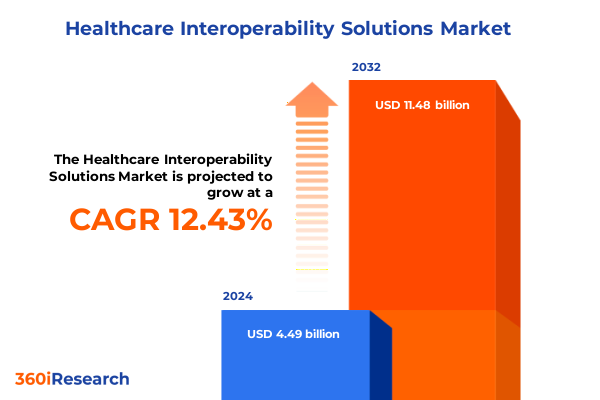

The Healthcare Interoperability Solutions Market size was estimated at USD 5.03 billion in 2025 and expected to reach USD 5.64 billion in 2026, at a CAGR of 12.50% to reach USD 11.48 billion by 2032.

Unlocking the Power of Interconnected Healthcare Systems with Innovative Interoperability Technologies to Revolutionize Data Exchange and Enhance Patient Outcomes

As healthcare systems worldwide advance toward a more connected and patient-centric future, interoperability solutions have emerged as the cornerstone of seamless information flow. The ability to integrate disparate electronic health record platforms, translate complex clinical data, and manage a growing ecosystem of APIs underpins everything from improved care coordination to enhanced operational efficiency. Conceptually, interoperability transcends mere data exchange: it establishes a dynamic digital ecosystem in which clinicians, administrators, and patients collaborate in real time, fostering better outcomes and reducing redundancies.

At its core, the interoperability imperative responds to evolving regulatory mandates, rising patient expectations for transparency, and the proliferation of cloud-based applications that demand agile integration frameworks. These drivers converge with broader technological shifts-such as the adoption of FHIR standards and the ascendancy of API-first architectures-shaping a landscape in which interoperability vendors play a pivotal role. Moreover, as telehealth services and remote monitoring devices generate unprecedented volumes of data, robust integration mechanisms become essential to harness insights and deliver personalized care pathways.

This report delivers an executive summary of critical market developments, including transformative shifts in interoperability technologies, the cumulative impact of United States tariffs enacted in 2025, and nuanced segmentation and regional analyses. By distilling key company strategies and actionable recommendations, it equips healthcare leaders with the insights needed to prioritize investments, optimize deployment models, and harness emerging opportunities across the interoperability spectrum.

Identifying The Major Disruptive Trends Redefining Healthcare Interoperability And Accelerating Digital Transformation Across Diverse Care Ecosystems

Healthcare interoperability is undergoing a seismic evolution driven by technological breakthroughs, regulatory momentum, and shifting stakeholder expectations. First, the widespread adoption of APIs as the architectural backbone has transitioned from proof-of-concept pilots to enterprise-scale deployments. Where early implementations focused on basic connectivity, today’s API management platforms deliver advanced analytics, traffic shaping, and robust security controls-enabling organisations to scale integration initiatives with confidence.

Simultaneously, cloud computing has redefined deployment paradigms. Hybrid-cloud and multi-cloud approaches have supplanted traditional on-premises systems, allowing health networks to balance data sovereignty requirements with agility and cost efficiency. These deployment models integrate seamlessly with emerging edge computing solutions, ensuring that critical patient data remains accessible at the point of care.

Furthermore, regulatory frameworks such as the 21st Century Cures Act and evolving FHIR standards are accelerating the push toward open APIs and greater interoperability. These mandates incentivize transparent data sharing and penalize information blocking, compelling vendors and healthcare organisations to innovate rapidly. In parallel, artificial intelligence and machine learning are being woven into interoperability platforms, enabling predictive analytics and real-time decision support that amplify clinical value.

Collectively, these transformative shifts are redefining expectations for data exchange, compelling stakeholders to adopt more agile, scalable, and standards-compliant interoperability solutions.

Assessing How The Latest United States Tariff Regulations In 2025 Are Influencing Supply Chains And Cost Structures For Healthcare Interoperability Solutions

The introduction of new United States tariffs in 2025 targeting semiconductor components and imported ICT hardware has reverberated throughout the healthcare interoperability sector. Vendors reliant on chipsets for edge devices and network appliances have experienced elevated input costs, leading to compressed margins and necessitating cost-optimization measures. In response, several interoperability solution providers have restructured supply chains to diversify component sourcing, while others have negotiated long-term agreements to mitigate price volatility.

Beyond hardware, tariffs have influenced the pricing of cloud-enabled services by indirectly raising operational expenses for data center operators. To safeguard profitability, some providers have adjusted subscription models and instituted tiered pricing, prompting healthcare organisations to reevaluate their consumption patterns. These shifts have amplified the strategic importance of deployment mode selection: stakeholders are increasingly weighing public cloud options for standard workloads while reserving private or hybrid environments for latency-sensitive and compliance-driven applications.

Despite these headwinds, the market has demonstrated resilience through innovation. Vendors are accelerating investments in software-defined solutions that minimize reliance on specialized hardware and enhance portability across diverse infrastructures. Moreover, partnerships with domestic manufacturing firms and increased use of off-the-shelf networking components are emerging as effective countermeasures, ensuring that interoperability deployments continue to scale without disruption.

In sum, while the 2025 tariff measures have introduced cost pressures, they have also catalyzed supply chain diversification and software-centric innovation, driving the sector toward more agile and resilient architectures.

Uncovering Critical Insights Into Solution Types Applications And Deployment Modes Driving The Evolution Of Healthcare Interoperability Markets

Insights derived from examining solution type segmentation reveal that API management platforms command attention for their dual capacity to deliver both API analytics and gateway functions. Providers that integrate real-time monitoring, performance optimization, and security orchestration are positioning themselves at the intersection of developer-friendly tooling and enterprise governance. Conversely, stakeholders seeking robust EHR integration frameworks are focusing on data mapping and synchronization capabilities, ensuring that patient records flow seamlessly between legacy systems and modern health information exchanges.

When exploring application segmentation, it becomes evident that administrative use cases such as billing and scheduling have matured into mission-critical functions. Solutions tailored to automate invoicing cycles and optimize appointment workflows are gaining rapid adoption, driven by the imperative to reduce administrative overhead. In clinical settings, platforms that facilitate EHR interoperability, ePrescription management, and laboratory information exchange are unlocking significant gains in patient safety and diagnostic efficiency. Financial interoperability has also advanced, with claims management and revenue cycle management tools leveraging consolidated data streams to accelerate reimbursement processes and minimize denials.

Deployment mode analysis underscores a pronounced shift toward cloud-native architectures. Hybrid cloud environments, which blend on-premises security controls with cloud scalability, have emerged as the preferred model for large health networks. Meanwhile, private cloud offerings cater to organizations with stringent compliance requirements, and public cloud services appeal to smaller providers seeking rapid time to value. This diversified deployment landscape reflects the sector’s commitment to balancing flexibility, cost optimization, and regulatory adherence.

Taken together, segmentation insights illuminate how solution specialization, application diversity, and deployment flexibility are shaping the competitive contours of the healthcare interoperability market.

This comprehensive research report categorizes the Healthcare Interoperability Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Application

- Deployment Mode

Analyzing Regional Dynamics In The Americas Europe Middle East Africa And Asia Pacific To Reveal Emerging Opportunities And Adoption Patterns

The Americas region continues to lead in healthcare interoperability adoption, propelled by proactive regulatory frameworks and significant investments in digital health infrastructure. In the United States, interoperability mandates have catalyzed broad implementation of API management and EHR integration platforms. Canada’s emphasis on provincial health data exchanges further underscores the region’s commitment to seamless data flow. This maturity has fostered a collaborative ecosystem, where health systems, payers, and technology providers co-innovate to enhance patient engagement and operational resilience.

Across Europe, the Middle East, and Africa, a diverse regulatory landscape is shaping varied adoption trajectories. The European Union’s focus on data privacy and cross-border health networks has elevated the importance of standardized integration protocols. Meanwhile, the Middle East is pursuing ambitious smart health initiatives that leverage cloud-based interoperability to support telemedicine and AI-driven diagnostics. In Africa, resource-constrained environments are driving the deployment of cost-effective, mobile-first interoperability solutions that improve rural healthcare access.

In Asia-Pacific, digital health strategies are accelerating government-sponsored interoperability programs aimed at enhancing care coordination across urban and rural regions. Countries such as Australia and Singapore are integrating nationwide patient record systems, while India is piloting blockchain-enabled networks to secure data exchange across its vast and fragmented healthcare ecosystem. Emerging markets in Southeast Asia are embracing cloud-native platforms to bypass legacy infrastructure challenges and swiftly expand access to critical health services.

Regional variations in regulation, infrastructure maturity, and healthcare priorities underscore the importance of a differentiated approach to interoperability deployment across global markets.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Interoperability Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting The Strategies Innovations And Collaborations Of Leading Enterprises Shaping The Future Trajectory Of Healthcare Interoperability Technologies

Leading enterprises in the interoperability domain are differentiating through strategic investments and ecosystem partnerships. One prominent approach involves enhancing API analytics capabilities, enabling clients to glean actionable insights from traffic patterns and usage metrics. By integrating machine-learning models that predict performance bottlenecks and security anomalies, these vendors deliver proactive reliability and compliance controls.

Another critical strategy has been forging alliances with electronic health record providers and cloud hyperscalers. Such collaborations streamline certification processes and enable plug-and-play integrations that reduce time to deployment. Additionally, several firms have expanded their service portfolios through targeted acquisitions of niche data mapping and translation tool specialists, consolidating expertise essential for complex EHR synchronization projects.

Innovation labs established by leading companies are exploring the intersection of interoperability and emerging technologies such as edge computing and blockchain. Pilot programs are testing decentralized architectures that bolster data provenance and trust, particularly in cross-institutional and international research initiatives. Simultaneously, developer-centric platforms offering sandbox environments and comprehensive SDKs are empowering healthcare IT teams to accelerate custom integration workflows with minimal vendor dependency.

Collectively, these strategic moves underscore how market leaders are combining organic innovation with strategic partnerships to extend their interoperability footprints and deliver differentiated value across diverse healthcare segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Interoperability Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1upHealth

- Amazon Web Services Inc.

- athenahealth Inc.

- Change Healthcare Inc.

- Dedalus Group

- eClinicalWorks LLC

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- HealthVerity Inc.

- Infor Inc.

- InterSystems Corporation

- Koninklijke Philips N.V.

- Lyniate Inc.

- McKesson Corporation

- MEDITECH

- Microsoft Corporation

- NextGen Healthcare Inc.

- Optum Inc.

- Oracle Corporation

- Orion Health Group Limited

- Redox Inc.

- Rhapsody Health Solutions

- Siemens Healthineers AG

- Veradigm Inc.

Delivering Practical Strategic Recommendations To Empower Industry Leaders To Capitalize On Healthcare Interoperability Trends And Drive Sustainable Competitive Outcomes

Industry leaders must prioritize an API-first architecture, integrating comprehensive governance frameworks from the outset. By embedding security policies, version control, and monitoring capabilities directly into API management platforms, organizations can minimize risk and accelerate developer adoption. Moreover, aligning interoperable solutions with standardized data models such as FHIR and HL7 will future-proof integrations and ensure compliance with evolving regulatory mandates.

In parallel, healthcare stakeholders should invest in robust data governance practices. Establishing clear data ownership, quality assurance protocols, and lineage tracking will enhance interoperability efforts and support advanced analytics initiatives. Cross-functional teams comprising clinical, IT, and compliance experts can foster a culture of shared accountability, driving consistent implementation of data standards and reducing information silos.

Supply chain resilience is equally critical. To mitigate the impact of trade policies and component shortages, interoperability vendors are advised to cultivate diversified procurement channels and embrace software-defined solutions that reduce hardware dependencies. Additionally, scaling hybrid-cloud environments with automated orchestration tools can optimize resource utilization and improve cost predictability.

Finally, forging alliances with technology partners-from cloud providers to device manufacturers-will unlock integrated service offerings and accelerate innovation. Co-development initiatives and open innovation forums can catalyze breakthroughs in areas such as edge-to-cloud connectivity and secure cross-institutional research networks, positioning organizations at the vanguard of healthcare interoperability.

Outlining A Rigorous Multi-Source Research Methodology Combining Primary Interviews Data Validation And Secondary Research To Ensure Comprehensive Insights

This research is anchored in a structured, multi-phase methodology designed to ensure the accuracy, relevance, and depth of market insights. The initial phase involved comprehensive secondary research, drawing on peer-reviewed journals, industry white papers, and regulatory publications to map the interoperability landscape and identify emerging trends. This foundational work informed the development of targeted questionnaires for primary data collection.

During the primary research phase, in-depth interviews were conducted with executives, solution architects, and clinical informaticists across healthcare providers, payers, and technology vendors. These qualitative conversations provided first-hand perspectives on deployment challenges, innovation roadmaps, and strategic priorities. Concurrently, quantitative surveys captured data on technology preferences, adoption timelines, and purchasing criteria, enabling robust cross-analysis of stakeholder needs.

Data validation was achieved through triangulation, comparing primary findings with third-party case studies and publicly disclosed financial reports to reconcile discrepancies and confirm emerging patterns. A dedicated expert advisory panel, comprising interoperability thought leaders and regulatory specialists, reviewed interim findings to enhance analytical rigour and ensure that conclusions accurately reflect real-world applications.

Finally, iterative peer reviews and editorial checks ensured consistency in terminology, methodological transparency, and adherence to ethical research standards, culminating in a report that delivers comprehensive, actionable insights for decision-makers in the healthcare interoperability space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Interoperability Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Interoperability Solutions Market, by Solution Type

- Healthcare Interoperability Solutions Market, by Application

- Healthcare Interoperability Solutions Market, by Deployment Mode

- Healthcare Interoperability Solutions Market, by Region

- Healthcare Interoperability Solutions Market, by Group

- Healthcare Interoperability Solutions Market, by Country

- United States Healthcare Interoperability Solutions Market

- China Healthcare Interoperability Solutions Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Summarizing Key Findings And Emphasizing The Strategic Imperative For Adopting Advanced Interoperability Solutions To Elevate Healthcare Outcomes

This executive summary distills the critical dynamics shaping healthcare interoperability, from the maturation of API management platforms and the strategic implications of 2025 U.S. tariffs to nuanced segmentation and regional analyses. The evidence underscores that organizations embracing standardized, software-centric integration frameworks will navigate regulatory requirements more effectively and unlock new avenues for value creation.

Strategic investments in data governance, underpinned by clear ownership structures and quality controls, emerge as a fundamental enabler of seamless interoperability. Meanwhile, diversification of deployment modes-spanning cloud, hybrid, and on-premises configurations-affords healthcare entities the agility to optimize performance, compliance, and cost efficiency concurrently. The interplay of these factors is further magnified by global variations in regulatory mandates and infrastructure maturity, necessitating tailored approaches for distinct geographies.

Leading enterprises have demonstrated that innovation is most potent when coupled with ecosystem partnerships, as evidenced by successful collaborations with cloud hyperscalers, EHR providers, and niche technology specialists. By operationalizing the recommendations outlined herein-ranging from API-first governance to supply chain resilience-industry leaders can secure sustainable competitive advantages and enhance patient-centric care delivery.

In conclusion, the strategic imperative is clear: harness the insights and recommendations provided to design and implement interoperability solutions that not only meet today’s demands but also anticipate tomorrow’s challenges.

Elevate Your Healthcare Integration Strategy By Partnering With Ketan Rohom To Unlock The Healthcare Interoperability Market Research Report

For organisations seeking to stay ahead in the evolving landscape of healthcare data exchange, engaging with Ketan Rohom presents a unique opportunity to transform integration strategies into tangible business results. By leveraging his expertise in sales and marketing for complex market research services, decision-makers can gain direct access to the comprehensive analysis, strategic recommendations, and nuanced regional and segmentation insights encapsulated in the Healthcare Interoperability Market Research Report. This collaboration empowers stakeholders to align investment priorities with the most impactful interoperability technologies and business models.

Initiating a conversation with Ketan Rohom is the gateway to acquiring a tailored research package that addresses specific organisational challenges-whether optimising API management frameworks, enhancing EHR integration workflows, or navigating the implications of U.S. tariffs on technology sourcing. His hands-on approach ensures that clients receive actionable deliverables, from executive briefings to detailed methodological appendices, all designed to accelerate informed decision-making and foster competitive differentiation.

- How big is the Healthcare Interoperability Solutions Market?

- What is the Healthcare Interoperability Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?