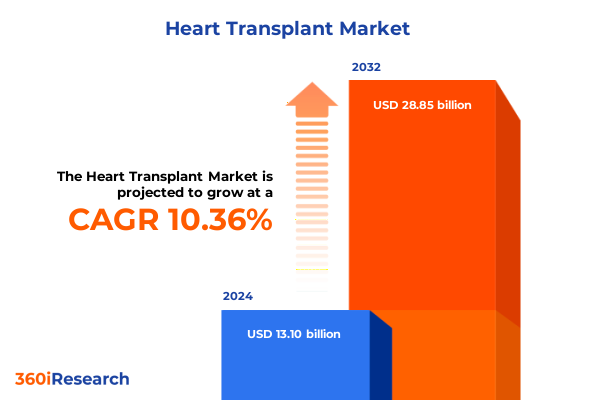

The Heart Transplant Market size was estimated at USD 14.41 billion in 2025 and expected to reach USD 15.86 billion in 2026, at a CAGR of 10.41% to reach USD 28.85 billion by 2032.

Exploring the Evolution of Heart Transplantation as Medical Advances and Patient Demographics Drive Unprecedented Opportunities for Life-Saving Interventions

Heart transplantation stands at the forefront of life-saving interventions, offering hope to patients with end-stage heart failure when all other therapies have been exhausted. Driven by advancements in surgical techniques, immunosuppressive therapies, and organ preservation technologies, the field continues to evolve at a rapid pace. Recent improvements in donor matching algorithms and organ retrieval logistics have reduced waitlist mortality, while emerging biotechnologies promise to address longstanding challenges such as graft rejection and organ shortage. These breakthroughs underscore the critical importance of centering patients and providers within an integrated ecosystem that encompasses research, clinical trials, and regulatory frameworks.

Over the past decade, the demographic profile of heart transplant recipients has shifted to include older adults and patients with comorbidities previously considered contraindications, reflecting both growing clinical confidence and expanding criteria. The rise in congenital heart disease survivors necessitating transplant in early adulthood, coupled with increasing incidences of ischemic cardiomyopathy, has driven demand for specialized surgical centers and multidisciplinary care teams. Simultaneously, advancements in minimally invasive donor retrieval and perfusion strategies have extended the viability window for donor hearts, reshaping procurement networks and supply chain logistics.

This executive summary distills the most pressing trends, market dynamics, and strategic imperatives shaping the global heart transplant landscape. By synthesizing primary insights from clinical specialists, transplant coordinators, and technology providers, alongside a rigorous secondary analysis of published studies and regulatory announcements, the report equips stakeholders with the knowledge required to navigate an increasingly complex environment and capitalize on emerging opportunities.

Uncovering Shifts in the Heart Transplant Landscape Driven by Technological Innovations Reimbursement Changes and Evolving Clinical Best Practices

The heart transplant landscape is being transformed by an interconnected series of innovations, regulatory shifts, and evolving care models that are collectively redefining best practices and patient outcomes. Technological advancements in organ preservation, particularly the maturation of machine perfusion platforms, have demonstrated the capacity to extend donor heart viability beyond traditional time limits, thereby facilitating broader geographic sharing and improved matching. At the same time, the proliferation of heart-assist devices as bridges to transplant has altered clinical pathways, enabling patients with advanced heart failure to stabilize for extended periods before surgery.

Reimbursement policies and regulatory guidelines are also adapting to facilitate greater access and incentivize innovation. New payment models that reward value-based outcomes are prompting providers to demonstrate post-transplant success through metrics such as graft survival rates and patient-reported quality of life. Regulatory agencies in key markets are streamlining approval processes for adjunctive technologies, including novel immunomodulatory agents and digital health solutions that support remote monitoring of transplant recipients. This shift is encouraging collaboration between device manufacturers, biotech firms, and transplant centers to co-develop integrated care solutions.

Moreover, growing emphasis on personalized medicine and biomarker-driven risk stratification is reshaping patient selection protocols. Emerging diagnostics that predict individual rejection risk are enabling tailored immunosuppression regimens, while machine learning algorithms are optimizing donor-recipient compatibility scoring. As clinical teams adopt these data-driven tools, standard operating procedures are evolving to incorporate real-time analytics and multidisciplinary decision-making, heralding a new era of precision in heart transplantation.

Assessing the Cumulative Impact of Newly Implemented United States Tariffs on Heart Transplant Equipment and Procedures in 2025 Year-To-Date Analysis

In 2025, newly introduced tariffs on medical equipment and supplies relevant to heart transplantation have begun to leave a noticeable imprint on procurement strategies and cost structures. Tariffs on preservation systems, disposables, and ancillary devices have exerted upward pressure on capital investments and per-procedure spending for transplant programs. Supply chain bottlenecks, exacerbated by higher import duties, have compelled providers to explore alternative sourcing arrangements or transition to domestically manufactured components where available.

These tariff-driven dynamics have encouraged equipment manufacturers and distributors to renegotiate supplier agreements, localize production lines, and in some cases, absorb initial cost increases to maintain competitive positioning. Hospitals and transplant centers have responded by streamlining inventory management and prioritizing utilization of high-value consumables that deliver measurable improvements in graft viability and patient recovery. Furthermore, tariff-induced cost inflation has accelerated adoption of cost-containment measures, including bulk purchasing consortia and value-based contracting, reshaping vendor-provider relationships.

Looking ahead, stakeholder collaborations aimed at lobbying for tariff exemptions on critical transplant technologies are gaining momentum, supported by emerging data that underscores the long-term economic benefits of improved transplant outcomes. At the same time, forward-looking institution-level strategies are focusing on operational resilience through diversified procurement channels, enhanced forecasting models, and strategic partnerships with local manufacturers. These adaptations are critical for ensuring that patient access to life-saving transplant procedures remains secure amid shifting trade policies in the United States.

Deriving Strategic Insights from Procedure Indications Graft Preservation Patient Age and End User Segmentation Frameworks

The heart transplant market can be strategically dissected across multiple dimensions, each offering unique insights into target populations, clinical workflows, and investment priorities. When examined through the lens of procedural approaches, it becomes evident that heterotopic and orthotopic transplant techniques cater to distinct patient profiles, with orthotopic methods-encompassing both biatrial and bicaval surgical techniques-dominating transplant volumes due to their favorable hemodynamic outcomes.

Turning to underlying indications, the disease spectrum driving transplant demand encompasses congenital heart disease, dilated cardiomyopathy, end-stage heart failure, and ischemic cardiomyopathy, each presenting its own set of clinical challenges and resource considerations. The prevalence of ischemic cardiomyopathy as a leading indication has spurred investments in regenerative therapies and mechanical support systems to optimize pre-transplant stabilization. Conversely, the growing cohort of congenital disease survivors entering transplant eligibility underscores the need for tailored surgical training and pediatric-centric care pathways.

Examining graft preservation strategies reveals a bifurcation between machine perfusion and static cold storage options. Machine perfusion methods, divided into hypothermic and normothermic perfusion subtypes, showcase the potential to enhance organ assessment and extend preservation windows, while static cold storage remains the incumbent standard due to its simplicity and lower infrastructure requirements. Additionally, the distribution of transplant recipients across adult, geriatric, and pediatric age groups highlights evolving demographic patterns and underscores the importance of age-specific post-operative care models.

Finally, the end user environment spans both large hospital systems and specialized transplant centers, each operating within distinct operational frameworks. Hospitals typically leverage established procurement networks and broad service portfolios, whereas transplant centers emphasize high-touch coordination services, clinical research integration, and specialized care teams. A holistic understanding of these segmentation layers is essential for stakeholders aiming to develop targeted solutions, optimize resource allocation, and deliver tailored value propositions within the heart transplant ecosystem.

This comprehensive research report categorizes the Heart Transplant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Procedure

- Indication

- Graft Preservation

- Patient Age Group

- End User

Unveiling Regional Dynamics Shaping Heart Transplant Adoption Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping heart transplant access, provider capabilities, and technology adoption across the globe. In the Americas, the United States remains the largest single-market contributor, driven by established transplantation infrastructure, extensive payer networks, and ongoing innovation in organ preservation. Meanwhile, Latin American markets are experiencing gradual growth, supported by partnerships with academic centers and pilot programs aimed at expanding transplant capacity in urban hubs.

Across Europe, the Middle East, and Africa, transplant adoption exhibits pronounced variability. Western European nations benefit from comprehensive reimbursement schemes and centralized organ sharing frameworks, resulting in high procedure volumes and robust clinical outcomes. In contrast, select Middle Eastern and African countries are focusing on developing local transplant registries, building surgical expertise through international collaborations, and refining regulatory pathways to accelerate program approvals. These efforts are fostering nascent transplant ecosystems that are poised for future expansion.

In the Asia-Pacific region, emerging economies are rapidly scaling transplant services in response to rising cardiovascular disease burdens and growing patient awareness. Countries such as Japan and Australia have mature programs characterized by rigorous donor evaluation protocols and advanced immunosuppressive regimens, while markets in Southeast Asia and India are prioritizing capacity building, training initiatives, and public health campaigns to improve organ donation rates. The interplay between public sector leadership and private sector innovation in this region is establishing a dynamic environment for the next phase of heart transplant growth.

This comprehensive research report examines key regions that drive the evolution of the Heart Transplant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Organizations and Strategic Partnerships Driving Innovation and Competitive Differentiation in the Heart Transplant Ecosystem

A constellation of leading organizations is spearheading innovation across the heart transplant continuum, engaging in strategic partnerships, clinical collaborations, and technology development to maintain competitive differentiation. Manufacturers of advanced organ perfusion systems are partnering with research institutions to validate hypothermic and normothermic perfusion workflows, while biotech firms are directing resources toward novel immunomodulatory therapies that aim to reduce rejection rates and minimize lifelong medication burdens.

In addition, several large medical device firms are expanding their portfolios through acquisitions of digital health platforms capable of remote patient monitoring and predictive analytics. These alliances facilitate comprehensive post-operative care solutions that integrate wearable sensor data with cloud-based reporting tools, enabling clinicians to detect early signs of rejection or infection and intervene proactively. Hospital networks and specialty transplant centers, for their part, are investing in interdisciplinary transplant teams that include genetic counselors, pharmacists, and psychosocial support specialists, thereby differentiating their services through patient-centric care models and enhanced outcome tracking.

Further shaping the competitive arena, coalition-building initiatives among providers, payers, and technology vendors are leveraging real-world evidence gathered from longitudinal patient registries to demonstrate the long-term value of advanced transplant solutions. As a result, partnerships that bridge clinical research and commercial deployment are becoming increasingly prevalent, underscoring the importance of collaborative ecosystems in driving both innovation and adoption within the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Heart Transplant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abiomed, Inc.

- Berlin Heart GmbH

- BiVACOR, Inc.

- Calon Cardio‑Technology Ltd.

- CARMAT SA

- CH Biomedical, Inc.

- Cleveland Heart, Inc.

- CorWave SA

- Evaheart, Inc.

- FineHeart SA

- Jarvik Heart, Inc.

- Leviticus Cardio Ltd.

- LivaNova plc

- Medtronic plc

- NuPulseCV, Inc.

- ReliantHeart, Inc.

- Sun Medical Technology Research Corporation

- SynCardia Systems LLC

- Syntach AB

- Thoratec Corporation

- Windmill Cardiovascular Systems, Inc.

Implementing Targeted Strategies and Collaborative Initiatives to Optimize Heart Transplant Outcomes Operational Efficiency and Stakeholder Engagement

Industry leaders seeking to strengthen their position in the heart transplant domain should prioritize investments in advanced preservation technologies and pursue collaborative models that align incentives across the value chain. By integrating machine perfusion platforms with real-time analytics, stakeholders can improve graft viability assessments and expand the donor pool while establishing evidence frameworks that support reimbursement negotiations.

Simultaneously, forging strategic alliances between medical device manufacturers, academic research centers, and transplant programs will catalyze co-development of next-generation solutions. These partnerships should encompass joint clinical trials, shared data science initiatives, and coordinated regulatory engagements. In parallel, provider organizations must optimize supply chain resilience by diversifying sourcing strategies and incorporating flexible contracting mechanisms to mitigate tariff-related cost pressures.

From a clinical perspective, standardizing care pathways through consensus-based guidelines and digital decision support tools can enhance operational efficiency and improve patient outcomes. Equally important is the cultivation of multidisciplinary teams that encompass nursing specialists, immunology experts, and rehabilitation professionals, thereby fostering a holistic care environment. Finally, prioritizing patient education initiatives and telehealth integration will support long-term adherence to immunosuppressive regimens and facilitate remote monitoring, ultimately driving down readmission rates and enhancing quality of life for transplant recipients.

Employing Robust Qualitative and Quantitative Research Methodologies to Ensure Reliability and Comprehensive Insights in Heart Transplant Market Analysis

The methodology underpinning this analysis combines rigorous qualitative and quantitative approaches to ensure both reliability and depth. Primary research entailed structured interviews with transplant surgeons, cardiologists, perfusionists, and supply chain specialists across major heart transplant centers. These conversations explored evolving clinical protocols, procurement challenges, and technology adoption drivers, providing firsthand perspectives on market dynamics.

Secondary research involved a comprehensive review of clinical trial registries, regulatory filings, professional society guidelines, and published literature on organ preservation and immunosuppressive therapies. Market trends were further contextualized through analysis of policy statements, tariff announcements, and reimbursement changes in key geographies. Data triangulation and validation were achieved by cross-referencing primary insights with independent publications and public datasets, ensuring robustness of findings.

Throughout the study, a systematic framework guided segmentation by procedure, indication, graft preservation method, patient age group, and end user setting. This framework facilitated nuanced insights into demand drivers, technology readiness levels, and service delivery models. Finally, all inputs underwent a multi-tier quality assurance process, including expert review panels and editorial validation, to deliver a comprehensive and actionable market intelligence report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Heart Transplant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Heart Transplant Market, by Procedure

- Heart Transplant Market, by Indication

- Heart Transplant Market, by Graft Preservation

- Heart Transplant Market, by Patient Age Group

- Heart Transplant Market, by End User

- Heart Transplant Market, by Region

- Heart Transplant Market, by Group

- Heart Transplant Market, by Country

- United States Heart Transplant Market

- China Heart Transplant Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Imperatives to Guide Stakeholder Decision-Making in the Future of Heart Transplantation

This executive summary has distilled the most critical developments influencing the heart transplant market, from groundbreaking preservation platforms and evolving regulatory landscapes to the impact of U.S. trade policies and granular segmentation dynamics. Key regional variations highlight areas of mature infrastructure in the Americas and Europe alongside emerging growth opportunities in the Asia-Pacific region. Leading organizations are forging strategic partnerships and driving innovation through integrated digital health solutions and real-world evidence initiatives.

For industry stakeholders, translating these insights into strategic action will require a balanced focus on technological investment, policy advocacy, and collaborative ecosystem-building. Aligning multidisciplinary care teams around standardized protocols and leveraging data-driven decision support can deliver meaningful improvements in both graft survival and patient quality of life. Concurrently, proactive supply chain management and flexible contracting models will be essential to navigate cost pressures associated with new tariffs and global sourcing challenges.

Looking forward, the ability to harness emerging diagnostics, personalize immunosuppressive regimens, and expand donor pools through advanced perfusion methods will define competitive differentiation. By synthesizing the core findings and strategic imperatives presented here, stakeholders can position themselves to lead the next frontier of heart transplantation, ultimately transforming patient outcomes and shaping the future of cardiovascular care.

Connect with Ketan Rohom to Unlock Exclusive Insights Secure Your Copy of the Heart Transplant Market Report and Drive Growth with Informed Decision-Making

To access the comprehensive heart transplant market analysis and gain a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will provide you with detailed data on procedure trends, tariff implications, segmentation breakdowns, and regional dynamics tailored to your organization’s needs. His expertise ensures you receive personalized guidance on how to leverage the report’s insights to accelerate growth, optimize investments, and enhance strategic planning. Don’t miss the opportunity to invest in a resource designed to empower decision-makers across healthcare delivery, medical device manufacturing, and service provision. Contact Ketan today to secure your copy of the full market research report and transform your approach to heart transplantation success

- How big is the Heart Transplant Market?

- What is the Heart Transplant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?