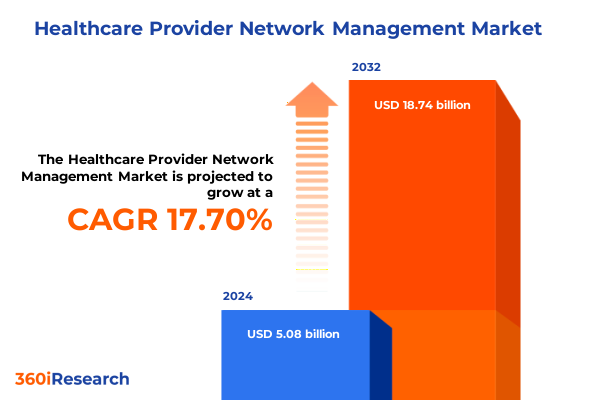

The Healthcare Provider Network Management Market size was estimated at USD 6.08 billion in 2025 and expected to reach USD 7.29 billion in 2026, at a CAGR of 20.71% to reach USD 22.74 billion by 2032.

Setting the Stage for Navigating Complex Healthcare Provider Networks in an Era of Technological Innovation and Regulatory Evolution

In today’s rapidly evolving healthcare environment, managing provider networks has become a cornerstone of operational excellence, driving both cost efficiency and patient satisfaction. Advances in interoperability standards and the proliferation of data analytics tools are reshaping how payers and providers collaborate. As digital transformation accelerates, healthcare organizations must navigate an intricate web of regulatory mandates, emerging technologies, and shifting reimbursement models to ensure robust network adequacy and quality of care.

Against this backdrop, provider network management emerges as a strategic imperative that influences everything from credentialing processes to value-based contracting. Organizations are increasingly leveraging artificial intelligence, machine learning, and cloud-based platforms to maintain accurate provider directories, optimize network performance, and mitigate risk. Consequently, the ability to integrate diverse data sources, streamline administrative workflows, and foster transparent communication between stakeholders will define the next frontier of network management.

How Emerging Technologies and Policy Mandates Are Reshaping the Operational and Strategic Landscape of Provider Network Management

Healthcare provider network management is undergoing a paradigm shift driven by the convergence of digital health innovations, regulatory reforms, and a renewed focus on value-based care. The CMS Interoperability and Prior Authorization final rule, effective January 2026, mandates the deployment of HL7 FHIR® APIs for provider directories and prior authorization data, fundamentally altering how payers publish and update network information. This rule compels Medicare Advantage, Medicaid managed care, and CHIP entities to maintain real-time provider data, promoting transparency and seamless patient access across networks.

Simultaneously, the rise of artificial intelligence and predictive analytics has enabled proactive network adequacy monitoring and risk stratification. Vendors are integrating AI-driven engines to cross-verify provider credentials against public and private data repositories, reducing inaccuracies and accelerating credentialing by nearly half. Furthermore, the expansion of telehealth platforms and remote monitoring technologies has blurred traditional network boundaries, prompting payers to reengineer network models that accommodate virtual care delivery and hybrid service modalities.

Assessing the Ripple Effects of the 2025 United States Healthcare Tariffs on Provider Network Stability, Supply Chains, and Strategic Sourcing Decisions

In April 2025, a new tranche of U.S. tariffs targeting pharmaceutical ingredients, medical equipment, and senior care devices was introduced, heightening supply chain volatility and cost pressures across provider networks. These levies on imports from China, Canada, and Mexico have led to immediate disruptions in the availability of critical supplies, including infusion pumps, diagnostic systems, and mobility aids, forcing healthcare organizations to seek alternative sourcing strategies and renegotiate long-term contracts.

Industry groups, including the American Hospital Association and AdvaMed, have lobbied for exemptions to safeguard patient care continuity, warning that increased import costs will be largely absorbed by government-funded programs like Medicare and Medicaid. As a result, payers and providers are reassessing network composition, prioritizing partnerships with domestically based suppliers and exploring reshoring initiatives to mitigate tariff exposure. In the interim, elevated lead times and higher procurement costs are compelling organizations to refine inventory management, adopt predictive ordering algorithms, and invest in supplier diversification to maintain network resilience.

Unlocking Strategic Segmentation Insights Across Provider Types, Technological Applications, Service Delivery Models, Network Structures, Deployment Modes, and Ownership Frameworks to Drive Tailored Network Solutions

A comprehensive understanding of market segmentation underpins effective provider network strategies, aligning resources to meet varied stakeholder needs. When examining provider type, networks span from clinics and home care agencies to specialty centers and telehealth platforms, each with unique operational and technological demands. Hospitals, in particular, encompass cardiology, neurology, oncology, orthopedics, and general care centers, necessitating tailored network adequacy criteria and referral pathways.

Across technology applications, solutions range from analytics and claims management to credentialing and patient engagement, with financial, operational, and predictive analytics driving data-informed decision-making. Telehealth platforms further diversify into mobile health, remote monitoring, and video consultation services, expanding access but requiring new performance metrics and quality standards.

Service-type segmentation highlights the spectrum from emergency and inpatient care to home healthcare and telemedicine, where each model demands specific network sufficiency requirements and contractual terms. Network models vary across accountable care organizations, clinically integrated networks, HMOs, IPAs, and PPOs, reflecting distinct governance structures, risk distribution arrangements, and provider collaboration frameworks.

Deployment options, whether cloud-native, hybrid, or on-premise, influence scalability, security protocols, and interoperability capabilities, while ownership structures-private for-profit, nonprofit, or public-shape investment priorities and regulatory compliance approaches. By synthesizing these segmentation dimensions, stakeholders can develop bespoke network configurations that optimize performance and adapt to evolving care delivery paradigms.

This comprehensive research report categorizes the Healthcare Provider Network Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Provider Type

- Service Type

- Network Model

- Ownership Structure

- Application

- Deployment Mode

Revealing How Americas, EMEA, and Asia-Pacific Region-Specific Regulations, Technology Adoption, and Policy Initiatives Shape Provider Network Excellence

Regional dynamics exert significant influence on provider network design and performance, shaped by local regulations, technology adoption rates, and care delivery priorities. In the Americas, robust regulatory frameworks such as the CMS Provider Directory API mandate and state-level telehealth parity laws have accelerated portal-based network transparency, while value-based reimbursement models and accountable care initiatives continue to drive consolidation and strategic alliances across payers and providers.

EMEA markets are characterized by stringent data privacy regulations under GDPR, prompting a cautious approach to cross-border data exchange and interoperability. Nevertheless, digital health revenue in this region is projected to exceed US$53 billion in 2025, supported by national telemedicine programs and AI-enabled diagnostics, which necessitate flexible network architectures and robust compliance mechanisms.

In the Asia-Pacific region, government-led initiatives like India’s digital health ecosystem, Thailand’s expansion of telemedicine kiosks, and Australia’s integration of AI-capable hospital information systems are catalyzing network evolution. These developments underscore the importance of scalable digital platforms and strategic partnerships to manage diverse provider landscapes and remote care delivery scenarios.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Provider Network Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling How Leading Technology and Service Providers Are Harnessing AI, Cloud, and Analytics to Transform Provider Network Management and Compliance

Leading players in the provider network management space are advancing capabilities through strategic investments in AI, cloud computing, and advanced analytics. Optum has expanded its AI-powered network optimization suite to automate directory updates, refine provider matching algorithms, and achieve significant gains in processing efficiency. Cognizant’s cloud-native network management platform now supports automated contract monitoring and proactive license renewal alerts, reducing administrative workload and enhancing interoperability across global payer networks.

Change Healthcare’s Smart Directory Integrity Engine leverages machine learning to cross-verify provider data against multiple sources, slashing inaccuracies and streamlining audit readiness. Similarly, Genpact and Infosys BPM have introduced modular credentialing and provider risk scoring systems that integrate with existing EHRs, enabling real-time compliance checks and accelerating onboarding timelines.

Specialty solution providers such as Availity and Zelis focus on revenue cycle optimization and payment integrity, embedding network management modules within their broader healthcare IT offerings. Emerging innovators like HealthSparq, Virsys12, and Symplr are niche specialists in provider directory accuracy, governance, risk management, and Salesforce-based network intelligence, meeting the complex needs of modern payers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Provider Network Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare Solutions, Inc.

- Change Healthcare Incorporated

- Cognizant Technology Solutions Corporation

- Cotiviti, Inc.

- Inovalon Holdings, Inc.

- International Business Machines Corporation

- McKesson Corporation

- Mphasis Limited

- NextGen Healthcare, Inc.

- Optum, Inc.

- Oracle Corporation

- UnitedHealth Group Incorporated

Actionable Recommendations for Leaders to Accelerate AI Adoption, Foster Collaboration, and Ensure Governance Excellence in Provider Network Strategies

Industry leaders should prioritize strategic investments in AI-driven directory management tools to enhance data accuracy and reduce manual processes. By adopting predictive analytics for network adequacy monitoring, organizations can proactively identify access gaps and optimize referral pathways. Furthermore, developing hybrid deployment models that balance cloud scalability with on-premise security controls will support both innovation and regulatory compliance.

Collaborative partnerships between payers, providers, and technology vendors are essential for sharing best practices and co-developing interoperability standards. Engaging in multi-stakeholder forums to influence policy development can ensure that future regulations align with operational realities and technological capabilities. In addition, aligning network contracts with value-based care metrics will reinforce quality incentives and foster provider accountability.

Finally, continuous training programs for network management teams on emerging technologies and regulatory updates will sustain organizational agility. Embedding change management frameworks and governance structures will facilitate seamless adoption of new processes, driving measurable improvements in network performance and patient experience.

Robust Research Methodology Integrating Multisource Literature, Stakeholder Interviews, and Advanced Data Validation to Deliver Comprehensive Provider Network Management Insights

This analysis is grounded in a rigorous mixed-methods approach, combining secondary research from peer-reviewed journals, regulatory publications, and industry reports with primary interviews conducted among network executives, payers, and providers. Quantitative data was validated through cross-reference of publicly available CMS filings, FDA databases, and trade association releases.

Segmentation frameworks were developed based on established market taxonomies, refined through consultation with subject-matter experts to reflect real-world network models and service delivery variations. Trend analysis incorporated advanced text mining of regulatory rule-making documents and financial disclosures, ensuring that the latest policy shifts and technological innovations informed the findings.

To ensure data integrity, multiple layers of review were applied, including inter-analyst audits and feedback loops with industry stakeholders. This methodology delivers a comprehensive and unbiased perspective on provider network management, offering actionable insights for strategic decision-making and operational improvement.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Provider Network Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Provider Network Management Market, by Provider Type

- Healthcare Provider Network Management Market, by Service Type

- Healthcare Provider Network Management Market, by Network Model

- Healthcare Provider Network Management Market, by Ownership Structure

- Healthcare Provider Network Management Market, by Application

- Healthcare Provider Network Management Market, by Deployment Mode

- Healthcare Provider Network Management Market, by Region

- Healthcare Provider Network Management Market, by Group

- Healthcare Provider Network Management Market, by Country

- United States Healthcare Provider Network Management Market

- China Healthcare Provider Network Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Critical Findings on Technology, Policy, and Strategic Imperatives to Guide Effective Provider Network Management Practices

This executive summary distills critical insights on how digital transformation, regulatory mandates, and global trade policies are reshaping provider network management. By understanding intricate segmentation dynamics, regional nuances, and competitive strategies, decision-makers can align network configurations with organizational goals and patient care imperatives.

The analysis highlights the strategic imperative of AI-powered solutions for directory accuracy and network adequacy monitoring, the significance of interoperability standards for seamless data exchange, and the necessity of diversified sourcing to mitigate tariff-induced supply chain disruptions. It also underscores the value of collaborative partnerships and governance frameworks in navigating evolving policy landscapes.

Ultimately, organizations that proactively integrate these insights into their network strategies will be positioned to enhance provider collaboration, optimize operational efficiency, and deliver superior patient outcomes, driving sustainable competitive advantage in the dynamic healthcare ecosystem.

Elevate Your Provider Network Strategy by Connecting with Ketan Rohom to Secure the Definitive Market Research Report

To unlock transformative insights and practical guidance tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, and secure your copy of the comprehensive Healthcare Provider Network Management market research report today

This report offers a deep dive into the dynamics shaping provider network optimization, equipping you with the knowledge to navigate technological advancements, policy shifts, and competitive pressures. Connect with Ketan Rohom to explore customized licensing options, gain early access to exclusive data sets, and leverage expert analysis for your next strategic move

Don’t miss this opportunity to strengthen your provider network strategy, enhance operational efficiencies, and drive sustainable growth with actionable intelligence. Contact Ketan Rohom now to elevate your decision-making and secure a competitive edge

- How big is the Healthcare Provider Network Management Market?

- What is the Healthcare Provider Network Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?