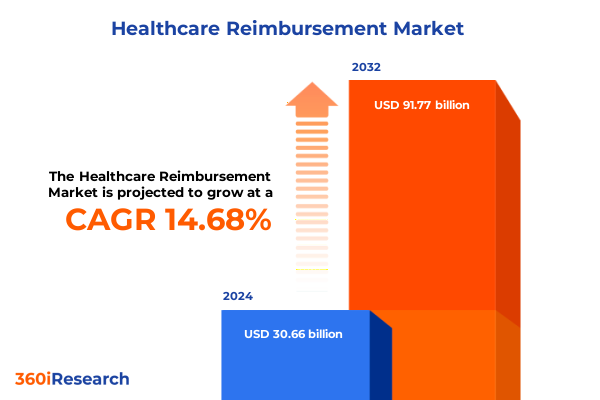

The Healthcare Reimbursement Market size was estimated at USD 34.66 billion in 2025 and expected to reach USD 39.18 billion in 2026, at a CAGR of 14.92% to reach USD 91.77 billion by 2032.

Setting the Stage for Healthcare Reimbursement Transformation by Exploring Key Drivers, Emerging Challenges, and Strategic Implications for Providers, Payers, and Patients

The healthcare reimbursement ecosystem has undergone a profound transformation in recent years, driven by evolving policy frameworks, technological innovation, and shifting stakeholder expectations. This landscape now demands that providers, payers, and patients navigate a labyrinth of reimbursement pathways, risk-sharing agreements, and performance metrics. As cost containment and quality outcomes have become intertwined objectives, traditional fee-for-service paradigms are being restructured to reward coordinated care, preventive measures, and patient engagement. Amid rising expenditure scrutiny, reimbursement strategies have emerged as critical levers for ensuring both fiscal sustainability and clinical excellence across the continuum of care.

Against this backdrop, it is essential to establish a clear understanding of the forces shaping reimbursement today. This executive summary presents a synthesis of transformative shifts occurring within regulatory environments, the cumulative impact of recent tariff adjustments, and deep segmentation and regional insights. Furthermore, we highlight leading organizations’ strategic responses and offer actionable recommendations for industry decision-makers. By laying out a holistic introduction to this multifaceted domain, the following sections will equip stakeholders with a comprehensive perspective on how reimbursement models are being reframed to address contemporary challenges and unlock future opportunities.

Navigating the Emergence of Digital Platforms, Value-Based Models, and Regulatory Overhauls Reshaping the Healthcare Reimbursement Landscape with Lasting Impacts

Emerging technologies and policy reforms are catalyzing seismic shifts in how healthcare reimbursement is structured and delivered. In recent years, the proliferation of digital health platforms-ranging from telehealth services to remote patient monitoring-has introduced new cost centers and reimbursement workflows that demand agile adaptation. Simultaneously, pay-for-performance and value-based care models have gained traction, incentivizing providers to focus on outcomes rather than volume. This paradigm shift has been accelerated by regulatory mandates that prioritize quality measures, risk adjustment, and transparency in reimbursement contracts.

Moreover, the integration of advanced analytics and artificial intelligence into claims adjudication and utilization management is redefining operational efficiencies. Predictive modeling now enables payers to forecast high-risk patient cohorts and adjust payment structures in near real-time. Looking ahead, continued convergence of clinical and financial data streams will further blur the lines between care delivery and reimbursement, compelling stakeholders to embrace interoperable systems and collaborative governance. Together, these transformative shifts underscore the need for strategic alignment between technology adoption, policy compliance, and stakeholder engagement across the reimbursement ecosystem.

Assessing the Ripple Effects of United States’ 2025 Tariff Adjustments on Medical Supply Chains, Pharmaceutical Pricing Structures, and Reimbursement Policies Across Stakeholders

The implementation of updated tariff measures in 2025 has introduced a new dimension of complexity to the United States healthcare supply chain. Increased duties on imported medical devices, pharmaceutical raw materials, and diagnostic equipment have elevated acquisition costs for providers and manufacturers alike. As a result, reimbursement frameworks are being recalibrated to accommodate higher input expenses, with negotiations between payers and suppliers intensifying around allowable cost increases and coverage criteria.

In addition, these tariff adjustments have triggered a diversification of sourcing strategies, prompting some manufacturers to onshore production while others seek alternative international suppliers. This supply chain realignment has rippled through contractual agreements, compelling payers to revisit pricing benchmarks and risk-sharing mechanisms. The cumulative impact is evident in the emergence of dynamic reimbursement clauses that factor in tariff volatility, enabling stakeholders to hedge financial exposure. Ultimately, the 2025 tariffs are accelerating a broader trend toward greater transparency, resilience, and adaptability within reimbursement policies across the healthcare industry.

Unveiling Deep Insights from Multi-Dimensional Segmentation Spanning Payer Type, Service Type, Reimbursement Models, and End User Profiles in Healthcare Payments

A nuanced analysis of payer type segmentation reveals varied reimbursement dynamics depending on whether funding originates from government programs, out-of-pocket expenditures, or private insurers. Within government channels, Medicaid and Medicare programs operate under distinct coverage mandates and reimbursement ceilings, often influencing provider participation and service delivery models. In contrast, individuals paying directly encounter different cost-sharing obligations that can affect care utilization patterns. Private insurer frameworks, spanning commercial carriers and managed care plans, further introduce tiered network strategies and performance-based incentives that reshape negotiation leverage and payment timelines.

Service type segmentation highlights how reimbursements are allocated across diagnostics, inpatient and outpatient care, pharmacy, and preventive services. Diagnostic imaging modalities, such as CT scans, MRIs, and ultrasounds, alongside lab testing panels, are reimbursed via fee schedules and bundled rates that reflect technological complexity. Inpatient settings covering acute care, emergency visits, and surgical suites adhere to prospective payment systems, whereas outpatient visits, home healthcare programs, and ambulatory procedures follow different per-visit or per-episode structures. Meanwhile, pharmacy channels differentiate between prescription fills and over-the-counter medications, and preventive care covers screenings and vaccinations under evolving benefit designs.

Reimbursement model segmentation underscores the progression from fee-for-service to advanced payment arrangements. Bundled payment schemes, classified by diagnosis or episode, provide fixed reimbursements that incentivize cost containment across care pathways. Capitation approaches allocate per-member-per-month payments, transferring risk to providers. Global payments bundle broad sets of services under single contracts, while value-based care introduces performance thresholds managed by accountable care organizations or patient-centered medical homes. Lastly, end-user segmentation-spanning ambulatory centers, clinics, home care settings, hospitals, individual patients, and telemedicine platforms-illustrates how reimbursement rules are tailored to specific delivery environments and service modalities.

This comprehensive research report categorizes the Healthcare Reimbursement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Reimbursement Model

- Payer Type

- End User

Comparative Regional Dynamics Demonstrating How the Americas, Europe Middle East & Africa, and Asia Pacific Markets Are Adapting to Reimbursement Evolution

Regional reimbursement trends diverge significantly across the Americas, Europe Middle East & Africa, and Asia Pacific markets, each influenced by unique regulatory frameworks and healthcare infrastructures. In the Americas, particularly within the United States and Canada, a strong emphasis on value-based contracting has accelerated pay-for-performance initiatives. Meanwhile, Latin American nations are prioritizing access and affordability, with government-sponsored programs seeking to expand coverage in underserved communities.

Across Europe, Middle East & Africa, diverse reimbursement models coexist alongside centralized national health systems and private insurance markets. Western European countries often leverage risk-adjusted capitation and global budgets, while emerging economies in the Middle East and Africa focus on building foundational insurance schemes and introducing performance-based subsidies. In the Asia Pacific region, a hybrid of public insurance expansions, private pay segments, and technology-driven payment platforms is evident. Governments in countries like Japan and South Korea maintain fee-schedule controls, whereas rapidly developing markets such as India and Southeast Asia explore innovative telehealth reimbursement to extend care to rural populations. These regional contrasts emphasize the necessity for contextualized strategies that reflect localized policy drivers, funding mechanisms, and healthcare delivery models.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Reimbursement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Postures of Leading Healthcare Reimbursement Stakeholders from Payers to Technology Innovators Driving Competitive Advantage

Leading healthcare organizations and technology innovators are adopting differentiated approaches to capture reimbursement opportunities and mitigate risk. Large commercial payers are investing heavily in analytics platforms that enable real-time claims adjudication and predictive risk modeling, enhancing their ability to manage high-cost patient populations. Notably, several insurers have forged strategic partnerships with digital health vendors to integrate telehealth and remote monitoring services into core payment bundles, fostering continuity of care while controlling cost drivers.

On the provider side, integrated delivery networks and major hospital systems are transforming care pathways to align with value-based arrangements. By establishing accountable care entities and patient-centered medical homes, these organizations secure shared savings agreements predicated on quality metrics and patient satisfaction scores. Simultaneously, pharmaceutical and medical device manufacturers are collaborating with payers to implement outcomes-based contracting, linking product reimbursement to real-world performance indicators. Collectively, these key market participants illustrate a shift toward collaborative reimbursement frameworks that leverage data insights, governance protocols, and aligned incentives for sustainable healthcare delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Reimbursement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- CareSource Management Group

- Centene Corporation

- Cigna Corporation

- CVS Health Corporation

- Elevance Health, Inc.

- Health Care Service Corporation

- Humana Inc.

- Kaiser Foundation Health Plan, Inc.

- Molina Healthcare, Inc.

- Niva Bupa Health Insurance Company Limited

- UnitedHealth Group Incorporated

Actionable Strategic Imperatives for Healthcare Industry Leaders Seeking to Optimize Reimbursement Models, Enhance Operational Efficiencies, and Foster Stakeholder Alignment

Industry leaders seeking to thrive in this evolving reimbursement environment should focus on several strategic imperatives. First, they must prioritize investment in integrated data platforms that consolidate clinical, claims, and financial information, enabling transparent insights into utilization trends and cost drivers. Moreover, fostering partnerships across the care continuum-from payers and providers to technology vendors and patient advocacy groups-will be critical for designing innovative reimbursement models that balance risk and reward.

Additionally, embedding advanced analytics and machine learning capabilities into revenue cycle management processes will enhance predictive accuracy for high-cost cohorts, reduce denials, and strengthen negotiation positions. Organizations should also explore flexible contracting arrangements, including value-based and bundled payment schemes, to align incentives around quality outcomes. Finally, cultivating a culture of continuous learning and agility will ensure that leadership teams can rapidly adapt to regulatory updates, tariff fluctuations, and emerging stakeholder needs, ultimately securing sustainable performance in the long term.

Detailing a Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Credibility and Relevance

This research draws on a multi-phase methodology combining primary and secondary data sources to ensure robust and credible insights. Initially, extensive secondary analysis was conducted on industry publications, regulatory guidelines, and peer-reviewed studies to map foundational trends and policy evolutions. These findings informed the development of structured interview guides, which were then employed in in-depth discussions with senior executives from payer organizations, integrated delivery networks, medical device manufacturers, and technology vendors.

Following primary data collection, quantitative analyses were performed on aggregated claims and reimbursement datasets to identify patterns in payment structures, cost allocations, and service utilization. Throughout the process, expert validation sessions were held with advisory panels comprising healthcare economists, reimbursement specialists, and regulatory experts to refine conclusions and ensure methodological rigor. Finally, all insights were triangulated across data sources and stakeholder perspectives, yielding a comprehensive overview of the latest shifts and strategic imperatives within the healthcare reimbursement landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Reimbursement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Reimbursement Market, by Service Type

- Healthcare Reimbursement Market, by Reimbursement Model

- Healthcare Reimbursement Market, by Payer Type

- Healthcare Reimbursement Market, by End User

- Healthcare Reimbursement Market, by Region

- Healthcare Reimbursement Market, by Group

- Healthcare Reimbursement Market, by Country

- United States Healthcare Reimbursement Market

- China Healthcare Reimbursement Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Drawing Comprehensive Conclusions on the Future of Healthcare Reimbursement Highlighting Strategic Priorities, Emerging Trends, and Pathways for Sustainable Value Creation

As reimbursement models continue to evolve under the combined influences of policy reform, technological innovation, and global supply chain dynamics, stakeholders must remain vigilant in adapting their strategies. Payers and providers alike are transitioning toward holistic value-based arrangements that reward quality, efficiency, and patient engagement. Simultaneously, tariff-driven cost pressures and regional disparities underscore the importance of flexible contracting mechanisms and localized reimbursement designs.

Looking ahead, organizations that successfully integrate data-driven decision making with collaborative governance structures will be best positioned to navigate uncertainty and enhance care delivery. By aligning incentives across the healthcare ecosystem, fostering interoperable systems, and prioritizing patient-centered outcomes, industry leaders can drive both financial sustainability and improved health metrics. This report serves as a roadmap for charting that course, highlighting the strategic levers that will define the future of healthcare reimbursement.

Engage with Ketan Rohom to Unlock In-Depth Healthcare Reimbursement Intelligence and Empower Decision-Making Through a Tailored Market Research Report

To delve deeper into the comprehensive analysis of healthcare reimbursement trends, strategic drivers, and actionable insights, connect with Ketan Rohom, Associate Director of Sales & Marketing, and secure your customized market research report today. Ketan can guide you through tailored solutions that align with your organization’s unique priorities, ensuring you harness the full potential of our rigorous study to support decision-making and long-term growth. Reach out now to initiate a partnership that will empower your team with data-driven intelligence and strategic clarity for navigating the evolving reimbursement environment.

- How big is the Healthcare Reimbursement Market?

- What is the Healthcare Reimbursement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?