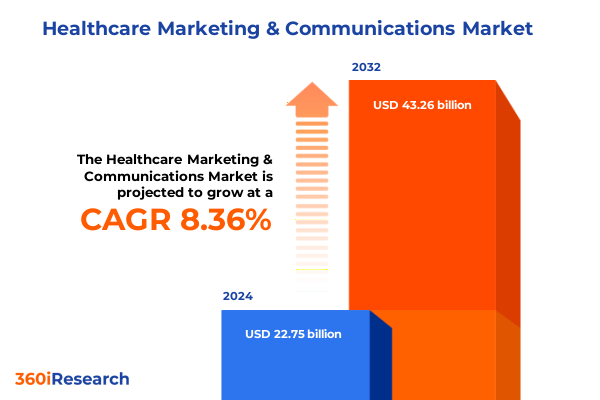

The Healthcare Marketing & Communications Market size was estimated at USD 24.55 billion in 2025 and expected to reach USD 26.52 billion in 2026, at a CAGR of 8.43% to reach USD 43.26 billion by 2032.

Unveiling the Critical Intersection of Healthcare Innovation and Strategic Communications in a Rapidly Evolving Medical Ecosystem

Healthcare marketing and communications now sit at the nexus of rapid innovation, heightened patient expectations, and a complex regulatory environment. In today’s medical ecosystem, organizations must continuously adapt their strategies to resonate with increasingly informed and empowered patient populations. Consequently, understanding the interplay between technological advancements-such as telemedicine platforms and artificial intelligence-driven diagnostics-and effective messaging has never been more critical. With the industry undergoing constant evolution, the insights presented in this executive summary offer a structured exploration of key trends, challenges, and strategic imperatives shaping the field.

This introduction sets the stage for a deep dive into the transformative forces redefining healthcare outreach. It highlights how patient-centric narratives, digital-first campaigns, and proactive reputation management are central to organizational success. In addition, the emergence of real-time data analytics has shifted the balance toward personalized communication, making it essential for stakeholders to interpret and apply insights with precision and agility. By laying out the foundational themes in this section, readers will gain a clear understanding of the underlying currents that drive modern healthcare communications forward.

Navigating the Paradigm Shift Toward Digital Transformation Patient Empowerment and Regulatory Complexity Reshaping Healthcare Communication Strategies

The healthcare marketing landscape has witnessed profound shifts driven by accelerating digital transformation and evolving patient expectations. Digital channels are no longer supplementary; they form the core of engagement strategies as more individuals turn to online resources for health information. Moreover, patients now demand seamless experiences that mirror consumer-grade services, prompting brands to prioritize user-friendly content, interactive tools, and omnichannel consistency. In parallel, regulatory bodies have introduced new compliance frameworks, compelling organizations to balance creative freedom with stringent privacy and accuracy standards.

Another significant shift is the rise of artificial intelligence and machine learning in campaign optimization. Predictive analytics now enable marketers to anticipate patient needs and deliver targeted messaging with unprecedented precision. At the same time, personalization extends beyond demographic categories to include behavioral cues and health literacy levels, fostering deeper trust and engagement. As a result, healthcare brands must reconcile the opportunities of advanced technologies with ethical considerations, ensuring transparent data usage and protecting individual privacy. These interconnected dynamics underscore a transformative moment, where strategic agility and a commitment to patient-centric communication define market leadership.

Assessing the Multidimensional Effects of 2025 United States Tariff Policies on Healthcare Supply Chains and Communication Dynamics

United States tariff policies introduced in 2025 have created notable ripple effects across the healthcare supply chain and communications terrain. Increased duties on imported medical devices and pharmaceuticals have led organizations to reassess supplier partnerships and contract structures. Consequently, marketing and procurement teams have collaborated more closely, aligning brand messaging around supply chain resilience and emphasizing transparent communication with stakeholders regarding product availability and cost drivers.

Furthermore, elevated tariff barriers have spurred domestic innovation, driving a surge in locally manufactured components and materials. From a communications perspective, this transition has provided a narrative opportunity to highlight homegrown expertise and bolster patient confidence in product integrity. Yet the associated increase in production costs has necessitated more nuanced value propositions; marketing leaders now integrate cost management stories into patient-facing materials, explaining how quality remains uncompromised. Additionally, the complexity of tariff schedules has underscored the importance of regulatory intelligence in shaping campaign timelines and creative approvals. As these forces converge, healthcare marketers must skillfully craft narratives that address economic realities while sustaining patient trust and brand credibility.

Unearthing Actionable Insights from Service Type Delivery Channels and End User Dynamics in Healthcare Marketing Segmentation

Segmenting the healthcare marketing landscape reveals distinct considerations across service types, delivery channels, and end user groups. Based on service type, organizations offering branding and creative services, crisis communication and reputation management, digital marketing, healthcare advertising, healthcare public relations, and patient communication services each face unique demands. For instance, creative agencies must now collaborate constantly with compliance teams to ensure storytelling aligns with evolving industry guidelines, whereas digital marketing specialists focus on optimizing patient journeys across virtual touchpoints.

Regarding delivery channel, both digital channels and traditional channels retain strategic importance. Digital platforms provide unparalleled targeting capabilities and performance measurement, yet traditional channels such as print and broadcast continue to hold sway among certain demographics and specialty audiences. Moreover, healthcare marketers are increasingly integrating channel approaches, blending high-impact events with online engagement to cultivate holistic brand experiences. Finally, end user segmentation highlights diverging priorities for health insurance and payer audiences versus healthcare providers. While payers emphasize cost containment and outcomes-based communication, providers seek messages centered on clinical efficacy and practice growth. This layered segmentation framework guides the development of tailored campaigns that resonate deeply with each stakeholder group.

This comprehensive research report categorizes the Healthcare Marketing & Communications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Engagement Approach

- Content Type

- Delivery Channel

- End User

- Therapeutic Area

Exploring Regional Variations in Healthcare Communication Demands Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional variations in healthcare communication needs and preferences are pronounced across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, patient empowerment and digital health adoption drive marketers to develop mobile-first experiences and bilingual content reflecting diverse populations. Meanwhile, in Europe, Middle East & Africa, regulatory heterogeneity demands adaptable frameworks; campaigns often incorporate localized compliance checks and multilingual creative to address jurisdictional nuances.

Transitioning to Asia-Pacific, rapid urbanization and expanding middle-class demographics have fueled demand for telehealth and personalized medicine narratives. Here, marketers must balance sophisticated digital tactics with culturally attuned messaging that acknowledges local healthcare infrastructures. Conversely, in regions where internet penetration remains uneven, traditional outreach through community events and print materials continues to be vital. Understanding these regional distinctions allows healthcare organizations to tailor strategies that respect local norms, regulatory requirements, and technological capacities, thereby enhancing engagement and driving sustainable growth across diverse markets.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Marketing & Communications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Collaborative Innovations of Leading Healthcare Marketing and Communications Organizations Worth Watching

Leading healthcare communications organizations are advancing competitive differentiation through partnerships, technology investments, and talent development. Many agencies have forged strategic alliances with data analytics firms, enabling them to harness real-world evidence and performance insights to refine campaign targeting. Others have elevated their service portfolios by integrating proprietary content management systems and AI-driven creative tools, fostering more agile production workflows and personalized storytelling.

In addition, human capital initiatives take center stage as firms recruit interdisciplinary experts-ranging from health economists to behavioral psychologists-to inform messaging strategies. These collaborative innovations not only enhance credibility in clinical audiences but also bolster thought leadership positioning in payer and regulatory circles. Moreover, forward-thinking organizations are piloting emerging channels such as virtual reality simulations and voice-enabled assistants, exploring new frontiers in patient education and provider engagement. By observing these leading practices, industry participants can adopt proven models for driving innovation, fostering differentiated brand experiences, and sustaining competitive momentum.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Marketing & Communications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ATREVIA CORPORACIÓN SLU

- Austin Williams

- Avalere Health, LLC

- Brainbroker

- Cheenti Digital

- Cognizant Technology Solutions Corporation

- Daniel J. Edelman Holdings, Inc.

- Evolve Healthcare Private Limited

- Experian PLC

- Flex Marketing Group LLC.

- GCI Health, Inc.

- Havas Health, Inc.

- Indegene Limited

- Infinity Communications SARL

- Inizio Group Limited

- Insignia Communications Private Limited

- Interpublic Group of Companies, Inc.

- IQVIA Inc.

- Jive Software, LLC

- Klick Inc.

- LeadSquared

- LEVO Healthcare Consulting, LLC

- MediaMedic Communications Pvt. Ltd.

- MedTrix Healthcare Pvt Ltd

- MyAdvice, LLC

- NexGen Healthcare Communications Ltd

- Omnicom Health Group Inc.

- OPEN Health Communications LLP

- Publicis Groupe SA.

- Real Chemistry, Inc.

- SCALE Healthcare

- Spectrio LLC

- Syneos Health, Inc

- The Mauldin Group, Ltd.

- Toppan Merrill LLC

- WPP plc

Implementing Future Proof Marketing Frameworks and Data Driven Communication Tactics to Elevate Healthcare Brand Engagement and Trust

To capitalize on emerging trends and fortify market positioning, healthcare marketers should implement future-proof frameworks that integrate data-driven insights with purpose-driven storytelling. First, establishing cross-functional governance structures will ensure marketing, compliance, and supply chain stakeholders remain aligned on strategic objectives and resource allocation. In turn, this collaborative approach accelerates campaign approval cycles and enhances message consistency across touchpoints.

Moreover, organizations should invest in advanced analytics platforms that merge patient sentiment data with operational metrics, enabling dynamic course corrections and ROI optimization. Coupled with a commitment to continuous learning through regular training on regulatory updates and digital best practices, these capabilities will strengthen resilience and adaptability. Finally, brands must center their narratives on authentic patient stories and clinical outcomes, reinforcing trust and differentiating offerings in a crowded marketplace. By adhering to these actionable recommendations, industry leaders can drive deeper engagement, optimize spend, and achieve measurable impact in healthcare communications.

Detailing a Rigorous Mixed Methods Research Approach Combining Qualitative Interviews Expert Panels and Comprehensive Industry Analysis

This research effort employs a rigorous mixed methods approach designed to capture both quantitative trends and qualitative nuances. Primary research includes in-depth interviews with senior marketing executives, compliance officers, and supply chain leaders across healthcare organizations. Additionally, expert panels comprising healthcare communication specialists and regulatory advisors provided iterative validation of emerging themes. These direct engagements furnished rich contextual insights into organizational priorities and pain points.

Complementing this, secondary research involved comprehensive analysis of industry publications, policy documents, and case studies to corroborate primary findings and situate them within broader market dynamics. Data synthesis techniques included thematic coding to identify recurring patterns and scenario mapping to forecast potential strategic responses. Throughout the methodology, strict protocols for data triangulation and confidentiality ensured the reliability and robustness of conclusions. This multi-layered research design underpins the precision and relevance of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Marketing & Communications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Marketing & Communications Market, by Service Type

- Healthcare Marketing & Communications Market, by Engagement Approach

- Healthcare Marketing & Communications Market, by Content Type

- Healthcare Marketing & Communications Market, by Delivery Channel

- Healthcare Marketing & Communications Market, by End User

- Healthcare Marketing & Communications Market, by Therapeutic Area

- Healthcare Marketing & Communications Market, by Region

- Healthcare Marketing & Communications Market, by Group

- Healthcare Marketing & Communications Market, by Country

- United States Healthcare Marketing & Communications Market

- China Healthcare Marketing & Communications Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Insights to Empower Strategic Decision Making and Accelerate Sustainable Growth in Healthcare Marketing and Communications

Bringing together the key insights from this executive summary, it is evident that healthcare marketing and communications are undergoing a pivotal transformation. Digital adoption, patient-centric narratives, and advanced analytics collectively redefine how organizations engage stakeholders, navigate regulatory complexities, and reinforce brand trust. Concurrently, external factors such as tariff policies and regional variations underscore the need for flexible strategies that respond to evolving economic and cultural contexts.

Going forward, leaders must embrace collaborative governance, invest in technology-enabled capabilities, and weave authentic storytelling into every campaign. By doing so, they can not only enhance operational efficiencies but also foster deeper connections with patients, providers, and payers. Ultimately, this synthesis of strategic imperatives and actionable recommendations forms a robust foundation for decision-makers seeking to chart a course toward sustainable growth and innovation in healthcare communications.

Partner with Ketan Rohom to Secure Comprehensive Healthcare Marketing Insights and Drive Transformative Strategic Outcomes Today

I invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at our firm, to explore how this comprehensive market research report can serve as a definitive tool for informing your strategic roadmap. By leveraging the deep-dive analyses provided in this report, you will gain unparalleled clarity on evolving patient behaviors, regulatory shifts, and emerging communication technologies. Through a tailored consultation, Ketan Rohom can guide you through the nuanced insights within the report, helping translate complex findings into actionable strategies that align with your organization’s unique objectives.

Whether you aim to refine brand positioning, optimize omnichannel messaging, or strengthen crisis preparedness, this report offers the frameworks and best practices essential for driving measurable impact. Don’t miss the opportunity to engage directly with a subject matter expert who can clarify specific sections, answer your strategic questions, and recommend the most relevant portions for your immediate priorities. Reach out today to secure your copy of this indispensable resource and accelerate your path to market leadership in healthcare communications and marketing.

- How big is the Healthcare Marketing & Communications Market?

- What is the Healthcare Marketing & Communications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?