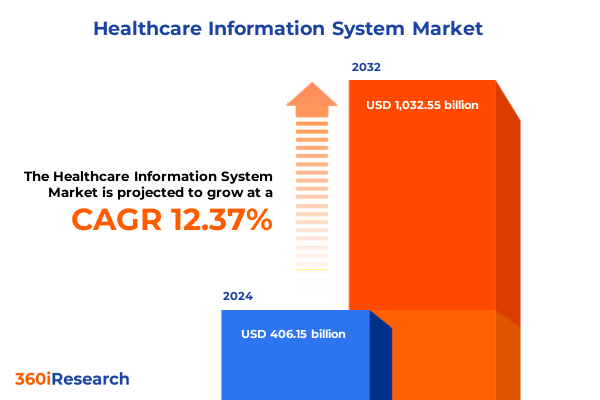

The Healthcare Information System Market size was estimated at USD 456.00 billion in 2025 and expected to reach USD 511.98 billion in 2026, at a CAGR of 12.38% to reach USD 1,032.55 billion by 2032.

Setting the Stage for Next-Generation Healthcare Information Systems with a Strategic Overview of Market Dynamics and Industry Drivers

In a healthcare environment defined by accelerating digital transformation, the demand for integrated, secure, and interoperable platforms is at an all-time high. Providers face mounting pressure to deliver patient-centric care while optimizing operational efficiency and cost effectiveness. Executives and decision-makers require a clear understanding of the technological, regulatory, and market forces that will shape the future of healthcare information systems. This executive summary provides that clarity, laying out the critical context needed to inform strategic choices and investment priorities.

Drawing insights from recent developments and established industry knowledge, this overview illuminates the key drivers influencing today’s landscape. It encapsulates the strategic imperatives of adopting advanced analytics, navigating evolving compliance requirements, and aligning IT capabilities with value-based care models. As organizations strive to enhance clinical outcomes and financial performance, this section establishes the framework for comprehending the transformative shifts, segmentation nuances, regional dynamics, and competitive strategies detailed in the full report

Navigating the Transformative Shifts Reshaping Healthcare Information Systems through Technological Innovation, Regulatory Changes, and Evolving Care Models

The pace of innovation in healthcare information systems has accelerated dramatically, driven by breakthroughs in artificial intelligence, data interoperability standards, and cloud computing architectures. Advanced algorithms now support real-time clinical decision support tools, enabling clinicians to harness predictive insights at the point of care. Simultaneously, regulatory mandates emphasizing patient data access and privacy have compelled vendors and providers to adopt standardized APIs and strengthen cybersecurity protocols.

At the same time, care delivery models are evolving toward greater decentralization, with telehealth and remote patient monitoring becoming integral to chronic disease management and preventive care. These shifts demand flexible platforms capable of integrating diverse data sources-from electronic health records to wearable sensors-while ensuring seamless user experiences across stakeholder groups. Altogether, these technological and regulatory developments are converging to redefine how healthcare information systems are designed, implemented, and leveraged to drive clinical excellence and operational resilience

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Healthcare Information System Supply Chains and Cost Structures

In early 2025, the United States implemented a series of tariffs targeting imported medical devices, key software modules, and cloud infrastructure hardware integral to healthcare information systems. These measures, designed to bolster domestic manufacturing, have introduced new cost pressures across supply chains. Providers and solution vendors have begun experiencing increased expenses for specialized servers, network appliances, and third-party software components imported from overseas.

The cumulative effect has prompted many organizations to reevaluate sourcing strategies, accelerating initiatives to nearshore component production and diversify supplier bases. For some healthcare institutions, this has meant renegotiating vendor contracts, adjusting IT budgets, and prioritizing modular architectures that can accommodate alternative hardware or open-source software substitutes without compromising performance or compliance. These tariff-induced adjustments are reshaping procurement practices and prompting renewed attention to total cost of ownership as a core criterion for system selection and deployment

Unearthing Key Segmentation Insights across Component, Application, Deployment Mode, End User, and Service Verticals Driving System Adoption and Innovation

Analyzing the market through the lens of component segmentation reveals a balancing act between services and software offerings. Implementation, support, and training services cater to diverse deployment scenarios, while custom software development competes alongside off-the-shelf solutions optimized for rapid adoption. Each of these paths presents distinct opportunities for vendors to differentiate on quality, flexibility, and integration capabilities.

When examining application areas, clinical decision support, electronic health records, practice management, and revenue cycle management remain foundational, but telehealth services-particularly remote patient monitoring and video consultation-are driving accelerated uptake in distributed care environments. Platform developers are weaving these capabilities into unified interfaces, ensuring that disparate modules communicate effectively and align with clinician workflows.

Deployment mode continues to evolve, with cloud architecture enabling scalability, reduced infrastructure overhead, and streamlined maintenance. Nevertheless, on-premise deployments retain appeal for organizations with stringent data residency mandates or complex legacy environments. The choice between these models influences integration complexity, security postures, and total cost considerations.

End users span ambulatory care centers, primary and specialty clinics, as well as private and public hospitals, each presenting unique needs in terms of system functionality, user training, and service levels. Similarly, managed services like help desk support and remote monitoring complement professional services-consulting, implementation, and training-to form comprehensive offerings that align vendor incentives with customer success

This comprehensive research report categorizes the Healthcare Information System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Service

- Application

- End User

Illuminating Regional Insights That Highlight Market Dynamics and Growth Opportunities across the Americas, EMEA, and Asia-Pacific Healthcare Ecosystems

Regional dynamics demonstrate that the Americas continue to lead in large-scale EHR implementations and advanced analytics adoption, driven by value-based care initiatives and public health data exchanges. North American providers are leveraging integrated platforms to coordinate population health management and optimize clinical workflows across vast networks.

In Europe, the Middle East, and Africa, diverse regulatory environments-from the European Union’s stringent GDPR framework to evolving digital health strategies in the Gulf Cooperation Council-create both challenges and opportunities. Vendors in this region focus on localization, multi-language support, and adherence to regional interoperability standards while forging partnerships with government agencies to digitalize national health systems.

Across the Asia-Pacific, rapid hospital modernization in metropolitan centers and government investments in telehealth infrastructure fuel demand for scalable cloud-based solutions. Emerging economies emphasize cost-effective deployment models and mobile-first interfaces to expand access to care, enabling providers to deliver clinical services to remote populations and address healthcare workforce shortages

This comprehensive research report examines key regions that drive the evolution of the Healthcare Information System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Shaping the Future of Healthcare Information Systems through Innovation, Strategic Partnerships, and Market Influence

Leading industry players are harnessing strategic partnerships, targeted acquisitions, and continuous R&D investments to maintain competitive differentiation. Organizations recognized for robust EHR and revenue cycle management suites are extending their portfolios with AI-driven analytics platforms and interoperability services that facilitate seamless data exchange among disparate systems.

Several vendors are collaborating with cloud hyperscalers to deliver managed infrastructure offerings that reduce deployment timelines and enhance platform resilience. Others are integrating machine learning frameworks to automate routine administrative tasks, from appointment scheduling to claims adjudication, thereby increasing operational efficiency and reducing manual errors.

Innovation is further underscored by alliances between established solution providers and emerging digital health startups, resulting in co-developed modules for remote patient monitoring, virtual care delivery, and advanced population health analytics. These joint ventures are accelerating the pace at which new capabilities reach the market and are establishing new benchmarks for user experience and clinical impact

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Information System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare Solutions, Inc.

- athenahealth, Inc.

- Change Healthcare LLC

- Cognizant Technology Solutions Corporation

- CompuGroup Medical SE & Co. KGaA

- Dedalus Group S.p.A.

- eClinicalWorks, LLC

- Epic Systems Corporation

- GE Healthcare

- IBM Corporation

- Infor, Inc.

- Inovalon Holdings, Inc.

- InterSystems Corporation

- Koninklijke Philips N.V.

- McKesson Corporation

- Medical Information Technology, Inc.

- NextGen Healthcare, Inc.

- Oracle Corporation

- Siemens Healthineers

- Tata Consultancy Services Limited

- Veradigm Inc.

- Wipro Limited

Delivering Actionable Recommendations to Empower Industry Leaders in Driving Sustainable Growth, Efficiency, and Patient-Centric Innovation

Industry leaders should prioritize interoperability initiatives that unite siloed data sources and enable seamless information flow across care settings. By adopting open APIs and adhering to emerging data exchange standards, organizations can reduce integration friction and accelerate time to value for new system deployments.

Investing in artificial intelligence and machine learning capabilities will become table stakes for differentiating service offerings. Whether applied to clinical decision support or financial operations, advanced analytics can surface actionable insights that drive quality improvements and cost reductions simultaneously. Embedding these capabilities into core platforms will be essential for sustaining competitive advantage.

To mitigate the impact of external cost pressures, such as the recent tariff adjustments, healthcare organizations should diversify supplier networks and explore modular solution architectures. This strategic flexibility will enable rapid substitution of critical components and streamline procurement cycles. Additionally, forging collaborative partnerships with channel allies and regional integrators can extend service reach and localize support models in key markets.

Finally, leaders must foster a culture of continuous learning and change management, ensuring that end users embrace new workflows and tools. Comprehensive training programs, coupled with robust support structures, will be instrumental in realizing the full potential of digital investments and driving measurable improvements in patient care and operational performance

Detailing the Research Methodology Employed to Ensure Data Integrity, Expert Validation, and Comprehensive Coverage of Healthcare Information System Insights

The research methodology underpinning this report integrates primary and secondary approaches to ensure rigor and comprehensiveness. Primary research included in-depth interviews with senior executives, IT directors, and clinical champions across leading provider organizations, combined with expert panels comprising technology vendors, implementation partners, and policy advisors.

Secondary research drew on peer-reviewed publications, white papers, regulatory filings, and industry analyses from reputable sources. Data from these channels was triangulated to validate market trends, technology adoption patterns, and regulatory impacts. Throughout the process, a structured data validation framework was employed to cross-check findings, identify inconsistencies, and refine insights.

Quality assurance protocols included iterative reviews by subject matter experts, ensuring that interpretations accurately reflect real-world experiences and strategic imperatives. A balanced approach of top-down and bottom-up analysis was used to capture both high-level market drivers and detailed operational considerations. The methodology prioritizes transparency and repeatability, enabling stakeholders to understand the basis for conclusions and recommendations

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Information System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Information System Market, by Component

- Healthcare Information System Market, by Deployment Mode

- Healthcare Information System Market, by Service

- Healthcare Information System Market, by Application

- Healthcare Information System Market, by End User

- Healthcare Information System Market, by Region

- Healthcare Information System Market, by Group

- Healthcare Information System Market, by Country

- United States Healthcare Information System Market

- China Healthcare Information System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Key Findings and Strategic Takeaways to Navigate the Complexities of Healthcare Information Systems and Drive Future Success

This executive summary has distilled the fundamental forces redefining healthcare information systems, from technological breakthroughs and regulatory adjustments to geopolitical influences such as 2025 tariffs. The segmentation insights underscore the nuanced requirements across components, applications, deployment modes, end users, and service models. Meanwhile, regional analyses reveal distinct adoption drivers and market dynamics in the Americas, EMEA, and Asia-Pacific.

Profiles of leading solution providers showcase how innovation, strategic alliances, and R&D investment are shaping next-generation offerings. The actionable recommendations laid out here equip industry leaders with a clear roadmap for enhancing interoperability, embracing advanced analytics, and building resilient supply chains. Through rigorous research and expert validation, the report delivers targeted guidance that empowers decision-makers to navigate complexity, seize emerging opportunities, and drive sustainable improvements in patient care and organizational performance

Take Immediate Action to Secure Your Comprehensive Market Research Report by Connecting with Associate Director of Sales & Marketing, Ketan Rohom

To explore the full depth of market dynamics, strategic drivers, and growth opportunities presented in this comprehensive report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy today. Engaging with an expert at this stage will ensure you have immediate access to actionable insights, detailed analysis, and tailored recommendations that can guide your organization’s next steps. By connecting with Ketan, you’ll gain priority support and customized guidance on how to leverage the report findings to achieve measurable business outcomes. Don’t miss the chance to arm your team with the data and expert perspectives required to navigate the complex landscape of healthcare information systems. Ensure your competitive edge by initiating a conversation with Ketan Rohom now and take decisive action toward informed growth and innovation

- How big is the Healthcare Information System Market?

- What is the Healthcare Information System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?