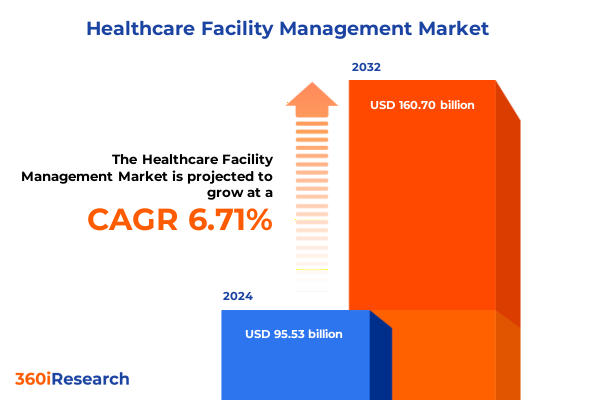

The Healthcare Facility Management Market size was estimated at USD 101.53 billion in 2025 and expected to reach USD 108.09 billion in 2026, at a CAGR of 6.77% to reach USD 160.70 billion by 2032.

Exploring the Critical Evolution of Healthcare Facility Management in Response to Technological Advances Operational Pressures and Regulatory Complexities

As the healthcare industry continues its rapid evolution, facility management has emerged as a pivotal function for ensuring patient safety, operational excellence, and regulatory compliance. Healthcare facilities must navigate an increasingly complex environment characterized by stringent quality standards and dynamic patient expectations. In recent years, the integration of advanced technologies such as automated building systems and data analytics platforms has reshaped the way healthcare organizations approach maintenance, resource allocation, and facility design.

Simultaneously, cost containment initiatives have intensified pressure on facility teams to optimize operational budgets without compromising service quality. Rising labor expenses, supply chain disruptions, and inflationary trends require facility managers to employ creative strategies that balance staff efficiency with capital planning. Moreover, the demand for environmentally sustainable practices has introduced new performance metrics related to energy consumption, waste reduction, and carbon footprint management, all of which are now integral to corporate social responsibility frameworks.

In addition to financial and environmental concerns, regulatory bodies continue to introduce updated guidelines for patient safety, infection control, and emergency preparedness. Facility management plays a central role in translating these requirements into practical infrastructure modifications and maintenance protocols. This alignment between regulatory imperatives and facility operations underscores the necessity of a holistic management approach that integrates clinical, technical, and administrative insights.

Against this backdrop, this executive summary presents a comprehensive analysis of the transformative shifts, tariff impacts, segmentation dynamics, regional nuances, leading industry players, and actionable recommendations shaping the healthcare facility management landscape. By examining the latest trends and emerging strategies, this report aims to equip decision-makers with the intelligence needed to navigate evolving challenges and capitalize on growth opportunities.

Uncovering Groundbreaking Transformations Shaping Healthcare Facility Operations Through Digital Innovation Sustainability Initiatives and Patient-Centric Models

The past decade has witnessed a series of transformative shifts redefining the boundaries of healthcare facility operations. At the forefront, digital innovation has ushered in a new era of smart buildings and interconnected systems. Internet of Things (IoT) sensors embedded within medical suites and public areas now continuously monitor environmental conditions, enabling real-time adjustments to temperature, humidity, and air quality. Consequently, facility managers can reduce energy waste, anticipate equipment failures, and uphold hospital-wide safety standards without manual intervention.

Parallel to technology adoption, the industry has embraced sustainability as more than a corporate ideal-it has become a business imperative. Green building certifications and renewable energy investments are driving down operating costs while reinforcing organizational commitments to environmental stewardship. Meanwhile, patient-centric design principles have elevated the role of facility aesthetics, acoustics, and wayfinding to enhance comfort, reduce stress, and accelerate recovery. This shift toward patient experience underscores the broader expectation that healthcare facilities function as healing environments rather than mere service providers.

In conjunction with these developments, workforce dynamics have evolved significantly. Facility management teams are increasingly multigenerational, requiring tailored training programs that address both digital literacy and traditional maintenance expertise. Collaboration across clinical, administrative, and technical departments has strengthened, fostering integrated workflows that prioritize safety and operational resilience. Furthermore, post-pandemic imperatives for infection control have prompted permanent upgrades to HVAC systems, touch-free technologies, and spatial reconfigurations that support social distancing protocols.

Collectively, these trends illustrate a comprehensive transformation in healthcare facility management. Organizations that proactively integrate digital solutions, sustainable practices, and patient-centric designs will be better positioned to navigate future challenges. The following sections delve deeper into sector-specific shifts, tariff influences, market segmentation, regional insights, and strategic recommendations driving the next generation of healthcare infrastructure excellence.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Medical Supply Chains Procurement Strategies and Operational Budgets

The introduction of new tariff measures in 2025 has precipitated a profound ripple effect across the healthcare facility management ecosystem. Historically dependent upon imported medical equipment, parts, and specialized materials, facilities now face elevated procurement costs for everything from diagnostic machinery to building maintenance components. The increased overhead associated with imported goods has compelled facility teams to reassess vendor relationships, negotiate longer-term supply agreements, and explore domestic sourcing alternatives to mitigate financial impact.

Tariff-driven cost pressures have also reshaped capital planning cycles. Projects that were once green-lit based solely on clinical or patient experience criteria now undergo rigorous cost-benefit analysis that incorporates tariff volatility. Facility managers are prioritizing scalable solutions and modular infrastructure upgrades that can absorb potential cost shocks without derailing broader organizational objectives. In certain cases, deferred maintenance budgets have been recalibrated to accommodate critical equipment acquisitions that would otherwise be delayed until tariff rates stabilize.

Moreover, the cumulative burden of tariffs has incentivized investment in local manufacturing partnerships. By collaborating with domestic producers, healthcare organizations aim to secure more predictable lead times, improve supply chain transparency, and reduce the risk associated with geopolitical tensions. These strategic alliances often extend beyond procurement to include joint research on materials optimization and cost-efficient production methods that benefit the broader medical supply industry.

Despite these adaptive strategies, certain categories-such as advanced imaging systems-remain heavily reliant on specialized international expertise, limiting the extent to which tariff escalation can be offset. Facility leaders must therefore maintain dynamic procurement strategies that balance in-house production, domestic partnerships, and select high-priority imports. Such an approach will be vital for ensuring uninterrupted access to critical equipment and maintaining operational continuity in the face of evolving trade policies.

Insightful Exploration of Diverse Healthcare Facility Market Segments From Outpatient Surgical Centers to Long-Term Care and Evolving Service and Deployment Requirements

Analyzing the healthcare facility management market through the lens of facility type reveals a spectrum of operational demands. Ambulatory surgical centers prioritize rapid turnover, advanced sterilization protocols, and streamlined patient flows to maintain throughput efficiency. Clinics, comprising primary care clinics and specialty clinics, require flexible layouts and scalable support services that accommodate fluctuating appointment volumes and diverse care pathways. Diagnostic centers, whether imaging centers or laboratory centers, emphasize precision infrastructure to support high-throughput testing while ensuring stringent environmental controls and data security.

Hospitals, categorized into general hospitals and specialty hospitals, face a dual imperative of broad operational resilience and focused service excellence. Within specialty hospitals, cardiac care centers must integrate life-support systems with continuous monitoring capabilities, whereas oncology centers demand specialized HVAC configurations and radiation shielding. In parallel, long-term care facilities such as assisted living facilities and nursing homes prioritize resident safety, comfort, and social engagement, necessitating robust maintenance protocols that minimize service disruptions and maintain compliance with residential care standards.

From a service perspective, advisory services now extend beyond baseline assessments to include strategic facility optimization, risk management frameworks, and sustainability roadmaps. Consulting practices are delivering tailored blueprints for digital transformation initiatives, while engineering teams design resilient infrastructures that can adapt to future technological advancements. Maintenance and operations functions are increasingly driven by predictive analytics, and training services equip staff with the skills required to leverage sophisticated building management platforms effectively.

When considering deployment models, the market is bifurcated between cloud and on-premise solutions. Cloud environments-encompassing hybrid cloud, private cloud, and public cloud configurations-offer rapid scalability and remote accessibility, enabling facility managers to centralize data from multiple sites through unified dashboards. Conversely, on-premise solutions, whether managed or self-managed, provide healthcare organizations with greater control over data sovereignty and customization, which can be particularly critical for institutions with strict privacy or regulatory mandates. The interplay between these deployment preferences underscores the need for adaptive strategies that align technological capabilities with organizational priorities.

This comprehensive research report categorizes the Healthcare Facility Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Mode

- Technology Integration

- Facility Type

Delving into Regional Nuances Influencing Healthcare Facility Management Trends Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping healthcare facility management practices around the globe. In the Americas, robust investment in digital infrastructure and a mature regulatory framework have accelerated the adoption of smart building technologies. U.S. and Canadian healthcare providers are harnessing advanced analytics, predictive maintenance, and integrated service platforms to reduce unplanned downtime and enhance patient care coordination. Latin American markets, while still evolving, are experiencing a surge in private sector participation that is driving modernization efforts in major urban centers.

In Europe, Middle East, and Africa, a diverse regulatory landscape and varying levels of infrastructure maturity have led to differentiated facility management approaches. Western European nations are advancing energy efficiency mandates and stringent patient safety regulations, prompting facility teams to invest in green retrofits and compliance management systems. The Middle East is witnessing an uptick in large-scale healthcare campus developments driven by government initiatives and private-public partnerships, while parts of Africa are focusing on scalable, cost-effective facility solutions that can bridge resource gaps and support rural healthcare delivery.

Asia-Pacific markets are characterized by rapid modernization and an expanding private healthcare sector, particularly in countries such as China, India, and Australia. Technological innovation hubs within the region are pioneering telemedicine integration and remote facility monitoring to address workforce constraints and geographical challenges. Additionally, regional trade agreements and local manufacturing incentives are influencing procurement strategies, enabling facility managers to source critical components domestically and reduce reliance on cross-border shipments.

Understanding these regional nuances is essential for crafting tailored strategies that account for local regulatory regimes, infrastructural capacities, and cultural expectations. Healthcare organizations that recognize the unique drivers in each market and deploy context-sensitive facility management solutions will be best positioned to achieve operational resilience and competitive differentiation on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Facility Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Healthcare Facility Management Companies Strategies Emphasizing Digital Solutions Sustainability Collaborations and Service Portfolio Diversification

Prominent companies in the healthcare facility management sector are redefining competitive benchmarks through innovation and strategic partnerships. Industry leaders have significantly expanded their digital solution portfolios by integrating IoT-enabled equipment monitoring, cloud-based analytics platforms, and mobile applications that empower on-site staff with real-time insights. These investments not only optimize maintenance operations but also generate actionable data that informs long-term capital planning and regulatory compliance reporting.

In parallel, sustainability has moved from a peripheral initiative to a core strategic pillar. Leading providers are assisting healthcare organizations in achieving carbon neutrality goals by offering energy auditing services, renewable energy integration roadmaps, and waste management optimization plans. Collaborative ventures with energy service companies and green technology start-ups are further enhancing the ability of healthcare facilities to reduce operational costs while meeting environmental benchmarks.

Another defining strategy among top companies is service portfolio diversification. By bundling advisory, consulting, engineering, maintenance, operations, and training services, these firms are creating end-to-end solutions that align with the full lifecycle needs of healthcare properties. This integrated approach not only simplifies vendor management for clients but also drives recurring revenue streams and deepens long-term customer relationships.

Moreover, mergers and acquisitions have played a critical role in reshaping competitive dynamics. Strategic acquisitions of specialized engineering firms and digital platform providers have enabled incumbents to broaden service capabilities and accelerate market penetration. As the industry continues to consolidate, facility management companies with the right blend of technological prowess, sustainability expertise, and comprehensive service models will emerge as preferred partners for healthcare organizations seeking to optimize operational performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Facility Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABM Industries Incorporated

- Accruent

- Amentum Services, Inc.

- Aramark

- CBRE, Inc.

- Compass USA

- Ecolab Inc.

- EMCOR Facilities Services, Inc.

- Equans SAS

- Forefront Healthcare

- G4S Limited

- Johnson Controls International PLC

- Jones Lang LaSalle IP, Inc.

- Medxcel Facilities Management, LLC

- Mitie Group PLC

- OCS Group Holdings Ltd.

- Rekeep S.p.a.

- Rubicon Professional Services

- Serco Group PLC

- SILA Solutions

- SODEXO

- Supreme Facility Management Limited

- UEM Edgenta Berhad

- Vanguard Resources, Inc.

Actionable Strategies for Industry Leaders to Navigate Cost Pressures Integrate Advanced Technologies and Strengthen Operational Resilience in Healthcare Facilities

Industry leaders must prioritize strategic investments that balance immediate cost pressures with long-term resilience goals. Implementing predictive maintenance programs driven by IoT sensors and machine learning algorithms can reduce emergency repair expenses and extend equipment lifecycles. By transitioning from reactive to proactive maintenance models, facility managers can optimize resource allocation, minimize unplanned downtime, and ensure consistent service delivery.

Moreover, the integration of digital twins-virtual replicas of facility infrastructures-offers a powerful way to simulate operational scenarios and test design modifications without physical disruptions. This approach enhances decision-making agility and allows teams to evaluate the impact of capital projects on energy consumption, workflow efficiency, and regulatory compliance before implementation. Embracing digital twins will be instrumental in accelerating modernization initiatives while mitigating budget overruns.

Supply chain resilience is another critical pillar for success. Establishing strategic relationships with domestic and regional suppliers can help diversify procurement channels and reduce exposure to tariff-driven cost fluctuations. Organizations should evaluate inventory management strategies such as safety stock optimization and just-in-time delivery to strike the right balance between operational readiness and cost efficiency. Regular supplier performance assessments are equally important to ensure continuity and quality standards.

Finally, fostering a culture of continuous learning and cross-disciplinary collaboration will empower facility teams to adapt to emerging challenges. Comprehensive training programs that blend technical certifications with leadership development can equip staff with the skills needed to leverage advanced management platforms and navigate regulatory changes. By investing in talent and technology in tandem, healthcare organizations will reinforce their operational resilience and sustain competitive advantage in a rapidly evolving landscape.

Comprehensive Outline of Research Methodology Integrating Primary Interviews Secondary Sources Data Triangulation and Expert Validation for Robust Facility Insights

This research report employs a rigorous methodology that combines qualitative and quantitative data collection techniques to ensure comprehensive and reliable insights. Primary research activities include in-depth interviews with key stakeholders such as healthcare facility executives, facility management service providers, and technology vendors. These conversations explore firsthand experiences related to operational challenges, technology adoption journeys, and strategic priorities.

Secondary research sources encompass a broad spectrum of industry publications, regulatory guidelines, white papers, and corporate financial disclosures. Data from public health agencies, accreditation bodies, and energy management organizations have been systematically reviewed to validate operational benchmarks and sustainability metrics. Additionally, proprietary databases have been leveraged to track service provider activities, partnership announcements, and product launches.

Data triangulation is achieved by cross-verifying information from disparate sources, ensuring consistency between interview insights, documented industry trends, and observed market activities. This process enhances the credibility of the findings and mitigates potential biases. A series of validation workshops involving subject-matter experts-ranging from clinical engineers to facility operations specialists-further refines the analysis and confirms key thematic conclusions.

The final research framework integrates thematic analysis, comparative benchmarking, and scenario planning to deliver actionable intelligence. Segmentation insights, regional evaluations, and tariff impact assessments are underpinned by this methodological approach, providing a clear roadmap for stakeholders to apply the report’s recommendations within their organizational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Facility Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Facility Management Market, by Service Type

- Healthcare Facility Management Market, by Delivery Mode

- Healthcare Facility Management Market, by Technology Integration

- Healthcare Facility Management Market, by Facility Type

- Healthcare Facility Management Market, by Region

- Healthcare Facility Management Market, by Group

- Healthcare Facility Management Market, by Country

- United States Healthcare Facility Management Market

- China Healthcare Facility Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Perspectives on Strategic Imperatives Guiding Healthcare Facility Management Amidst Regulatory Shifts Technological Evolution and Market Diversification

In conclusion, healthcare facility management stands at a pivotal juncture defined by regulatory complexity, digital transformation, and evolving market segmentation. Organizations that embrace a holistic management philosophy-one that integrates advanced technologies, sustainable practices, and patient-centered design principles-will be best positioned to navigate the challenges ahead. The convergence of IoT-driven maintenance, predictive analytics, and digital twins represents a paradigm shift in how facility teams can optimize performance and anticipate future needs.

The impact of 2025 tariff adjustments underscores the necessity of agile procurement strategies and supply chain diversification. By forging strategic alliances with domestic manufacturers and adopting flexible inventory management practices, facility leaders can mitigate cost volatility and maintain operational continuity. Furthermore, understanding regional market nuances-from the Americas’ digital maturity to the diverse infrastructure landscapes of EMEA and Asia-Pacific-is critical for deploying location-specific solutions that drive efficiency and compliance.

Segmentation insights reveal that each facility type presents distinct operational priorities, service requirements, and technological preferences. Whether managing ambulatory surgical centers, specialty hospitals, or long-term care facilities, decision-makers must align service portfolios and deployment models with the unique demands of each segment. Leading companies have demonstrated that comprehensive service offerings, bolstered by sustainability and digital innovation, create enduring value for healthcare providers.

Ultimately, the recommendations outlined in this report serve as a strategic compass for industry leaders seeking to optimize healthcare facility management. By investing in predictive technologies, building supply chain resilience, and fostering a culture of continuous learning, organizations can achieve sustainable excellence and enhance patient outcomes in an increasingly competitive environment.

Engaging Call-To-Action Inviting Executive Stakeholders to Connect with Ketan Rohom for Acquiring In-Depth Healthcare Facility Management Market Intelligence Report

To capitalize on the insights detailed in this executive summary and to gain access to the comprehensive market intelligence report, we invite healthcare executives and facility operations leaders to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Your organization can benefit from tailored briefings that delve into advanced facility management strategies, proprietary segmentation analyses, and region-specific evaluations. By partnering with Ketan, you will receive expert guidance on implementing the actionable recommendations outlined in this report, ensuring your facility management programs achieve maximum efficiency and sustainability.

Schedule a personalized consultation today to explore detailed case studies, in-depth tariff impact models, and exclusive data visualizations that are not available in this summary. Ketan’s expertise in healthcare facility management research will help your team develop a customized roadmap for technology integration, cost-optimization tactics, and strategic supplier partnerships. Take the next step toward operational excellence by connecting with Ketan Rohom and securing the full market research report that will empower your organization to lead in the evolving landscape of healthcare facility management.

- How big is the Healthcare Facility Management Market?

- What is the Healthcare Facility Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?