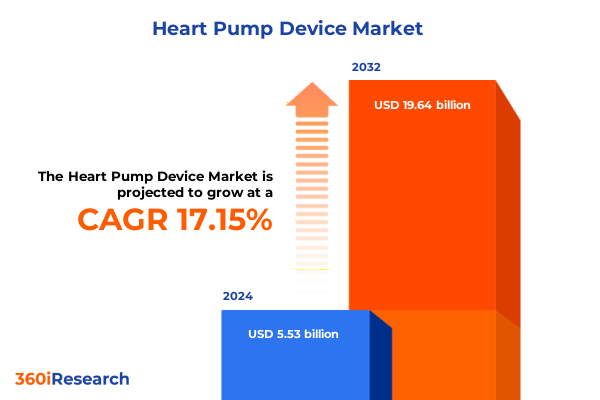

The Heart Pump Device Market size was estimated at USD 6.46 billion in 2025 and expected to reach USD 7.55 billion in 2026, at a CAGR of 17.21% to reach USD 19.64 billion by 2032.

Exploring the Intricacies of Modern Heart Pump Devices and Their Critical Role in Revolutionary Cardiac Care and Patient Survival

The field of heart pump devices represents a convergence of engineering brilliance and life-saving medicine. Through decades of iterative innovation, these sophisticated systems have progressed from rudimentary mechanical pumps to advanced circulatory support platforms capable of bridging patients to transplant or providing long-term destination therapy. Early academic prototypes have transformed into robust clinical solutions, reducing wait-list mortality and enhancing quality of life for individuals facing end-stage heart failure.

As cardiovascular disease remains a leading cause of morbidity globally, the imperative to refine and expand heart pump technologies has accelerated. Researchers and clinicians collaborate closely to optimize hemocompatibility, miniaturize components, and integrate digital monitoring. These efforts not only extend the functional lifespan of devices but also improve patient comfort and mobility. Moreover, regulatory bodies have evolved their frameworks to accommodate new classes of implantable circulatory support systems, enabling faster pathways from concept to clinical adoption.

With each innovation cycle, the heart pump sector garners increased attention from biopharmaceutical players, medical device pioneers, and venture investors. This robust ecosystem fosters cross-disciplinary partnerships and amplifies the pace of development. As a result, current devices boast enhanced durability, reduced thrombosis risk, and intelligent control algorithms that adapt flow rates to individual physiologic demands. Such breakthroughs have real-world impact, lowering complications and enabling outpatient management for select patient cohorts.

Analyzing the Transformative Technological Innovations and Market Dynamics Redefining Heart Pump Solutions in Contemporary Healthcare Ecosystems

Over recent years, transformative technological shifts have reshaped how heart pump devices are conceived and deployed within clinical settings. Advancements in sensor-based feedback systems now allow real-time monitoring of hemodynamic parameters, empowering physicians to fine-tune flow rates and minimize adverse events. Concurrently, artificial intelligence-driven analytics facilitate predictive maintenance algorithms that anticipate device wear, thereby enhancing patient safety and reducing unplanned interventions.

Meanwhile, materials science breakthroughs have yielded more biocompatible surface coatings that reduce blood trauma and inflammatory responses. Such innovations have enabled smaller pump profiles with higher efficiency, opening new possibilities for percutaneous implantation and outpatient usage. This shift toward minimally invasive procedures enhances patient comfort and shortens hospital stays, aligning with broader healthcare priorities around cost containment and value-based care.

Additionally, integration with telehealth platforms is transforming postoperative follow-up care, enabling remote adjustment of device settings and continuous trend analysis. These interconnected systems offer a holistic approach that extends beyond the implant itself, fostering a patient-centered model of care management. Collectively, these transformative dynamics signify a paradigm evolution, as heart pump devices transition from reactive life support mechanisms to proactive, intelligent circulatory assistance solutions.

Evaluating the Aggregate Effects of Elevated United States Tariffs on Heart Pump Device Supply Chains and Cost Structures in 2025

In 2025, the cumulative impact of elevated United States tariffs on imported components and subassemblies has introduced new complexities for heart pump device manufacturers. Increased duties on critical raw materials such as specialty alloys and electronics have driven procurement teams to explore alternative sourcing strategies. Some suppliers are relocating production closer to end markets, while others are negotiating long-term contracts to hedge against further tariff escalations.

Consequently, these shifts have influenced cost structures and supply-chain resilience, prompting device designers to optimize component standardization and modular assembly techniques. By reducing reliance on high-tariff inputs, manufacturers can maintain competitive pricing without compromising on performance or durability. At the same time, ongoing dialogue with regulatory bodies seeks to clarify tariff classification criteria, ensuring that emerging device variants qualify for preferential treatment under free trade agreements.

Strategic collaborations have also emerged as a response to the changing tariff environment. Partnerships between multinational device firms and domestic suppliers aim to localize critical manufacturing steps while preserving global quality standards. In parallel, advocacy groups are engaging with policymakers to balance the objectives of domestic industry protection against the imperative of keeping advanced cardiac therapies affordable and accessible to patients across the country.

Deriving Actionable Segmentation Insights Highlighting Key Device Categories End Users Sales Channels and Application Types Fueling Market Differentiation

A deep examination of market segmentation reveals distinct insights that guide competitive positioning and innovation prioritization. Within device category segmentation, the dichotomy of total artificial heart versus ventricular assist devices underscores divergent clinical pathways: biVentricular assist devices address biventricular failure scenarios, left ventricular assist devices serve dominant left-ventricular deficits, and right ventricular assist devices target isolated right-side dysfunction. Understanding these specific usage contexts informs R&D pipelines and post-market surveillance strategies.

Shifting to end-user perspectives, the comparative operational requirements of ambulatory surgical centers against hospital environments shape device design attributes and service models. Ambulatory centers emphasize rapid turnover, simplified maintenance protocols, and outpatient management, whereas hospitals focus on comprehensive ICU support and integration with advanced imaging modalities. These contrasting needs influence product support infrastructure and training programs for healthcare professionals.

Sales channel segmentation further differentiates market approaches. Direct sales models enable tighter control over client engagement and customized service agreements, whereas distributor sales networks deliver broader geographic reach and localized logistical support. Aligning channel strategy with regional distribution networks ensures optimized inventory management and responsive service levels.

Finally, application segmentation highlights the nuanced split between bridge to transplant and destination therapy. Bridge to transplant serves patients awaiting donor hearts for a finite period, whereas destination therapy represents a permanent solution, with distinct sub-cohorts in adult and pediatric populations. This delineation carries implications for clinical trial design, reimbursement pathways, and long-term patient monitoring frameworks.

This comprehensive research report categorizes the Heart Pump Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Category

- Application

- End User

- Sales Channel

Uncovering Regional Variations and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Heart Pump Device Markets

Regional dynamics in the Americas are characterized by a mature ecosystem of research institutions, large academic medical centers, and favorable reimbursement policies that accelerate adoption of cutting-edge heart pump technologies. The well-established regulatory landscape fosters a predictable pathway for new device approvals, while robust venture capital activity underpins early-stage innovation and commercialization endeavors.

In Europe, Middle East & Africa, heterogeneous regulatory frameworks present both challenges and opportunities. The European Union’s centralized approval process coexists with varied national reimbursement decisions, driving manufacturers to adopt flexible market entry strategies. Meanwhile, Middle Eastern investment in advanced healthcare infrastructure and targeted public–private partnerships catalyze the uptake of both bridge to transplant and destination therapy solutions. In Africa, the emphasis on expanding access to essential cardiac care prompts collaborative initiatives focused on training and remote patient management platforms.

Asia-Pacific’s landscape merges rapid market growth with evolving regulatory regimes. Countries such as Japan and South Korea boast domestically led device development, supported by government incentives for medical technology innovation. In emerging economies like India and Southeast Asia, expanding healthcare access is driving demand for cost-effective circulatory support systems. These markets also serve as hubs for clinical trials, leveraging large patient populations to generate critical real-world evidence and validate new indications.

This comprehensive research report examines key regions that drive the evolution of the Heart Pump Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leading Companies Pioneering Innovation Operational Excellence and Strategic Collaborations in the Heart Pump Device Sector

Global leadership in heart pump devices is epitomized by organizations that combine deep technical expertise with strategic partnerships across the value chain. One pioneering company has concentrated on refining axial-flow pump designs to enhance durability and reduce energy consumption, collaborating with electrophysiology specialists to integrate advanced control software. Another industry leader has leveraged strategic acquisitions of biocompatible material suppliers, securing proprietary surface treatments that minimize hemolysis risks and extend device longevity.

A third prominent participant has built an integrated ecosystem by establishing direct clinician training academies and remote patient monitoring hubs, thereby collecting longitudinal usage data to inform iterative design improvements. In parallel, a fourth enterprise has formed joint development agreements with robotic surgery platform providers, enabling next-generation implantation techniques and reducing procedural complexity. These collaborations underline the importance of cross-sector alliances in accelerating clinical adoption and broadening therapy access.

Meanwhile, strategic alliances between device manufacturers and payers are emerging to develop outcome-based reimbursement models. By linking payment to metrics such as hospitalization reduction and quality-adjusted life years, these frameworks align stakeholder incentives and support broader acceptance of advanced mechanical circulatory support as a sustainable, value-based treatment option.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heart Pump Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abiomed, Inc.

- Berlin Heart GmbH

- BiVACOR, Inc.

- Calon Cardio‑Technology Ltd.

- CardiacAssist, Inc.

- CH Biomedical, Inc.

- Cirtec Medical Systems, Inc.

- CorWave SA

- Evaheart, Inc.

- FineHeart SA

- Getinge AB

- Jarvik Heart, Inc.

- Leviticus Cardio Ltd.

- LivaNova plc

- Medtronic plc

- NuPulseCV, Inc.

- ReliantHeart, Inc.

- SynCardia Systems, LLC

- Terumo Corporation

Delivering Strategic Recommendations to Equip Industry Leaders to Navigate Regulatory Complexities and Catalyze Sustainable Growth in Heart Pump Technologies

Industry leaders can strengthen their competitive advantage by prioritizing regulatory engagement early in the development cycle. Proactively collaborating with agencies to define breakthrough device pathways and real-world data requirements will expedite approval timelines and minimize post-market obligations. Furthermore, establishing cross-functional task forces that integrate clinical, regulatory, and reimbursement expertise ensures comprehensive alignment on evidence generation and pricing strategies.

Another key recommendation involves forging partnerships with component suppliers and contract manufacturers to localize critical production steps. This approach mitigates tariff exposure while enhancing supply-chain resilience. At the same time, investing in advanced manufacturing techniques such as additive metal printing can reduce lead times and lower production costs, providing a strategic edge in highly competitive markets.

Leaders should also embrace digital transformation initiatives that integrate device telemetry with population health management platforms. By delivering actionable insights to care teams and payers, these systems enhance patient outcomes and create new revenue streams through data-driven service contracts. Lastly, adopting adaptive clinical trial designs that incorporate Bayesian methodologies will generate robust evidence more efficiently, accelerating the path from concept validation to market presence.

Illuminating Robust Methodological Frameworks Underpinning Rigorous Data Collection Analysis and Validation Approaches for Heart Pump Market Research

The research underpinning this report is grounded in a multi-stage methodological framework that emphasizes data integrity and analytical rigor. In the initial phase, extensive secondary research was conducted across peer-reviewed journals, regulatory filings, and industry white papers to identify emerging technology trends and competitive dynamics. This foundation ensured a comprehensive understanding of the heart pump device ecosystem.

Subsequently, primary research comprised in-depth interviews with key opinion leaders, including cardiothoracic surgeons, biomedical engineers, and procurement specialists. These conversations provided nuanced perspectives on clinical adoption barriers, procurement processes, and post-implantation management practices. To validate insights, a cross-reference process triangulated primary findings against public regulatory documentation and corporate investor presentations.

Quantitative analysis leveraged proprietary databases capturing clinical trial outcomes, device registries, and reimbursement policy changes. Rigorous data cleansing protocols were applied to eliminate anomalies and ensure consistency across data sources. Finally, validation workshops with industry experts were convened to refine conclusions, ensuring that the final recommendations are grounded in the most current evidence and reflect the practical considerations faced by stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heart Pump Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heart Pump Device Market, by Device Category

- Heart Pump Device Market, by Application

- Heart Pump Device Market, by End User

- Heart Pump Device Market, by Sales Channel

- Heart Pump Device Market, by Region

- Heart Pump Device Market, by Group

- Heart Pump Device Market, by Country

- United States Heart Pump Device Market

- China Heart Pump Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Drawing Conclusive Perspectives on Emerging Opportunities Challenges and Strategic Imperatives Shaping the Future of Heart Pump Device Innovation

The heart pump device sector stands at the intersection of technological innovation, regulatory evolution, and shifting healthcare economics. While the field continues to benefit from material science breakthroughs and AI-enhanced monitoring, it also faces the challenge of navigating complex cross-border tariff regimes and heterogeneous regional approval processes. Striking the right balance between localized manufacturing and global R&D collaboration will be essential to sustaining momentum.

Emerging opportunities lie in expanding destination therapy into underserved patient segments, particularly pediatric populations, and integrating digital health capabilities to transform devices into holistic care platforms. Conversely, stakeholders must remain vigilant to interventional therapy competition, evolving payer demands, and potential device-related safety concerns. By aligning innovation strategies with clear regulatory pathways and outcome-based reimbursement models, industry participants can unlock new revenue streams and improve patient access. Ultimately, the interplay of strategic partnerships, adaptive clinical evidence generation, and digitally enabled care coordination will define the trajectory of heart pump technology innovation.

Seizing the Moment with Exclusive Insight and an Invitation to Secure Comprehensive Market Research on Heart Pump Devices Today

The complexity and potential of the heart pump device landscape demand timely action. To capitalize on the insights and strategic intelligence laid out in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who stands ready to guide you through securing the detailed findings and proprietary analysis that can shape your next steps in this high-impact arena.

Your organization’s competitive positioning and future innovation roadmap can benefit from the nuanced understanding of technological breakthroughs, tariff ramifications, and critical market dynamics contained within this comprehensive resource. Engage with Ketan Rohom today to obtain immediate access and unlock the detailed research that will inform your decisions and drive sustainable growth in the realm of advanced cardiac support devices.

- How big is the Heart Pump Device Market?

- What is the Heart Pump Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?