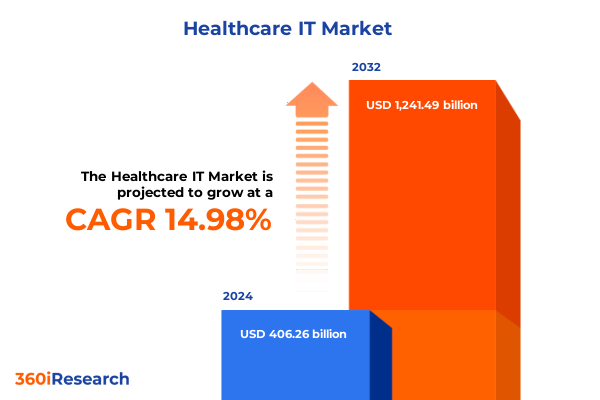

The Healthcare IT Market size was estimated at USD 464.40 billion in 2025 and expected to reach USD 531.50 billion in 2026, at a CAGR of 15.08% to reach USD 1,241.49 billion by 2032.

Setting the Stage for Healthcare IT Excellence Amidst Rapid Digital Transformation Policy Shifts and Emerging Technology Frontiers

As healthcare delivery models accelerate toward more digitally enabled care, organizations face a critical juncture between harnessing emerging technologies and navigating a complex regulatory environment. The drive to modernize legacy systems has never been more urgent, as institutions strive to replace manual workflows with cloud-based platforms that support real-time data exchange, advanced analytics, and patient-centric services. Federal initiatives such as TEFCA and Qualified Health Information Networks continue to push interoperability forward, yet many providers still encounter fragmented data silos that impede operational efficiency and care coordination.

In parallel, the surge in artificial intelligence and machine learning investments is reshaping clinical and administrative workflows alike. AI-powered decision support tools are improving diagnostic accuracy and reducing clinician burden, while natural language processing is streamlining documentation and revenue cycle processes. At the same time, heightened cybersecurity risks demand that organizations implement robust protections as they migrate sensitive patient records to interconnected environments. Despite these challenges, leaders recognize the transformative potential of digital health, with only 18% of organizations fully prepared for AI deployments, underscoring the imperative for strategic technology roadmaps that balance innovation and security.

Uncovering the Transformative Shifts Revolutionizing Healthcare IT Through AI Adoption Interoperability Breakthroughs and Consumer-Centric Evolutions

The healthcare IT landscape is undergoing a fundamental rewrite as artificial intelligence moves from theoretical promise to practical application. Generative AI solutions showcased at major conferences are automating routine charting tasks, mining unstructured data for actionable insights, and enabling predictive analytics that anticipate patient needs. Platforms integrating ambient voice recognition and large language models are now core to major EHR systems, accelerating clinician workflows and supporting personalized care interventions on a scale never before feasible.

Interoperability has emerged as the linchpin for realizing the full potential of digital health ecosystems. Progress in FHIR-based standards and the nationwide interoperability showcase highlight how seamless data exchange across disparate systems can improve care coordination, reduce redundant testing, and enhance patient safety. Yet, nearly 57% of physicians still cite data exchange barriers as their primary obstacle, reinforcing the need for standardized frameworks and cross-stakeholder collaboration to bridge persistent gaps.

Consumerization of healthcare continues to drive virtual care innovations and digital patient engagement strategies. Hybrid models combining teleconsultation, remote monitoring, and in-person visits are expanding access and convenience, especially among underserved populations. At the same time, the shift to cloud-native architectures and software-as-a-service delivery models is lowering infrastructure costs and enabling rapid scalability. Organizations that embrace a Zero Trust approach to cybersecurity while empowering patients with real-time access to their health records will lead the charge in this new era of connected care.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Healthcare IT Supply Chains Infrastructure Costs and Operational Resilience Strategies

In April 2025, the U.S. government enacted baseline import tariffs of 10% on most medical and IT equipment, with escalated duties applied to key trading partners. These measures, intended to incentivize domestic manufacturing and bolster supply chain resilience, have raised import costs for critical hardware, including imaging devices, networking switches, and server components. Healthcare organizations report that these additional levies will translate directly into higher procurement expenses and longer lead times for essential infrastructure upgrades.

With tax duties imposed on imported data center equipment and hardware, many institutions are reevaluating capital expenditure plans and deferring planned on-premises deployments. Survey data indicate that nearly 39% of healthcare IT executives anticipate increased costs for cloud migrations and managed services as they seek to mitigate tariff impacts by shifting workloads to outsourced environments. However, only 16% of vendors expect these levies to significantly affect core hardware pricing, illustrating a disconnect between provider concerns and supplier pricing strategies.

The ripple effects extend beyond procurement budgets to supply availability, with 81% of equipment manufacturers forecasting longer lead times and potential shortages due to higher production costs and import restrictions. Industry associations, including AdvaMed and the American Hospital Association, have petitioned for exemptions on essential medical supplies and devices to prevent disruptions in patient care. Hospitals warn that without targeted carve-outs, strained supply chains could exacerbate staffing shortages and elevate risks for critical services.

In response to these headwinds, provider organizations are prioritizing strategic stockpiling, dual-sourcing arrangements, and early purchase agreements to lock in favorable terms before tariffs escalate. At the same time, collaborative efforts with group purchasing organizations and regional health alliances are emerging as effective mechanisms for pooling demand and negotiating bulk discounts. By proactively assessing tariff schedules and incorporating alternative suppliers into procurement strategies, healthcare leaders can safeguard project timelines and maintain continuity of care amidst an evolving trade landscape.

Deriving Key Segmentation Insights from Healthcare IT Components End Users and Applications to Illuminate Market Complexity and Growth Levers

An in-depth examination of the healthcare IT market through a component lens reveals distinct value drivers across hardware, services, and software offerings. High-value hardware segments such as imaging equipment and network infrastructure underpin critical diagnostic and treatment functions, while server and storage systems form the backbone of on-premises and hybrid cloud deployments. Services integrate consulting, implementation, support, and training expertise to ensure that deployments align with clinical and operational objectives, and administrative and clinical software suites provide the intelligence needed to streamline workflows, manage revenue cycles, and deliver evidence-based care.

From an end-user standpoint, ambulatory care centers, clinics, diagnostic laboratories, and hospitals each exhibit unique needs and procurement patterns. Ambulatory centers prioritize agile, patient-facing solutions that enhance throughput and remote engagement, whereas large hospital systems focus on enterprise-grade interoperability, security, and scale. Diagnostic laboratories demand precision instrumentation and robust data management platforms to support high-volume workflows, while clinics balance cost-effective connectivity with specialty-specific clinical decision support.

Application-based analysis underscores the pivotal roles of electronic health records, clinical decision support, health information exchange, and revenue cycle management in driving efficiency and patient safety. Imaging informatics and telehealth platforms extend the reach of diagnostic and consultation services, and population health management tools integrate analytics, care management, patient engagement, and risk stratification into cohesive frameworks for preventive care. By dissecting the interplay of these components, end users, and applications, stakeholders can pinpoint growth levers and align investments with evolving care delivery models.

This comprehensive research report categorizes the Healthcare IT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- End User

- Application

Gaining Key Regional Insights on Healthcare IT Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Market Transformations

The Americas continue to lead global digital health funding, securing over $3.6 billion in Q1 2025, driven by major deals in HealthTech and AI-enabled diagnostics. While North America’s funding dipped 20% year-on-year, it remains the top destination for large-scale investments in telehealth platforms and enterprise EHR modernization projects. Providers here are increasingly prioritizing cloud migrations and AI-driven automation to offset labor shortages and control operational costs, reflecting the broader shift toward value-based care and remote service delivery models.

In Europe, the Middle East, and Africa, evolving data privacy regulations such as the EU’s GDPR and the UAE’s new health data law are reshaping interoperability strategies and vendor engagements. Healthcare CFOs in Australia highlight workforce constraints and inflationary pressures as key challenges, prompting heightened investment in digital infrastructure and AI tools to streamline administrative tasks. Despite varying regulatory environments, regional health systems align on three priorities: controlling rising costs, augmenting workforce productivity through automation, and enhancing patient access via virtual care channels.

The Asia-Pacific region is experiencing rapid government support for AI and digital health initiatives, with India projecting AI contributions of up to $30 billion to GDP by 2025 through diagnostics and virtual care programs. Countries like Singapore and South Korea are investing heavily in national health information exchanges and telehealth networks, while emerging markets in Southeast Asia leverage mobile health solutions to extend basic services. However, skill gaps in AI governance and data security remain critical hurdles, underscoring the need for comprehensive training and robust policy frameworks to sustain growth.

This comprehensive research report examines key regions that drive the evolution of the Healthcare IT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Key Healthcare IT Company Strategies Innovation Partnerships and Market Leadership in Shaping the Future of Digital Health Ecosystems

Major technology and cloud service providers are intensifying their focus on healthcare AI, forging strategic partnerships to embed intelligence into core workflows. Amazon leverages its AWS portfolio and One Medical acquisition to drive AI-powered drug discovery and virtual care, while Nvidia collaborates with GE Healthcare on advanced imaging analytics and robotics. Microsoft’s acquisition of Nuance and integration of Copilot tools into hospital EHRs enable automated documentation and clinical decision support. At the same time, Oracle has retooled its Cerner platform with cloud native architectures and AI agents, and Salesforce launched Agentforce for Health to automate prior authorizations and patient messaging. Palantir is extending its data integration platform across major health systems, optimizing revenue cycle management and patient flow operations.

Among dedicated EHR vendors, Epic continues to expand its ecosystem beyond core records, unveiling generative AI agents that autonomously engage patients about care goals, schedule tasks based on case analyses, and enhance clinician documentation through ambient voice recognition. Over 2,000 hospitals and 50,000 clinics are adopting Epic’s TEFCA-aligned interoperability framework, and the company’s integration programs facilitate connectivity with nearly 800 patient-facing applications via standardized APIs. Epic’s ongoing collaborations with Microsoft and Nuance advance large language model capabilities, while internal R&D efforts target enterprise resource planning tools for staffing, procurement, and financial management functions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare IT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- athenahealth, Inc.

- Change Healthcare Inc.

- Cognizant Technology Solutions Corporation

- Dedalus S.p.A.

- eClinicalWorks, LLC

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Greenway Health, LLC

- HealthEdge Software, Inc.

- Infosys Limited

- InterSystems Corporation

- Komodo Health, Inc.

- McKesson Corporation

- Medhost, Inc.

- Medical Information Technology, Inc.

- Merative L.P.

- Netsmart Technologies, Inc.

- NextGen Healthcare, Inc.

- Nuance Communications, Inc.

- Orion Health Group Limited

- Siemens Healthineers AG

- Tata Consultancy Services Limited

- Teladoc Health, Inc.

- WellSky Corporation

- Wipro Limited

Actionable Recommendations for Healthcare IT Industry Leaders to Drive Digital Transformation Resilience and Growth Through Strategic Investments

Industry leaders should prioritize strategic investments in cloud infrastructure and artificial intelligence, aligning technology roadmaps with clinical and financial objectives. By adopting hybrid and multi-cloud architectures, organizations can mitigate tariff-related hardware costs while accelerating access to advanced analytics and generative AI capabilities. Collaborative innovation models, including vendor partnerships and specialized incubator programs, will be essential for scaling AI safely and effectively across the care continuum.

Robust cybersecurity frameworks, particularly Zero Trust models, must underpin all digital health initiatives. Healthcare entities should enforce strong encryption, continuous monitoring, and identity-based access controls to safeguard patient data as systems become more interconnected. Concurrently, adherence to interoperability standards such as FHIR and USCDI v3 will streamline data exchange and reduce integration costs, enabling seamless collaboration between providers, payers, and technology vendors.

To address supply chain vulnerabilities, executives should implement diversified sourcing strategies, secure multi-tier supplier agreements, and leverage group purchasing consortia to negotiate favorable terms ahead of tariff escalations. Early engagement with alternative manufacturers and adoption of digital supply chain platforms can enhance visibility into inventory levels and shipment timelines, reducing the risk of service disruptions and ensuring continuity of patient care.

Finally, organizations must tailor solutions to their specific segments and regions by leveraging detailed component, end user, and application analyses. Customizing digital health platforms for ambulatory clinics, diagnostic laboratories, and hospital networks ensures alignment with operational priorities and market dynamics, driving sustainable adoption and maximizing return on technology investments.

Elucidating a Comprehensive Mixed Method Research Methodology Integrating Primary Expert Insights and Rigorous Data Triangulation for Healthcare IT Analysis

The research methodology employed an exhaustive secondary research process, gathering data from public domain sources, industry associations, regulatory filings, and thought leadership publications. Key inputs included federal healthcare interoperability frameworks, trade association reports on tariffs, and peer-reviewed studies on AI adoption challenges. This phase established a foundational understanding of market dynamics, technological advancements, and policy shifts across regions and segments.

Primary research comprised in-depth interviews with over 30 senior executives, clinical leaders, and IT specialists representing diverse healthcare settings. These conversations provided critical qualitative insights into deployment experiences, vendor selection criteria, and strategic priorities. Interviewees included C-suite stakeholders from hospitals, digital health startups, system integrators, and government agencies, ensuring balanced perspectives on both operational hurdles and innovative solutions.

Data triangulation and validation techniques were applied to reconcile findings from multiple sources and corroborate key trends. Quantitative data points were cross-verified against proprietary databases, while qualitative themes were tested through follow-up consultations with industry experts. The research framework aligned segmentation definitions with component, end user, and application categories to ensure consistency and relevance. This rigorous approach underpins the credibility and actionability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare IT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare IT Market, by Component

- Healthcare IT Market, by End User

- Healthcare IT Market, by Application

- Healthcare IT Market, by Region

- Healthcare IT Market, by Group

- Healthcare IT Market, by Country

- United States Healthcare IT Market

- China Healthcare IT Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding Synthesis of Healthcare IT Market Trends Challenges and Strategic Imperatives to Inform Decision Making and Future Research Directions

The healthcare IT landscape is poised for transformative change driven by advanced analytics, AI, and interoperable architectures. Yet, challenges such as cybersecurity risks, tariff-induced supply chain disruptions, and variable regional regulations require proactive strategies to sustain momentum. By understanding segmentation nuances and regional dynamics, executives can tailor investments and partnerships to optimize outcomes. Strategic recommendations emphasizing cloud migration, data standardization, and diversified sourcing will enhance resilience and create a solid foundation for future innovation. This synthesis of market trends, company strategies, and actionable guidance offers a roadmap for navigating the complexities of digital health and achieving sustainable growth.

Empowering Your Next Strategic Move Secure Access to the In-Depth Healthcare IT Market Research Report Through Direct Engagement

Ready to delve deeper into these insights and empower your organization with actionable data? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive access to the full healthcare IT market research report and unlock the strategic guidance you need to stay ahead in a rapidly evolving landscape.

- How big is the Healthcare IT Market?

- What is the Healthcare IT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?