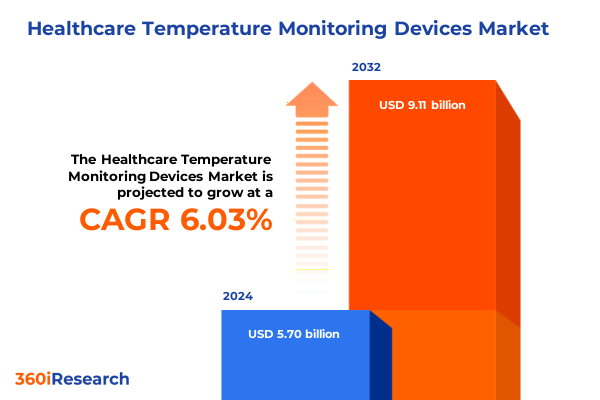

The Healthcare Temperature Monitoring Devices Market size was estimated at USD 6.01 billion in 2025 and expected to reach USD 6.34 billion in 2026, at a CAGR of 6.11% to reach USD 9.11 billion by 2032.

Illuminating the essential importance of temperature monitoring devices in enhancing patient outcomes and optimizing clinical workflows

Temperature monitoring devices have become foundational to delivering quality care across diverse healthcare settings, from large-scale hospitals to remote home environments. These instruments ensure accurate and timely readings, enabling clinicians to detect critical fluctuations in patient conditions and to intervene proactively. By mitigating risks associated with undetected fevers or hypothermia, healthcare providers can improve clinical outcomes, reduce length of stay, and limit costly complications.

Moreover, as healthcare delivery evolves to emphasize outpatient services and decentralized care, the demand for reliable portable and wearable monitoring solutions is intensifying. Innovations such as infrared sensors and smart watch–integrated thermometers not only optimize workflow efficiency but also empower patients with continuous visibility into their health status. Consequently, temperature monitoring has emerged as a vital component of both acute care and preventive health strategies, charting a path toward more responsive and patient-centric models of care.

Exploring pivotal technological regulatory and patient engagement trends reshaping the future of temperature monitoring solutions

The healthcare temperature monitoring landscape is undergoing transformative shifts driven by rapid technological advancements, changing regulatory frameworks, and rising patient expectations for seamless care delivery. Integration of Internet of Medical Things platforms has enabled real-time data aggregation, facilitating predictive analytics and remote interventions that were previously unattainable. Consequently, monitoring solutions are no longer confined to point measurements; they are evolving into comprehensive systems that support end-to-end patient management and cross-disciplinary collaboration.

Regulatory bodies are also adapting to these innovations by streamlining approval pathways for digital health devices while imposing rigorous cybersecurity and interoperability standards. This dual momentum of facilitation and oversight is fostering an environment where manufacturers must prioritize both rapid time-to-market and long-term data integrity. As a result, the industry is witnessing a surge in partnerships between device makers, software developers, and healthcare providers, forging new value chains that emphasize continuous monitoring, patient engagement, and scalable infrastructure.

Assessing how recent United States import tariffs on critical components are catalyzing supply chain realignment and cost management strategies

In 2025, the United States implemented a series of tariffs targeting imports of key temperature monitoring components, including advanced infrared sensors and microelectronic modules. The cumulative effect of these trade measures has reverberated across supply chains, leading to incremental production costs that device manufacturers ultimately must absorb or pass on to end customers. This dynamic is prompting companies to re-evaluate sourcing strategies, with an increasing number exploring domestic production partnerships and vertical integration to mitigate tariff exposure.

Furthermore, these tariffs have accelerated initiatives to localize component manufacturing and to invest in alternative technologies that rely less on imported materials. While cost pressures persist, companies that proactively adapt their supply chain architecture are poised to maintain competitive pricing and minimize disruption. Consequently, the tariff environment is catalyzing a broader reassessment of global manufacturing footprints in favor of more resilient, regionally diversified operations.

Unveiling nuanced insights across device types monitoring modes and application environments to guide targeted strategic initiatives

Diving into the device type dimension reveals three distinct subsegments, each exhibiting unique attributes and growth trajectories. Fixed systems incorporating infrared sensors and thermistor probes remain the gold standard for clinical environments due to their robustness and high throughput. Meanwhile, portable offerings such as handheld thermometers and thermal scanners are gaining traction in ambulatory care and emergency response scenarios, delivering rapid assessments without compromising accuracy. On the cutting edge, wearable patches and smart watch–embedded sensors are redefining continuous monitoring by providing unobtrusive, real-time temperature tracking for both inpatient and at-home use.

Beyond hardware categorization, the monitoring mode axis underscores a bifurcation between continuous and intermittent measurement paradigms. Continuous monitoring is increasingly adopted in critical care and high-risk patient cohorts, where timely detection of temperature shifts can inform immediate clinical interventions. Conversely, intermittent monitoring remains prevalent in general ward settings and routine health checks, balancing resource utilization with essential surveillance. When mapping applications, general wards demand versatile devices that can scale with patient turnover, whereas home healthcare solutions prioritize user-friendliness and remote connectivity. In the intensive care unit context, adult and pediatric units require precision instruments capable of withstanding rigorous sterilization protocols and integrating with complex patient management platforms.

This comprehensive research report categorizes the Healthcare Temperature Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Monitoring Mode

- Application

Decoding diverse regional adoption patterns regulatory ecosystems and growth drivers across major global markets

Regional dynamics in the healthcare temperature monitoring domain reflect varying adoption rates, regulatory landscapes, and healthcare infrastructure maturity across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, strong hospital networks and supportive reimbursement policies drive demand for both fixed and portable systems, with the United States at the forefront of integrating digital health solutions. Moving eastward, Europe Middle East and Africa presents a fragmented tapestry of regulatory standards and budgetary constraints, resulting in heterogeneous uptake where leading economies invest heavily in advanced systems while emerging markets seek cost-effective alternatives.

Meanwhile, the Asia-Pacific region is characterized by rapid expansion fueled by aging populations, increasing healthcare spending, and government initiatives to bolster public health infrastructure. This environment has sparked a wave of local OEMs that offer competitively priced devices alongside global players establishing regional manufacturing hubs. Furthermore, integration with mobile health platforms is particularly pronounced in North Asia and select Southeast Asian markets, underscoring the region’s appetite for hybrid models that combine affordability with digital connectivity.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Temperature Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting competitive strategies and innovation-driven partnerships that are redefining leadership in temperature monitoring markets

Leading companies are differentiating their portfolios through strategic investments in R&D, acquisitions, and collaborative ventures. Established medical technology corporations have leveraged their global distribution networks to scale device deployments rapidly, while emerging specialized firms focus on niche innovations, such as low-power wearable sensors and AI-driven analytics. Partnerships between device manufacturers and software developers have become increasingly common, enabling comprehensive solutions that integrate temperature data with broader vital sign monitoring and clinical decision support systems.

Moreover, competitive dynamics are shaped by the need to navigate evolving regulatory requirements, particularly around data security and interoperability. Companies that demonstrate early compliance and robust post-market surveillance capabilities position themselves as trusted providers, gaining preference among healthcare systems and patients alike. This emphasis on end-to-end reliability is fostering consolidation trends, wherein larger players absorb high-potential startups to accelerate innovation cycles and to secure advanced sensor technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Temperature Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- American Diagnostic Corporation

- Becton, Dickinson and Company

- Braun GmbH

- Briggs Healthcare

- Cadi Scientific

- Cardinal Health, Inc.

- Drägerwerk AG & Co. KGaA

- EarlySense Ltd.

- Exergen Corporation

- GE Healthcare

- Gentherm Incorporated

- Hicks Thermometers India Limited

- Hill‑Rom Holdings, Inc.

- Kaz USA, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Microlife Corporation

- Omron Healthcare, Inc.

- Sensitech, Inc.

- Stryker Corporation

- Terumo Corporation

Driving future growth through integrated platform development data analytics and strategic supply chain collaborations

To thrive in this dynamic environment, industry leaders should prioritize the development of modular platforms that support both fixed installations and portable or wearable extensions. Investing in scalable software architectures will facilitate seamless integration with electronic health records and telehealth ecosystems, thereby enhancing value propositions. Additionally, forging alliances with component suppliers and exploring localized manufacturing arrangements can mitigate tariff-related risks and improve supply chain agility.

Leaders must also cultivate data-centric services by leveraging machine learning algorithms to interpret temperature trends, predict patient deterioration, and optimize resource allocation. Establishing cross-sector collaborations with academic institutions and healthcare organizations will accelerate clinical validation and promote widespread adoption. Finally, proactive engagement with regulatory stakeholders to shape guidelines around digital health interoperability and cybersecurity will ensure smoother market entry and foster long-term trust among end users.

Detailing a robust mixed methods approach integrating secondary analysis primary interviews and quantitative validation for authoritative insights

The research methodology underpinning this analysis combines in-depth secondary research with primary interviews and quantitative data collection. Initially, industry literature, regulatory filings, and corporate disclosures were reviewed to establish a foundational understanding of technological advancements and market dynamics. Subsequently, structured interviews with device manufacturers, healthcare providers, and regulatory experts provided qualitative insights into adoption drivers, pain points, and strategic priorities.

To validate these findings, quantitative surveys were administered to a broad spectrum of stakeholders across key regions, capturing preferences related to device functionality, pricing considerations, and service expectations. The data were rigorously triangulated using cross-sectional analysis and scenario modeling to ensure consistency and to identify emergent trends. Throughout the process, quality controls, including peer reviews and expert vetting, were implemented to uphold the reliability and accuracy of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Temperature Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Temperature Monitoring Devices Market, by Device Type

- Healthcare Temperature Monitoring Devices Market, by Monitoring Mode

- Healthcare Temperature Monitoring Devices Market, by Application

- Healthcare Temperature Monitoring Devices Market, by Region

- Healthcare Temperature Monitoring Devices Market, by Group

- Healthcare Temperature Monitoring Devices Market, by Country

- United States Healthcare Temperature Monitoring Devices Market

- China Healthcare Temperature Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing key findings to underscore the imperative for adaptable integrated and data empowered temperature monitoring solutions moving forward

The healthcare temperature monitoring sector stands at the intersection of technological innovation, regulatory evolution, and shifting care delivery models. As patient-centric approaches gain traction, demand for versatile devices that blend accuracy with accessibility will continue to rise. Meanwhile, tariff pressures and regional disparities underscore the importance of resilient supply chains and localized strategies.

Looking ahead, the convergence of wearable technologies, cloud-based analytics, and integrated care platforms will unlock new opportunities for proactive health management and remote patient monitoring. By embracing interoperable architectures and data-driven services, stakeholders can deliver enhanced clinical value while navigating complex market dynamics. Ultimately, success will hinge on the ability to adapt swiftly, collaborate across ecosystems, and maintain a steadfast focus on improving patient outcomes.

Secure unparalleled strategic advantages with expert guidance to access the definitive healthcare temperature monitoring market research report today

Elevate your decision-making with our comprehensive healthcare temperature monitoring market research report by reaching out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan Rohom will provide tailored insights, answer any queries, and facilitate seamless access to the data-driven guidance you need to stay ahead in a rapidly evolving environment. Connect today to unlock the full scope of opportunities and strategic direction essential for your organization’s success and secure your copy of the definitive analysis.

- How big is the Healthcare Temperature Monitoring Devices Market?

- What is the Healthcare Temperature Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?