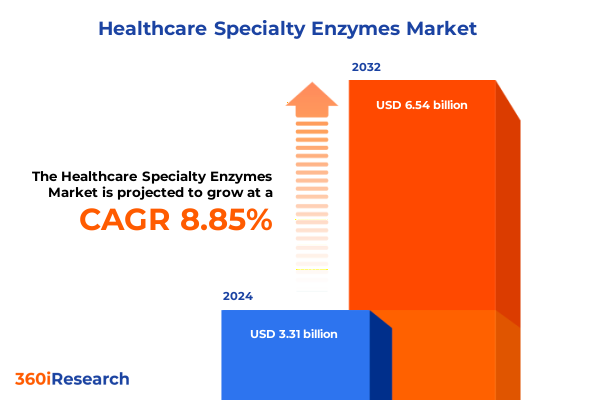

The Healthcare Specialty Enzymes Market size was estimated at USD 6.58 billion in 2025 and expected to reach USD 6.97 billion in 2026, at a CAGR of 6.65% to reach USD 10.33 billion by 2032.

Exploring the Critical Role of Specialty Enzymes in Driving Next-Generation Healthcare Innovations and Transforming Patient Therapy Outcomes Worldwide

The application of specialty enzymes in healthcare has rapidly evolved from niche laboratory reagents to foundational tools that drive diagnostic innovation and therapeutic development. Emerging trends in personalized medicine, biocatalysis, and advanced diagnostic protocols have amplified the demand for highly specific biocatalysts. As global healthcare systems seek to improve efficacy, reduce adverse reactions, and streamline production pipelines, specialty enzymes have become indispensable for catalyzing key biochemical reactions with unparalleled precision and efficiency.

This executive summary serves as an introduction to the comprehensive exploration of healthcare specialty enzymes and the factors reshaping this critical landscape. It outlines the strategic imperatives, technological advancements, and market forces that define current opportunities and challenges. By synthesizing sectoral shifts, policy impacts, and segmentation insights, this section frames a holistic perspective for decision-makers striving to harness enzyme technologies for next-generation healthcare solutions.

Uncovering Transformative Shifts in Healthcare Specialty Enzymes Driven by Technological Breakthroughs and Evolving Clinical Applications

Healthcare specialty enzymes are experiencing a phase of transformative evolution driven by breakthroughs in molecular biology and protein engineering. Advances in directed evolution, high-throughput screening, and computational design now enable the creation of enzymes with bespoke characteristics-ranging from enhanced substrate specificity to improved thermal stability. Such innovations are dismantling historical barriers to large-scale biocatalysis and fostering the development of enzyme-driven manufacturing processes that deliver higher yields, reduced waste, and greater cost efficiency.

In parallel, evolving clinical applications are broadening the scope of enzyme usage beyond traditional laboratory assays. Diagnostic platforms increasingly incorporate enzyme-linked assays for rapid and point-of-care testing, while therapeutic research leverages enzyme-mediated prodrug activation and targeted drug delivery systems. These shifts underscore a dynamic ecosystem where interdisciplinary collaboration between biotechnologists, clinicians, and regulatory bodies is accelerating the translation of enzyme technologies into tangible improvements in patient care and streamlined drug development cycles.

Analyzing the Cumulative Impact of 2025 United States Tariff Changes on the Dynamics and Supply Chains of Specialty Enzymes in Healthcare

In 2025, the United States instituted revised tariff structures affecting imported specialty enzymes, reflecting broader trade policy adjustments aimed at protecting domestic manufacturing while addressing supply chain vulnerabilities. These measures have introduced incremental duties on key enzyme categories, altering the cost calculus for organizations reliant on international suppliers. Consequently, procurement strategies have shifted toward a balance of nearshoring and local partnerships to mitigate tariff-induced price variations.

The cumulative impact of these tariffs extends beyond direct cost increases to influence inventory management, contract negotiation practices, and long-term sourcing commitments. Companies are proactively reevaluating supplier portfolios, exploring joint ventures with domestic enzyme producers, and investing in in-house bioprocessing capabilities. This strategic realignment not only reduces exposure to external policy fluctuations but also strengthens supply chain resilience, ultimately safeguarding R&D pipelines against potential disruptions.

Revealing Key Segmentation Insights Across Product Types, Applications, Sources, Forms, and End Users Shaping Specialty Enzymes in Healthcare

The landscape of healthcare specialty enzymes can be dissected across multiple intersecting dimensions that collectively shape market dynamics and innovation pathways. First, product type segmentation underscores the distinct roles of amylases, cellulases, lipases, and proteases, each engineered to facilitate specific biochemical reactions ranging from starch degradation to peptide cleavage. Secondly, application segments span diagnostics, fine chemicals, pharmaceuticals, and research reagents, reflecting how enzyme functionalities are tailored to diverse operational contexts-from clinical assays to high-purity chemical synthesis.

Further granularity emerges when examining source and form classifications alongside end-user profiles. Sources include animal-derived, microbial, plant-based, and recombinant enzymes, each offering unique performance characteristics and regulatory considerations. Enzymes are also available in liquid or powder preparations, optimizing stability and ease-of-use for targeted laboratory or production settings. Finally, end users range from academic and research institutes to biopharmaceutical companies and diagnostic laboratories, illustrating a value chain where collaborative partnerships and co-development agreements are essential for driving both fundamental research and commercial-scale applications.

This comprehensive research report categorizes the Healthcare Specialty Enzymes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Form

- Application

- End User

Highlighting Regional Growth Dynamics and Strategic Opportunities Across the Americas, Europe Middle East & Africa, and Asia-Pacific Enzyme Markets

Regional dynamics reveal distinct growth trajectories and strategic imperatives across the Americas, where innovation hubs in North America are counterbalanced by emerging biomanufacturing capacities in Latin America. In the United States and Canada, robust regulatory frameworks and well-established research ecosystems have fostered early adoption of advanced enzyme technologies, while Latin American countries are leveraging cost advantaged production to expand access to diagnostic and therapeutic enzymes throughout the region.

In Europe, the Middle East & Africa, diverse market conditions drive both high-end specialty demand in Western Europe and capacity-building initiatives across the Middle East and North Africa. Strong government support in selected European nations incentivizes local enzyme development, whereas Israel and GCC countries are investing in biotechnology clusters. In contrast, the Asia-Pacific region demonstrates the fastest acceleration, propelled by large-scale manufacturing capabilities in China, innovation-focused biotechnology corridors in India, and regulatory reforms in Southeast Asia that facilitate faster market entry for enzyme-based diagnostic and therapeutic solutions.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Specialty Enzymes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Profiles and Strategic Initiatives of Leading Specialty Enzyme Companies Driving Innovation and Competitive Differentiation in Healthcare

Industry leaders are driving the specialty enzyme segment through continuous innovation, strategic collaborations, and targeted acquisitions. Global pioneers have expanded their portfolios by integrating recombinant enzyme production platforms, enhancing process efficiencies, and pursuing co-development partnerships with biotech startups. This forward-thinking approach is complemented by investments in digital manufacturing technologies, such as bioreactor automation and real-time process analytics, which streamline scale-up timelines and improve consistency across batches.

Simultaneously, mid-tier and emerging players are carving out niches by focusing on specialized enzyme variants and custom formulation services. These agile organizations often collaborate with academic institutions to translate novel enzyme discovery into proprietary product lines. As competitive differentiation intensifies, strategic alliances between established firms and innovative challengers are becoming increasingly prevalent, reinforcing the importance of a diversified product pipeline and end-to-end value chain integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Specialty Enzymes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Enzymes GmbH

- Advanced Enzyme Technologies Limited

- Amano Enzyme Co., Ltd.

- BASF SE

- Codexis, Inc.

- DuPont de Nemours, Inc.

- Kikkoman Corporation

- Koninklijke DSM N.V.

- Novozymes A/S

- Specialty Enzymes & Probiotics, Inc.

Presenting Actionable Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Trends in Specialty Enzymes

Industry leaders should prioritize the diversification of their supply chains by establishing strategic partnerships with both domestic and international enzyme producers to buffer against geopolitical fluctuations and tariff volatility. Concurrently, allocating resources to recombinant enzyme engineering and high-throughput screening platforms will ensure a robust pipeline of tailored biocatalysts equipped to meet evolving clinical requirements.

In addition, fostering collaborative ecosystems that bridge biotechnology firms, academic research centers, and regulatory stakeholders will accelerate the validation and adoption of novel enzyme-based applications. Policy engagement is equally critical-companies must actively participate in trade forums and regulatory consultations to advocate for balanced tariff structures and streamlined approval pathways, thereby securing an operational environment conducive to sustained innovation.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Expert Validation for Comprehensive Insights

This research employs a comprehensive methodology that integrates qualitative and quantitative approaches to deliver robust, actionable insights. Primary research comprises in-depth interviews with key opinion leaders, enzyme manufacturers, and R&D executives, supplemented by expert workshops to validate emerging themes and strategic imperatives. These interactions provide firsthand perspectives on technological breakthroughs, regulatory challenges, and market adoption drivers.

Secondary research draws from peer-reviewed journals, patent databases, regulatory filings, and industry white papers to contextualize primary findings within broader scientific and commercial landscapes. Data triangulation ensures consistency and accuracy, while iterative cross-validation among research analysts and subject matter experts enhances the credibility of insights. This multi-faceted approach guarantees a holistic understanding of the healthcare specialty enzyme market and its future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Specialty Enzymes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Specialty Enzymes Market, by Product Type

- Healthcare Specialty Enzymes Market, by Source

- Healthcare Specialty Enzymes Market, by Form

- Healthcare Specialty Enzymes Market, by Application

- Healthcare Specialty Enzymes Market, by End User

- Healthcare Specialty Enzymes Market, by Region

- Healthcare Specialty Enzymes Market, by Group

- Healthcare Specialty Enzymes Market, by Country

- United States Healthcare Specialty Enzymes Market

- China Healthcare Specialty Enzymes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives Emphasizing Strategic Imperatives and Future Directions for Specialty Enzymes to Advance Healthcare Efficacy and Accessibility

The evolving healthcare specialty enzyme market is characterized by rapid technological advancement, shifting policy landscapes, and nuanced regional dynamics. Companies that harness enzyme engineering innovations and proactively adapt to tariff implications will capture strategic advantage in diagnostic and therapeutic arenas. Key segmentation insights further highlight the importance of tailoring product portfolios to specific application requirements and end-user needs.

Looking ahead, sustained collaboration among industry stakeholders, concerted policy advocacy, and targeted investments in emerging markets will shape the next chapter of specialty enzyme deployment. Organizations that align their strategic roadmaps with these imperatives will not only drive scientific breakthroughs but also ensure broader patient access and global health impact.

Engage with Ketan Rohom to Acquire the Comprehensive Specialty Enzymes in Healthcare Market Research Report for Informed Strategic Decisions

To engage deeply with the in-depth analysis and uncover tailored insights that can inform your strategic roadmap, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in specialty enzymes paired with comprehensive knowledge of market dynamics ensures a seamless acquisition process and immediate access to actionable data, enabling your organization to maintain a competitive edge and accelerate decision-making.

- How big is the Healthcare Specialty Enzymes Market?

- What is the Healthcare Specialty Enzymes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?