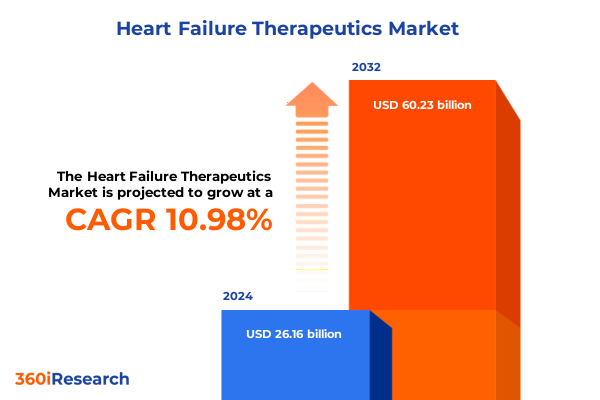

The Heart Failure Therapeutics Market size was estimated at USD 29.10 billion in 2025 and expected to reach USD 31.69 billion in 2026, at a CAGR of 10.94% to reach USD 60.23 billion by 2032.

Understanding the Crucial Demands and Emerging Innovations Transforming Heart Failure Therapeutics Across Clinical, Regulatory, and Patient Care Paradigms

Heart failure represents a profound public health challenge in the United States, with approximately 6.7 million adults diagnosed and at risk for significant morbidity and mortality. This condition arises when the heart fails to pump sufficient blood to meet the body’s demands, leading to symptoms ranging from fatigue and dyspnea to fluid overload and acute decompensation. As the population ages and comorbidities such as hypertension, diabetes, and obesity become more prevalent, the burden of heart failure intensifies, underscoring the imperative for novel therapeutic approaches and improved models of care.

Rapid Therapeutic Innovations and Digital Transformation Reconstruct the Heart Failure Treatment Paradigm with Personalized, Value-Based and Remote Care Solutions

The heart failure treatment paradigm has been fundamentally reshaped by rapid therapeutic innovations and digital transformation. Sodium–glucose cotransporter 2 inhibitors have ascended to a Class I level A recommendation for both preserved and reduced ejection fraction across major international guidelines, marking their transition from diabetes therapies to cornerstone agents in heart failure management. Concurrently, clinical consensus now advocates for the early and rapid initiation of the quadruple therapy regimen-encompassing renin–angiotensin system inhibitors, beta blockers, mineralocorticoid receptor antagonists, and SGLT2 inhibitors-to maximize reduction in hospitalizations and mortality. Beyond pharmacology, digital health solutions such as remote patient monitoring platforms and algorithm-driven wearables are enabling real-time detection of physiologic changes, facilitating proactive adjustments in therapy and reducing readmission rates. Moreover, hospital-at-home models and virtual care networks are expanding access to acute-level interventions outside traditional settings, reflecting a shift toward patient-centric, cost-efficient care delivery that leverages home-based technologies.

Assessing the Cumulative Economic and Clinical Consequences of United States Pharmaceutical Tariffs Enacted in 2025 on Heart Failure Treatment Accessibility and Supply Chains

In 2025, proposed U.S. tariffs on pharmaceutical imports-ranging from 25% to as high as 200%-have intensified scrutiny over heart failure drug accessibility and supply chain resilience. A 25% levy alone threatens to add nearly $51 billion in annual costs and raise domestic drug prices by up to 12.9% if fully passed on to consumers, potentially undermining patient adherence and outcomes. The American Hospital Association has urged the administration to grant exceptions for essential medications and active pharmaceutical ingredients, warning that tariffs on imports from China, Canada, and Mexico could precipitate shortages of critical heart failure therapies and medical devices. Recognizing the strategic imperative, leading companies such as AstraZeneca have announced multi-billion-dollar investments in U.S. manufacturing capacity to mitigate tariff exposure, exemplifying a proactive shift toward domestic production amid evolving trade policies.

Illuminating Critical Segmentation Insights That Define Clinical, Administration, End User, and Distribution Dynamics in Heart Failure Therapeutics

Segmentation by drug class reveals that legacy therapies-ACE inhibitors and ARBs-continue to form the foundation of guideline-directed medical therapy, yet novel agents such as mineralocorticoid receptor antagonists and SGLT2 inhibitors are driving a transformative shift in prescribing patterns. Whereas treatment historically prioritized neurohormonal modulation, the emergence of sodium–glucose cotransporter 2 inhibitors has redefined risk reduction across the full spectrum of ejection fractions, signaling the advent of a new therapeutic era. Distinguishing by heart failure type underscores that preserved ejection fraction and reduced ejection fraction disease states not only differ in pathophysiology but also in clinical management; both acute and chronic presentations demand tailored regimens, with SGLT2 inhibitors now enjoying Class I status in HFpEF and foundational roles in HFrEF. When considering mode of administration, oral agents offer ease of use and broad outpatient utility, while intravenous formulations-such as ferric carboxymaltose for iron-deficient patients-play a critical role in acute decompensation and hospital-based care. End user analysis highlights that hospitals remain central to acute management pathways, clinics drive ongoing outpatient optimization, and home care settings are emerging as pivotal venues for remote monitoring and therapy delivery. Finally, distribution channel segmentation illustrates a dual trajectory: traditional offline channels, including hospital and retail pharmacies, maintain indispensability, while online pharmacies have surged in prominence, reflecting a digital-first consumer trend that reshaped medication access during and beyond the pandemic.

This comprehensive research report categorizes the Heart Failure Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Heart Failure Type

- Mode Of Administration

- End User

- Distribution Channel

Distilling Vital Regional Variability in Epidemiology, Therapeutic Adoption, and Resource Allocation across Americas, Europe-Middle East-Africa, and Asia-Pacific Markets

In the Americas, heart failure prevalence remains among the highest globally, with U.S. adult rates approximating 2.5% and more than 6.7 million affected patients, underscoring a sustained need for both innovative therapeutics and optimized care models. The Europe, Middle East, and Africa region exhibits marked heterogeneity, where prevalence ranges from 12 to over 30 cases per 1,000 individuals, driven by demographic aging and variable resource availability across high- and middle-income countries; dedicated heart failure centers and reimbursement policies further shape regional treatment trajectories. Asia-Pacific presents an expansive therapeutic frontier, evidenced by an age-standardized prevalence rate of 722.45 per 100,000 population and over 31.9 million cases; within this diverse landscape, East Asian nations exhibit the highest rates, while targeted public health initiatives are pivotal to address rising incidence in South and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Heart Failure Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Leading Pharmaceutical Innovators Driving Breakthroughs and Competition in Heart Failure Drug Development Through Strategic Investments and Pipeline Advances

Novartis continues to champion heart failure innovation through Entresto, which sustained robust performance in Q2 2025 with $2.36 billion in global sales even as generic competition looms following a recent patent dispute ruling in Delaware. AstraZeneca has expanded its cardiovascular franchise by integrating Farxiga into heart failure indications and acquiring CinCor Pharma, culminating in the promising pipeline candidate baxdrostat, which targets aldosterone-mediated pathways and has demonstrated significant blood pressure reduction in late-stage trials. Boehringer Ingelheim and Eli Lilly’s Jardiance (empagliflozin) has redefined standard of care, reducing cardiovascular death and hospitalization by 25% in HFrEF and proving for the first time that SGLT2 inhibition benefits extend to HFpEF, as evidenced by the landmark EMPEROR-Preserved trial outcomes. Additional competition and collaboration dynamics are emerging as smaller biotech firms innovate on next-generation modalities, including gene therapy and precision cardiology platforms, further intensifying a rapidly evolving competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heart Failure Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abiomed, Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Boston Scientific Corporation

- Bristol-Myers Squibb Company

- Cytokinetics, Inc.

- Edwards Lifesciences Corporation

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Les Laboratoires Servier

- Medtronic plc

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

Actionable Strategic Imperatives for Industry Stakeholders to Strengthen Resilience, Accelerate Innovation, and Enhance Patient-Centric Heart Failure Care

Industry leaders must prioritize resilient supply chain strategies by diversifying API sourcing and expanding domestic manufacturing capacity to mitigate tariff risks and ensure continuous access to life-saving heart failure medications. Adopting agile regulatory pathways and forging public-private partnerships will accelerate approvals for novel agents, while collaborative advocacy can secure essential exemptions for critical therapeutics. Embracing digital health infrastructure-integrating remote monitoring, AI-driven analytics, and telemedicine-will enhance patient engagement and outcomes, particularly in managing chronic heart failure and reducing avoidable readmissions. Strategic portfolio optimization should balance established neurohormonal therapies with emerging modalities such as dual SGLT1/2 inhibitors and gene-based interventions, aligning R&D investment with the shifting landscape of heart failure phenotypes. Finally, aligning stakeholder incentives through value-based contracting and evidence generation can facilitate the adoption of transformative therapies across diverse care settings.

Comprehensive Mixed-Methods Framework Integrating Literature Synthesis, Expert Interviews, and Real-World Data to Illuminate Heart Failure Therapeutics Dynamics

This research employed a rigorous mixed-methods approach, beginning with a comprehensive review of peer-reviewed literature, regulatory guidelines, and clinical trial outcomes published up to July 2025. Secondary data were triangulated from authoritative sources, including academic journals and industry reports. Primary research included in-depth interviews with key opinion leaders across cardiology, pharmacoeconomics, and supply chain management. Data were synthesized through thematic analysis to identify transformative trends, tariff impacts, and segmentation dynamics. Quantitative insights were validated against real-world evidence and company disclosures. The study’s scope encompassed regional epidemiology, therapeutic innovations, and competitive profiling, ensuring a holistic perspective. Methodological limitations include reliance on publicly available data and evolving policy developments; however, triangulation and expert validation reinforce the robustness of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heart Failure Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heart Failure Therapeutics Market, by Drug Class

- Heart Failure Therapeutics Market, by Heart Failure Type

- Heart Failure Therapeutics Market, by Mode Of Administration

- Heart Failure Therapeutics Market, by End User

- Heart Failure Therapeutics Market, by Distribution Channel

- Heart Failure Therapeutics Market, by Region

- Heart Failure Therapeutics Market, by Group

- Heart Failure Therapeutics Market, by Country

- United States Heart Failure Therapeutics Market

- China Heart Failure Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Implications and Forward-Looking Insights to Steer Strategic Decision-Making in an Evolving Heart Failure Therapeutics Environment

The heart failure therapeutics landscape in 2025 is characterized by unprecedented innovation, evolving regulatory and trade environments, and accelerating digital transformation. The integration of SGLT2 inhibitors across ejection fraction phenotypes, combined with rapid initiation of foundational therapies, has redefined clinical practice. Simultaneously, emerging threats from proposed tariffs underscore the need for supply chain resilience and strategic investment in domestic manufacturing. Segmentation analyses highlight diverse clinical and distribution dynamics, while regional insights underscore significant epidemiological variability. Leading pharmaceutical companies are advancing robust pipelines, yet competitive pressures and policy shifts demand agile strategies. By adopting actionable imperatives-spanning manufacturing, digital health, and value-based frameworks-industry and clinical stakeholders can collaboratively navigate this dynamic landscape and optimize patient outcomes.

Unlock Bespoke Strategic Intelligence on Heart Failure Therapeutics Tailored to Your Needs with a Direct Consultation

To secure a comprehensive analysis of the evolving heart failure therapeutics market, including strategic segmentation, regulatory and tariff impact assessments, and actionable insights, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage with an expert who can tailor in-depth research to your organization’s needs, ensuring you have the intelligence required to drive confident decisions and maintain a competitive edge in this dynamic landscape.

- How big is the Heart Failure Therapeutics Market?

- What is the Heart Failure Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?