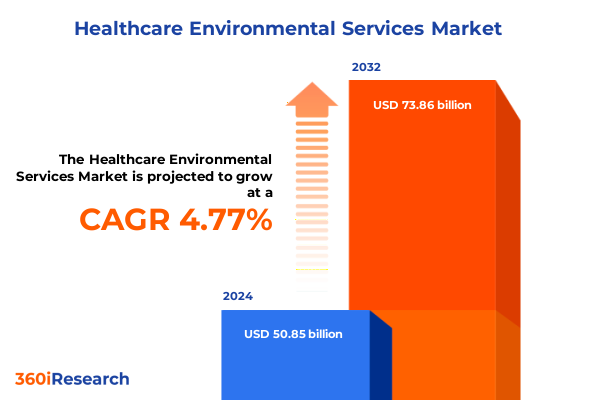

The Healthcare Environmental Services Market size was estimated at USD 53.14 billion in 2025 and expected to reach USD 55.54 billion in 2026, at a CAGR of 4.81% to reach USD 73.86 billion by 2032.

Pioneering a Resilient Framework for Healthcare Environmental Services Through Strategic Innovation, Operational Excellence, and Patient Safety

The healthcare environmental services sector stands at the intersection of patient safety, operational efficiency, and regulatory rigor. An overarching focus on infection prevention has elevated the role of environmental protocols, while evolving sustainability mandates have driven the adoption of greener cleaning technologies and practices. At the same time, escalating workforce pressures and cost containment requirements are compelling service providers and facility managers to innovate in staffing, training, and resource allocation.

Against this backdrop, a clear framework is emerging that positions environmental services as a strategic partner in healthcare delivery, rather than a purely cost-center function. By integrating advanced disinfection methods, data-driven performance monitoring, and cross-functional collaboration between clinical and support teams, organizations are improving patient outcomes, optimizing asset utilization, and reinforcing compliance with tightening regulations. Moreover, stakeholder expectations now span environmental stewardship, transparency, and resilience, challenging traditional service models to evolve with agility.

In this executive summary, critical shifts in the landscape will be examined alongside the influence of recent U.S. tariff changes, key segmentation and regional patterns, as well as leading competitors’ strategies. The objective is to provide decision-makers with a synthesized understanding of current dynamics, actionable recommendations, and an outline of the rigorous research methodology that underpins these insights.

Transformative Shifts in Healthcare Environmental Services Driving Quality Improvement, Sustainability, Workforce Evolution, and Operational Efficiency

The healthcare environmental services landscape has experienced a series of transformative shifts that redefine expectations across quality, sustainability, workforce, and technology. Enhanced regulatory standards now mandate more frequent and scientifically validated cleaning protocols, challenging providers to invest in specialized equipment and continuous training. Concurrently, the industry is embracing eco-friendly chemistries and energy-efficient processes, spurred by institutional commitments to reduce carbon footprints and minimize chemical waste in patient care environments.

Workforce evolution also marks a pivotal change. Demand for skilled technicians capable of leveraging advanced disinfection systems, interpreting performance analytics, and responding to infection outbreaks in real time is outpacing traditional staffing models. In response, innovative companies have launched comprehensive training programs and established competency frameworks that align staff proficiency with emerging service requirements.

Technology adoption further underscores the sector’s shift toward proactive environmental management. Internet of Things-enabled sensors now track room turnover and microbial loads, while UV-C robots and electrostatic sprayers deliver consistent decontamination in high-risk zones. Together, these shifts are driving a new operational paradigm in which data, sustainability, and human expertise converge to elevate the standard of care.

Analyzing the Cumulative Impact of 2025 U.S. Tariffs on Healthcare Environmental Services Supply Chains, Cost Structures, and Compliance Strategies

The introduction of U.S. tariffs in 2025 on imported cleaning chemicals, personal protective equipment, and specialized disinfection technologies has created a cumulative impact reverberating through healthcare environmental services supply chains and cost structures. Many providers have faced increased procurement expenses for disinfectants and disposable supplies, prompting an urgent reevaluation of sourcing strategies to mitigate margin erosion and maintain service levels.

As a result, organizations are forging closer partnerships with domestic manufacturers and exploring alternative chemistries that fall outside tariff schedules. These measures have alleviated some cost pressures, yet compliance strategies have also become more complex. Service contracts now incorporate tariff-adjustment clauses, requiring transparent pass-through mechanisms and dynamic pricing models to ensure fair cost allocation between providers and client facilities.

Furthermore, supply chain disruptions linked to tariff-related border inspections have underscored the importance of inventory optimization and contingency planning. Environmental services leaders are increasingly deploying predictive analytics to balance stock levels of critical items, reducing the risk of service delays without tying up excessive working capital. This strategic shift toward supply chain resilience reflects a broader industry trend of integrating financial discipline with operational agility.

Uncovering Segmentation Insights for Healthcare Environmental Services Across Service Types, Delivery Modes, Facility Settings, and Organization Sizes

Segmentation analysis reveals pronounced differences in underlying service dynamics, highlighting opportunities for tailored strategies. Based on service type, cleaning and disinfection services command attention as facilities prioritize reducing healthcare-associated infections, while linen and laundry services face rising demand for efficient, on-site throughput and minimal cross-contamination. Pest control services continue to address endemic threats, particularly in older infrastructure, and staff training and consultancy services are growing as organizations recognize the value of standardized protocols. Waste management services round out the portfolio, with increasing focus on regulated medical waste disposal and recycling programs that align with environmental goals.

Service form further delineates market behavior, distinguishing on-demand engagements that cater to urgent needs and outbreak responses from scheduled services that ensure consistent routine maintenance. Each form necessitates distinct operational workflows and resource allocations, influencing provider staffing models and technology investments.

Facility type underscores varying environmental requirements across ambulatory surgical centers, clinics and physician offices, hospitals, laboratories and research facilities, and long-term care facilities. While surgical centers demand rapid turnaround and stringent microbial control, research laboratories prioritize containment and compliance with biosafety standards. Long-term care settings, by contrast, emphasize resident comfort and infection prevention within a communal living environment.

Organization size shapes procurement sophistication and scale economics. Large healthcare facilities often leverage centralized contracts and advanced analytics to drive efficiency, whereas mid-size hospitals and clinics balance cost control with service customization. Small community health centers adopt leaner models that emphasize versatility, cross-trained staff, and collaborative partnerships to optimize limited operational budgets.

This comprehensive research report categorizes the Healthcare Environmental Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Service Form

- Facility Type

- Organization Size

Exploring Key Regional Dynamics Shaping Healthcare Environmental Services Market Trends Across Americas, Europe Middle East Africa, and Asia Pacific

Regional factors exert a profound influence on environmental services priorities and service delivery models. In the Americas, mature regulatory frameworks in the United States and Canada drive rigorous compliance with infection prevention standards and propel the adoption of sustainable chemistries and equipment. Latin American markets, meanwhile, are experiencing a surge in private healthcare investment, heightening demand for outsourced environmental services in urban centers.

Across Europe, the Middle East, and Africa, the regulatory landscape spans stringent European Union directives that enforce unified safety protocols, to emerging economies where infrastructure modernization is spurring new service partnerships. Sustainability mandates across the region have led to collaborative procurement initiatives and pan-regional service agreements that achieve scale efficiencies.

In the Asia-Pacific region, rapid expansion of healthcare infrastructure in countries such as Australia, Japan, and select Southeast Asian markets has catalyzed the adoption of advanced environmental technologies. However, regulatory variability across jurisdictions presents a challenge for multinational service providers, who must adapt protocols to align with local standards and cultural nuances. Throughout each region, environmental services leaders are tailoring offerings to reconcile global best practices with geopolitical and operational realities.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Environmental Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovations Driving Leading Companies in Healthcare Environmental Services Toward Operational Excellence and Growth

Leading service providers have deployed differentiated strategies to capture competitive advantage. Several global firms have built digital platforms that integrate real-time environmental monitoring, allowing facility managers to track room cleanliness metrics and generate compliance reports on demand. Others have invested in proprietary sustainable chemistries that reduce environmental impact without compromising disinfection efficacy. Strategic acquisitions and alliances have enabled select players to expand geographic coverage rapidly and diversify service portfolios.

Innovation has become a distinguishing factor, with pioneers introducing robotics and ultraviolet disinfection systems to augment manual processes and achieve consistent outcomes. Equally important is the emphasis on workforce development, where top companies have established accredited training centers to certify technicians in the latest protocols and equipment handling.

Partnership models also vary, from full outsourcing arrangements that transfer end-to-end environmental management responsibility, to hybrid models in which providers collaborate with in-house teams. This strategic flexibility allows service organizations to meet the unique risk tolerances and budget constraints of diverse healthcare facilities. Collectively, these competitive insights demonstrate a market in which innovation, operational efficiency, and tailored client engagement define leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Environmental Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABM Industries Incorporated

- American Bio Recovery, Inc.

- Aramark Corporation

- Cardinal Health, Inc.

- Cintas Corporation

- Clean Harbors, Inc.

- Coverall North America, Inc.

- Diversey, Inc.

- Ecolab Inc.

- Enviro-Master, Inc.

- ISS Facility Services, Inc.

- Jani-King International, Inc.

- McKesson Corporation

- Medline Industries, Inc.

- Sodexo, Inc.

- Stericycle, Inc.

- Sterigenics International, LLC

- Veolia Environnement S.A.

- Waste Management, Inc.

Strategic Recommendations for Industry Leaders to Elevate Healthcare Environmental Services Through Innovation, Collaboration, and Regulatory Excellence

Industry leaders seeking to solidify their market position should prioritize investments in digital integration that harmonize disinfection data, asset utilization records, and regulatory documentation within unified dashboards. By standardizing data streams and leveraging predictive analytics, organizations can preempt service gaps and demonstrate value through quantifiable outcomes.

Simultaneously, advancing greener cleaning protocols with eco-certified chemistries and energy-efficient equipment will meet escalating sustainability benchmarks and differentiate providers in procurement evaluations. Workforce excellence demands a renewed focus on continuous training programs and competency assessments, aligned to real-time performance feedback and certification pathways.

Collaborative partnerships with technology innovators, supply chain partners, and regulatory bodies will accelerate protocol development and streamline compliance processes. In addition, diversifying sourcing strategies to include both domestic and international suppliers can mitigate tariff impacts while maintaining supply continuity. Finally, piloting emerging disinfecting technologies in controlled environments will uncover best practices prior to full-scale rollout, ensuring operational reliability and staff acceptance.

Collectively, these recommendations position industry leaders to deliver superior patient safety, boost operational resilience, and sustain competitive differentiation in an increasingly complex landscape.

Comprehensive Research Methodology Delivering Rigorous Data Collection, Stakeholder Validation, and In-Depth Analysis of Healthcare Environmental Services

The research underpinning this analysis employed a comprehensive, multi-phase approach designed to ensure methodological rigor and data integrity. Initially, a thorough review of secondary sources-including regulatory guidelines, professional association publications, and scientific literature-provided foundational insights into evolving disinfection standards and sustainability practices.

Subsequently, primary research consisted of structured interviews with a cross-section of stakeholders, such as facility executives, environmental services directors, supply chain managers, and regulatory experts. These conversations validated emerging trends, identified pain points related to tariffs and supply chain disruptions, and illuminated best-practice innovations in both mature and developing markets.

Data triangulation was achieved by comparing qualitative interview findings with operational performance benchmarks and case studies from leading organizations. Throughout this process, an advisory panel of industry veterans reviewed preliminary conclusions, ensuring that insights were both contextually grounded and strategically actionable. Finally, the data synthesis phase integrated quantitative and qualitative evidence into a cohesive analytical framework, facilitating robust segmentation and regional analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Environmental Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Environmental Services Market, by Service Type

- Healthcare Environmental Services Market, by Service Form

- Healthcare Environmental Services Market, by Facility Type

- Healthcare Environmental Services Market, by Organization Size

- Healthcare Environmental Services Market, by Region

- Healthcare Environmental Services Market, by Group

- Healthcare Environmental Services Market, by Country

- United States Healthcare Environmental Services Market

- China Healthcare Environmental Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Core Insights and Strategic Imperatives for Shaping the Future of Healthcare Environmental Services Through Innovation and Collaboration

Collectively, the insights presented highlight an industry in transition, driven by heightened regulatory demands, sustainability imperatives, and technological innovation. The interplay of these forces has reshaped service delivery models, compelling providers to adopt data-driven approaches, diversify supply chains in response to tariff pressures, and customize solutions across service types and organizational scales.

Regional variations underscore the necessity for adaptable strategies, as service providers navigate mature compliance regimes in North America, pan-regional alliances in Europe, the Middle East, and Africa, and rapid infrastructure development in the Asia-Pacific. Concurrently, leading companies are distinguishing themselves through digital platforms, proprietary chemistries, and workforce development programs that collectively set new performance benchmarks.

Looking ahead, the capacity to integrate sustainability with operational agility and to forge strategic partnerships will define market leadership. As environmental services assume an increasingly strategic role in patient safety and cost containment, organizations that harness emerging technologies and insights will be best positioned to thrive. This executive summary offers a consolidated roadmap for stakeholders seeking to capitalize on current trends and to shape the future of healthcare environmental services.

Take Action Now to Partner with Ketan Rohom and Secure the Definitive Market Research Report on Healthcare Environmental Services Excellence

Ensure immediate engagement with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to an authoritative, in-depth market research report covering critical insights, competitive intelligence, and actionable strategies for excelling in healthcare environmental services. This comprehensive resource will enable decision-makers to benchmark operations, identify untapped opportunities, and implement best-in-class practices that enhance patient safety, sustainability performance, and regulatory compliance. Take this step now to secure a foundational asset that informs strategic planning, supports investment decisions, and accelerates growth in a rapidly evolving sector. Connect with Ketan Rohom today and position your organization to lead in healthcare environmental services excellence without delay.

- How big is the Healthcare Environmental Services Market?

- What is the Healthcare Environmental Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?