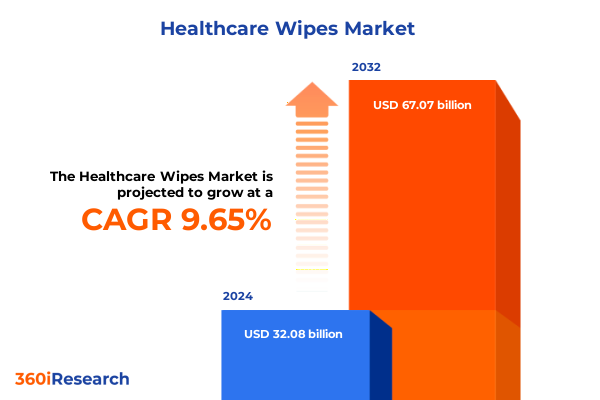

The Healthcare Wipes Market size was estimated at USD 35.08 billion in 2025 and expected to reach USD 38.36 billion in 2026, at a CAGR of 9.70% to reach USD 67.07 billion by 2032.

Establishing a Comprehensive Overview of Surging Demand and Strategic Imperatives Shaping the Evolution of Healthcare Wipes in Modern Care Settings

Healthcare wipes have become indispensable for infection prevention and control across diverse care environments, serving as a frontline defense against healthcare-associated infections. The United States Centers for Disease Control and Prevention emphasizes environmental cleaning and disinfection as core practices that underpin patient safety, highlighting the necessity of using appropriate disinfectant agents to mitigate pathogen transmission in all healthcare settings. As healthcare delivery extends beyond traditional hospitals into ambulatory, long-term care, and homecare settings, the versatility and ease of use of wipes ensure consistent adherence to cleaning protocols, thereby elevating the standard of care.

In parallel, advances in wipe composition and formulation have enhanced both efficacy and user experience, reflecting growing demand from clinicians and patients alike. Low-level disinfectant wipes employing quaternary ammonium compounds and alcohol-based solutions demonstrate significant microbial reduction with contact times as brief as one minute, aligning with EPA requirements for rapid disinfection cycles. Furthermore, the integration of ergonomically designed packaging and presaturated textiles supports streamlined workflows for environmental services personnel, reinforcing the strategic value of wipes in achieving robust infection control outcomes.

Unveiling the Critical Technological and Market Dynamics Redefining Healthcare Wipes Toward Sustainability and Efficacy Innovations

The healthcare wipes landscape is undergoing transformative shifts driven by both technological breakthroughs and evolving market demands. Eco-conscious formulations have emerged as a defining trend, with manufacturers such as Kimberly-Clark Professional introducing fully plant-based, biodegradable Kleenex® Eco Wipes to address the industry’s imperative for sustainable solutions. These innovations leverage renewable raw materials to reduce environmental impact while maintaining requisite disinfection performance, marking a strategic repositioning of wipes from disposable convenience items to environmentally responsible consumables.

Concurrently, the pursuit of enhanced antimicrobial efficacy is reshaping product portfolios, exemplified by the launch of high-level germicidal wipes designed to neutralize a broad spectrum of pathogens, including emerging viral threats. PDI Healthcare’s introduction of Sani-Cloth® Prime Germicidal Disposable Wipes reflects a market pivot toward formulations offering expedited kill times and extended shelf stability, catering to the accelerated cleaning cycles demanded by modern healthcare facilities. These advances underscore a broader shift toward purpose-driven product development, where efficacy, safety, and sustainability converge to deliver next-generation healthcare wipes.

Assessing the Layered Impact of 2025 U.S. Tariff Measures on Raw Materials, Manufacturing Costs, and Supply Chain Resilience in Healthcare Wipes

The introduction of a near-universal 10% global tariff on imported goods in April 2025 has reverberated across the healthcare sector, imposing elevated costs on critical inputs such as disinfectant chemistries, packaging substrates, and personal protective consumables. These levies, tailored to curtail the national trade deficit and incentivize reshoring, apply to active pharmaceutical ingredients and specialized chemicals vital to wipe production, prompting manufacturers to reassess sourcing strategies and pricing structures in order to preserve profit margins and maintain competitive positioning.

Despite broad tariff coverage, key chemical classes integral to wipe substrates-namely polymers such as polyethylene, polypropylene, and nonwoven fabric precursors-were exempted from duties under selective eligibility criteria, shielding certain supply chain segments from immediate cost escalations. Nevertheless, associated logistical fees and proposed maritime shipping surcharges have introduced additional financial burdens, eroding the cost advantage of overseas raw materials and necessitating greater reliance on domestic production or alternative global suppliers.

A parallel set of punitive measures targeting Canada and Mexico, comprising 25% tariffs on a wide array of imports, further complicates North American supply chain optimization. With near-simultaneous retaliatory duties on U.S. exports, cross-border sourcing of disinfectant packaging components and adhesive laminates faces heightened uncertainty, compelling industry stakeholders to fortify supply chain resilience through diversified procurement and strategic inventory management.

Deep Dive into Form, End User, Distribution Channels, Product Type, and Packaging Variations Revealing Critical Market Segmentation Insights

Analysis of wipe formats reveals a bifurcated landscape between dry and premoistened options, each with distinct subcategories tailored to specialized applications. Dry wipes encompass both non-sterile and sterile variants, serving functions ranging from simple surface cleaning to critical aseptic preparation, while premoistened wipes are further classified by their solvent bases, including both alcohol-based formulations for rapid disinfection and non-alcohol alternatives for sensitive surfaces and skin applications. This segmentation underscores the importance of form-factor selection in meeting the precise hygiene requirements of end users.

End-user segmentation distinguishes between food service operations, healthcare facilities, households, and industrial sites, highlighting a nuanced differentiation in performance attributes and regulatory oversight. Within healthcare facilities, demand is subdivided among clinics, hospitals, and long-term care environments, each with unique protocol mandates and budgetary considerations that drive product specifications and purchasing decisions. This layered segmentation reflects the necessity for manufacturers to calibrate product characteristics to the stringent safety standards of professional care settings while accommodating cost efficiencies for broader consumer applications.

Distribution channel analysis identifies a spectrum encompassing convenience stores, e-commerce platforms, institutional suppliers, pharmacies and drug stores, specialty retailers, and supermarkets and hypermarkets. E-commerce outlets split between direct-to-consumer models and third-party marketplaces, while pharmacy channels differentiate hospital pharmacies from retail outlets, illustrating the complexity of market access strategies. Manufacturers must navigate channel-specific dynamics, optimizing packaging sizes, order fulfilment logistics, and promotional tactics to align with the operational realities of each route to market.

Product-type segmentation spans adult wipes, baby wipes, cosmetic wipes, personal hygiene wipes, and surface disinfectant wipes, with further stratification to address sub-niche demands. Baby wipe offerings range from fragrance-free to hypoallergenic and sensitive skin variants, while cosmetic wipe categories encompass facial and makeup remover formulations. Personal hygiene wipes target feminine hygiene and intimate care, and surface disinfectant wipes vary between alcohol- and quaternary ammonium-based chemistries. This granular differentiation enables brands to tailor functional attributes-such as lotion infusion, pH buffering, and antimicrobial additives-to specific consumer and clinical use cases.

Packaging type further diversifies the market, with canisters constructed from metal or plastic, flow packs, pouches segmented into multi-pack or single-packet formats, and refill packs designed for cost-effective replenishment. These packaging formats balance user convenience, shelf-life preservation, and environmental considerations, requiring manufacturers to innovate in materials science and design engineering to enhance both product performance and sustainability metrics.

This comprehensive research report categorizes the Healthcare Wipes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Packaging Type

- End User

- Distribution Channel

Uncovering Diverse Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific Driving Distinct Healthcare Wipes Demand Patterns

In the Americas region, advanced healthcare infrastructure and stringent regulatory frameworks in the United States and Canada drive strong demand for premium disinfectant and sterile wipe solutions. High standards for healthcare facility accreditation and infection prevention have catalyzed the adoption of specialized wipes with validated kill-time performance and documented safety profiles. Meanwhile, Latin American markets exhibit growing investment in public health initiatives and increasing penetration of branded wipes through expanding pharmacy and e-commerce channels, underscored by rising patient awareness of hygiene best practices.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and market maturity levels that shape wipe consumption patterns. In Western Europe, stringent registration requirements and EU-wide harmonization of biocidal ingredient approvals necessitate compliance innovation, prompting manufacturers to develop formulations aligned with EU Biocidal Products Regulation mandates. Gulf Cooperation Council countries and select African markets are witnessing heightened healthcare capital spending, leading to increased procurement of disposable wipes for hospitals and clinics, often in combination with government-driven infection control programs.

The Asia-Pacific region emerges as a dynamic growth arena, fueled by rapid expansion of healthcare infrastructure in China, India, Southeast Asia, and Oceania. Rising urbanization, elevated consumer expectations for hygiene, and surge in e-commerce adoption have created fertile ground for both domestic and multinational wipe brands. Local manufacturers are leveraging cost-efficient production capabilities to cater to high-volume demand, while international players introduce premium and value-added offerings through strategic partnerships and localized marketing initiatives.

This comprehensive research report examines key regions that drive the evolution of the Healthcare Wipes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Shaping Competitive Dynamics in the Global Healthcare Wipes Arena with Expertise and Agility

Global market analysis identifies a cadre of leading companies anchoring the competitive landscape, including Procter & Gamble Co., Kimberly-Clark Corporation, Johnson & Johnson Services, Inc., 3M Company, Essity AB, Medline Industries, Inc., Nice-Pak Products, Inc., and Clorox Company. These organizations possess entrenched distribution networks spanning hospitals, pharmacies, and consumer retail channels, enabling them to drive scale economies and sustain robust R&D pipelines focused on advanced substrate technologies, novel disinfectant chemistries, and sustainable packaging innovations.

Procter & Gamble leverages its Pampers and Always portfolios to cross-pollinate baby and adult wipe innovations, emphasizing dermatologically tested formulations and eco-friendly materials. Kimberly-Clark’s Professional division has invested heavily in plant-based substrates and compostable packaging, exemplified by its Kleenex® Eco Wipes series. Johnson & Johnson has expanded its Aveeno and Johnson’s Baby wipe lines with fragrance-free and hypoallergenic variants, while Clorox and Reckitt Benckiser group has extended their disinfectant wipe platforms into new geographies, targeting emerging markets and institutional buyers with enhanced germicidal performance profiles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Healthcare Wipes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Cardinal Health, Inc.

- Ecolab Inc.

- Johnson & Johnson Services, Inc.

- Kimberly-Clark Corporation

- McKesson Corporation

- Procter & Gamble Company

- Reckitt Benckiser Group plc

- Sealed Air Corporation

- The Clorox Company

Actionable Strategies for Industry Leaders to Navigate Market Disruptions, Drive Innovation, and Enhance Operational Resilience in Healthcare Wipes

To thrive amidst evolving regulatory landscapes and tariff pressures, industry leaders should cultivate multi-sourced supply chains, integrating regional manufacturers and specialty chemical suppliers to hedge against import duties and logistical bottlenecks. Strategic partnerships with raw material producers can secure preferential pricing agreements and priority allocations, while investment in domestic nonwoven production capabilities fosters operational resilience and reduces dependency on volatile international trade flows.

Embracing sustainability mandates is paramount; companies should accelerate the adoption of plant-based fibers, bio-resins, and recyclable packaging designs to align with emerging environmental regulations and consumer preferences. Collaborative initiatives with environmental NGOs and participation in certification programs can validate eco-credentials, amplify brand equity, and open access to government tender opportunities emphasizing green procurement standards.

Continuous innovation in wipe formulation and delivery systems presents a critical differentiator. Leaders should allocate R&D resources to next-generation antimicrobial agents, contact-time optimization, and smart packaging that integrates traceability features such as QR codes or NFC chips for inventory management and compliance verification. Cross-functional co-development with healthcare practitioners will refine product performance and support evidence-based endorsements that drive institutional adoption.

Outlining a Robust Research Methodology Integrating Primary Engagements and Secondary Analytics to Deliver Reliable Healthcare Wipes Industry Insights

This report synthesizes qualitative and quantitative research approaches, commencing with an exhaustive review of secondary data sources, including peer-reviewed journals, regulatory filings, industry association publications, and proprietary trade databases. Secondary inputs establish a foundational understanding of market drivers, regulatory frameworks, and technological advancements, informing the design of primary research instruments.

Primary research encompasses structured interviews with senior executives from leading healthcare facilities, procurement professionals, and supply chain managers to capture firsthand perspectives on product performance, purchasing criteria, and emerging needs. A concurrent series of surveys directed at end-user segments-spanning hospitals, clinics, long-term care facilities, food service operators, and industrial hygiene departments-yields robust quantitative data to validate secondary findings.

Data triangulation techniques reconcile insights from disparate sources, ensuring analytical rigor and minimizing bias. Key performance indicators and market themes undergo iterative validation through expert advisory boards and targeted workshops. Final synthesis benefits from statistical modeling, trend extrapolation, and scenario analysis to deliver actionable intelligence that supports strategic decision-making across the healthcare wipes value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Healthcare Wipes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Healthcare Wipes Market, by Product Type

- Healthcare Wipes Market, by Form

- Healthcare Wipes Market, by Packaging Type

- Healthcare Wipes Market, by End User

- Healthcare Wipes Market, by Distribution Channel

- Healthcare Wipes Market, by Region

- Healthcare Wipes Market, by Group

- Healthcare Wipes Market, by Country

- United States Healthcare Wipes Market

- China Healthcare Wipes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings and Strategic Imperatives Highlighting the Future Trajectory of Healthcare Wipes in Evolving Care Ecosystems

The convergence of heightened infection control priorities, sustainability imperatives, and technological innovation has redefined the healthcare wipes market into a dynamic arena characterized by rapid product evolution and strategic market realignment. Transformative shifts-ranging from biodegradable substrate development to advanced germicidal formulations-underscore the industry’s response to both regulatory drivers and end-user demands for effective, eco-responsible solutions.

U.S. tariff measures introduced in 2025 have introduced complex cost structures, compelling manufacturers to recalibrate supply chain strategies and explore domestic production partnerships. While selective exemptions for core chemical inputs provide a degree of relief, the broader impact of global and regional duties necessitates agile procurement planning and diversified sourcing to maintain competitive margin profiles.

Detailed segmentation analysis highlights the importance of form-factor innovation, end-user customization, and channel-specific offerings in achieving market penetration across care settings and consumer applications. Regional variations further emphasize the need for localized strategies that address unique regulatory, infrastructural, and cultural contexts, particularly within emerging economies.

Leading players have demonstrated resilience through strategic R&D investments, digital integration, and collaborative partnerships, reinforcing the imperative for continuous innovation and sustainable practice. The future trajectory of the healthcare wipes sector will be shaped by the ability of stakeholders to balance efficacy, cost management, and environmental stewardship, forging a path toward more resilient and responsible hygiene solutions.

Connect with Ketan Rohom to Secure Your Customized Healthcare Wipes Market Research Report and Gain a Competitive Edge Today

To acquire the full-depth market research report and explore bespoke insights tailored to your strategic priorities, engage directly with Ketan Rohom, Associate Director for Sales & Marketing. His expertise will guide you through the comprehensive data sets, segmentation analyses, and actionable recommendations designed to empower your organization’s decision-making process.

Reach out to coordinate a personalized briefing, request sample chapters, or discuss enterprise licensing options that align with your project requirements. Partnering with a dedicated specialist will ensure you receive the critical intelligence needed to optimize product portfolios, anticipate market shifts, and drive sustainable growth in the evolving healthcare wipes landscape.

- How big is the Healthcare Wipes Market?

- What is the Healthcare Wipes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?