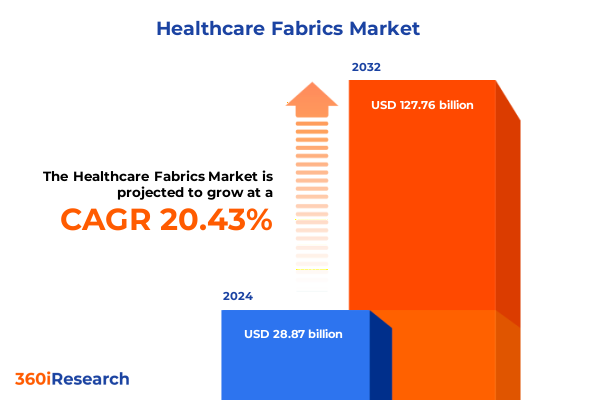

The Healthcare Fabrics Market size was estimated at USD 34.72 billion in 2025 and expected to reach USD 41.77 billion in 2026, at a CAGR of 20.45% to reach USD 127.76 billion by 2032.

Discover How Healthcare Fabrics Are Redefining Medical Safety and Performance Amid Rapid Clinical Evolution with Strategic Insights

The healthcare industry’s relentless pursuit of patient safety, operational efficiency, and cost containment has propelled healthcare fabrics to the forefront of clinical innovation. In recent years, heightened awareness around infection control, coupled with unprecedented global health events, has underscored the critical role that specialized medical textiles play in safeguarding patients and practitioners alike. From nonwoven mask filters to woven surgical gowns, these materials form the very fabric of modern healthcare environments, demanding ever-greater performance, sterility, and reliability.

Against this backdrop, stakeholders across the value chain-from raw material suppliers and fabric producers to distributors and end users-must navigate an intricate web of regulatory requirements, evolving clinical protocols, and dynamic supply chain risks. Rising expectations for sustainable and reusable solutions are disrupting traditional manufacturing and sourcing approaches, while technological advances in antimicrobial coatings, nanofiber integration, and smart textiles are redefining material capabilities. This introduction sets the stage for a deep dive into the forces reshaping the healthcare fabrics market today, outlining the strategic imperatives that will determine which organizations thrive in a rapidly evolving landscape.

Embracing Innovation and Sustainability to Navigate Disruptive Shifts Transforming the Healthcare Fabrics Landscape for Optimal Outcomes

Over the past decade, the healthcare fabrics landscape has been fundamentally reshaped by converging trends in sustainability, digitalization, and advanced materials science. Industry participants are increasingly embracing bio-based and recyclable fibers as environmental stewardship becomes a boardroom priority, prompting a shift from single-use disposables toward circular economy models. Concurrently, the integration of sensor technology and data analytics into textile substrates is enabling real-time monitoring of patient vitals and treatment efficacy, ushering in a new era of intelligent medical textiles.

Regulatory bodies and accreditation agencies have responded to these technological advances by updating standards for performance validation, sterility assurance, and lifecycle analysis. This regulatory evolution has catalyzed deeper collaboration between material scientists, clinicians, and manufacturers, accelerating the translation of lab-scale innovations into commercial products. As automation and digital twins optimize production processes, the cost and lead time associated with next-generation fabrics continue to decline. The net result is a healthcare fabrics ecosystem characterized by unprecedented agility, where the capacity to anticipate clinical needs and deploy innovative solutions rapidly has become a core competitive differentiator.

Assessing the Rippling Effects of 2025 US Tariffs on Healthcare Fabrics Supply Chains Costs and Strategic Sourcing Dynamics

In response to shifting trade policies, the United States implemented targeted tariffs on imported medical textiles in early 2025, aiming to bolster domestic manufacturing and strengthen strategic supply chains. These levies, applied primarily to nonwoven materials and finished surgical drapes, have had a cascading effect across the healthcare fabrics ecosystem. Fabric converters and downstream distributors are contending with increased input costs, prompting renegotiations of supplier agreements and a reexamination of global sourcing strategies.

At the same time, hospitals and clinics have reported modest upticks in procurement expenses, sparking efforts to optimize inventory management and explore alternative fabric blends that maintain clinical performance while mitigating cost pressures. This environment has accelerated nearshoring initiatives, with several established producers expanding North American meltblown and spunbond capacity to reduce exposure to cross-border duties. While these adjustments have enhanced supply resilience, they have also underscored the imperative for end users to adopt more flexible contracting models and demand greater transparency on total cost of ownership.

Unveiling Critical Segmentation Perspectives to Illuminate Diverse Healthcare Fabric Applications Materials and User Environments Driving Market Depth

A nuanced understanding of market segmentation reveals the multifaceted nature of demand for healthcare fabrics. By fabric type, nonwoven materials have become synonymous with single-use protective applications, leveraging meltblown and spunbond technologies to deliver high filtration efficiencies, liquid barrier performance, and cost-effective disposability. In contrast, woven textiles continue to play an indispensable role where durability and tensile strength are paramount, particularly in reusable gowns and drape systems.

Application segmentation further distinguishes demand vectors: dressings prioritize moisture management and biocompatibility, gowns emphasize barrier integrity and wearer comfort, while masks and surgical drapes require precise control over fiber density and sterilization compatibility. Material type segmentation underscores the trade-offs between natural fibers such as cotton, which offers breathability and biodegradability, and engineered polymers like polyester, polypropylene, and regenerated cellulose, each selected for unique balances of strength, regulatory compliance, and sustainability credentials.

End-user segmentation highlights that ambulatory centers and clinics often drive demand for cost-effective single-use items, whereas hospitals maintain more stringent performance and certification requirements, and home care settings call for user-friendly, low-temperature sterilization compatibility. Sterilization method segmentation-covering ethylene oxide, gamma irradiation, and steam sterilization-shapes material selection protocols and logistical workflows. Finally, distribution channel segmentation reflects a dual reality: while direct sales and distributor networks dominate traditional procurement, the rise of e-commerce and retail pharmacy availability is democratizing access to critical fabric-based supplies, reshaping purchasing behaviors across all end-user categories.

This comprehensive research report categorizes the Healthcare Fabrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fabric Type

- Material Type

- Sterilization Method

- Distribution Channel

- Application

- End User

Exploring Regional Differentiators Shaping Demand Innovation and Regulatory Landscapes Across the Americas EMEA and Asia Pacific Zones

Regional market dynamics for healthcare fabrics are intricately tied to local regulatory frameworks, manufacturing capabilities, and healthcare infrastructure investments. In the Americas, a legacy of advanced medical device regulation and robust domestic production capacity has fostered a competitive environment where reshoring initiatives are further invigorating local nonwoven and woven fabric output. This regional ecosystem benefits from established logistics networks and strong partnerships between fabric producers and major hospital chains.

Europe, Middle East & Africa present a mosaic of market conditions: stringent European Union directives on medical device classification and environmental impact drive high standards for material safety and recyclability, while emerging economies in the Middle East and Africa are witnessing rapid growth in hospital construction, creating fresh demand for cost-effective fabric solutions. Harmonization efforts under the EU’s Medical Device Regulation have set a benchmark for quality and have spurred innovative collaborations between European technical textile manufacturers and global research institutions.

Asia-Pacific continues to spearhead global production volumes, with China and India leading nonwoven capacity expansions supported by government incentives and private investment. Rising healthcare spending in Southeast Asia and the Asia-Pacific rim nations is stimulating demand for a broader spectrum of fabric applications, from single-use surgical gowns to advanced antimicrobial dressings. Logistic corridors within the region facilitate efficient export flows, yet geopolitical considerations and trade agreements continue to influence supply chain realignment decisions.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Fabrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Healthcare Fabric Innovators Uncovering Strategic Moves Competitive Advantages and Collaborative Ventures Driving Industry Leadership

Several industry leaders have distinguished themselves through targeted investments, technological collaborations, and strategic vertical integration. One global nonwoven specialist has ramped up capacity for meltblown filtration media to support both protective mask and high-performance gown production, while forging alliances with antimicrobial chemistry innovators to enhance barrier efficacy. Another legacy chemical company has leveraged its polymer expertise to pioneer bio-based regenerated cellulose fabrics, positioning itself at the convergence of circular economy objectives and regulatory drive for green materials.

Major diversified manufacturers have pursued cross-sector M&A to reinforce their presence in the healthcare segment, integrating downstream converting and sterilization services to offer turnkey fabric solutions. At the same time, medium-sized specialty textile firms are carving out niches by focusing on smart fabric technologies that embed sensors for patient monitoring and temperature regulation. Their agile R&D capabilities allow rapid prototyping and direct engagement with leading healthcare institutions to co-develop next-generation products.

Collectively, these strategic moves underscore a competitive landscape in which scale economies, innovation pipelines, and supply chain control coalesce to define industry leadership. Companies that can efficiently navigate complex regulatory pathways, while delivering differentiated materials with proven clinical performance, are best positioned to capture the evolving needs of healthcare providers worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Fabrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ahlstrom-Munksjö Oyj

- Asahi Kasei Corporation

- Avient Corporation

- Berry Global Group, Inc.

- Cardinal Health, Inc.

- DuPont de Nemours, Inc.

- Freudenberg Performance Materials GmbH

- Glatfelter Corporation

- Kimberly-Clark Corporation

- Lydall, Inc.

- Medline Industries, LP

- Suominen Corporation

- Toray Industries, Inc.

- Winner Medical Co., Ltd.

Empowering Industry Stakeholders with Pragmatic Strategies to Enhance Supply Resilience Sustainability and Innovation in Healthcare Fabric Operations

To fortify supply resilience and capitalize on emerging growth opportunities, industry leaders must adopt a multi-pronged strategic agenda. First, investing in sustainable and circular material platforms will not only address tightening environmental regulations but also differentiate product portfolios in a market increasingly sensitive to lifecycle impacts. Concurrent partnerships with recycling specialists and waste-to-resource innovators can accelerate closed-loop programs for nonwoven production and end-of-life garment reclamation.

Second, diversifying sourcing footprints through nearshoring and allied manufacturing partnerships will reduce exposure to tariff volatility and logistical disruptions. This entails establishing contingency agreements across multiple geographies and incorporating dual-sourcing frameworks within procurement contracts. Third, scale-up of digital manufacturing technologies-such as automated fiber deposition, robotics-enabled conversion lines, and digital twin process simulations-will improve production agility, yield consistency, and cost predictability.

Finally, deepening collaboration with sterilization providers and clinical end users can yield co-developed product formulations aligned with specific sterilization methodologies and procedural workflows. By integrating performance feedback loops and leveraging data analytics, manufacturers can refine product specifications, drive clinical outcomes, and secure long-term supply agreements. Adopting these actionable strategies will empower industry stakeholders to thrive amid the next wave of healthcare fabric innovation.

Detailing the Rigorous Research Framework Integrating Primary Expert Insights and Comprehensive Data Validation Protocols for Market Analysis

This analysis was built upon a rigorous research framework combining qualitative and quantitative methodologies. Primary research included structured interviews with over thirty senior executives and technical experts across fabric production, healthcare procurement, and regulatory compliance functions. These conversations provided firsthand insights into strategic priorities, supply chain challenges, and emerging product requirements.

Secondary research entailed an exhaustive review of peer-reviewed journals, government regulatory documents, industry white papers, and corporate disclosures to validate material properties, production technologies, and trade policy impacts. Data points were triangulated across multiple sources to ensure accuracy and consistency, with particular attention paid to tariff schedules, sterilization standards, and regional manufacturing capacities.

The segmentation model was developed collaboratively with subject-matter experts, ensuring that fabric types, end-user categories, sterilization methods, and distribution channels were distinct, mutually exclusive, and reflective of real-world procurement processes. Regional analyses leveraged trade flow statistics and healthcare expenditure data to map demand trajectories. All insights underwent peer review and editorial scrutiny to uphold a high standard of analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Fabrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Fabrics Market, by Fabric Type

- Healthcare Fabrics Market, by Material Type

- Healthcare Fabrics Market, by Sterilization Method

- Healthcare Fabrics Market, by Distribution Channel

- Healthcare Fabrics Market, by Application

- Healthcare Fabrics Market, by End User

- Healthcare Fabrics Market, by Region

- Healthcare Fabrics Market, by Group

- Healthcare Fabrics Market, by Country

- United States Healthcare Fabrics Market

- China Healthcare Fabrics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Critical Insights and Strategic Imperatives to Guide Future Investment and Innovation Decisions in Healthcare Fabric Markets

In synthesizing the evolving dynamics of healthcare fabrics, this executive summary has charted the intersection of innovation, regulation, and supply chain strategy. The industry is being transformed by sustainable material mandates, digital manufacturing breakthroughs, and shifting trade policies that together reshape competitive imperatives. Understanding the nuanced segmentation of fabric types, applications, materials, end users, sterilization processes, and distribution channels provides a granular lens through which to evaluate market opportunities.

Regional insights reveal distinctive growth drivers and regulatory complexities across the Americas, EMEA, and Asia-Pacific, underscoring the need for adaptable sourcing and compliance capabilities. Leading companies are executing differentiated strategies-from capacity expansions and partnerships to M&A and smart textile development-that position them at the vanguard of this dynamic landscape. As healthcare providers continue to demand higher performance, safety, and sustainability, stakeholders equipped with actionable intelligence and robust strategic plans will be best placed to lead the next generation of medical textile solutions.

Connect with Ketan Rohom Associate Director Sales and Marketing to Secure Exclusive Access to the Comprehensive Healthcare Fabrics Market Research Insights Today

To access the full breadth of market insights, strategic analyses, and detailed segment breakdowns contained in this comprehensive report, reach out to Ketan Rohom, Associate Director, Sales and Marketing. His expertise can guide you through our research scope, answer any questions, and facilitate the acquisition process. Don’t miss the opportunity to leverage actionable intelligence on healthcare fabrics that will inform your strategic planning and operational initiatives. Contact Ketan today to secure your copy and stay ahead in a rapidly evolving industry landscape

- How big is the Healthcare Fabrics Market?

- What is the Healthcare Fabrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?