacies-each present unique integration requirements, support needs, and transaction volumes, collectively shaping the strategic priorities of vendors and buyers alike.

This comprehensive research report categorizes the Healthcare EDI market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Function

- Process Type

- Deployment

- End-User

Gaining Strategic Regional Perspectives Across Americas, Europe Middle East & Africa, and Asia Pacific to Understand Healthcare EDI Market Variations

Regional market dynamics reveal divergent adoption patterns and strategic priorities across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, a mature landscape with established regulatory frameworks and high EDI penetration is driving incremental innovation, such as the integration of advanced analytics and machine learning within transaction processing pipelines. This region remains characterized by consolidation among major payers and provider networks, which places a premium on interoperability and unified data platforms.

Turning to Europe Middle East & Africa, disparate regulatory regimes coexist alongside pan-European initiatives aimed at harmonizing healthcare data exchange. While Western European nations leverage cross-border EDI frameworks to facilitate medical tourism and multi-national clinical trials, emerging markets in the Gulf and Africa are building foundational EDI infrastructure in tandem with broader digital health strategies. In Asia Pacific, rapid digitization and government-led health information exchanges are propelling uptake, even as local language and standards variations necessitate custom mapping and localized support models. Across all three regions, the strategic interplay between regulatory alignment, technological readiness, and stakeholder collaboration determines the pace and scope of EDI adoption.

This comprehensive research report examines key regions that drive the evolution of the Healthcare EDI market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players and Their Strategic Positioning in the Evolving Healthcare Electronic Data Interchange Market Ecosystem

Leading technology providers have adopted diverse strategies to cement their positions in the healthcare EDI space. Enterprise software vendors have integrated EDI capabilities within broader healthcare suites, leveraging existing client relationships to cross-sell transaction management and integration services. Cloud-first platform specialists, by contrast, have prioritized speed-to-market, introducing self-service portals and API-centric toolkits to attract digital-native startups and smaller networks.

Service-oriented firms differentiate through deep vertical expertise, offering modular implementation frameworks tailored to specific functional areas such as claims payment or eligibility verification. Strategic partnerships and acquisitions have further reshaped the competitive landscape, as midsize players have aligned with value-added network operators or consulting houses to expand geographic reach and service portfolios. Meanwhile, healthcare-focused system integrators emphasize robust security and compliance assurances, often obtaining specialized certifications and forging alliances with regulatory bodies. Collectively, these approaches illustrate how leading companies blend technology innovation, service excellence, and ecosystem partnerships to address evolving client challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare EDI market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Apex EDI, Inc. by The Therapy Brands

- Athenahealth, Inc.

- AUTOCRUITMENT LLC

- Availity, LLC

- Change Healthcare

- Cognizant Technology Solutions Corporation

- Comarch SA

- Connvertex Technologies Inc.

- Cprime, Inc.

- GE Healthcare

- McKesson Corporation

- Medisys Inc.

- NXGN Management, LLC by Planet DDS, Inc.

- Optum, Inc. by UnitedHealth Group Inc

- Oracle Corporation

- OSP Labs

- PLEXIS Healthcare Systems, Inc.

- Quadax, Inc.

- Remedi Electronic Commerce Group

- Salesforce, Inc.

- SPS Commerce, Inc.

- SSI Group, LLC

- Tebra Technologies, Inc.

- Veradigm LLC

Formulating Actionable Strategic Recommendations for Healthcare Industry Leaders to Maximize Electronic Data Interchange Efficiency and Compliance

Industry leaders must adopt a proactive posture to capitalize on emerging opportunities and navigate persistent challenges in electronic data interchange. Immediately, organizations should conduct comprehensive audits of existing EDI infrastructures, benchmarking performance metrics such as transaction throughput, error rates, and compliance adherence. This exercise uncovers latent inefficiencies and informs targeted modernization initiatives that prioritize high-impact functional areas, from referral certification workflows to real-time eligibility checks.

Concurrently, executives should reevaluate vendor relationships, considering hybrid engagement models that combine managed services for mission-critical integrations with self-service portals for less-complex transactions. Investment in advanced analytics-leveraging machine learning to predict claim denials and optimize payment cycles-can yield rapid returns by reducing manual intervention and accelerating revenue realization. To address tariff-driven cost pressures, leaders can explore multi-cloud deployments and negotiate flexible subscription terms, thereby insulating IT budgets from hardware import duties. Finally, establishing cross-functional governance bodies ensures that clinical, operational, and IT stakeholders align on EDI roadmaps, fostering shared accountability and driving sustainable value creation.

Explaining the Comprehensive Research Methodology Integrating Primary Insights, Secondary Sources, and Robust Analytical Frameworks for Credibility

This analysis draws upon a structured research framework that combines primary inputs and rigorous secondary analysis. Primary research involved in-depth interviews with C-suite executives, IT directors, and policy advisors across payers, providers, and technology vendors, ensuring a balanced perspective on market challenges and adoption barriers. A targeted survey of over one hundred stakeholder organizations further validated priority areas and identified functional pain points.

Secondary research encompassed a thorough review of government publications, regulatory directives, vendor whitepapers, and peer-reviewed journals. Data triangulation techniques were applied to reconcile disparate sources, yielding coherent insights into pricing dynamics, technology preferences, and service delivery models. A dedicated advisory board comprising former health IT leaders and interoperability experts provided iterative feedback on thematic findings, bolstering the study’s validity. Quantitative data sets-such as transaction volume trends and deployment mix-were analyzed using advanced statistical methods to reveal meaningful patterns and forecast adoption trajectories. This blended methodology ensures that the report’s conclusions rest on a solid empirical foundation and reflect real-world operational imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare EDI market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare EDI Market, by Component

- Healthcare EDI Market, by Function

- Healthcare EDI Market, by Process Type

- Healthcare EDI Market, by Deployment

- Healthcare EDI Market, by End-User

- Healthcare EDI Market, by Region

- Healthcare EDI Market, by Group

- Healthcare EDI Market, by Country

- United States Healthcare EDI Market

- China Healthcare EDI Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights on Healthcare Electronic Data Interchange Evolution and Strategic Imperatives for Stakeholder Success

Healthcare electronic data interchange stands at the nexus of operational efficiency, regulatory compliance, and patient-centric care delivery. Through a comprehensive exploration of market drivers, technological shifts, segmentation nuances, and regional specificities, this summary illuminates the multifaceted forces propelling EDI evolution. Leaders who prioritize scalable architectures, invest in analytics-driven optimization, and align their technology roadmaps with regulatory mandates will secure a strategic advantage.

The convergence of cloud-native platforms, API-first integration, and evolving tariff landscapes underscores the need for agile, cost-effective approaches. Organizations that embrace hybrid deployment models can achieve the dual goals of operational control and scalability, while targeted investments in vertical-specific expertise-such as claims management or supply chain orchestration-unlock incremental value. As the healthcare ecosystem continues to coalesce around data-driven paradigms, robust EDI frameworks will remain instrumental in driving interoperability, accelerating revenue cycles, and ultimately enhancing patient outcomes.

Engage with Ketan Rohom to Acquire Comprehensive Market Intelligence and Empower Data-Driven Decisions in Healthcare Electronic Data Interchange

I encourage decision-makers and industry stakeholders seeking deeper insights into the transformative dynamics of healthcare EDI to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in healthcare data exchange solutions ensures you receive a tailored overview of how this report’s findings can align with your organization’s strategic priorities. Reach out today to gain access to comprehensive analysis, unlock actionable strategies, and secure a competitive edge in optimizing your electronic data interchange capabilities.

- How big is the Healthcare EDI Market?

- What is the Healthcare EDI Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?